DIpil Das

[caption id="attachment_98114" align="aligncenter" width="700"] Source: Company reports[/caption]

FY19 Results

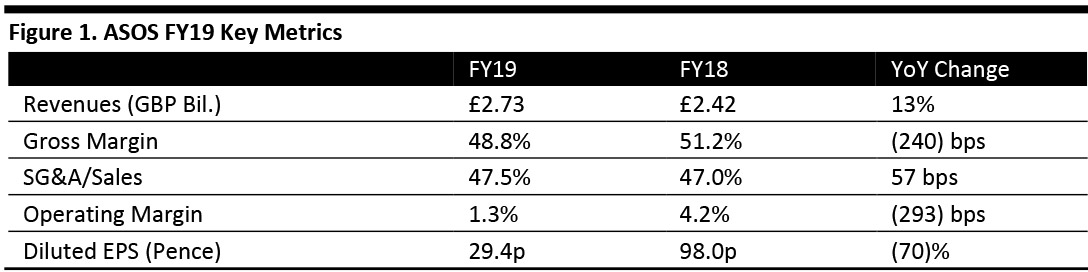

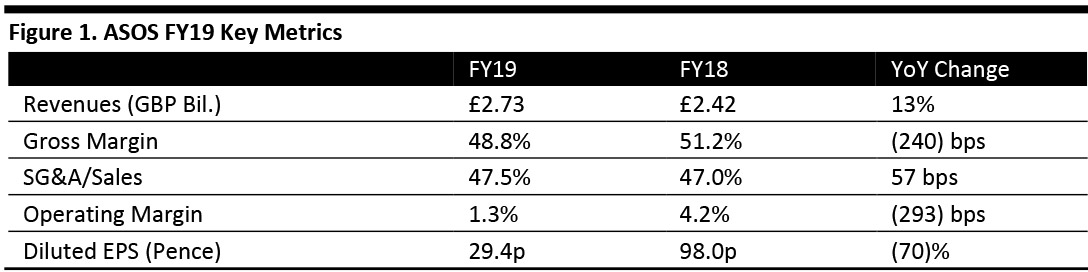

ASOS reported FY19 revenues higher than consensus but below expectation EPS. The highlights are as follows:

Source: Company reports[/caption]

FY19 Results

ASOS reported FY19 revenues higher than consensus but below expectation EPS. The highlights are as follows:

Source: Company reports[/caption]

FY19 Results

ASOS reported FY19 revenues higher than consensus but below expectation EPS. The highlights are as follows:

Source: Company reports[/caption]

FY19 Results

ASOS reported FY19 revenues higher than consensus but below expectation EPS. The highlights are as follows:

- ASOS grew revenues 12% year over year on a constant-currency basis to £2.73 billion (up 13% as reported), slightly ahead of the consensus estimate of £2.71 billion recorded by StreetAccount. Growth was driven by an increase in order frequency from a growing loyal customer base, coupled with strong fourth-period sales performance.

- Operating profit of £35.1 million was down 66% year over year, but higher than the consensus of £32.0 million.

- PBT slid 68% to £33.1 million after the company incurred warehouse transition costs of £45 million, up £20 million year over year. PBT was also negatively impacted by an increase in finance costs as the business moved into a net debt position following substantial warehouse investments.

- The company reported net debt of £90.5 million, higher than the consensus estimate of £40.2 million. The rise in debt is a result of the company’s ongoing and substantial capex investment in its global logistics platform.

- Gross margin contracted 240 basis points (bps) over the previous year. Management attributed this to three principal factors: increased freight and duty costs as the US hub in Atlanta went live; adverse territory mix due to underperformance in the US and EU caused by warehouse transition issues; and, the expansion of high-street branded offerings, which carry lower gross margins.

- Management noted it had “underestimated the impacts of large-scale operational change being executed on two continents simultaneously” and that the company was “not adequately prepared for the additional complexities of planning and trading across our expanded warehouse footprint.”

- The company reported diluted EPS of 29.4 pence, down 70% year over year, driven by the decrease in PBT during the year.

- Operating expenses increased 14% year over year to £1.3 billion and total operating costs as a percentage of sales increased 50 bps year over year, largely due to increased warehouse transition costs in the US and Europe.

- Inventories were up 32% year over year as of August 31. At the company’s analyst presentation, management noted that uncertainty surrounding the circumstances and timing of the UK’s exit from the EU has prompted the company to actively accelerate stock intake in August and September, but they are happy with the current profile of current and old stock.

- Private labels (excluding its new Collusion brand) accounted for 40% of sales in the fourth period, up from 36% in the first half.

- The company incurred cash capex of £221.6 million in FY19, compared to £212.7 million in FY18.

- The company reported total orders of 72.3 million, up 14% year over year, due to continued strong inbound website traffic.

- Management emphasized that Euro Hub automation and mechanization issues have been resolved and the facility is operational as planned, adding that product rebalancing and stock build in the US is also progressing well.

- ASOS grew UK retail sales to £993.4 million, up 15% year over year, below the consensus of 17.9% growth. The increase was driven by strong demand from its customer base, with good growth in frequency and conversion for the year.

- International retail sales were £1.66 billion, up 10% year over year on a constant-currency basis (up 11% as reported).

- EU retail sales grew 12% year over year (9% on a constant-currency basis), slightly ahead of consensus estimate of 11.3%.

- US retail sales grew 9% year over year (4% constant currency), lower than the consensus of 12.1%.

- The rest of worldegment grew 12% year over year (14% on a constant currency basis), marginally higher than the consensus of 11.9%.

This financial year was a pivotal period for ASOS, (in which) we have invested significantly and enhanced our global platform capability to drive our future growth. Regrettably, this was more disruptive than we originally anticipated. However, having identified the root causes of our operational issues, we have made substantial progress over the last few months in resolving them. Whilst there remains lots of work to be done to get the business back on track, we are now in a more positive position to start the new financial year.

Outlook Management’s priorities for FY20 are to:- Strengthen organizational capability to deliver effectively into the future.

- Remove non-strategic cost to support future growth and profitability.

- Further increase product choice, availability and newness.

- Optimize the approach to customer acquisition and retention.

- Leverage benefits from transformational investments to drive efficiency and enhance customer propositions.