Introduction

A confluence of trends is supporting the steady growth of athleisure apparel and sportswear. In the US, the casual zeitgeist has a broad swathe of the population dressing in outfits that work from the office to the gym and from the café to the college classroom. Time-starved consumers expect their apparel to work in more than one setting throughout the day, and to be comfortable and presentable no matter the environment. One size may not fit all, as we note in

a recent report on inclusivity in fashion, but one outfit can now fit most occasions.

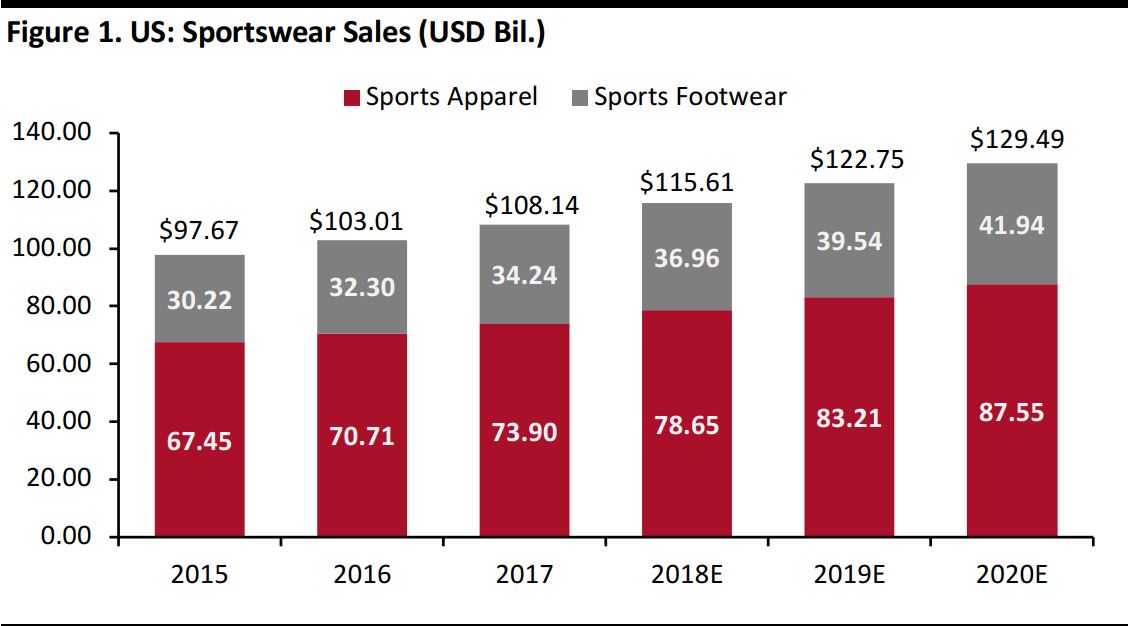

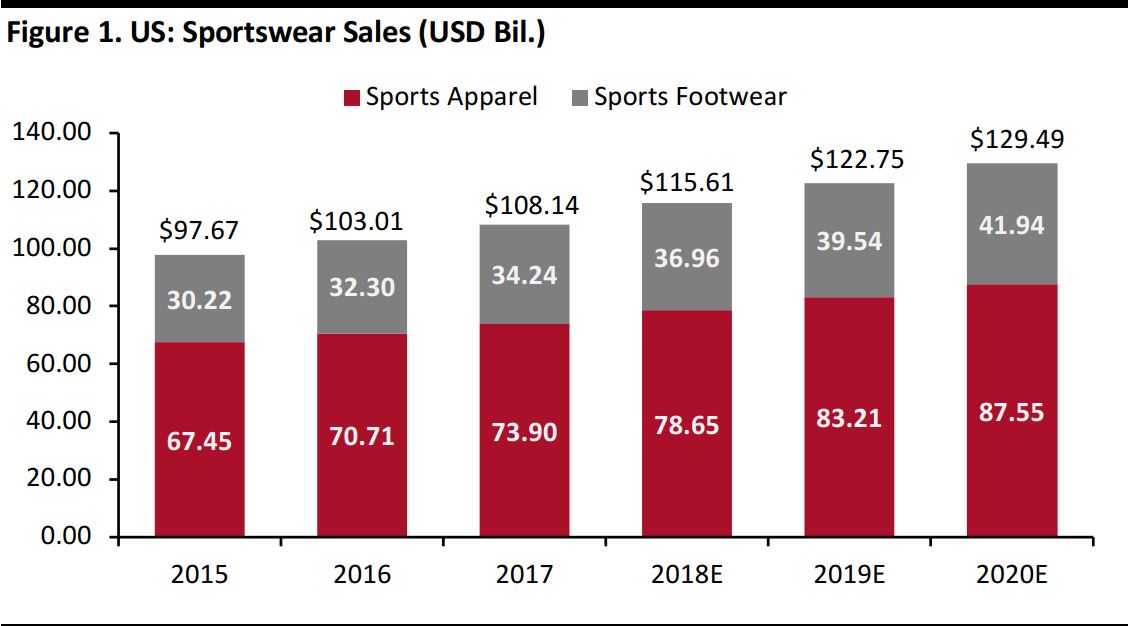

Athleisure apparel’s popularity has led to it replacing more traditional workwear in multiple industries, beginning with technology and then spreading to marketing, academia and consulting. In the past five years, the sportswear market has grown at a 6.5% CAGR, propelling overall growth of the apparel and footwear market in the US, which grew at only a 2.5% CAGR between 2012 and 2017.

As athleisure moves further into the mainstream, we note two significant trends in the market:

- Athleisure is influencing traditional fashion categories such as denim and formalwear. Ministry of Supply and other startups are offering lines of performance businesswear that appeal to millennials’ desire for apparel that is both comfortable and easy to care for.

- The sports footwear market is being buoyed by sneaker culture, from the mass market segment to the luxury segment. The sneaker trend is one of the most visible manifestations of the casualization of fashion, and it is fueling the outperformance of the sports footwear category.

Athleisure, by the Numbers

Athleisure Sales Growth Has Outpaced Traditional Apparel Sales Growth, and the Market Continues to Expand

The definition of athleisure is fluid, because the difference between “sportswear” and “athleisurewear” depends more on how consumers choose to wear items than on specific characteristics of particular garments or shoes. In theory, any sportswear item can be characterized as athleisurewear, which means that estimating the size of the total sportswear market is the most useful way to estimate the scope of the athleisure market:

- US sportswear sales will total almost $116 billion this year, according to Euromonitor International, with apparel contributing $79 billion and footwear $37 billion. That forecast total is 46% higher than 2012’s figure and represents a five-year CAGR of 6.5%.

- The $116 billion forecast represents a year-over-year increase of almost 7%—which would be a very strong performance in an apparel market that is otherwise growing slowly.

- Euromonitor expects the total sportswear market to be 12% higher still by 2020, supported by 13% growth in sports footwear and 11% growth in sports apparel.

- We estimate that growth in the total US apparel and footwear market will be lower, at only 4.3% between 2018 and 2020.

Sportswear growth is projected to slow modestly from a 6.5% CAGR between 2012 and 2017 to a 6.2% CAGR between 2017 and 2020, according to Euromonitor. This forecast slowdown reflects consumers’ transition from the acquisition stage to the replenishment stage with regard to sportswear.

