DIpil Das

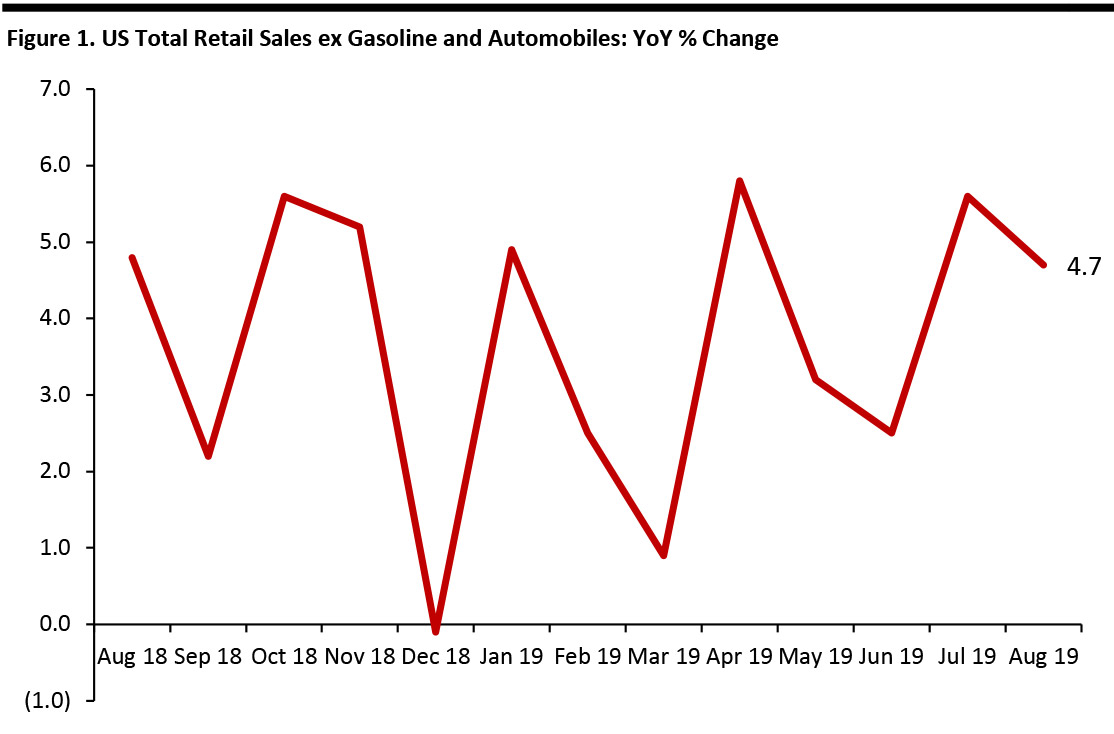

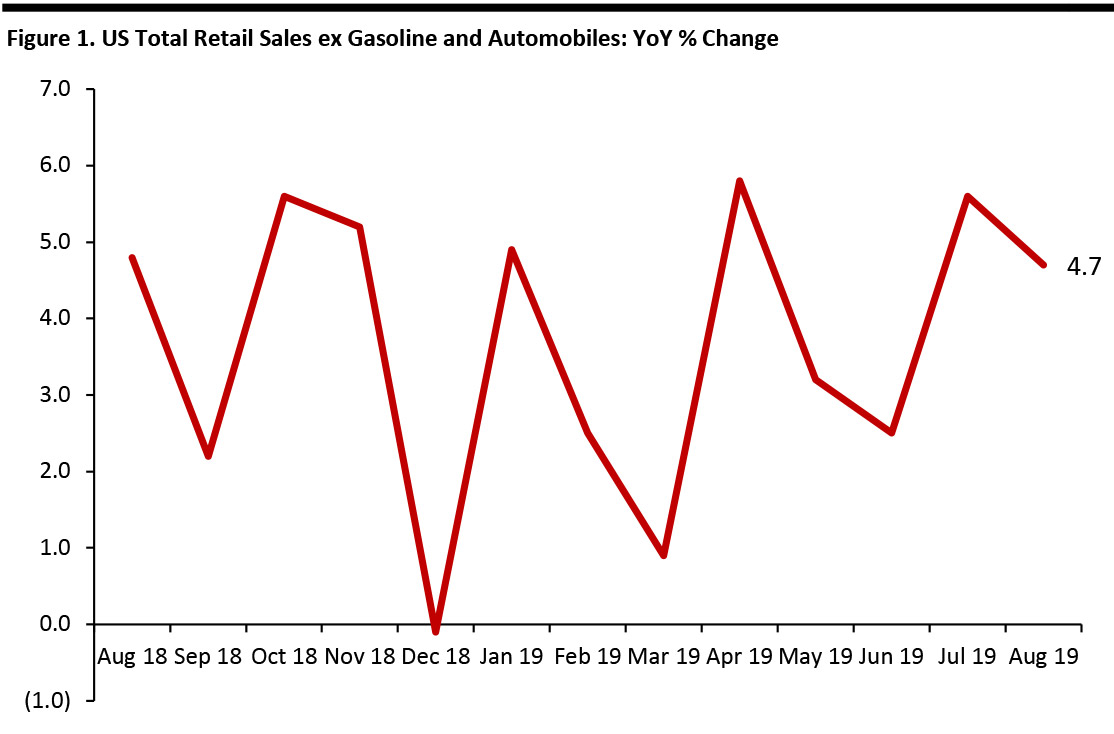

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric stood at a solid 4.7% in July, versus 5.6% in July.

[caption id="attachment_96384" align="aligncenter" width="700"] Data is not seasonally adjusted

