Nitheesh NH

What’s the Story?

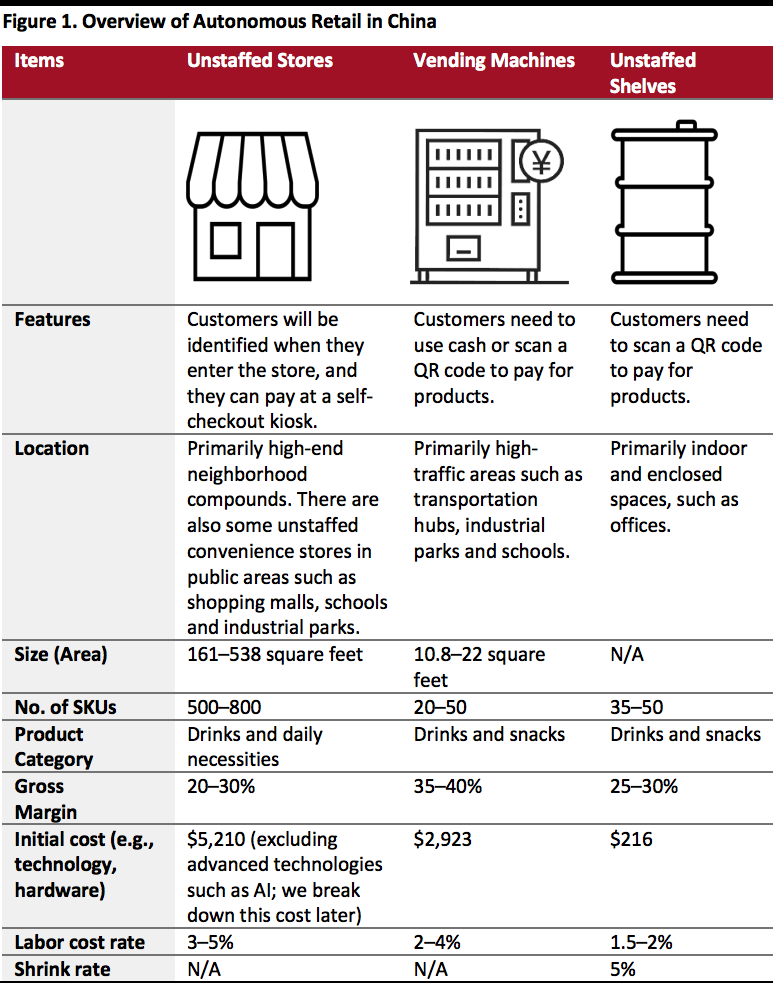

Autonomous retail is getting bigger in China, post crisis. Autonomous retail is our term for a labor-light, technology-heavy retail segment that encompasses unstaffed stores, vending machines and unstaffed shelves. We expect it will continue to grow as consumers pursue faster, more convenient ways of shopping. [caption id="attachment_116004" align="aligncenter" width="700"] Source: Guoxiaomei/Huatai Securities/Coresight Research[/caption]

Source: Guoxiaomei/Huatai Securities/Coresight Research[/caption]