Source: Euromonitor International

Source: Euromonitor International

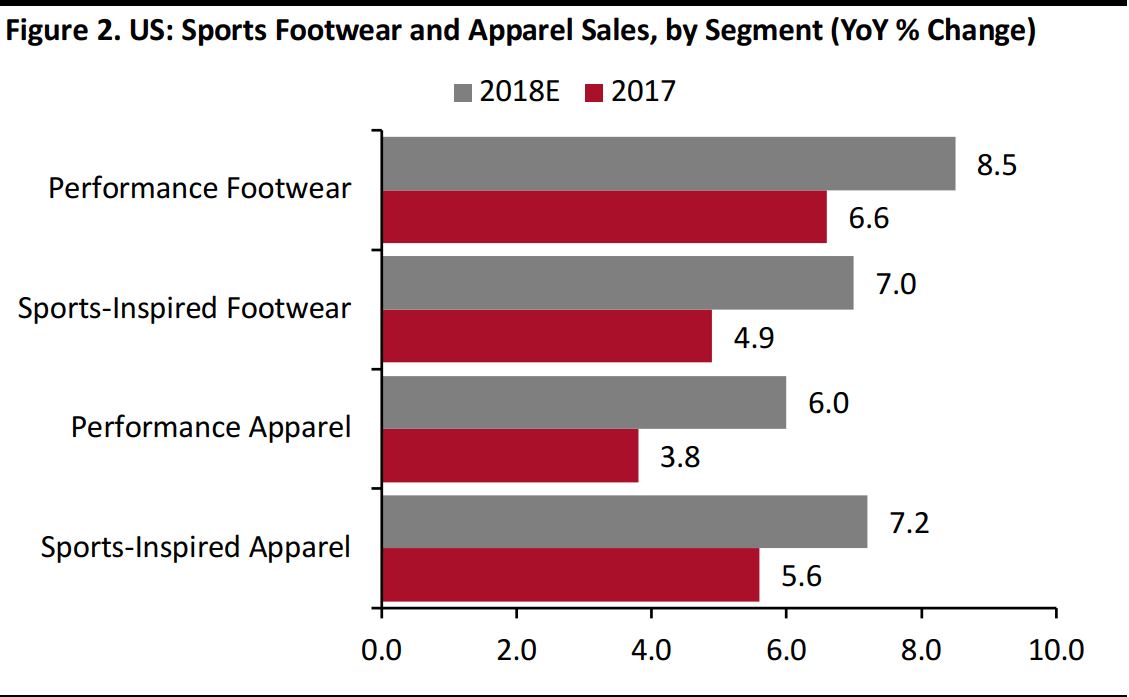

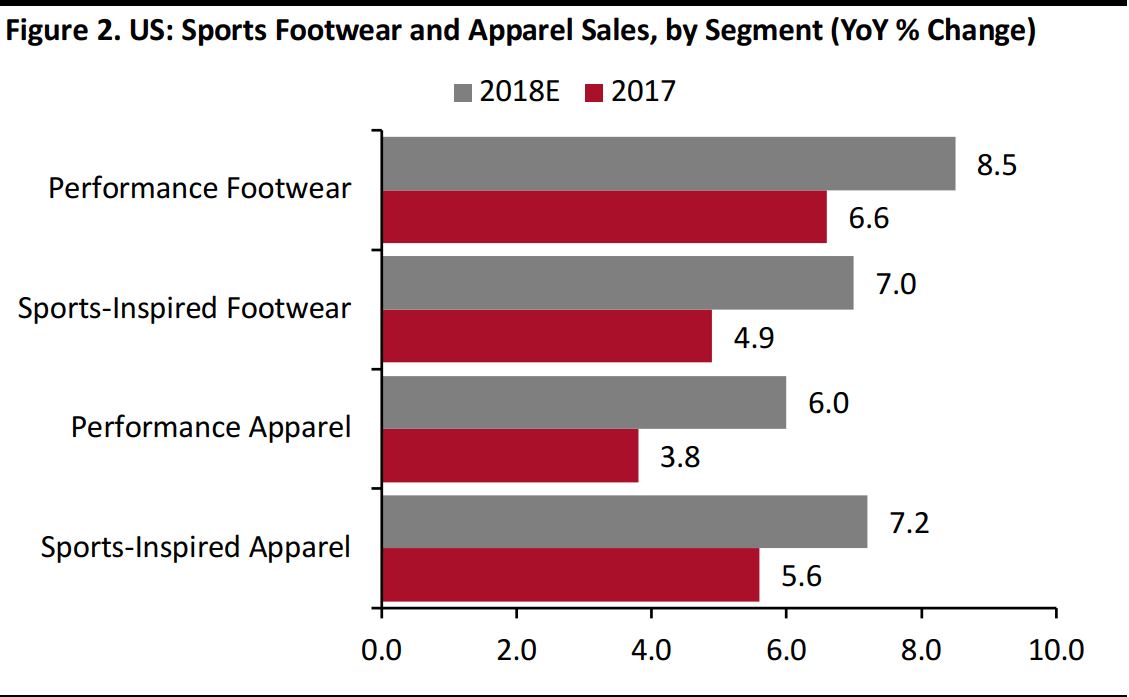

Sports Footwear Sales Are Growing Faster than Sports Apparel Sales

In the US, sports footwear sales have tended to grow faster than sports apparel sales, and Euromonitor expects footwear growth to accelerate this year from the already strong growth seen in 2017. As we discuss later, the sneaker trend is supporting growth in sports footwear.

Within the category, growth is expected across both performance products,

which support atheltic endeavors, and sports-inspired products, which are fashion items with a sports influence.

Performance footwear and apparel is specifically designed for sports activities. Sports-inspired footwear and apparelincludes nonperformance/outdoor items from major sports brands (such as Puma and Adidas Originals) as well as sports-inspired products from general apparel brands (such as H&M, Zara and Gap).

Source: Euromonitor International

Performance footwear and apparel is specifically designed for sports activities. Sports-inspired footwear and apparelincludes nonperformance/outdoor items from major sports brands (such as Puma and Adidas Originals) as well as sports-inspired products from general apparel brands (such as H&M, Zara and Gap).

Source: Euromonitor International

Sports footwear was a $34.2 billion market in the US in 2017, according to Euromonitor. It grew at a CAGR of 7.8% in the five years through 2017, compared to a 5.9% CAGR for sports clothing over the same period.

Sports footwear is a concentrated market, with the two largest participants accounting for well over half of the total: Nike is the largest name in sports footwear, with its 46% market share in 2017 giving it a strong lead over second-place Adidas, which had a 10% share per Euromonitor. Nike’s Snkrs app, which provides early access to new launches of premium and exclusive Nike products, drove digital sales growth of 41% in the final quarter of the company’s 2018 fiscal year (ended May 31, 2018).

