All data in this report are not seasonally adjusted.

Source: ONS/Coresight Research

All data in this report are not seasonally adjusted.

Source: ONS/Coresight Research

Source: ONS/Coresight Research

Source: ONS/Coresight Research

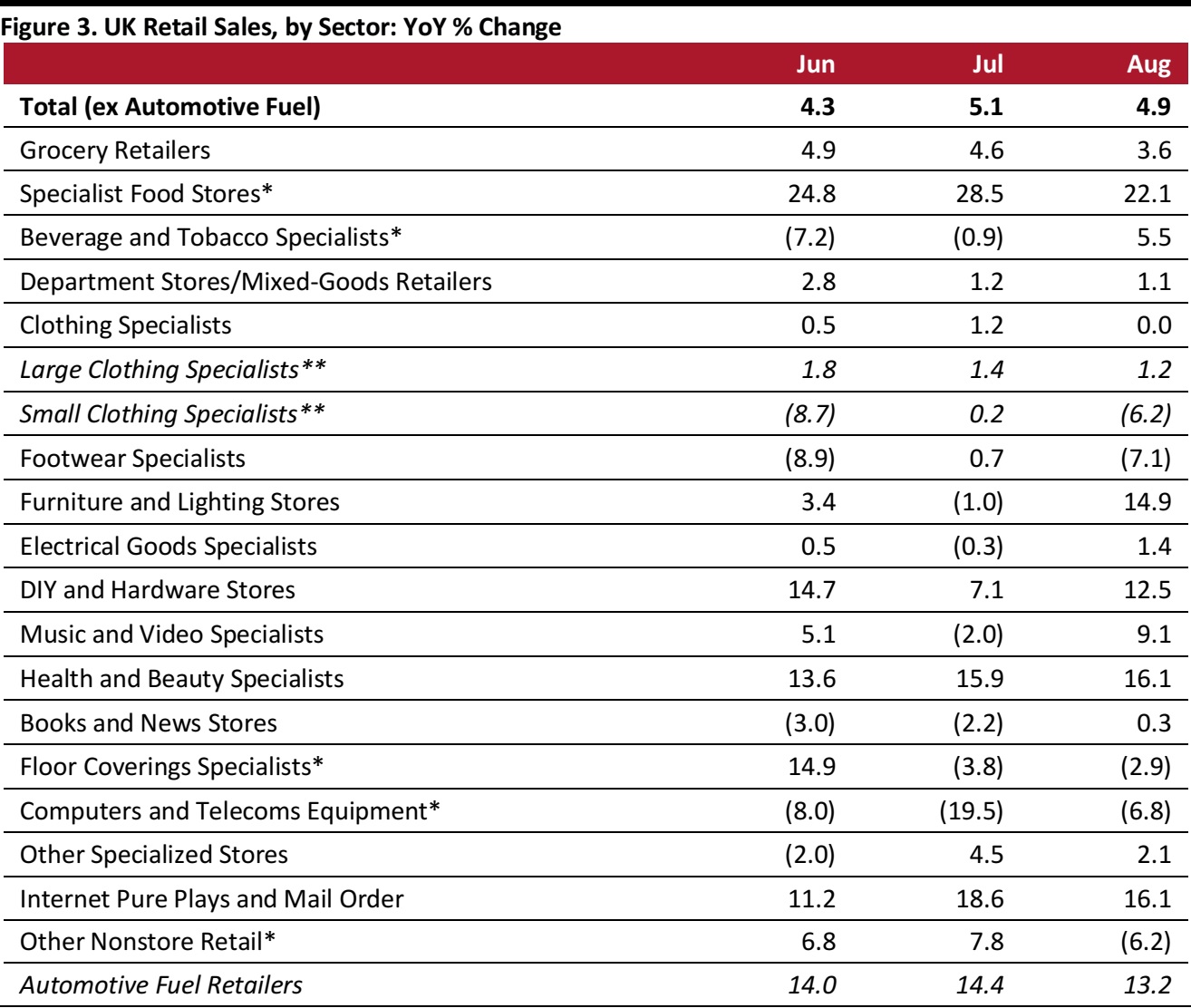

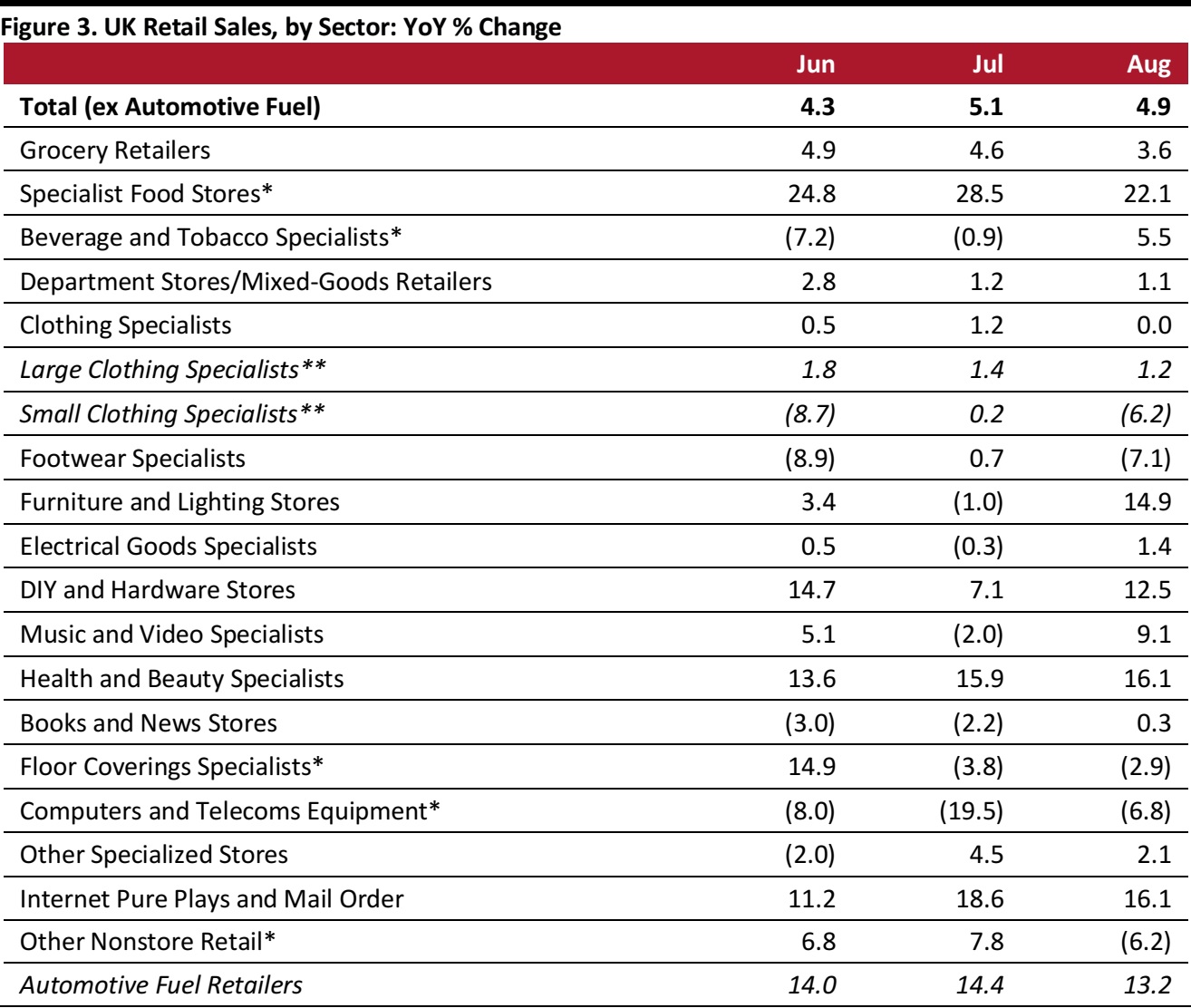

RETAIL SALES GROWTH BY SECTOR

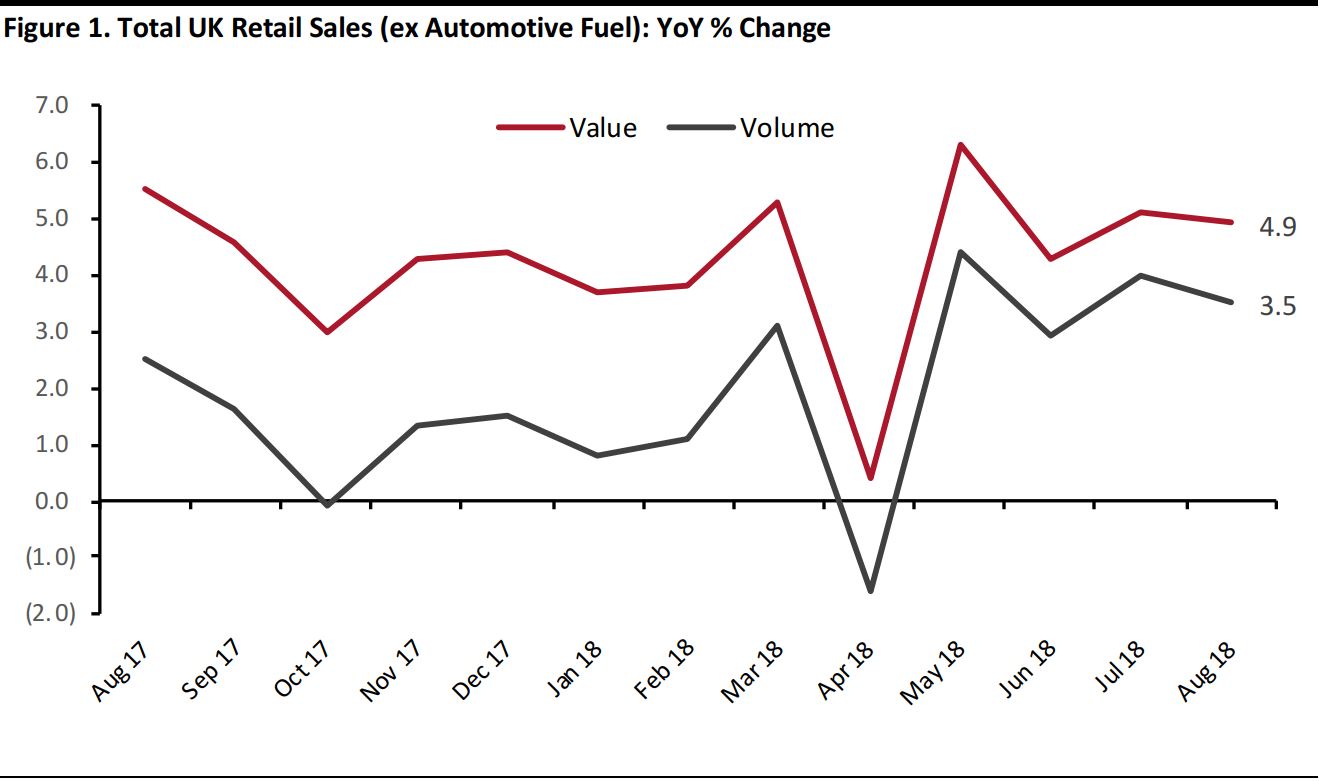