Data is not seasonally adjusted

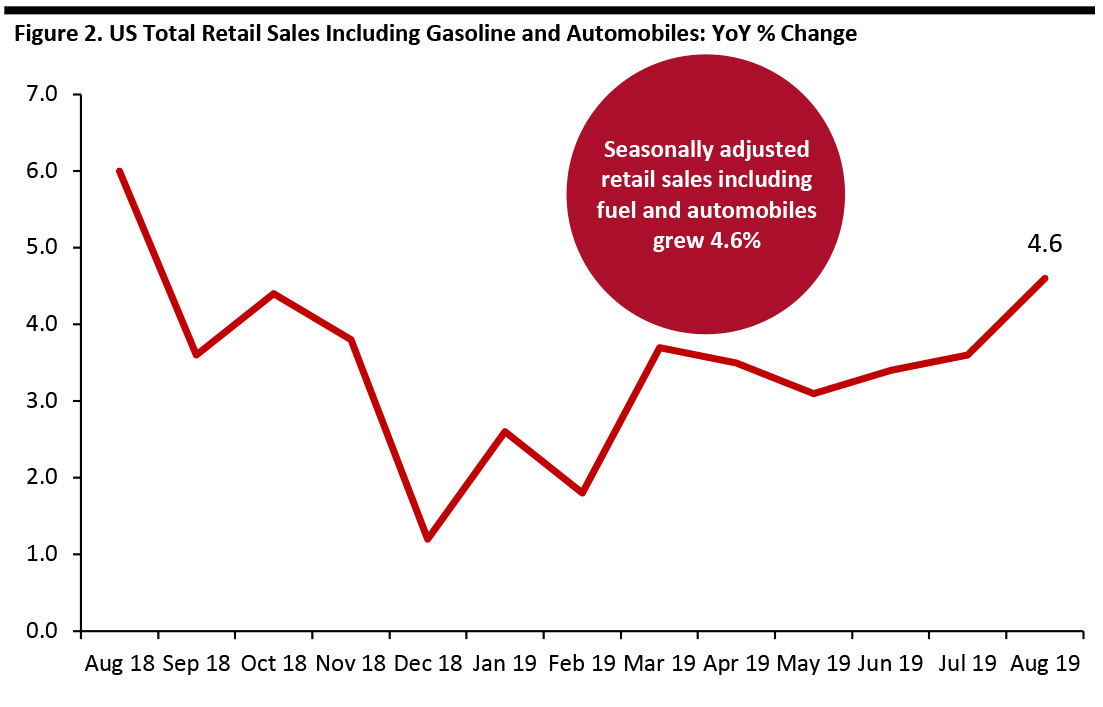

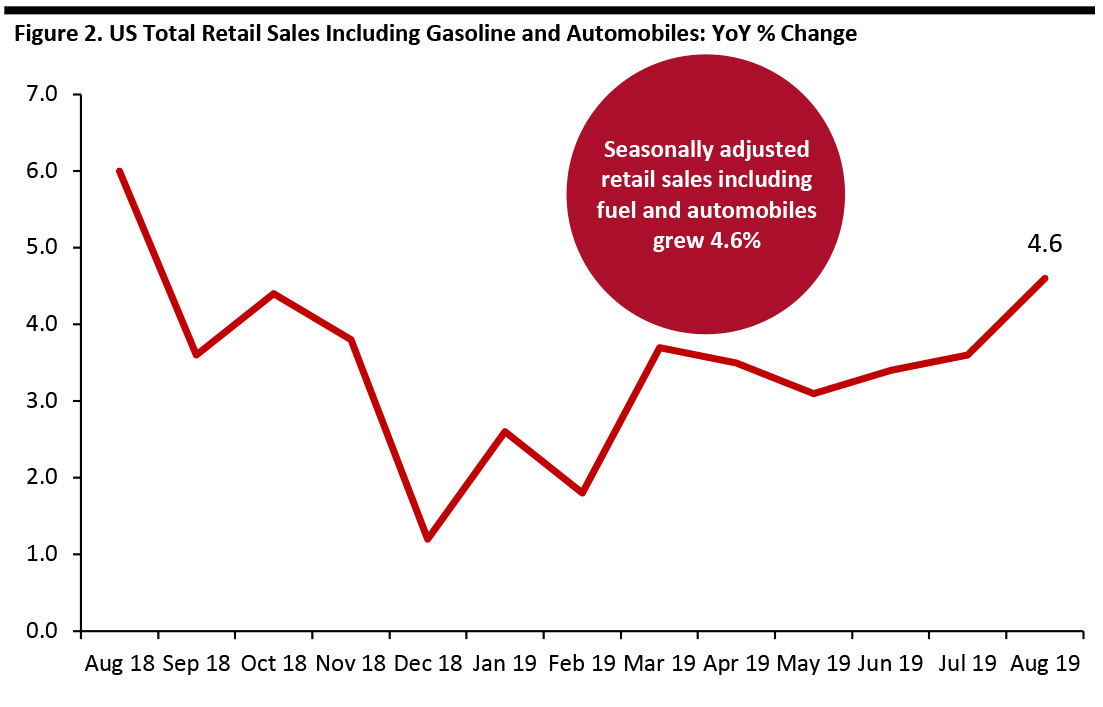

Source: US Census Bureau/Coresight Research [/caption] Retail Sales Grow Month Over Month The Census Bureau’s own core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure grew 4.6% year over year in August, slightly faster than the 3.6% growth rate seen in July. On a month-over-month basis and seasonally adjusted, retail sales grew 0.6% in August. [caption id="attachment_96385" align="aligncenter" width="700"] Data is seasonally adjusted