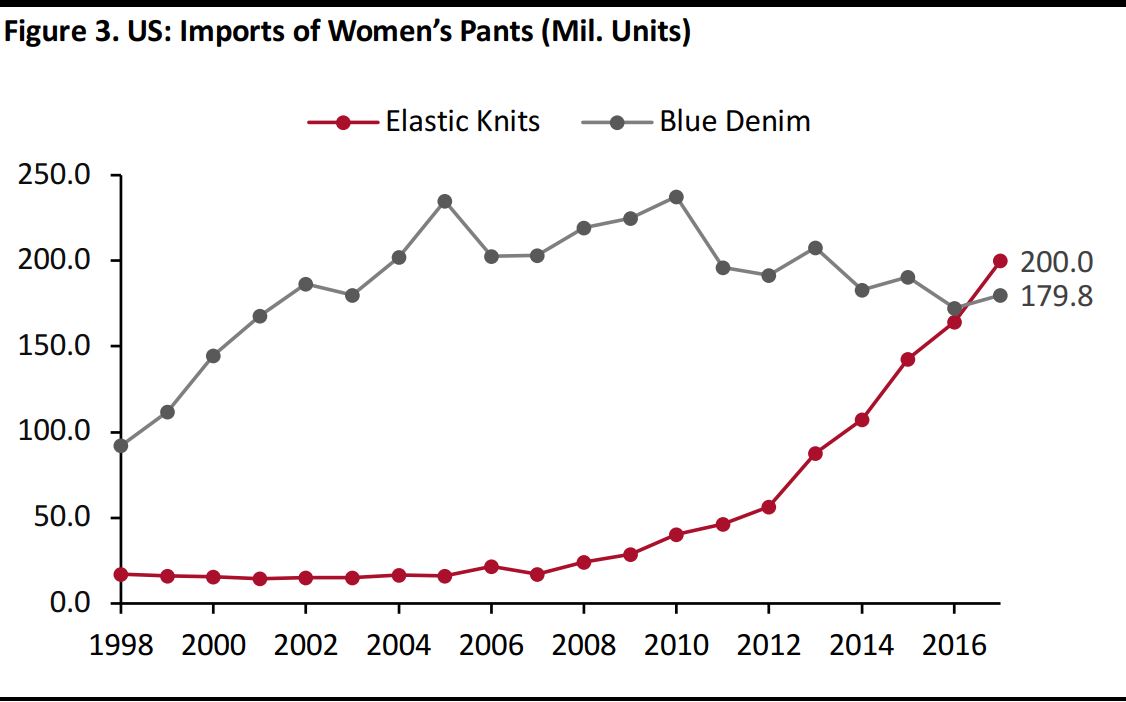

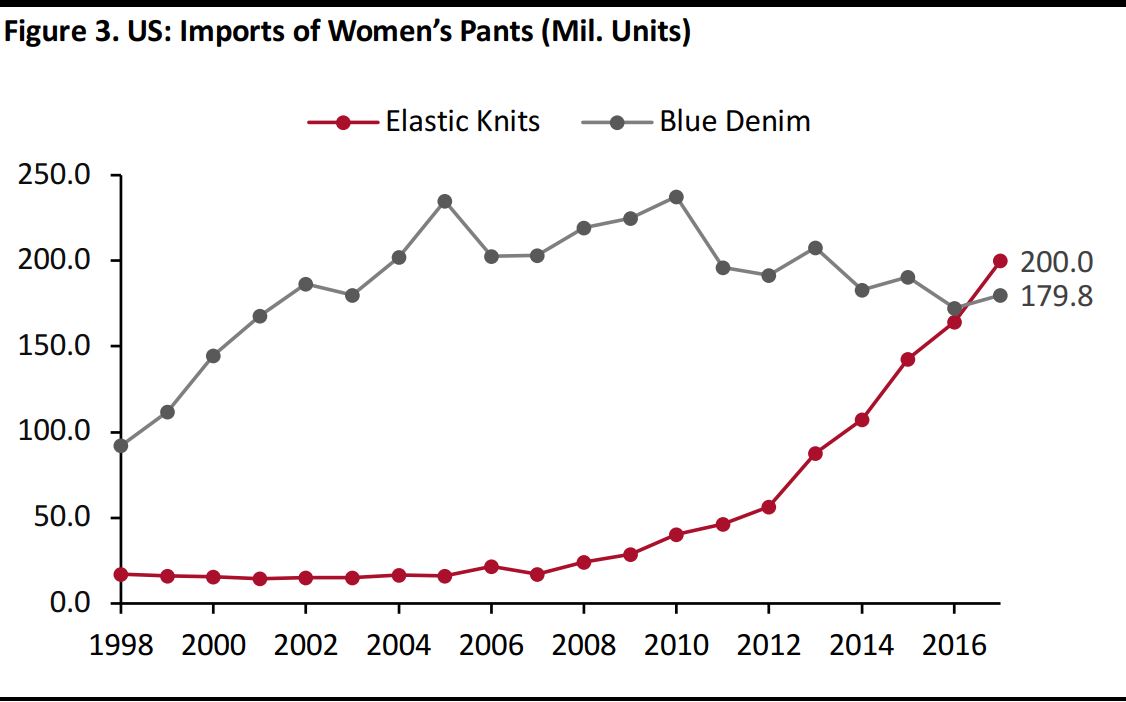

Trend 1. Athleisure’s Influence Is Expanding Beyond Sportswear

Athleisure’s influence is expanding beyond sportswear into more traditional apparel categories, including denim and workwear. In many cases, athleisurewear has replaced denim as consumers’ go-to casual staple. According to The NDP Group, the athleisure bottoms business (particularly leggings and yoga pants) has displaced the jeans business one to one. Denim, specifically premium denim, was a hot commodity around the year 2000, when some consumers were willing to shell out $200–$300 for a pair of jeans. This year, however, the average price for a pair of jeans will be $32, according to Euromonitor, and the firm forecasts that the US premium jeans segment will decline by 1.8% in 2018 versus a low-single-digit increase for the overall jeans market.

Instead of buying a new pair of designer jeans, many women have opted for more comfortable and less expensive yoga pants in recent years. As the trend gained traction with Lululemon Athletica’s success, new brands entered the market at both ends of the pricing spectrum. Reflecting the erosion of denim, US imports of women’s elastic knit pants totaled 200 million pairs in 2017, surpassing imports of women’s blue denim pants, which totaled 179.8 million pairs.

Source: US Census Bureau

Source: US Census Bureau

Despite the popularity of yoga pants and other athleisure offerings, denim enjoyed something of a rebound in 2017, with Levi’s reporting an 8% sales gain, its strongest growth since 2011, and other denim leaders reporting a

Designers, luxury labels and athletic brands are capitalizing on the sneaker trend. sales lifts as well. Jeans companies are leveraging product innovation to regain share and attract consumers accustomed to the comfort of sportswear. Hybrid denim products that combine denim’s durability and style with the comfort of athletic clothing are restoring denim demand, and denim specialists’ commitment to innovation via labs and textile partnerships should result in the continued flow of new product with enhanced functionality.

Business and professional attire has also been impacted by activewear’s attributes of comfort, stretch and mobiity. Ministry of Supply, a high-performance men’s and women’s businesswear brand, was founded in 2012 by former Massachusetts Institute of Technology students, who used some of the same temperature-regulating material in their designs that NASA astronauts wore. The Ministry of Supply lines allow for full range of motion, provide odor control and require no ironing or dry cleaning. The brand caters to young executives working long hours, many of whom travel extensively and often need to go straight from an airplane to a business meeting without changing clothes. Today, the company has a substantial ecommerce business along with seven US urban store locations.

In 2017, Banana Republic introduced a similar performance businesswear line for men: the Rapid Movement Chinos line combines tailoring and performance, and the company hired four pro athletes to market it. By incorporating activewear attributes into traditional workwear, as Ministry of Supply and Banana Republic have, apparel brands can reinvigorate their brand appeal by attracting younger consumers who are accustomed to the comfort of athleisurewear.

Trend 2: Sneaker Culture Is Providing New Impetus to Athletic Footwear

Sneaker culture is pervading fashion across segments, from the mass market to luxury, and is buoying the sports footwear market. The sneaker trend is one of the most visible manifestations of the casualization of fashion—with consumers increasingly wearing sports footwear in traditionally formal contexts—and the trend is supporting the growth of the athleisure market.

Source: www.bergdorfgoodman.com

Source: www.bergdorfgoodman.com

We have seen a proliferation of high-end sneakers and running shoes designed by luxury brands such as Balenciaga, Coach, Fendi, Gucci and Prada. The latest luxury shoe craze is the sock sneaker, and Balenciaga,zDKNY, Fendi, Marni and Rick Owens have all offered sock sneaker designs. These shoes have a minimal, stretchy knit upper attached to a sole, with no laces. The design was partially pioneered by sports apparel companies Adidas and Nike. According to fashion research firm Edited, from the first quarter of 2017 to the start of the third quarter ofz2017, the number of sock-like sneakers offered by luxury brands increased by 220%. The average price of new sock sneaker arrivals in the third quarter of 2017 was $410, according to Edited.

On Nike’s fourth quarter 2018 call with investors, CEO Mark Parker commented on consumer demand for comfortable sports footwear, saying:

In Sportswear, the consumer demand for all-day comfort is making Air Max one of the fastest-growing platforms in our industry. Our icons, the Air Max Plus, 95, 97 and 98, are all performing incredibly well. Air Vaporzax built on that demand, and this quarter, we took it a step further with Nike’s first innovation built specifically for lifestyle, Air Max 270. Launching in March, 270 is the most successful Air Max launch in our history.

