Web Developers

Source: Company reports/StreetAccount

Source: Company reports/StreetAccount

Costco’s August Comps Beat Expectations; Solid Growth in E-Commerce Comps

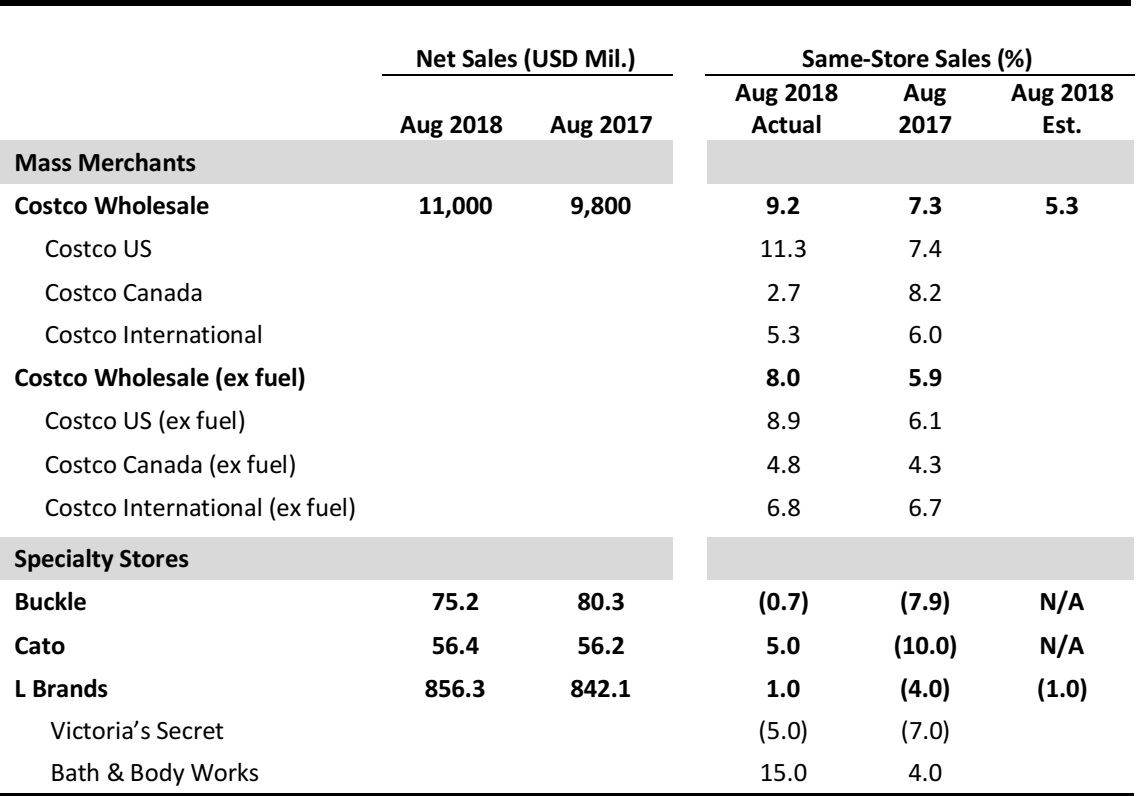

- Costco’s August same-store sales grew by 9.2% year over year, comfortably beating the consensus estimate of 5.3%.

- Costco’s e-commerce comp sales were up 23.8% in August, higher in comparison to the 20.9% growth reported in July.

- In August, traffic at Costco was up 5.3% worldwide and up 5.5% in the US.

- In terms of regions, the retailer witnessed strongest results in the Midwest, San Diego and the Bay Area, in the US. Internationally, Costco saw strong sales growth in Spain, Japan, Taiwan and Mexico.

- Foreign currency fluctuations negatively impacted the overall company’s comps by slightly less than 100 basis points. Canada was hurt by a little less than 400 basis points, while international comp sales were negatively impacted by 250 basis points.

- Cannibalization negatively impacted each of the US, Canada and other international segments by about 50 basis points.

- Food and sundries same-store sales were up by mid to high single digits. Departments that had strongest comp growth were tobacco, sundries and frozen foods. Hardlines were up by low double digits. The better-performing departments included toys and seasonal, hardware, health and beauty, and office.

- Softline comps increased by high single digits. Departments that performed well included houseware, home furnishings, small appliances and special-order kiosks. Fresh foods were up by mid single digits, with bakery and meat among the better-performing departments. Comp growth in fresh foods was mainly volume driven as prices were flat.

- In the ancillary business segment, gasoline, hearing aids and pharmacy saw best comp sales increases during the month. Gasoline price inflation added slightly more than 200 basis points to Costco’s total reported comp sales. The average selling price was up 20%, to $2.96, compared with $2.47 last year.

L Brands Reported Sluggish Comp Growth; Bath & Body Works Continues to Outperform other Segments

- L Brands’ comps grew marginally, by 1%, in August, with strong growth at Bath & Body Works offsetting weakness at the Victoria’s Secret chain. Victoria’s Secret’s comps fell by 5% while comps at Bath & Body Works were up 15%.

- L Brands’ merchandise margin rate was down in August compared to last year due to promotional activity at Victoria’s Secret.

- Inventories per square foot as of the end of August grew 15% year over year.

- At Victoria’s Secret, growth in beauty was more than offset by a decline in the PINK business, while Lingerie comps were roughly flat.

- At Bath & Body Works, comps increased by 15%, driven by strong product acceptance. The brand’s merchandise margin for the month was up compared to last year, driven by lower promotional activity and partially offset by channel shift and transportation cost.

Buckle Reported Negative Sales Growth led by Poor Comps; Men’s Business Outperformed Women’s Segment

- Buckle’s comp decreased marginally by 0.7% year over year in August, an improvement from the 7.9% year-over-year decrease recorded in the same month last year.

- Total sales in the men’s business grew 2.5% year over year. The men’s segment accounted for 53.0% of total sales compared with 51.0% in August last year. Price points were down 1.5% for August in the men’s segment.

- Total sales for the women’s segment fell 6.5% year over year. The women’s segment accounted for 47.0% of total monthly sales versus a slightly higher 49.0% share in August last year. Price points were down by around 6.0% in the women’s business.

- Accessories sales fell 6.0% year over year in August and accounted for 8.5% of total sales, flat versus August 2017. Footwear sales grew by only 1% compared to 9.5% growth last month and represented 5.5% of total sales, versus 5% in August 2017. The average accessory price points were down 3.5% and the average footwear price points were up 1.5%.

- In the current month, units per transaction rose by 1% and the average transaction value fell by about 2.5%, year over year.

Cato Reports Modest Comps Growth while Sales were almost Flattish

- Cato’s sales grew by 0.4% to $56.4 million while comps increased 5% year over year.

- As of September 1, 2018, the company operated 1,350 stores in 33 states, down from 1,372 in the year-ago period. Cato did not add or close any of its stores in the current month.