DIpil Das

Avenue Supermarts

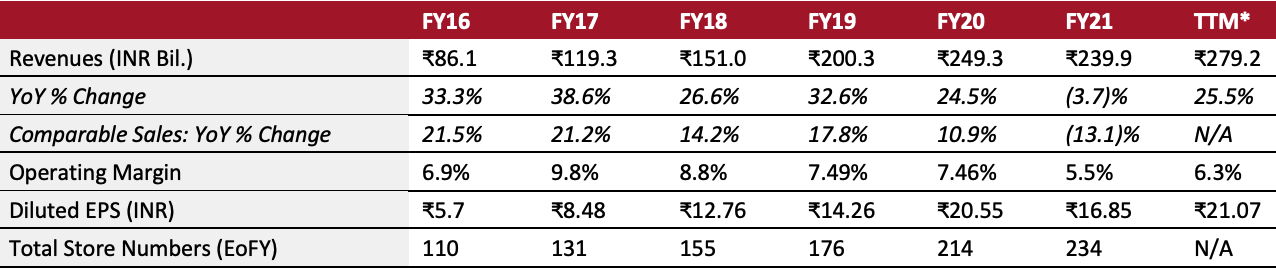

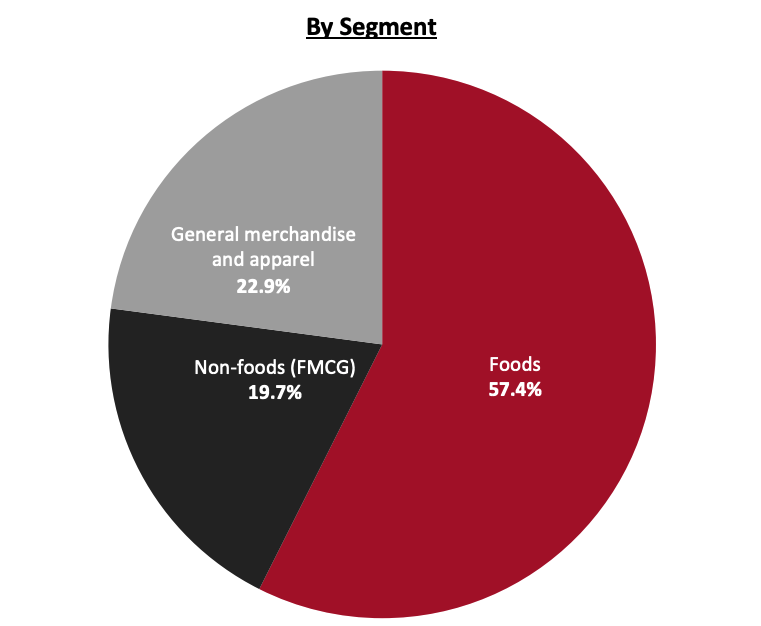

Sector: Food, drug and mass retailers Country of operation: India Key product categories: Apparel, food and beverage, general merchandise, and health and beauty Annual Metrics [caption id="attachment_135854" align="aligncenter" width="700"] Fiscal year ends on March 31 of the same calendar year

Fiscal year ends on March 31 of the same calendar year*Trailing twelve months ended September 30, 2021[/caption] Summary Founded in 2002 and headquartered in Mumbai, India, Avenue Supermarts is an Indian value-based retail chain that operates under the brand name DMart. The company offers apparel, food and beverages, health and personal care products, and general merchandise through physical and online stores. As of September 30, 2021, Avenue Supermarts operates a total of 246 stores with a retail business area covering 9.44 million square feet across 12 Indian states and one union territory. Company Analysis Coresight Research insight: Avenue Supermarts employs a value-driven pricing approach, targeting lower-middle and middle-income households. The company owns most of its store real-estate, reducing monthly rental costs and maintaining high positive cash flows. It is currently following a cluster-based expansion strategy that focuses on deepening its penetration: opening new stores around existing stores and distribution centers, before expanding into newer regions. This ensures higher cost-efficiency due to the economies of scale achieved in inventory management and supply chain. It also helps develop a better understanding of local needs and preferences, according to the company. Another important operational aspect of the company is Avenue Supermart’s zero-credit policy. It pays suppliers within days, instead of weeks, putting it ahead of the industry norm. This gives the company stronger negotiation positions with vendors, enabling discount procurement for prompt payments, helping to execute its strategies Everyday Low Cost (EDLC)/Everyday Low Price (EDLP). Although the company operates efficient brick-and-mortar retailing, compared to its offline retail peers it is trailing behind in e-commerce adoption. The pandemic has caused an unprecedented surge in online shopping, and we expect e-commerce to remain embedded in shopper’s buying habits well beyond the pandemic. In its investor/analyst call held on July 22, 2021, the company’s management stated that it has taken tentative steps to e-commerce by fulfilling online orders from two stores in Mumbai. However, this measured approach may create a significant headwind going forward given the rapid expansion of e-commerce players Amazon and Walmart-owned Flipkart in India, and Reliance Retail’s entry into the online space through JioMart in June 2020. A much stronger second wave of cases hit India towards the end of the company’s fiscal year 2021 (ended March 31, 2021), which forced more than 80% of its stores to close or operate for significantly lower hours due to government-imposed lockdowns. However, the company recovered strongly, reporting year-over-year growth of 40.1% in its first half (ended September 30, 2021)—it witnessed higher customer footfall than in the same period last year, which translated into higher sales.

| Tailwinds | Headwinds |

|

|

- Focus on deepening its penetration in its existing locations, before expanding to new areas.

- Aim to further increase market penetration in the states of Gujarat and Maharashtra and enhance its store networks in the states of Andhra Pradesh, Chhattisgarh, Karnataka, Madhya Pradesh, Tamil Nadu, Telangana and in North India.

- Prioritize customer satisfaction and optimize product assortment, keeping in mind local needs and preferences.

- Offer products at everyday low prices—achieved through low costs in procurement, supply, operations and other areas.

- Refine store operating systems.

- Invest further in IT and data management systems.

- Bolster supplier relationships with closer cooperation.

- Expand and upgrade distribution centers.

- Emphasize managing attrition and attracting and retaining motivated employees.

- Invest in training programs to enhance employees’ skills and productivity.

Company Developments

Company Developments

| Date | Development |

| May 8, 2021 | Avenue Supermarts added 22 new stores during its fiscal year ended March 31, 2021, and converted two stores into fulfillment centers. Its total sales of ₹239.9 billion, down by 3.7%, for the fiscal year ended March 31, 2021. |

| January 11, 2021 | Avenue Supermarts added one store during its third quarter, ended December 31, 2020, taking its store count to 221. The company reports total sales of ₹74.3 billion ($1.0 billion), up 10% for the quarter. |

| October 17, 2020 | Avenue Supermarts added six new stores during its second quarter, ended September 30, taking its total store count to 220. It reports total sales of ₹), down by 10.6%. |

| July 11, 2020 | Avenue Supermarts stated that the lockdown restrictions had a significant impact on its operational and financial performance in its first quarter, ended June 30. The company reports total sales of ₹39.3 billion ($527.6 million), down by 32.5%. |

| June 17, 2020 | Radhakishan Damani, owner of 34.3% of the total shares of Avenue Supermarts as of March 30, 2020, is reportedly considering acquiring a controlling stake in cement manufacturing company, India Cements. |

- Ramesh Damani—Chairman

- Ignatius Navil Noronha—Managing Director and CEO

- Ramakant Baheti—Whole-time Director and Group CFO

Source: Company reports