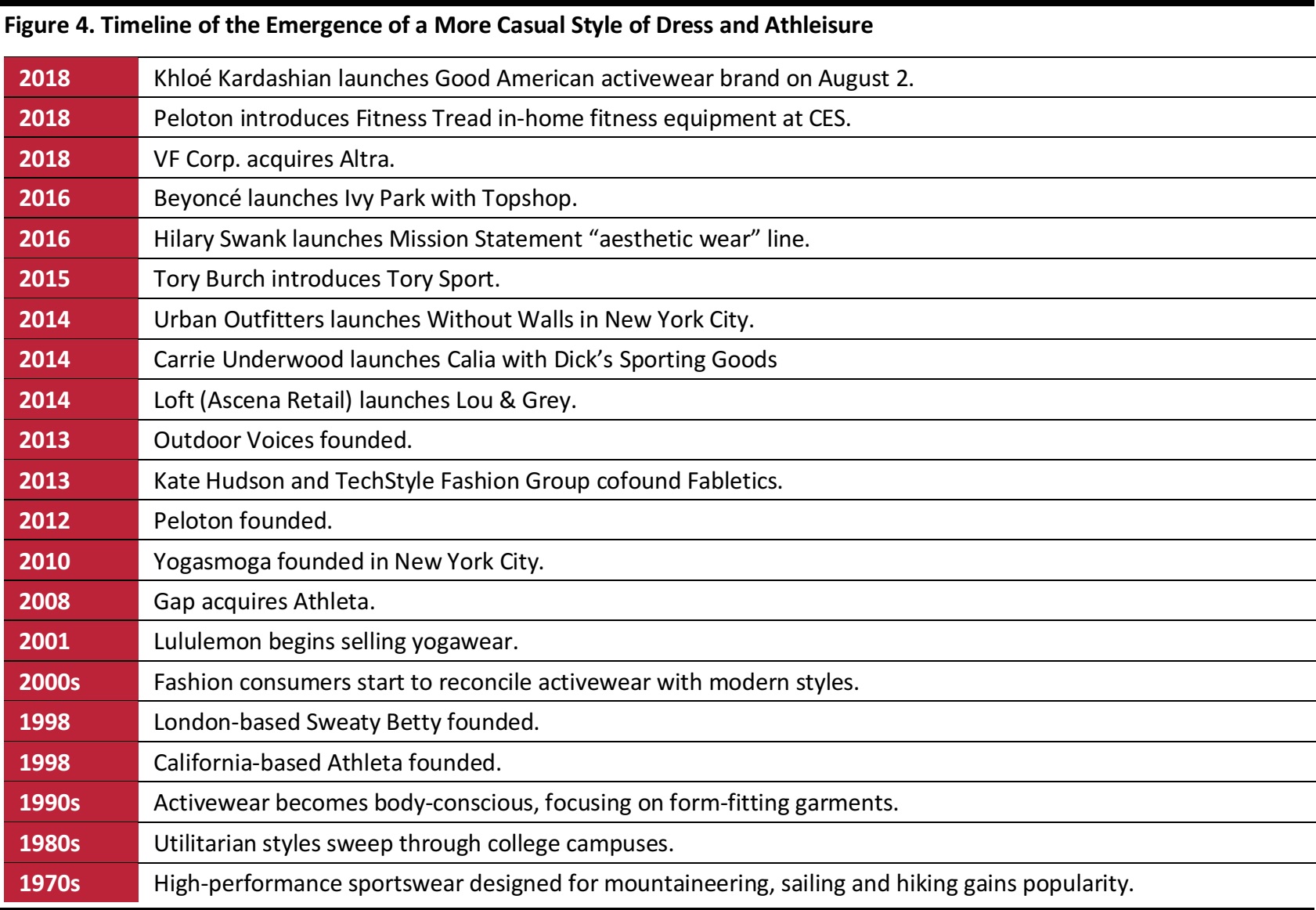

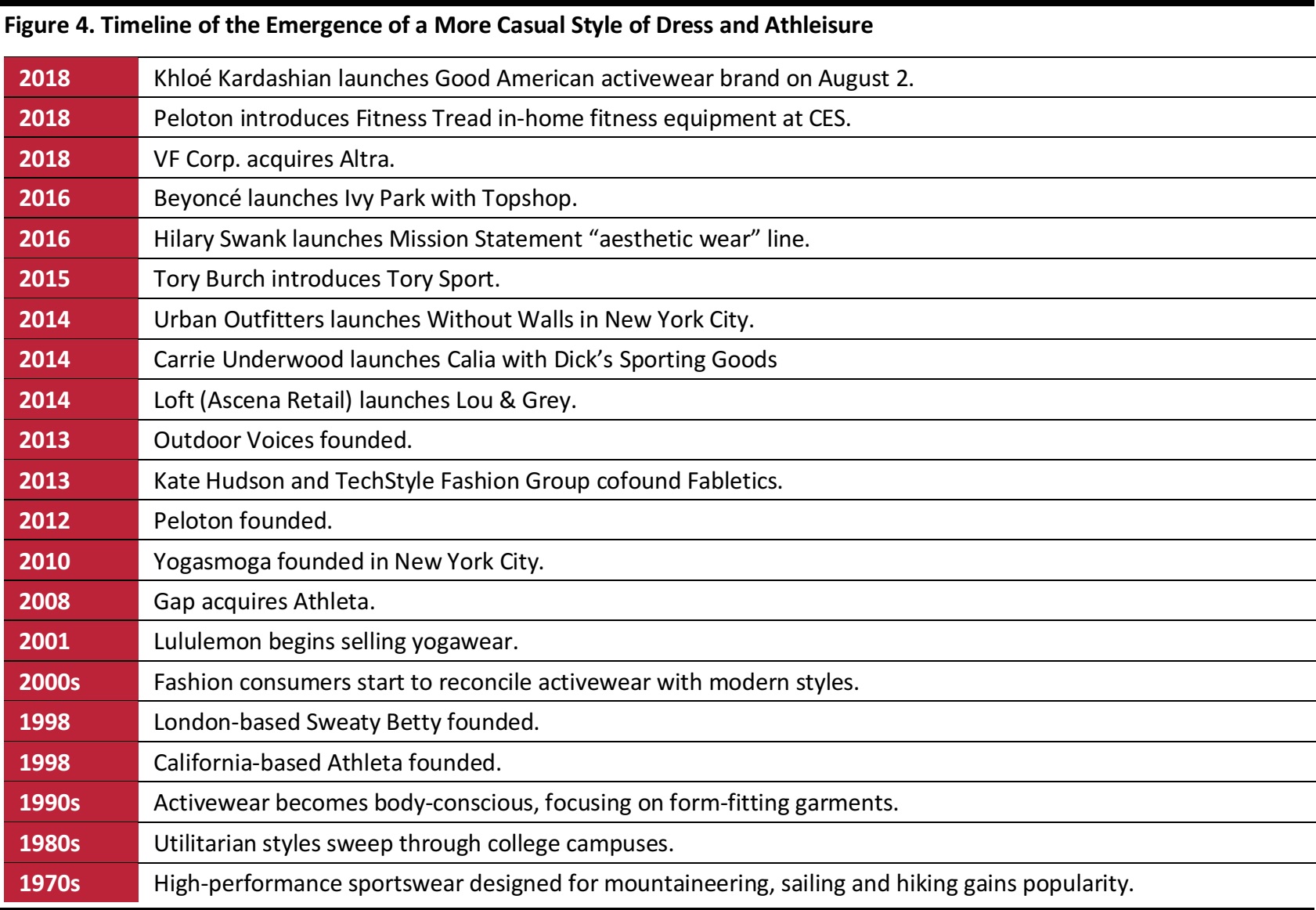

Tracing the Development of Athleisure

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Top Athleisure Brands: Strategies and Performance

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

The athleisure market is dominated by global brands such as Nike, Adidas and The North Face and by athleisure pure plays such as Lululemon and Sweaty Betty. But opportunities are bright for new brands whose selling points span innovative technical fabrication, personalization and an authentic social media presence. Barriers to entry have dropped, and textile advances and technology-driven engagement make athleisure a lucrative business for startup and traditional apparel brands alike.

In the US, the sports apparel market is more fragmented than the sports footwear market is, according to Euromonitor data. The firm estimates that Nike holds approximately 9.5% of the US sports apparel market, while its nearest competitor, Under Armour, holds about 5.2%, followed by Adidas, with approximately 3.3%. The top 10 sports apparel brands accounted for less than 30% of total sports apparel sales in the US in 2017.

Major Athletic Brands

Reports of Nike’s demise faded fast when the company released its most recent quarterly results on June 28. The company reported that North America sales momentum turned positive and that digital sales rose by 38% year over year. Nike’s focus on its direct-to-consumer strategy resulted in a nearly 20% lift in the division’s sales in the fourth quarter and a 15% lift for the fiscal year ended May 31. The women’s business is setting the pace at Nike, with sales of the women’s Jordan sneaker line tripling in the company’s most recent quarter and representing a significant fiscal 2019 opportunity.

Adidas is benefiting from the demand for classic retro styles in running and training products and footwear, which is being driven in part by streetwear culture. The company reported a 10% sales gain in the first quarter of 2018 (ended March 31, 2018), to $6.8 billion, and a 17% increase in net income from continuing operations, to $668 million.

Under Armour’s North America business, which accounts for about 73% of the company’s global revenue, stablized during the first quarter of 2018 (ended March 31, 2018) at $868 million, reflecting a slight decline in wholesale revenue that was offset by growth in the direct-to-consumer business. The 2016 bankruptcy of Sports Authority and the closing of the chain’s 450 stores impacted Under Armour’s US wholesale business through 2017.

Some top brands from the 1970s and 1980s, such as Reebok (which was acquired by Adidas in 2005) and Fila, are enjoying renewed popularity, particularly among young millennials. Meanwhile, Vans remains a perennial favorite and Supreme consistently sells out. Reebok’s North America business returned to growth (up 3%) in the first quarter ended March 31, 2018, and with the July 20 launch of the Victoria Beckham collaboration—a unisex streetwear capsule collection inspired by Shaquille O’Neal—the brand is attracting a new generation of shoppers.

Athleisure Pure Plays

Many of the athleisure pure plays evolved because traditional wholesale brands weren’t addressing the needs of female athletes who sought both fashion and function in their workout gear. Some of these pure plays have also launched activewear for men. Celebrities are attracted to the category as well, as many have formidable workout routines that they want to share with their fans on social media and through product lines.

Lululemon was among the first brands to address the unmet needs of women seeking fashion and function in workout apparel, and the company continues to drive industry growth. In its most recent quarterly earnings report (for the quarter ended April 29, 2018), the company reported a 25% sales increase that was driven by an 8% comparable store sales increase and a 62% increase in direct-to-consumer (e-commerce) sales. Brick-and-mortar accounts for approximately 75% of Lululemon’s sales, and increased store traffic is lifting the comparable store sales metric. The company achieved a strong financial performance in its most recent quarter, with gross margin expansion of 270 basis points, to 53.1%; operating margin expansion of 400 basis points, to 16.1% of sales; and EPS up 71.9%, to $0.55. Lululemon is benefiting from demand for men’s apparel as well as women’s. The men’s business represented about 30% of the company’s first-quarter 2018 sales and Lululemon is targeting $1 billion in sales for its men’s line by 2020.