Data is seasonally adjusted

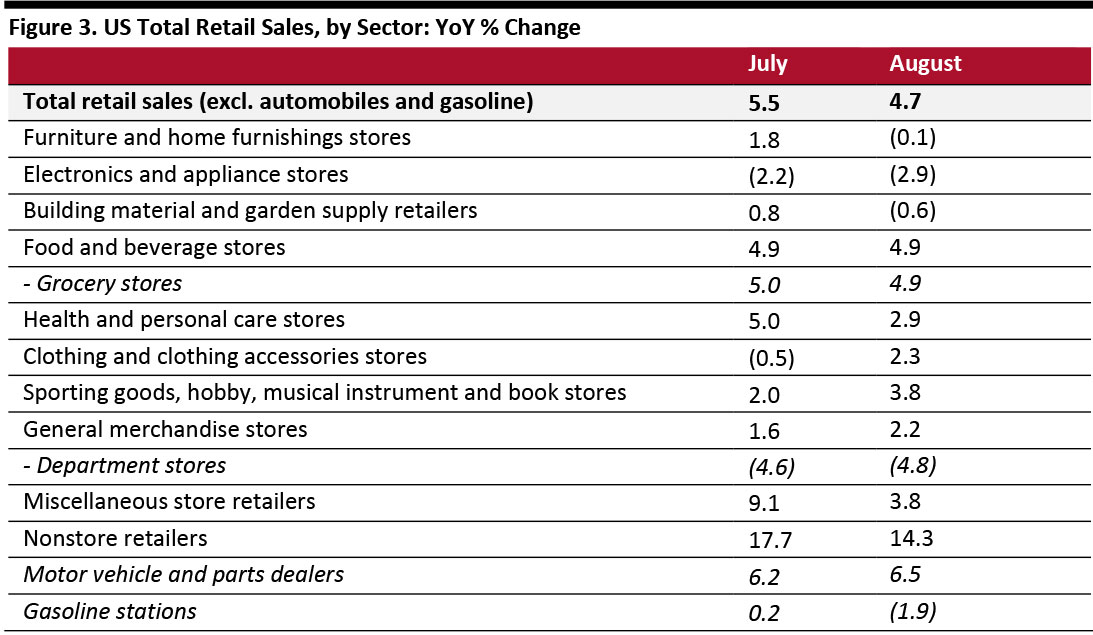

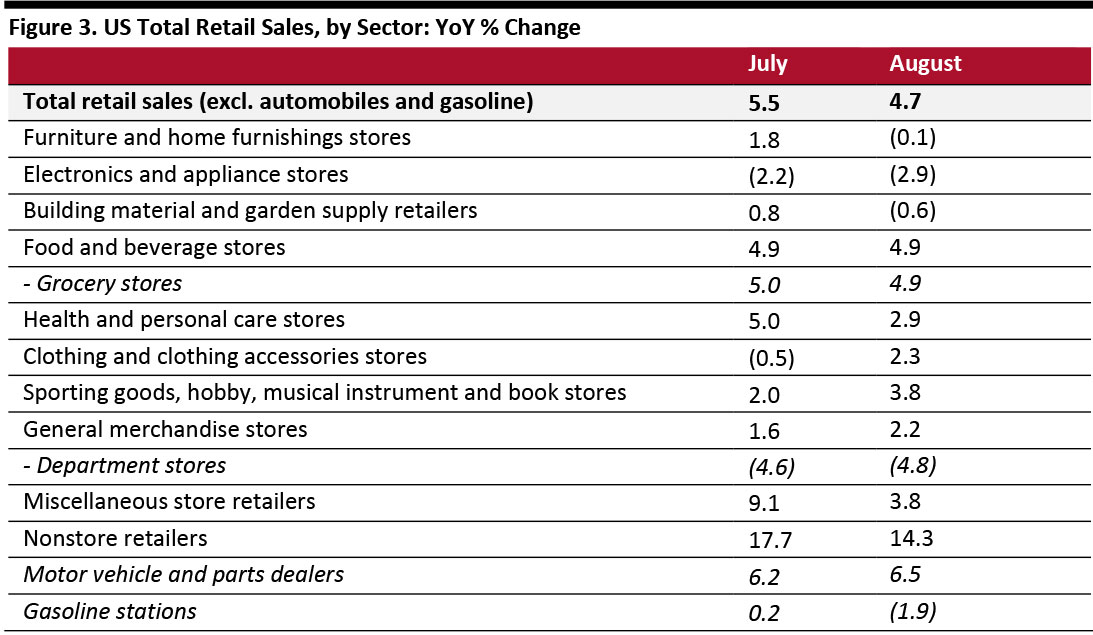

Source: US Census Bureau [/caption] Retail Sales Growth by Sector Several sectors saw slower growth in August than in July, notably furniture and home furnishings; building materials, garden supply retailers and health and personal care stores. Electronics and appliance stores continued to see sales decline: Sales were down 2.9% year over year in August, deteriorating further from July’s 2.2% slide. Clothing-store sales were up 2.3% year over year in August, improved from July’s 0.5% decline. Year-to-date, clothing-store sales were up 0.1%. The 2.3% increase is a strong lift likely due to back-to-college and back-to-school spending, as well as new fashions. Lower gas prices lead to lower dollar sales at gasoline stations, putting more cash into consumers’ pocket and contributing to growth in food, beverage and clothing stores. Nonstore retailers were up 14.3% from August 2018; sales in July had been boosted by Amazon Prime Day. [caption id="attachment_96406" align="aligncenter" width="700"] Data is not seasonally adjusted

Data is not seasonally adjusted

Source: US Census Bureau[/caption]

Data is not seasonally adjusted

