Nitheesh NH

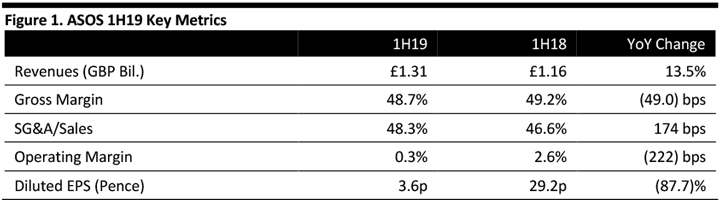

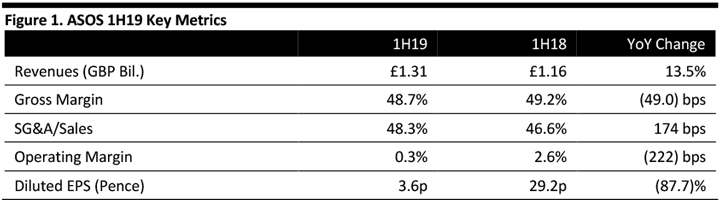

[caption id="attachment_83489" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1H19 Results

ASOS reported 1H19 results with the top line and EPS ahead of consensus. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

1H19 Results

ASOS reported 1H19 results with the top line and EPS ahead of consensus. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

1H19 Results

ASOS reported 1H19 results with the top line and EPS ahead of consensus. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

1H19 Results

ASOS reported 1H19 results with the top line and EPS ahead of consensus. The highlights are as follows:

- ASOS grew total sales 12.0% year over year on a constant-currency basis to £31 billion (up 13.5% as reported), slightly ahead of the consensus estimate of £1.30 billion recorded by StreetAccount.

- The gross margin contracted 49 basis points (bps) year over year to 48.7%.

- The operating margin contracted 222 bps year over year to 0.3%, mainly due to higher technology and warehousing costs.

- Warehousing costs as a percentage of sales expanded 120 bps to 11.0% due to higher transitional costs related to the expansion of supply chain capacity, as well as increased fulfilment mix from the company’s Euro hub and US hub in Atlanta, both of which are manual operations. ASOS expects costs associated with operating these hubs to shrink as the company automates processes at these facilities.

- The company reported diluted EPS of 3.6 pence, down 87.7% year over year, but above the consensus of 3.1 pence recorded by StreetAccount.

- The company incurred total capex of £103.2 million in 1H19, compared to £107.7 in 1H18.

- ASOS noted that active customers increased to 19.2 million, up 16% year over year. However, active customer growth in the first half slowed, with 800,000 active customers added in the first half compared to 1.1 million in the same period last year.

- It reported a 2% decline in average basket value, mainly due to a 3% decline in the average selling price per unit.

- ASOS grew UK retail sales 16.0% year over year to £481.5 million. International retail sales grew 9.0% year over year on a constant-currency basis to £799.8 million (up 12.0% as reported).

- In its international segment, and at constant exchange rates: EU retail sales (ex UK) grew 10.0% year over year to £402.2 million (up 15.0% as reported); US retail sales grew 4.0% to £161.6 million (up 8.0% as reported); rest-of-the-world retail sales grew 9.0% to £236.0 million (up 8.0% as reported).

We grew sales by 14% despite a more competitive market. We have identified a number of things we can do better and are taking action accordingly. We are confident of an improved performance in the second half and are not changing our guidance for the year. We are nearing the end of a major capex program. Whilst this has inevitably involved significant disruption and transition costs, the global capability it now provides us gives us increased confidence in our ability to continue to capture market share whilst restoring profitability and accelerating free cash flow generation.

Outlook Management maintained its previously issued guidance for FY19, namely:- Sales growth of about 15%.

- Retail gross margin contraction of about 150 bps.

- EBIT margin of approximately 2%.

- Capital expenditure maintained at roughly £200 million.

- Net debt of about £50 million.