Athleta contributed double-digit sales growth to Gap Inc.’s fiscal first quarter (ended April 29, 2018) and is regarded as the “gem” in the company’s brand portfolio. Gap CEO Art Peck said on the company’s first-quarter conference call that Athleta is “becoming a very nicely sized gem, and remains underappreciated.” Athleta also just became a B Corporation, or a certified benefit corporation. To achieve certification, companies must meet rigorous standards across social and environmental performance, accountability, and transparency. This is a critical component of Athleta’s brand identity and should enhance its brand engagement.

Athleisure Celebrity Brands

Kate Hudson, Don Ressler and Adam Goldenberg launched Fabletics in 2013 in the US. By 2015, the company had entered seven international markets, added a men’s line and opened six US retail locations. Today, Fabletics operates 25 stores in North America. The company has also added plus sizes to its women’s assortment. Fabletics has more than 1 million VIP members who receive monthly recommendations of stylish, fashion-forward activewear; membership is free and offers savings of up to 50%. In 2017, Fabletics’ sales were estimated at $250 million.

Tennis star Venus Williams leveraged her visibility on the tennis court when she launched her activewear brand, ELeVen, in 2007. The brand features functional and fashionable workout gear. Williams opened a pop-up store in Hong Kong’s Lane Crawford department store in 2017 and another at Selfridges in London in June of 2018.

Khloé Kardashian’s activewear brand, Good American, is the most recent addition to the celebrity athleisure segment, having just launched on August 2, 2018.

Retailers

Traditional apparel retailers have introduced new lines and line extensions to take advantage of growing demand for athleisurewear. For example, Victoria’s Secret launched the Victoria Sport line, whose tagline is “Inspired by sport, but made to wear wherever.” Lou & Grey, launched in 2014 by Loft (which is owned by Ascena Retail), fuses activewear and streetwear, and the brand just launched another activewear subbrand, Lou & Grey Form. Kate Spade partnered with Beyond Yoga, and J.Crew with New Balance, to offer shoppers new activewear styles and in 2014, Tory Burch launched Tory Sport, which now has six US brick-and-mortar locations.

Changing Attitudes and Tastes Underpin Sustained Growth

The Rise of the Wellness Culture

For many US consumers, wellness is the new status symbol, and increasing numbers of health-minded individuals are participating in aspirational fitness classes and social fitness events; enjoying healthy, organic and natural food; and using devices to measure health metrics and track their fitness progress. Consumers are also showcasing their healthy lifestyles on social media, posting photos of themselves dressed in activewear, participating in healthy activities and preparing to eat healthy meals.

