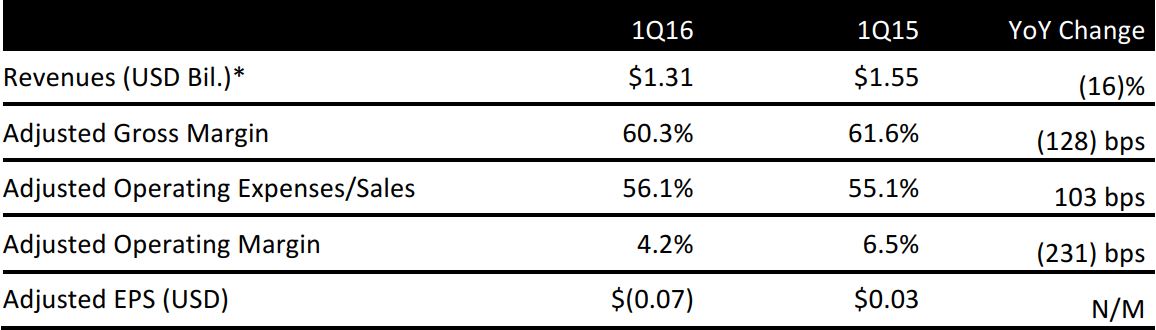

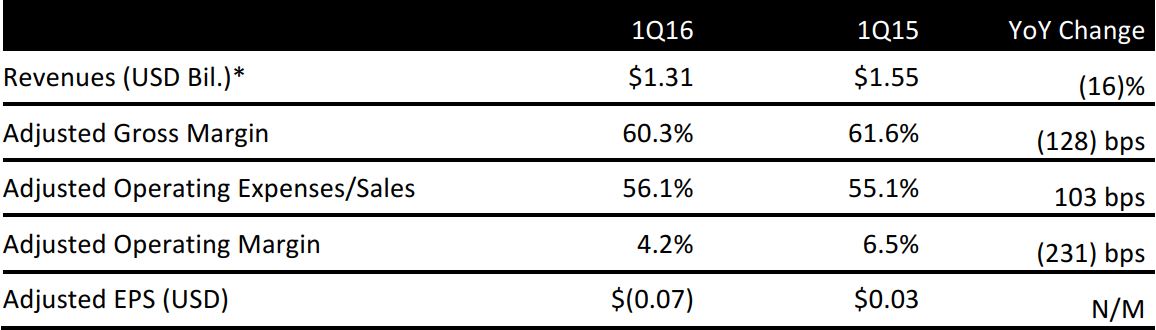

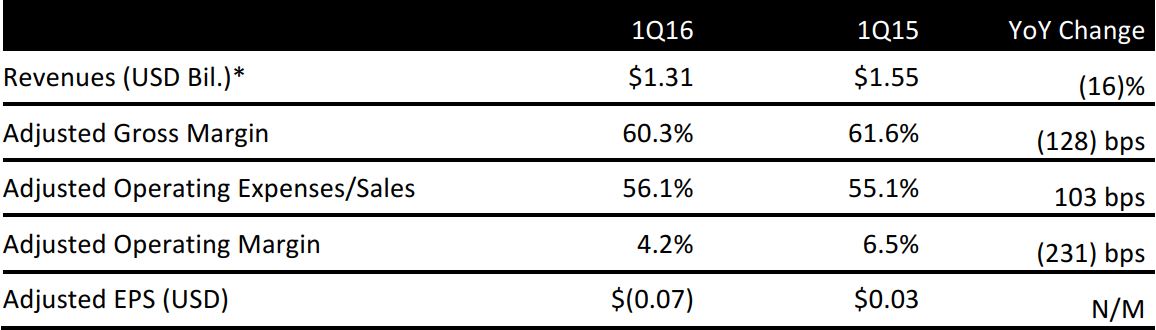

*Does not include currency effects

Source: Company reports

1Q16 RESULTS

For 1Q16, Avon reported total revenues of $1.31 billion, down 16% year over year but up 3% in constant-currency terms excluding referrals. The number of active representatives, who have the ability to place orders, was down 1%. The average order grew by 3% and the price mix increased by 5%. Both sales and representative numbers were in line with management’s expectations. Overall, management was pleased with its top 10 markets, which represent 70% of total revenue.

Among geographic regions, the Europe, Middle East and Africa region saw the strongest growth, at 11%. Sales in the region were driven by a surge of active representatives and total sales in Russia and South Africa. The Asia-Pacific region posted the largest decline; sales fell by 10% in constant dollars in the region. The Asia-Pacific business now accounts for 10% of the company’s total revenue and is expected to be under pressure due to slowdowns in key markets such as the Philippines and China.

In terms of Avon’s top markets by country, Brazil was flat, which was consistent with the company’s expectation of declining representative activity levels and an overall slowing of consumer spending in the country. The company expects its growth momentum in Mexico and the UK to continue. Mexico delivered solid growth of 2% and the UK posted strong growth of 4%.

From a category perspective, fragrance saw the strongest growth, at 4%, followed by color at 3%. The skin care business decreased by 6%.

Management shared that it is focusing on product innovation in the color category. Avon’s new true match lipstick line, Perfectly Matte, was its strongest global lipstick launch in six years. In the first two months after launch, the company sold 8 million units of the lipstick in Brazil alone.

2016 OUTLOOK

Avon management expects to drive top-line growth by expanding in its top 10 markets, and it hopes to grow its active representative base by 1%–2%. The company also shared its ambitious cost-saving goals for the future: it plans to reduce supply chain costs by $200 million ($20 million in 2016) by rationalizing its manufacturing capacity and optimizing its distribution network. In terms of sourcing, it identified opportunities to improve direct material purchases.