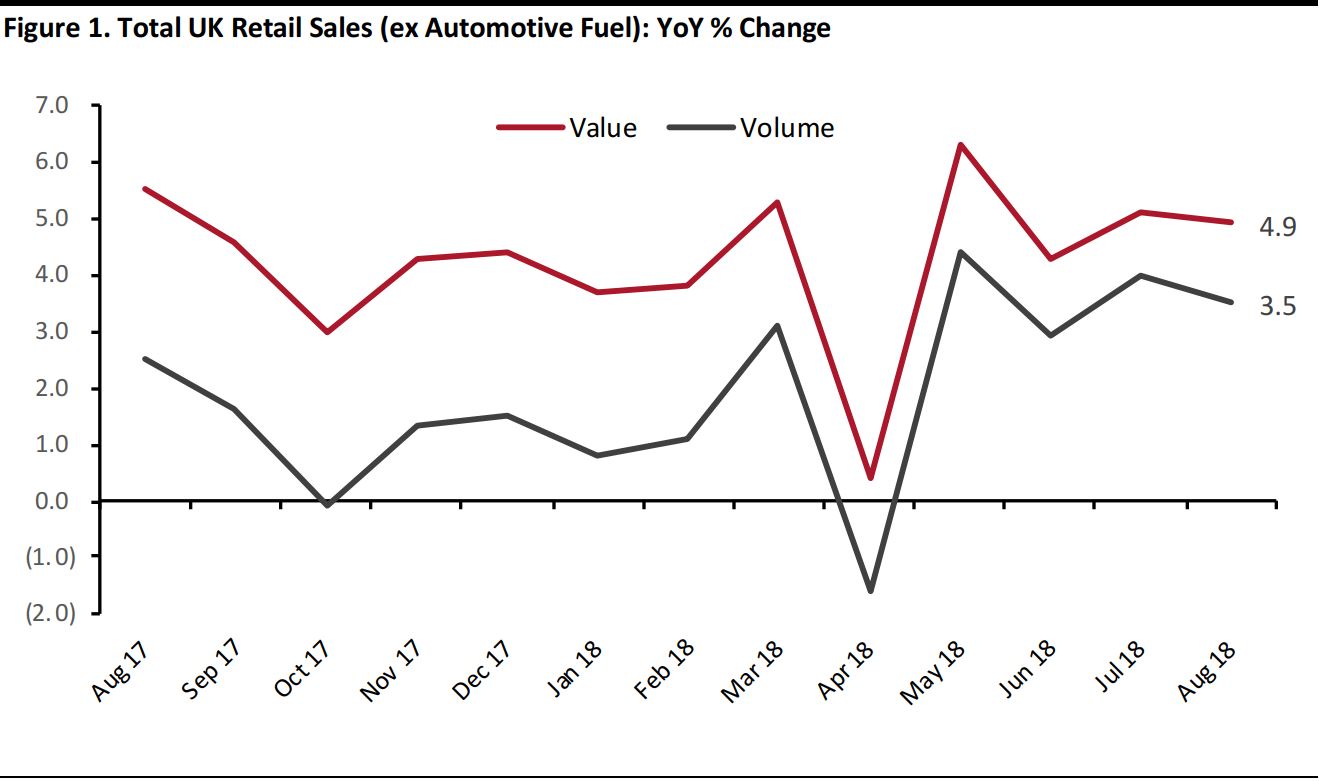

In spite of some negative headlines, UK retail is proving consistently strong according to ONS data, with solid volume growth and value growth having levelled off