We have

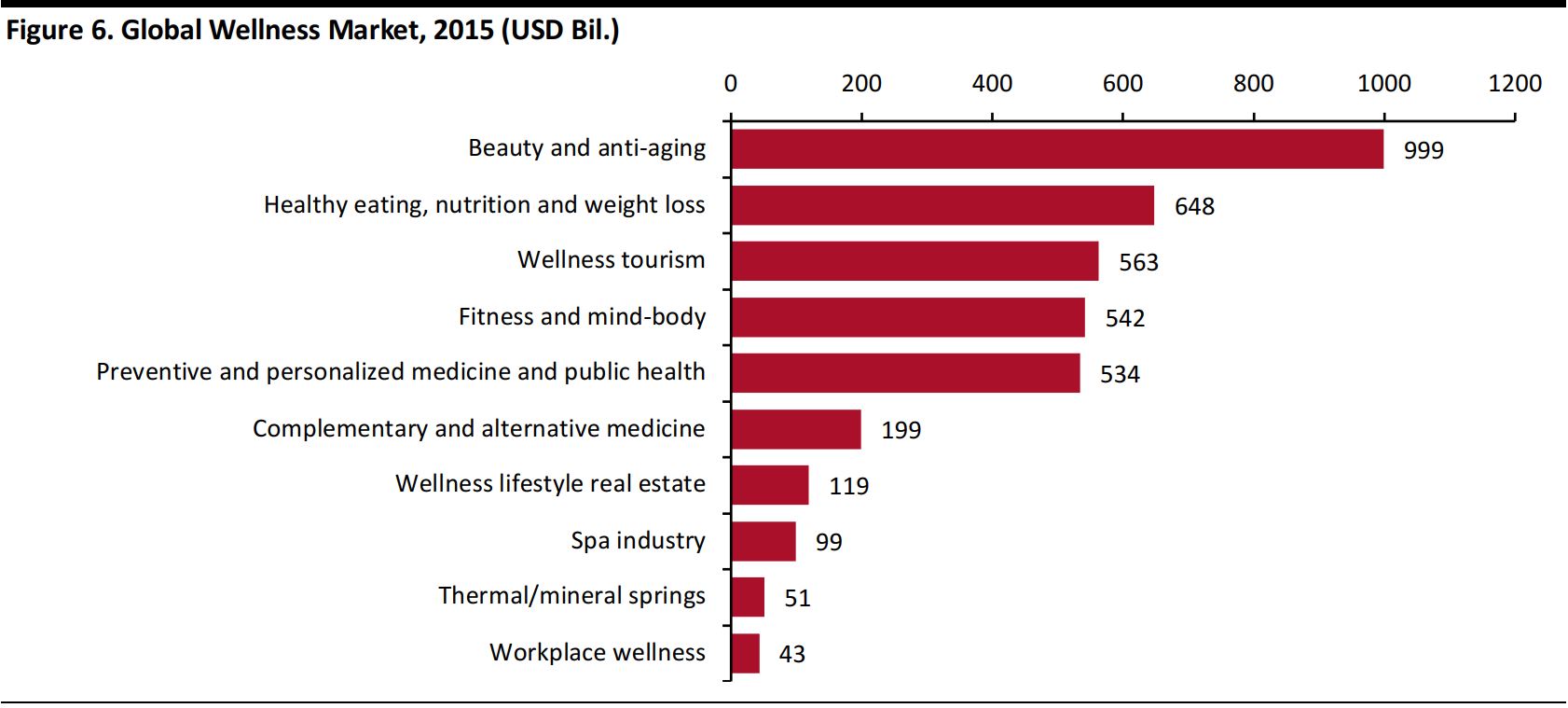

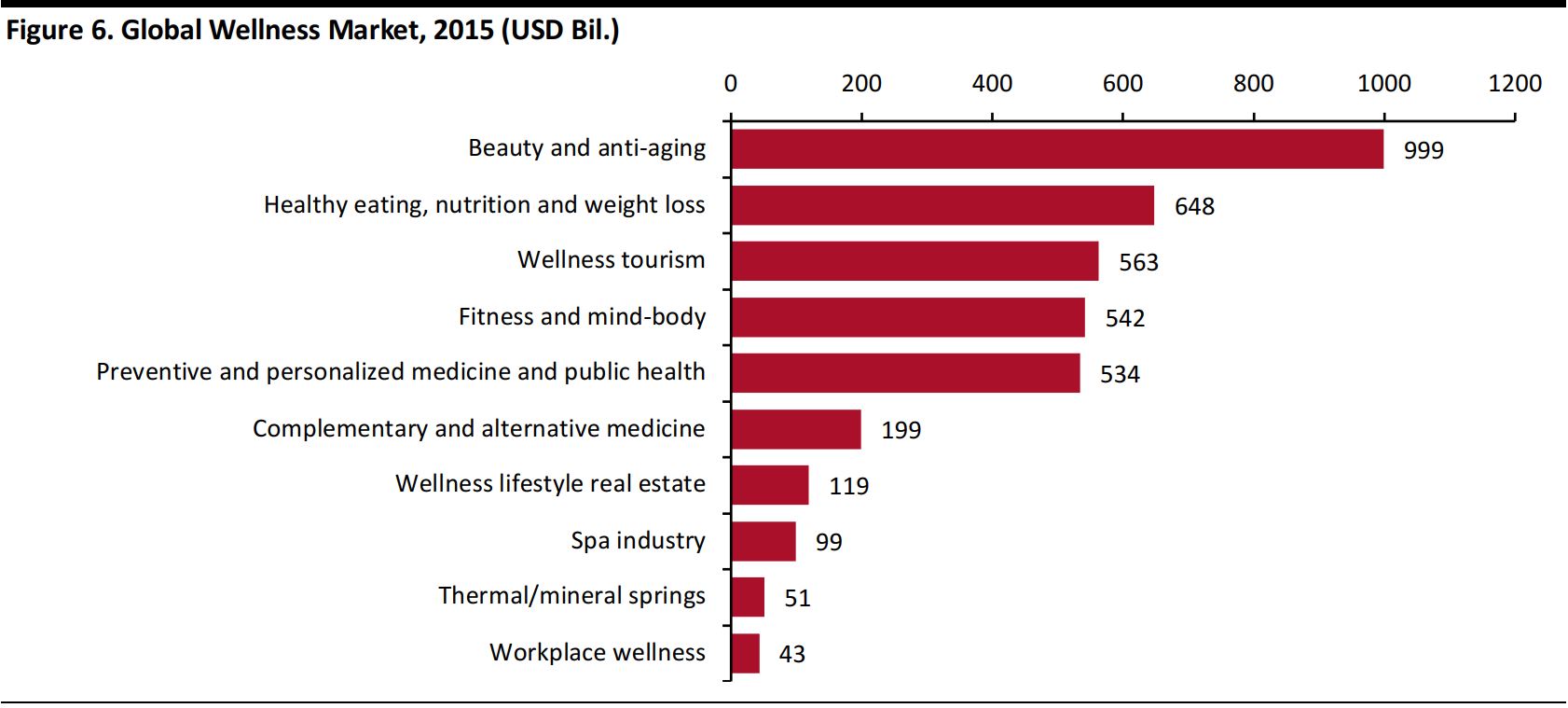

discussed the wellness trend in depth in previous reports, and it is one of the drivers of demand for athleisure products. The wellness economy is booming: according to the nonprofit Global Wellness Institute, it was worth $3.7 trillion in 2015.

Source: SRI International/Global Wellness Institute

Source: SRI International/Global Wellness Institute

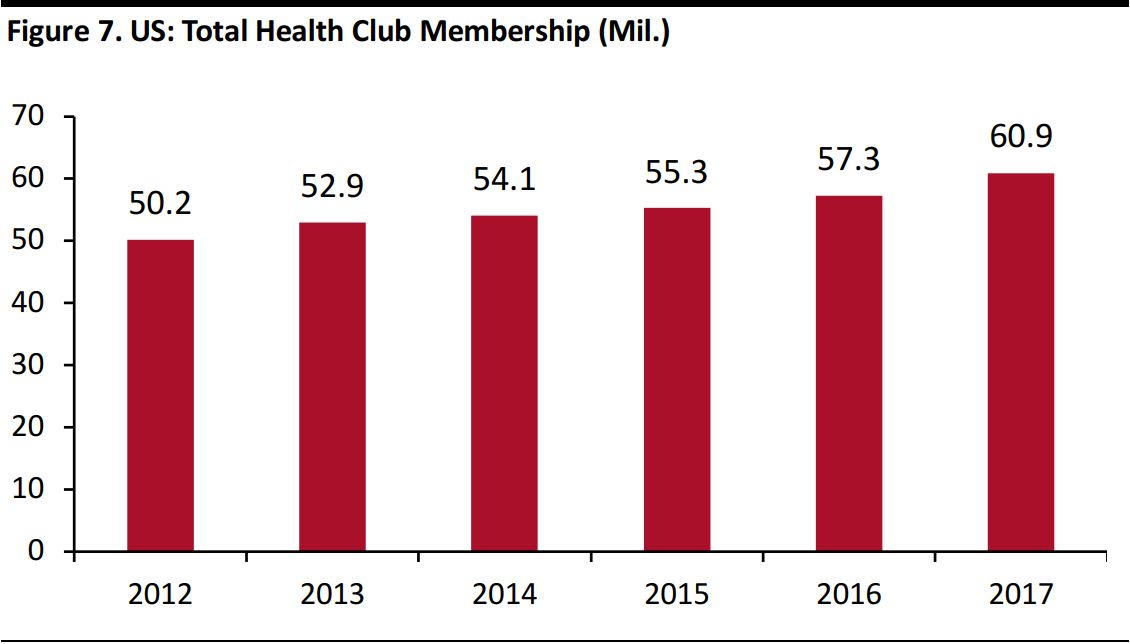

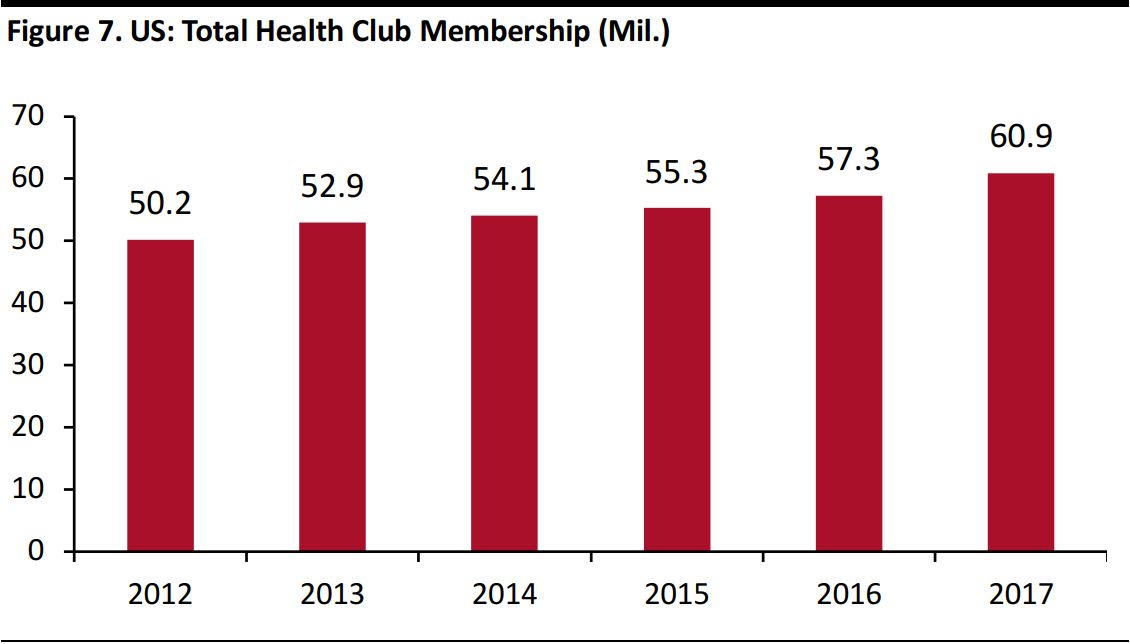

In 2017, there were 38,477 health clubs in the US serving 60.9 million members, according to fitness industry trade organization IHRSA. Fitness club membership grew at an average of 3.9% per year in the five years to 2017 and total member numbers have grown by more than 10 million since 2012. For some consumers, gyms are replacing bars, restaurants and cafes as social hubs, and these gym-goers are seeking to meet like-minded peers and potential partners at their health clubs.

Source: IHRSA

Source: IHRSA

Fitness at Home

Another growing fitness trend is at-home workouts on expensive equipment. Many popular at-home programs offer livestreamed classes led by “fitfluencers,” or trainers with celebrity status and their own groupies, followers and tribes.

Peloton is one such program: riders purchase the Internet-connected Peloton bike and participate in streamed classes led by live instructors. Peloton’s CEO, John Foley, is disrupting the traditional at-home exercise business and planning to create a fitness-as-a-service model, whereby users’ monthly subcription fees allow for regular fitness equipment upgrades.

For many consumers of at-home fitness programs, the combination of personalization, convenience and access to instructors creates an experience that is worth the cost of the equipment. According to

Forbes, the top 10 fitness influencers have a total social reach of 106 million followers across Instagram, Facebook, Twitter and YouTube.

While it might seem probable that the fitness-at-home trend will dampen demand for fashionable workout clothing, the rise of social media platforms indicates otherwise. Twitter, Instagram and Facebook provide new ways for people to share various aspects of their lives, including their fitness and wellness regimens, and to interact with others who share their interests around the world. Social media not only allows people to share their experiences, but also adds pressure on them to look good and to be seen as living fulfilling lives, providing further support to the fitness industry.

