DIpil Das

China Retail Sales: August 2021

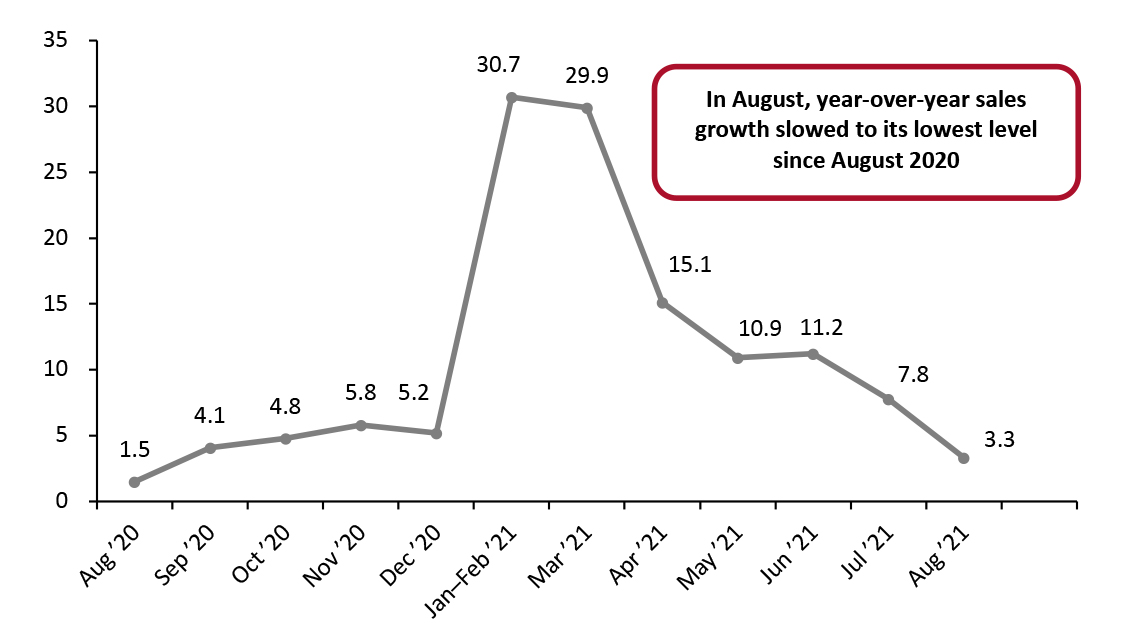

In August, China’s total retail sales growth (ex. food service, incl. automobiles and gasoline) slowed for the second consecutive month to 3.3% year over year, representing the weakest growth in retail sales since August 2020—further indicating that recovery is losing momentum. The National Bureau of Statistics attributed the slowdown to the impact of sporadic local Covid-19 outbreaks. On a two-year basis, total sales were up just 3.0% in August. Pre-crisis, in 2019, China’s monthly retail sales were growing by between 7.0% and 9.9% year over year. We anticipate that retail sales will continue to grow by single digits in the coming months as momentum in China has slowed. China’s zero-tolerance approach to Covid-19 infections coupled with supply chain bottlenecks poses headwinds to future retail growth.Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_132818" align="aligncenter" width="726"]

January and February figures are reported together

January and February figures are reported together Source: National Bureau of Statistics/Coresight Research [/caption] Retail Sales Growth by Sector Five sectors saw negative year-over-year growth in August and sales rose at a slower pace than any other month this year for most of the remaining categories:

- School/office supplies and computers saw the highest growth relative to other sectors in August, increasing by 20.4%. Growth remains strong in this sector compared to pre-pandemic values, growing 20.5% on a two-year basis.

- Alcohol and tobacco retailers saw the second-highest growth in August, at 14.4%. On a two-year basis, alcohol and tobacco sales grew 11.9%.

- The apparel and footwear sector decreased by 6.0% year over year in August, following a 7.5% increase in July. On a two-year basis, the sector fell by 4.9%. In previous months, the domestic apparel sector benefited from a shift in consumer spending from international brands to domestic; however, in August sales were likely adversely impacted by strict Covid-19 restrictions, aiming to contain local outbreaks.