at around 5% year over year.

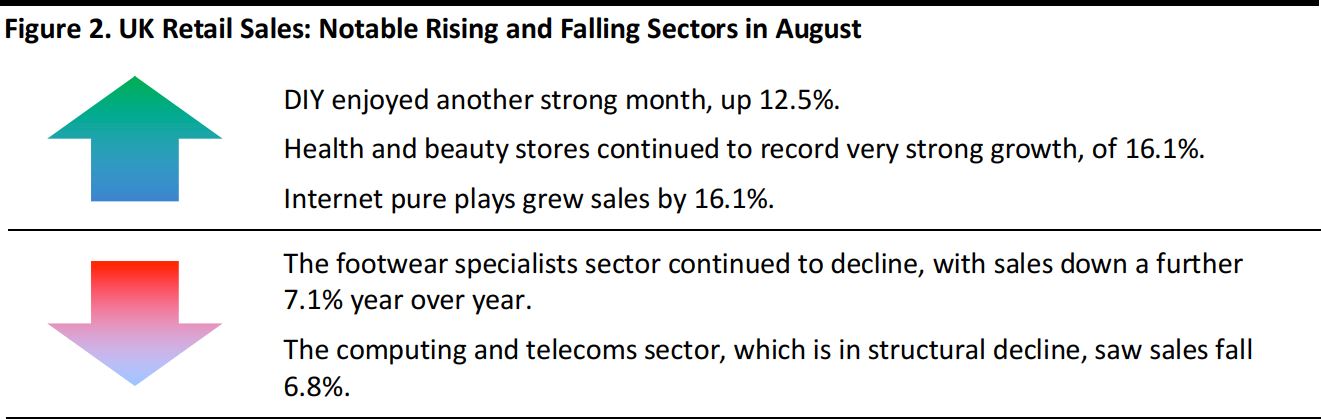

- Grocery-sector growth softened to 3.6% in August, even as inflation at food retailers ticked up to 2.0%, from 1.8% in July.