Demographic Drivers

Millennials Are Focusing on Active Lifestyles

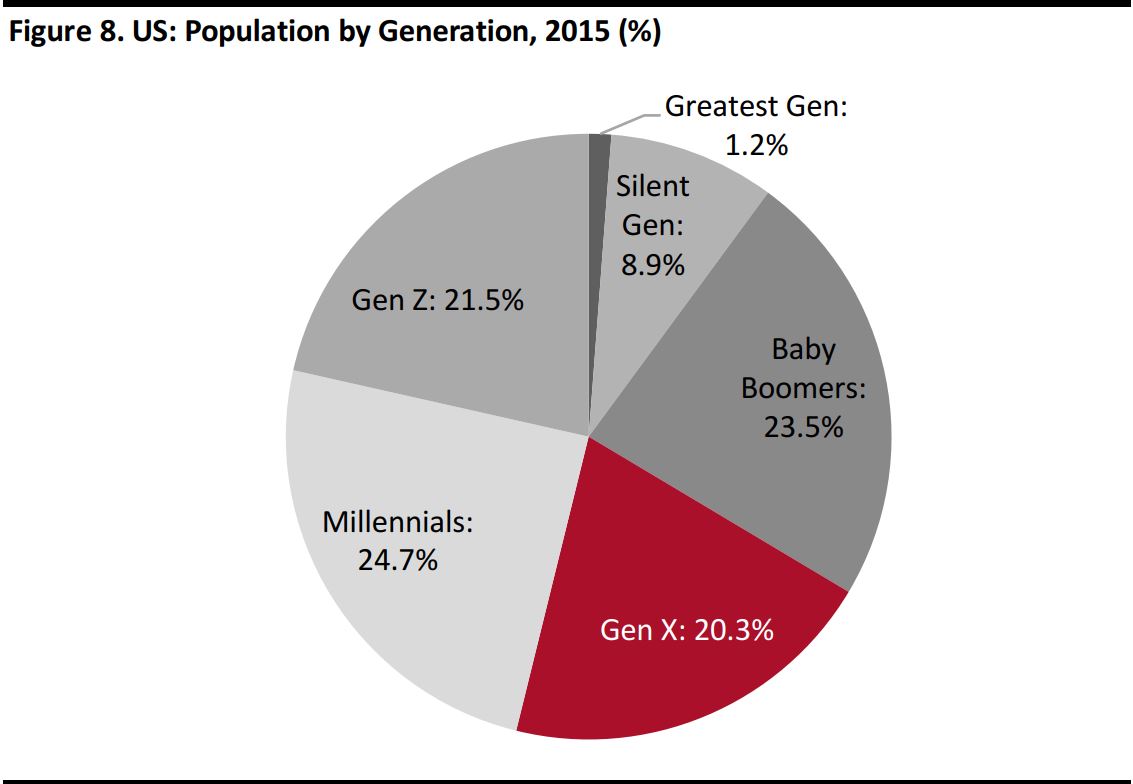

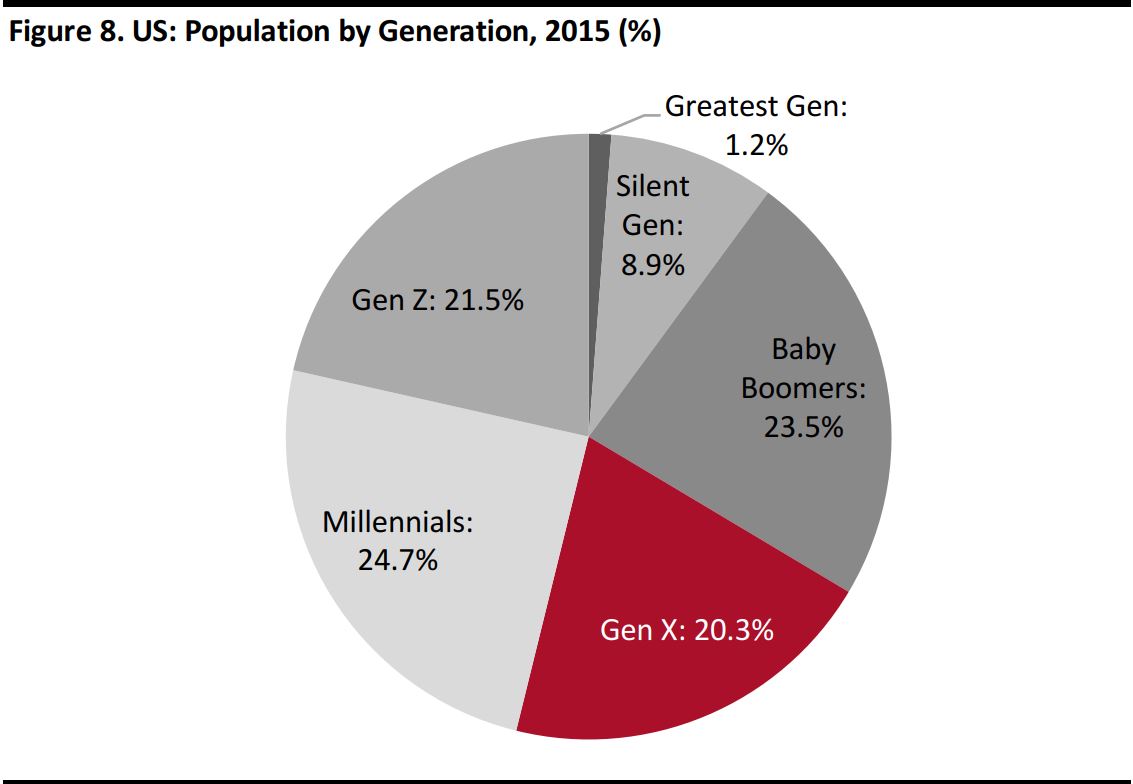

According to the US Census Bureau, millennials, or those born between 1980 and 2000, are currently the largest demographic in the US. As of 2015, they numbered about 79.4 million, compared with 65.7 million Generation Xers and 75.5 million baby boomers. To put that into perspective, millennials now comprise roughly 25% of the entire US population.

Source: US Census Bureau

Source: US Census Bureau

Millennials’ habits and spending patterns will be significant to the overall economy as the group enters its prime working and spending years. In general, millennials’ spending skews more toward creating a lifestyle and having and sharing experiences than on acquiring tangible items.

Millennials are also defining fitness and health in ways that reflect their values and lifestyles, and they are taking a more holistic approach to wellness than prior generations have. Members of the millennial generation tend to look for simplicity and convenience in fitness programs, but they are also quick to try new regimens.

Experiences over Products

The trend of consumers valuing experiences over products began as early as the year 2000. Factors contributing to the trend include the natural progression of a developed culture as society aims higher on Maslow’s hierarchy of needs, a lack of exciting fashion and the growing proportion of healthcare expenditure as a percentage of total personal consumption expenditure. The good news for athleisure brands is that they are part of an experience, whether at the gym, at home, on the track or on fitness-inspired vacations. So, athleisure apparel and footwear is somewhat insulated from consumers’ shift away from spending on goods to spending on experiences.

The Macro Environment

While the US macro environment is marked by positive trends in GDP, unemployment, consumer spending and confidence, uncertainty regarding tariffs and their impact is mitigating robust consumer spending, as are low savings rates.

The US unemployment rate fell to 3.8% in May 2018, the lowest rate since April 2000 and an 18-year low. The labor participation rate notched lower as well, to 62.7% from 62.8%. At the end of June, consumer sentiment backtracked slightly, reflecting growing tariff concerns. According to Richard Curtin, Chief Economist of the University of Michigan’s Surveys of Consumers, one in four consumers surveyed cited the potential impact of tariffs on the domestic economy as an area of concern, with most expecting a negative impact on the domestic economy.

Meanwhile, personal incomes are growing in the US. At nearly $15,000, US disposable personal income rose by 3.9% year over year and by 0.5% sequentially in May 2018. Tax cuts early in 2018 are benefiting the retail and consumer services sectors this year, but the volatility of the stock market is mitigating the wealth effect from 2017.