- The beauty sector remained flat in August, registering 0.0% growth—a decrease from July’s slow 2.8% growth. However, on a two-year basis, sales by beauty retailers remained strong, registering 26.7% growth since August 2019.

- The food sector continued to perform steadily overall, despite slower growth for the third consecutive month: Food retail sales in August 2021 saw growth of 9.5% year over year and 12.3% compared to the same period in 2019.

- Communication equipment exhibited a steep decline of 14.9% in August. This is largely attributable to the global microchip shortage. Despite such a large decrease year over year, communication equipment increased by 12.3% compared to 2019 values.

Figure 2. China Retail Sales (ex. Food Service; incl. Gasoline and Automobiles), by Sector: YoY % Change and Two-Year % Change [wpdatatable id=1270 table_view=regular]

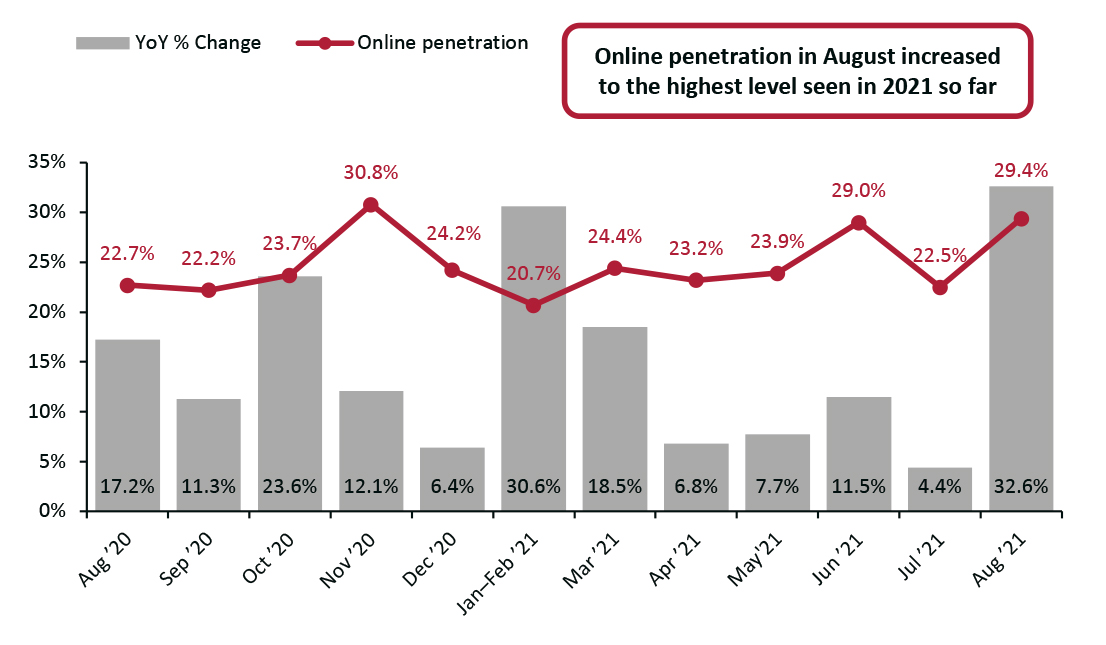

The sector breakdown is based on surveys from enterprises with annual sales of ¥5 million (around $730,000) and above Source: National Bureau of Statistics Online Retail Sales Account for 29.4% of All Retail Sales In August, online retail sales growth in China climbed 32.6% year over year. The channel accounted for 29.4% of the month’s total retail sales, surpassing June as the highest of any month this year. Elevated online penetration in August is likely related to strict Covid-19 restrictions. Online retail sales include food service, as the National Bureau of Statistics does not provide online data that exclude food service. In Figure 3, online sales are benchmarked to total retail sales.

Figure 3. Online Retail Sales (YoY % Change) as a Proportion of Total Retail Sales (%) (incl. Automobiles, Gas and Food Service) [caption id="attachment_132821" align="aligncenter" width="725"]

Online retail sales include food service

Online retail sales include food service January and February figures are reported together

Source: National Bureau of Statistics [/caption]