- Large clothing retailers, comprising 90% of the clothing-specialists sector, registered modest positive growth, with the sector total depressed by the volatile small retailers’ index.

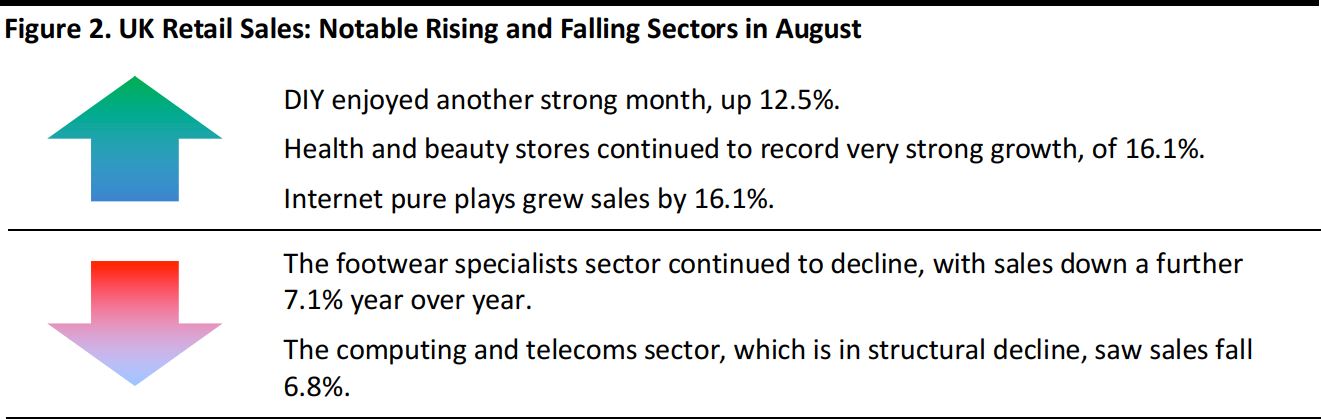

- Footwear specialist stores continued their apparent structural decline, which is fuelled by the growth of Internet-only retailers and the sneakers trend channeling footwear spend to sports stores—both types of retailers are counted elsewhere in the ONS index.

- Big-ticket DIY and furniture enjoyed a strong month, though the highly erratic floor-coverings sector was down a touch, according to the ONS.

- Elsewhere, recent trends continued with very strong growth in health and beauty, a structural decline in computing and telecoms, and strong growth for Internet-only retailers (which includes mail-order).

The ONS reported that total shop-price inflation (ex automotive fuel) strengthened to 1.3% in August, from 1.1% in July. We have already noted the uptick in food-retail inflation, and the ONS reported an acceleration in nonfood retail, too. This was supported by inflation at clothing and footwear stores increasing from 0.0% in July to 0.5% in August. At automotive fuel retailers, inflation moderated slightly to 11.3% in August from 11.9% in July.

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

ONLINE RETAIL SALES GROWTH

Total Internet retail sales were up 14.4% year over year in August, versus 15.0% growth in May. In August, Internet sales grew by 5.9% at food retailers, 17.9% at nonfood retailers and 14.4% at non-store retailers.

Internet retail sales accounted for 16.8% of all retail sales in August versus 17.0% in July. In August, e-commerce’s share of sales stood at 5.1% at food retailers and 12.9% at nonfood retailers, which included a 15.1% share of sales at clothing and footwear specialist retailers.

All data in this report are not seasonally adjusted.

Source: ONS/Coresight Research

All data in this report are not seasonally adjusted.

Source: ONS/Coresight Research Source: ONS/Coresight Research

Source: ONS/Coresight Research *A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS