DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

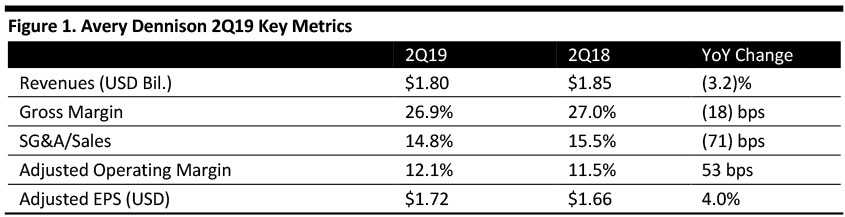

Avery Dennison reported 2Q19 revenues of $1.80 billion, down 3.2% year over year and slightly below the $1.77 billion consensus estimate. Adjusted organic growth was 1.6%.

Adjusted EPS was $1.72, up 4.0% year over year and beating the consensus estimate by four cents. GAAP EPS was $1.69, compared to $1.07 in the year-ago quarter. Adjusted figures exclude charges for restructuring partially offset by a tax credit.

Management characterized performance as better than expectations, with softer-than-expected organic growth more than offset by productivity gains, though the year is playing out differently than originally planned. Management commented further that high-value categories continue to grow faster than the base business, which, combined with productivity improvements, enabled margin expansion despite a slower growth environment.

Performance by Segment

Label and Graphic Materials (LGM)

- Revenues of $1.2 billion declined 4.1% year over year. Organic growth declined 0.9%, with modest declines in volume more than offsetting pricing changes from the prior year. Sales in high-value categories increased by mid single digits. The label and packaging materials business was flat. Sales in the combined graphics and reflective solutions businesses were up by low single digits.

- The adjusted operating margin was flat year over year, at 13.9%. Still, slower demand trends in Q1 extended into Q2, which is reflected in the updated guidance, which also assumes gradual share gains. Restructuring in the European operations are expected to improve profitability in that division in the second half.

- Sales in North America and Western Europe declined low single digits. Emerging markets grew by low single digits. China was up low single digits and South Asia was up high single digits.

Retail Branding and Information Solutions (RBIS)

- Revenues of $418 million increased 0.4% year over year. Organic growth was 4.4%, driven by continued strength in RFID, which again grew by more than 20%. The pace of business slowed, attributed to general market softness accompanied by choppiness in purchasing related to ongoing trade-related uncertainty.

- Adjusted operating margins grew 130 basis points to 12.5%, due to higher productivity and volume more than offsetting higher employee-related costs and investments in growth.

Industrial and Healthcare Materials

- Revenues of $171 million declined 5.0% year over year. Organic growth was (0.1)%, driven by the decline in global automobile production, which offset solid growth in industrial categories and strong growth in medical. A low-single digit decline in industrial categories was largely offset by a mid-single-digit increase in healthcare categories.

- The adjusted operating margin increased 120 basis points to 12.5%, driven by productivity gains and higher gross margins which more than offset higher restructuring expenses and employee-related costs.