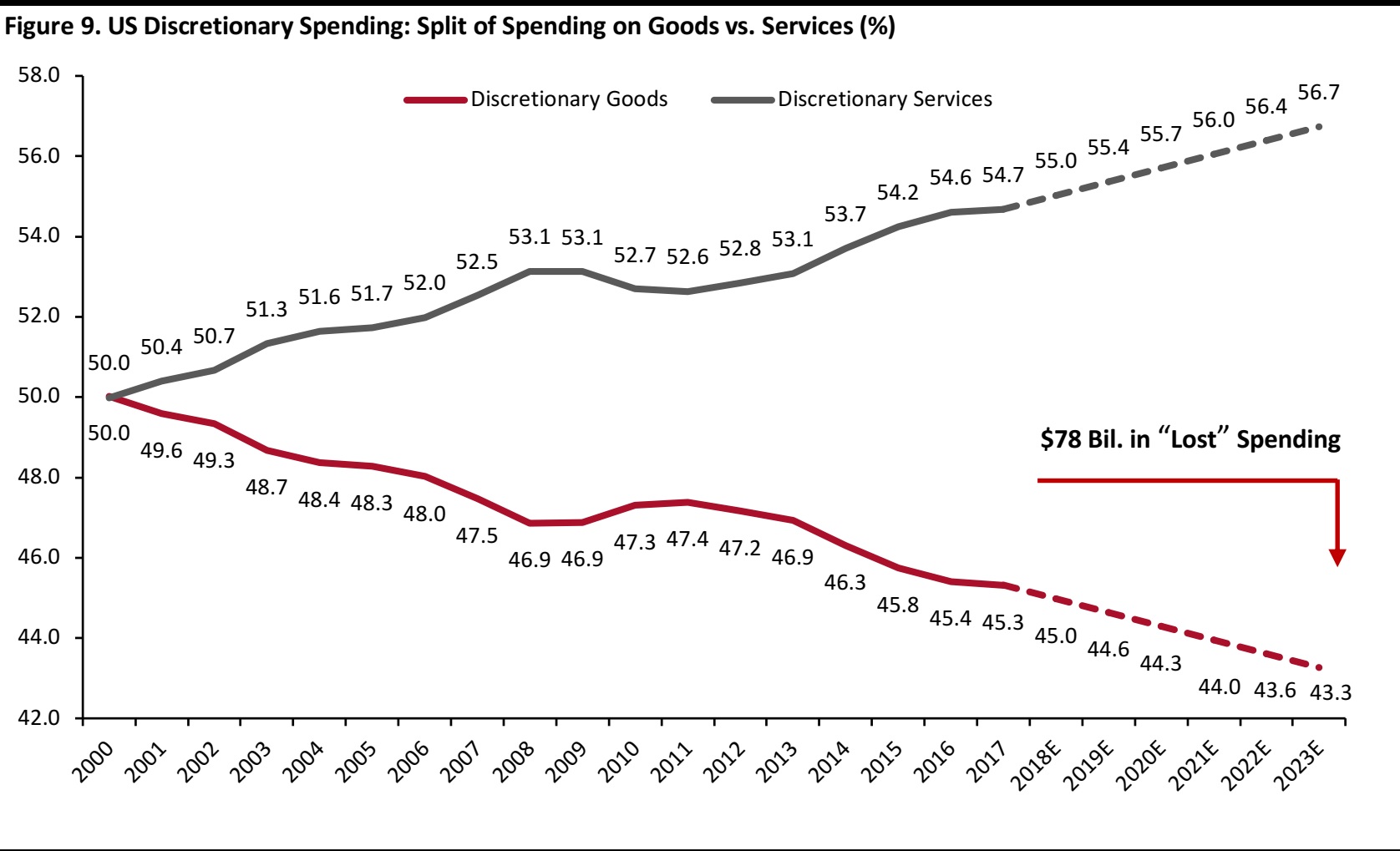

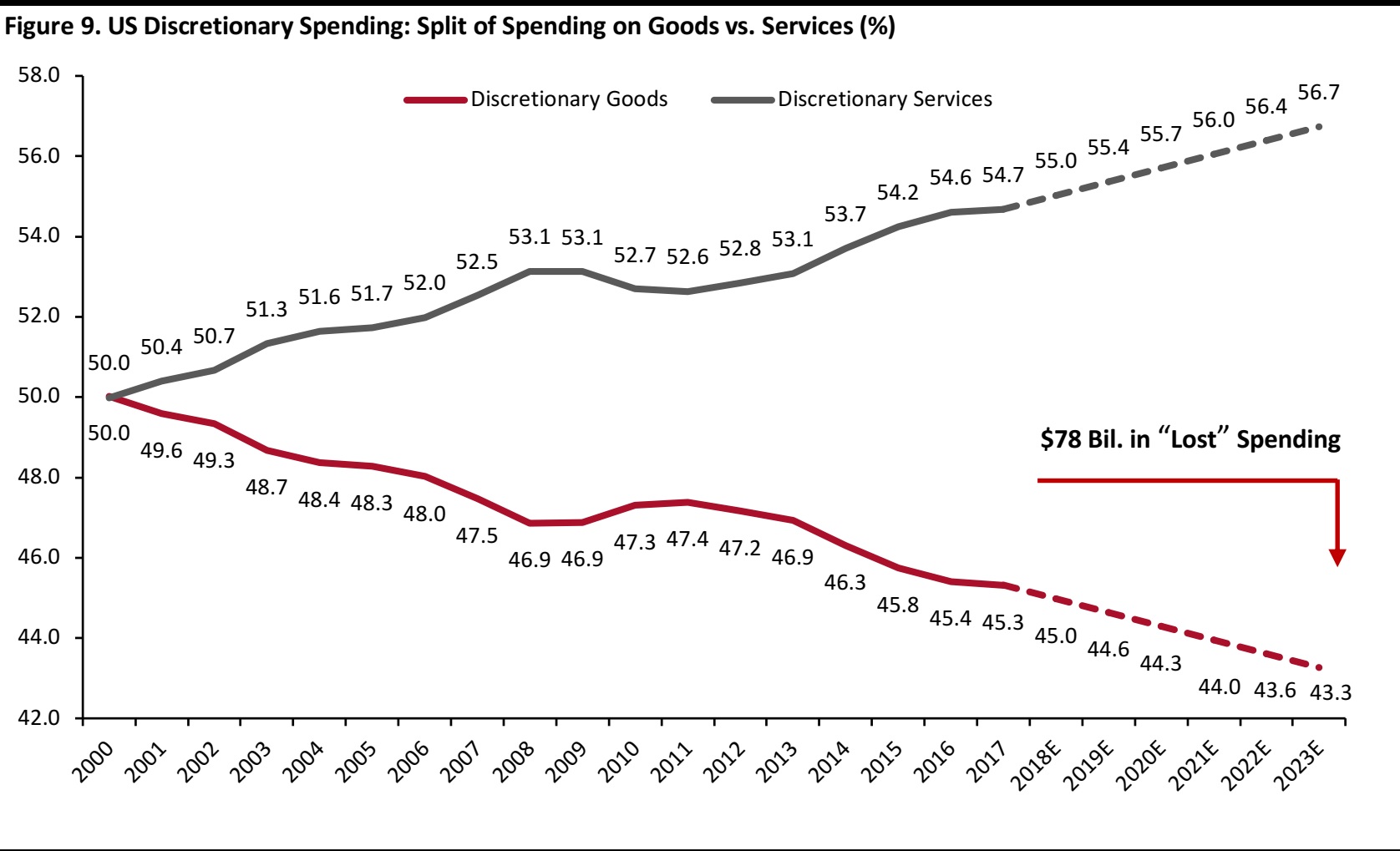

Year after year, American consumers have dedicated a greater share of their total discretionary spending to services and a lower share to goods. We chart this bifurcation below, showing that spending on goods as a share of total discretionary spending fell from 50% to just over 45% between 2000 and 2017.

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research

In absolute terms, this means that discretionary retailers have lost out on billions of dollars in sales that they would have made had the goods-versus-services balance remained consistent. We estimate that US consumers spent $139 billion less on discretionary goods in 2017 than they would have if the goods/services split had remained at the level seen in 2000.

We also expect that consumers will redirect an additional $78 billion in spending to discretionary services at the expense of discretionary goods by 2023. This is the difference between the forecast share of discretionary spending on goods in 2023 and the share seen in 2017, which was 45.3%—and it is over and above the $139 billion that consumers have already redirected away from discretionary goods.

However, given athleisurewear’s popularity in sports and other everyday activities, and the way many consumers use it to signal their participation in a lifestyle focused on wellness, we think that the category is protected from the spending trend toward services and may, in fact, benefit from the shift.

Looking Ahead

As consumers increasingly adopt sportswear for daily wear, existing apparel brands will innovate and add functionality to trendy products. We expect to see more new companies enter the athleisure category and more traditional apparel and footwear brands extend their product offerings into athleisure, attracted by the category’s strong growth opportunities. The blurred line between activewear and daywear will provide additional opportunities as well.

Over the next three years, the combined sports apparel and footwear category is likely to continue to grow at a mid-single-digit pace, considerably faster than the apparel and footwear market generally, with sports footwear growth modestly outpacing sports apparel growth. Cultural trends, favorable demographics and innovation will drive superior category performance as the industry approaches $130 billion by 2020. Celebrity participation and attention from designer and luxury brands will also help drive continued consumer interest in athleisure.

Source: Euromonitor International

Source: Euromonitor International Performance footwear and apparel is specifically designed for sports activities. Sports-inspired footwear and apparelincludes nonperformance/outdoor items from major sports brands (such as Puma and Adidas Originals) as well as sports-inspired products from general apparel brands (such as H&M, Zara and Gap).

Source: Euromonitor International

Performance footwear and apparel is specifically designed for sports activities. Sports-inspired footwear and apparelincludes nonperformance/outdoor items from major sports brands (such as Puma and Adidas Originals) as well as sports-inspired products from general apparel brands (such as H&M, Zara and Gap).

Source: Euromonitor International Source: US Census Bureau

Source: US Census Bureau Source: www.bergdorfgoodman.com

Source: www.bergdorfgoodman.com Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: SRI International/Global Wellness Institute

Source: SRI International/Global Wellness Institute Source: IHRSA

Source: IHRSA Source: US Census Bureau

Source: US Census Bureau Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research