Data is not seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Retail Sales Grow Month Over Month The Census Bureau’s own core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure grew 4.6% year over year in August, slightly faster than the 3.6% growth rate seen in July. On a month-over-month basis and seasonally adjusted, retail sales grew 0.6% in August. [caption id="attachment_96385" align="aligncenter" width="700"]

Data is seasonally adjusted

Data is seasonally adjusted Source: US Census Bureau [/caption] Retail Sales Growth by Sector Several sectors saw slower growth in August than in July, notably furniture and home furnishings; building materials, garden supply retailers and health and personal care stores. Electronics and appliance stores continued to see sales decline: Sales were down 2.9% year over year in August, deteriorating further from July’s 2.2% slide. Clothing-store sales were up 2.3% year over year in August, improved from July’s 0.5% decline. Year-to-date, clothing-store sales were up 0.1%. The 2.3% increase is a strong lift likely due to back-to-college and back-to-school spending, as well as new fashions. Lower gas prices lead to lower dollar sales at gasoline stations, putting more cash into consumers’ pocket and contributing to growth in food, beverage and clothing stores. Nonstore retailers were up 14.3% from August 2018; sales in July had been boosted by Amazon Prime Day. [caption id="attachment_96406" align="aligncenter" width="700"]

Data is not seasonally adjusted

Data is not seasonally adjusted Source: US Census Bureau[/caption]