DIpil Das

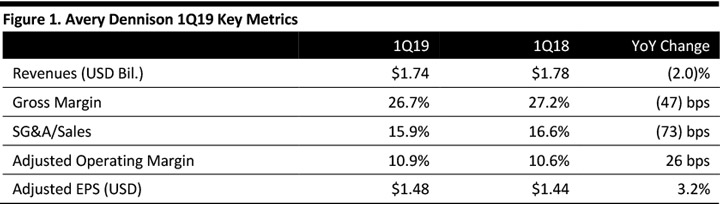

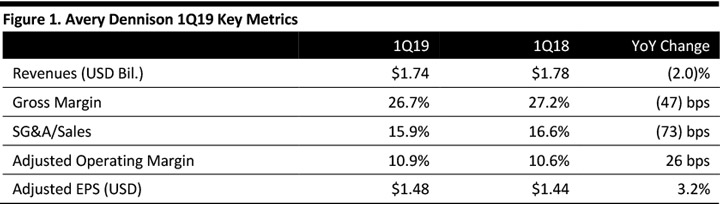

[caption id="attachment_85162" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Avery Dennison reported 1Q19 revenues of $1.74 billion, down 2.0% year over year and slightly below the $1.77 billion consensus estimate. Organic growth was 2.4%.

Adjusted EPS was $1.48, up 3.2% year over year and beating the consensus estimate by two cents. GAAP EPS was ($1.74), compared to $1.40 in the year-ago quarter. Adjusted figures exclude pension-settlement charges of $3.13 per share.

Management characterized performance as solid, despite a challenging start to the year. Organic revenue was a bit lower because soft volume in the two materials businesses partially offset strong performance in the retail branding and information solutions segment.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Avery Dennison reported 1Q19 revenues of $1.74 billion, down 2.0% year over year and slightly below the $1.77 billion consensus estimate. Organic growth was 2.4%.

Adjusted EPS was $1.48, up 3.2% year over year and beating the consensus estimate by two cents. GAAP EPS was ($1.74), compared to $1.40 in the year-ago quarter. Adjusted figures exclude pension-settlement charges of $3.13 per share.

Management characterized performance as solid, despite a challenging start to the year. Organic revenue was a bit lower because soft volume in the two materials businesses partially offset strong performance in the retail branding and information solutions segment.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Avery Dennison reported 1Q19 revenues of $1.74 billion, down 2.0% year over year and slightly below the $1.77 billion consensus estimate. Organic growth was 2.4%.

Adjusted EPS was $1.48, up 3.2% year over year and beating the consensus estimate by two cents. GAAP EPS was ($1.74), compared to $1.40 in the year-ago quarter. Adjusted figures exclude pension-settlement charges of $3.13 per share.

Management characterized performance as solid, despite a challenging start to the year. Organic revenue was a bit lower because soft volume in the two materials businesses partially offset strong performance in the retail branding and information solutions segment.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Avery Dennison reported 1Q19 revenues of $1.74 billion, down 2.0% year over year and slightly below the $1.77 billion consensus estimate. Organic growth was 2.4%.

Adjusted EPS was $1.48, up 3.2% year over year and beating the consensus estimate by two cents. GAAP EPS was ($1.74), compared to $1.40 in the year-ago quarter. Adjusted figures exclude pension-settlement charges of $3.13 per share.

Management characterized performance as solid, despite a challenging start to the year. Organic revenue was a bit lower because soft volume in the two materials businesses partially offset strong performance in the retail branding and information solutions segment.

Performance by Segment

- Label and Graphic Materials (LGM)—Revenues of $1.2 billion declined 3.3% year over year. Organic growth was 1.4% due to price increases that more than offset a decline in volume and mix. The market for label materials was characterized as soft over the past couple of quarters in Europe, China and North America. Within the LGM segment, sales increased modestly in label and packaging materials and were up in the low-single digits in the combined graphics and reflective solutions businesses. Operating margins decreased due to higher employee-related costs, lower volume, and transition costs from the European restructuring plan. Management ceded some market share in lower-margin, less-differentiated categories, which management expects regain over the next couple of quarters. The company also expects margins to improve throughout the year owing to the completion of its European restructuring.

- Retail Branding and Information Solutions (RBIS)—Revenues of $398 million increased 3.2% year over year. Organic growth was 7.0%, owing to by continued strength in radio frequency identification (RFID) solutions and solid growth in the base business. Adjusted operating margins increased 220 basis points due to a decline in restructuring charges, higher volume and lower currency-related costs that more than offset higher employee-related costs.

- Industrial and Healthcare Materials—Revenues of $163 million declined 5.1% year over year. Organic decline was 1.0%, owing to sales in industrial categories down in the low-single digits (but up mid-single digits excluding products serving global automotive markets), whereas sales in healthcare categories were up in the low single digits. (Automotive represents about one-third of the segment’s sales.) Healthcare categories saw revenue growth in the low single digits, and medical applications grew by the mid-teens. Operating margins increased due to the benefit of productivity actions that more than offset the impact of lower volume and higher restructuring charges.