Web Developers

Later Labor Day Affected Costco’s August Comps

- The four-week August period had 28 selling days both this year and last year.

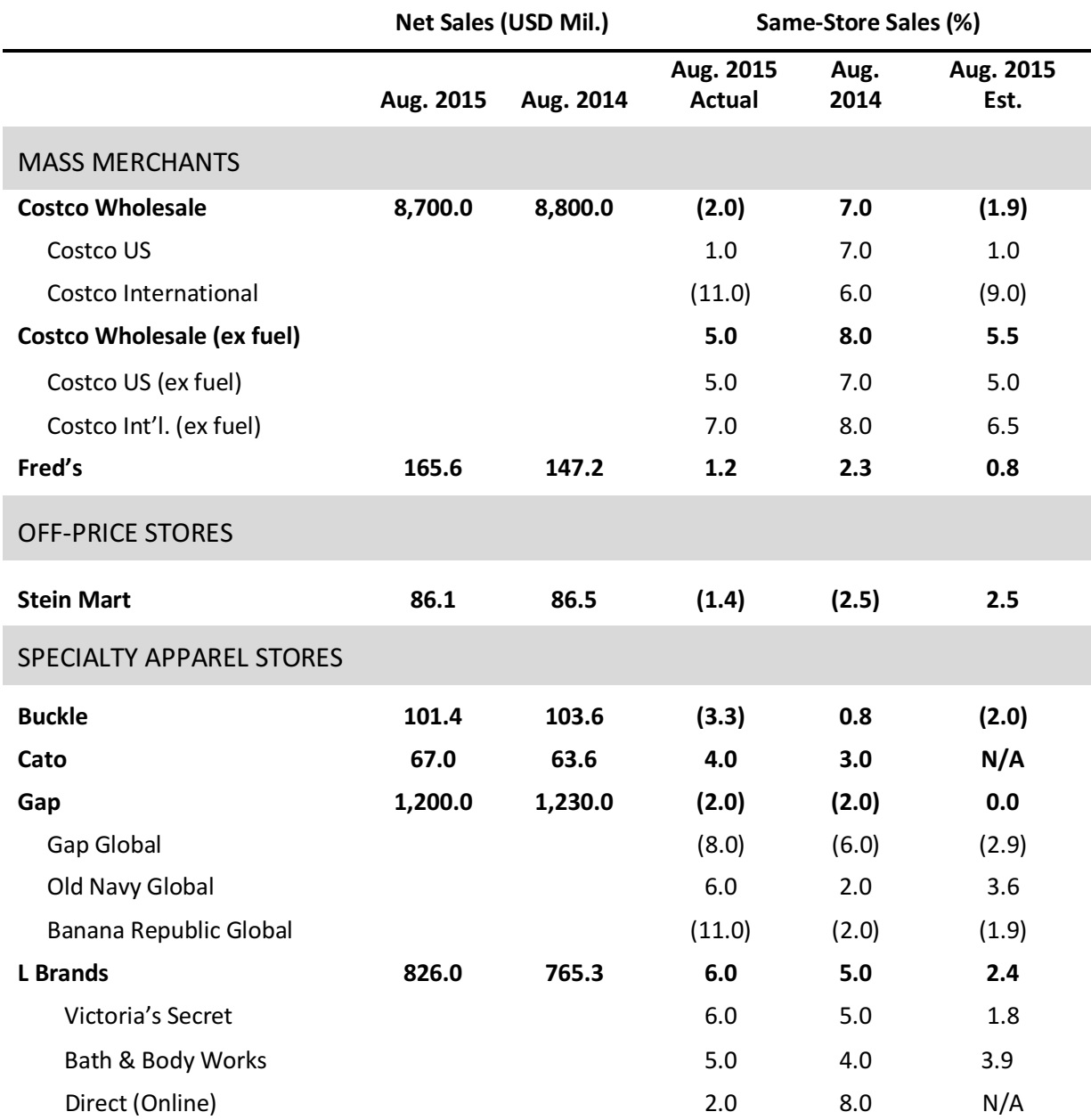

- Costco’s (2)% comparable sales growth in August missed analysts’ estimates of (1.9)%.

- A late Labor Day holiday in the US and Canada and a late Chuseok holiday in South Korea affected preholiday sales performance. The calendar shift was responsible for a sales decline of just under 1%.

- Within the US, the strongest sales regions were Los Angeles, San Diego, Texas and the Midwest. Internationally, Australia and Mexico posted strong sales, as they have in recent months.

Fred’s Better-than-Expected Sales Benefited from Improved General Merchandise and Pharmacy Sales

- Total sales for value store Fred’s increased by 12%, to $165.6 million, in August, up from $147.2 million in August last year. Total sales growth would have been 17%, had $5.6 million from last year’s 54 closed stores not been excluded.

- Same-store sales for the month increased by 1.2%, which was lower than the 2.3% increase during the same period last year.

- Recent specialty pharmacy expansion continued to benefit total sales. Solid August sales were in line with the company’s internal expectations. General merchandise departments that performed well included back-to-school categories such as stationery, apparel, health and beauty, toys, and domestics.

Stein Mart August Comp Sales Missed Estimates

- August comps at Stein Mart were affected by the late Labor Day holiday.

- Total sales reported were $86.1 million, a 0.4% decrease from last year. Comp sales decreased by 1.4%.

- Florida posted the strongest sales, while Texas and the West had weak results.

Buckle’s August Comps Declined, Driven by Weak Women’s Apparel and Footwear Sales

- Teen retailer Buckle saw overall comps decline by 3.3% in August.

- The women’s section accounted for 55.5% of total monthly sales versus 57.5% last year. The total sales portion for men’s categories increased to 44.5% from 42.5% last year.

- Popular men’s categories included casual bottoms, knit shirts, shorts and accessories. On the women’s side, casual bottoms, shorts, dresses and woven tops were popular sellers. The price points on both the men’s and women’s sides of the business were even compared to last year.

Cato’s August Comp Sales Results Up 4%, Beating Expectations and Recent Trends

- Cato reported sales of $67 million for the four weeks ended August 29, 2015, up 5%, from $63.6 million, in 2014. Comp sales were up 4%.

- “August same-store sales were above our expectations and higher than our recent trend. However, due to strong sales in the back half of last year, we remain cautious for the remainder of the year,” commented John Cato, the company’s Chairman, President and Chief Executive Officer.

Gap Inc.’s Total Same-Store Sales Dropped 2% in August, but Old Navy Had Positive Comps and Benefited from Back-to-School Season

- Gap’s August comp sales were down 2%, following a 2% decrease last year in the same period. Total net sales were $1.20 billion in August, down from $1.23 billion last year.

- Its largest brand, Old Navy, delivered positive results again, driven by healthy back-to-school sales. Banana Republic’s weak performance was primarily due to the Labor Day calendar shift.

- The benefit of tax-free holidays in certain states has been largely offset by the late Labor Day this year.

L Brands Reported a 6% Increase in August Comps and Expects Continued Growth in September

- August comps were up 6% at Victoria’s Secret, driven by strong back-to-school sales in the PINK line. Comps were up 5% at Bath & Body Works. Total comps were affected by about one percentage point by the Labor Day calendar shift.

- Overall inventory per square foot was up 2% and the merchandise margin rate was also up compared to last year.

- The company expects September comps to be up, in the low to mid-single-digit range, with a one-percentage-point gain from the late Labor Day this year.