Why It Matters

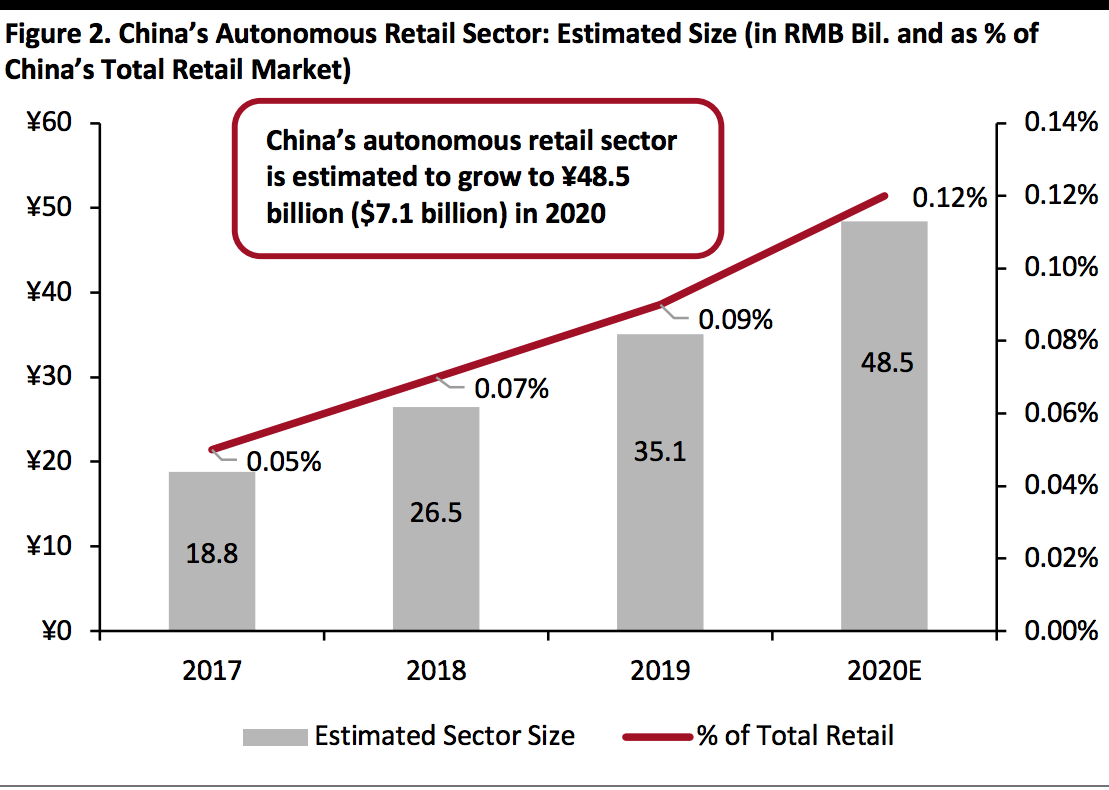

China’s autonomous retail sector is estimated to grow to ¥48.5 billion ($7.1 billion) in 2020 from ¥18.8 billion ($2.7 billion) in 2017—representing a CAGR of 37.2%—according to a pre-crisis estimate by research company iResearch. We estimate the total retail market in China will be worth ¥38.9 trillion (around $5.7 trillion) in 2020, meaning that the automated retail sector will account for 0.12% of the total market this year—up from 0.09% in 2019 (see Figure 2). [caption id="attachment_116005" align="aligncenter" width="700"] Estimate is based on the increasing number of vending machines, the number of registered enterprises that sell unstaffed shelves in China and their penetration rate, the number of mid- to high-end neighborhood compounds and the penetration rate of unstaffed stores.

Estimate is based on the increasing number of vending machines, the number of registered enterprises that sell unstaffed shelves in China and their penetration rate, the number of mid- to high-end neighborhood compounds and the penetration rate of unstaffed stores.Source: iResearch/Coresight Research[/caption] Covid-19 Accelerated Development of the Unstaffed Retail Business Unstaffed stores in China emerged in 2016 and developed rapidly in 2017, with financing of ¥4.3 billion (around $620 million) at its peak, according to data aggregator IT Juzi. However, after only one year, the frenzy cooled down—partly due to the format not offering a great user experience as well as not yielding much profit.

- Some unstaffed store operators were merged—for example, Bianlifeng acquired Lingwa.

- Unstaffed store operator BingoBox, which raised ¥100 million ($14.5 million) in a Series A financing round and ¥80 million ($11.6 million) in a Series B financing round, reportedly made losses and laid off its employees.

- Unstaffed shelf operator GoGo Xiaochao closed its business, and unstaffed shelf operator Xiaoe Weidian turned its unstaffed shelf business to a vending machine format, partly due to a high shrink rate. The shrink rate for some underperforming players, such as GoGo Xiaochao, could reach 10%, according to smart-retail company 37Cang.

Autonomous Retail Sector in China: A Deep Dive

1. Unstaffed Stores Unstaffed stores operate without associates inside; at a minimum, they facilitate checkout-free transactions or self-checkout. This format is most mainstream in the convenience store sector. In China, unstaffed convenience stores are mainly based in high-end neighborhood compounds, although they can also be found in public areas such as shopping malls, schools and industrial parks. Unstaffed stores are usually around 161 square foot in size and typically sell fresh food, ready-prepared meals and daily necessities, with around 500–800 stock-keeping units (SKUs). The full initial cost of setting up an unstaffed store includes regular fit-out costs as well as autonomous-enabling technologies—such as RFID (radio-frequency identification) tags, cameras, sensors and self-checkouts. We list a breakdown of these additional costs below, using data from New Retail service provider Lingke. This list excludes advanced technologies—artificial intelligence (AI), for example—which are used in some autonomous retail formats worldwide, such as Amazon Go in the US.- Cameras, sensors and self-checkouts for a 161-square-foot unstaffed store: ¥34,939 ($5,102)

- RFID: The cost of a single RFID tag is around ¥0.30 ($0.04)—if the store has 500 SKUs and a single SKU has five items in stock, then the total cost for RFID will be ¥750 ($108).

- The total initial cost of autonomous-enabling tech is ¥35,689 (around $5,210).

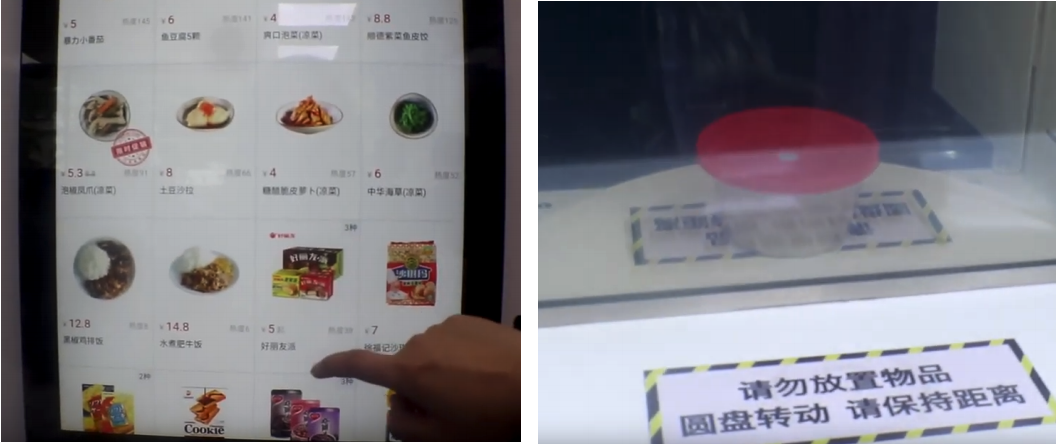

A customer selects items on a shopping screen in the F5 Future Store (left); After paying, the customer goes to the pickup counter, where robotic arms deliver the products (right).

A customer selects items on a shopping screen in the F5 Future Store (left); After paying, the customer goes to the pickup counter, where robotic arms deliver the products (right).Source: YouTube[/caption] F5 Future Store also features self-cleaning dining tables at which customers can eat in store. Shoppers can push a button above the glass table that prompts the table to open up and swallow the trash. [caption id="attachment_116007" align="aligncenter" width="700"]

F5 Future Store features self-cleaning dining tables.

F5 Future Store features self-cleaning dining tables.Source: Weibo[/caption] Bianlifeng Another unstaffed store operator, Bianlifeng, has embarked on new store openings post pandemic; it opened its first store in the city of Guangzhou in June 2020. The retailer plans to open around 10 stores in Guangzhou in the near future. Bianlifeng operates more than 1,000 stores across China as of September 2019. Each store features a self-service coffee machine that saves queueing time. Consumers can scan QR codes at point-of-sale terminals to close transactions via mobile payment. Bianlifeng uses electronic price tags and implements dynamic pricing: When products approach their expiration dates, the price tags change from black to red and display price-reduction information. There are some store staff to perform manual duties like serving prepared foods, restocking items and conducting cash payments, if necessary. [caption id="attachment_116008" align="aligncenter" width="700"]

A Bianlifeng store

A Bianlifeng storeSource: Weibo[/caption] Advantages and Disadvantages Reduced labor costs are a major selling point of unstaffed stores. The labor cost rate for unstaffed stores is much lower (around 3–5% of sales) than traditional convenience stores (10–12% of sales), according to financial firm Huatai Securities. One staff member can usually manage 10–20 unstaffed stores and can do tasks such as stock replenishment, cleaning and attaching RFID tags to products. The format’s gross margin is around 20–30%, which is similar to a regular convenience store, according to Huatai. The freshly prepared/cooked food category tends to have a higher gross margin than packaged food in unstaffed stores, but it is difficult for them to offer freshly cooked food without having personnel to prepare it. There are a number of challenges for retailers pursuing the unstaffed concept:

- Shrink rate—Self-checkout services typically see higher shoplifting rates compared to staffed stores.

- Some shoppers are unable to use self-checkout kiosks without support from staff.

- Currently, facial recognition payment is not widely adopted, so the majority of unstaffed stores still use RFID tags and self-checkout kiosks; consumers still need to line up to pay.

- The maintenance costs of cameras and sensors in the more advanced tech-equipped stores can be significant.

- Due to their limited size, unstaffed convenience stores generally offer fewer SKUs than typical convenience stores, but the products are largely similar. This means that shoppers can buy the same products elsewhere, so it is not a must for them to go to an unstaffed convenience store.

- The average cost of a vending machine is around ¥20,000 ($2,882), according to financial firm Great Wall Securities.

- RFID: The cost of a single RFID tag is around ¥0.30 ($0.04)—if the vending machine has 20 SKUs, with a single SKU having three items in stock, then the total cost will be ¥18 ($2.60), according to Lingke.

- The total initial cost is ¥20,018 (around $2,923).

Maker Store vending machine

Maker Store vending machineSource: Weibo[/caption] JD.com E-commerce giant JD.com rolled out its AI vending machines in several cities in China in March 2020, to offer residents access to fresh produce sourced from JD.com’s 7Fresh supermarket nearby. Consumers can use their mobile phones to scan a QR code to open the door of the machine, and payment will be automatically processed after they take out the products. Employees from 7Fresh regularly disinfect the machine and ensure there is sufficient fresh produce available. JD.com also leverages big data to analyze which products are more favored than others by local residents; it frequently changes assortments to meet localized demand. [caption id="attachment_116010" align="aligncenter" width="700"]

JD.com’s AI vending machine

JD.com’s AI vending machineSource: Company website[/caption] Advantages and Disadvantages Vending machines usually have quite a high gross margin of 35–40%, mainly due to the low cost of goods—for instance, the cost of a bottle of water is around ¥0.70 (around $0.10) , and the selling price is ¥1.50 (around $0.20). Vending machines also have a low labor cost rate (2–4% of sales), according to Huatai Securities. Staff only need to replenish stock at regular intervals and check that the machine is working properly. There are two main challenges in adopting vending machines as part of a retail business model:

- The hardware cost remains high, and the operation and maintenance costs of vending machines are high. This is partly because vending machines usually sit in outdoor areas such as transportation hubs, industrial parks and schools, so are more likely to incur damage.

- User experience is not always great—consumers sometimes need to wait a while for the machine to dispense purchased products.

- The average cost of purchasing an unstaffed shelf is around ¥1,500 ($216), according to Guoxiaomei.

A Miss Fresh Bianligou unstaffed shelf

A Miss Fresh Bianligou unstaffed shelfSource: Weibo[/caption] Advantages and Disadvantages Unstaffed shelves have the advantage of a low initial cost—around $216, compared to vending machines ($2,923) and unstaffed stores ($5,210). The labor cost rate is also the lowest among the three options, at 1.5–2% of sales, compared to 2–4% for vending machines and 3–5% for unstaffed stores However, there is one clear disadvantage to implementing this concept:

- Shrink rate—Users usually shop without technical monitoring, so there will likely be a bigger product shrink rate (5%) than other shopping formats. This is compounded by the fact that there are no doors to protect the products from theft compared to vending machines, according to Guoxiaomei.

What We Think

Autonomous/unstaffed retail formats are becoming highly desirable for brands and retailers to meet consumer demand for safety and convenience—particularly in the current coronavirus-impacted environment. It is important for them to adapt quickly to the new reality. Implications for Brands/Retailers- Autonomous retail is more than AI-heavy Amazon Go-style formats—As we have broken down in this report, the technology costs for stores using technology such as RFID is much lower than the reported $1 million it costs to fit out an Amazon Go store. Currently, unstaffed stores in China use RFID tags to detect whether consumers have bought products or not. Based on the fit-out costs reported in China, the approximate $5,210 technology cost—cameras, sensors and self-checkouts ($5,102) plus RFID ($108)—are around a third of the approximate $15,000 wage cost of one employee on the US minimum wage.

- Brands and retailers—in China and internationally—could explore the unstaffed shelf format, which has the advantage of low initial costs. They could also consider employing the unstaffed store concept in residential areas to enable consumers to purchase products more conveniently and thus more frequently.

- Brands and retailers, especially in the grocery category, can leverage the unstaffed store format to reach consumers in neighborhood compounds in China, while the unstaffed shelf format could be used to reach consumers in their office buildings. Categories such as snacks and drinks will be more relevant for this type of unstaffed retail format.

- Unstaffed stores—in China and elsewhere—require technology support for cameras, sensors, RFID, and voice and facial recognition. At a basic, non-AI level, technology vendors can offer autonomous stores at a cost that could prove appealing to retailers when compared with labor costs.

- Vendors can continue to develop and implement technologies to equip intelligent vending machines, which can include payment technologies, analytics, cloud, and gesture and image recognition.

- There are opportunities to further develop technologies for unstaffed shelves, to reduce shrink rates—such as smart-shelf software and deep-learning algorithms.