What’s the Story?

On April 20, 2021, the Coresight Research team attended ASOS’s Capital Markets Day 2021, which was held virtually. In this report, we present three key insights from the event.

ASOS Capital Markets Day 2021: Key Insights

1. The Company’s Vision To Be the “Top Destination for 20-Somethings Worldwide”

ASOS re-emphasized its aims to become the “top destination for fashion-loving 20-somethings worldwide.” Jose Calamonte, Chief Commercial Officer at ASOS, stated that the company will continue to offer a distinctive and irreplicable assortment, keeping 20-somethings in mind through two approaches:

- ASOS will curate its offer of leading international brands, complemented by its in-house brands.

- The retailer will promote fashion products through engaging visual language, including featuring “real” people as models. Management stated that iconic fashion brands, including Adidas and Ralph Lauren, are looking to cooperate with ASOS to integrate its visual language skills into their product promotions.

[caption id="attachment_126167" align="aligncenter" width="725"]

Source: Company reports

Source: Company reports [/caption]

ASOS has two key focus areas as it looks to boost engagement with its target consumers, which we outline below.

Social Media

During its Capital Markets Day event, ASOS stated that its continued investment in social media channels, particularly Clubhouse and TikTok, are a key tool for the company to better understand its global target consumer base. Strong engagement with consumers through social media channels will also enhance the company’s ability to pivot to changing consumer demand.

To get ahead of fashion trends, the retailer’s inventory procurement team is reviewing the social media landscape to identify emerging fashion brands and labels started by fashion entrepreneurs in local markets. Management stated that ASOS also continues to partner with social media celebrities and influencers to produce style edits tailored to different consumer fashion preferences.

[caption id="attachment_126168" align="aligncenter" width="725"]

Source: Company reports

Source: Company reports[/caption]

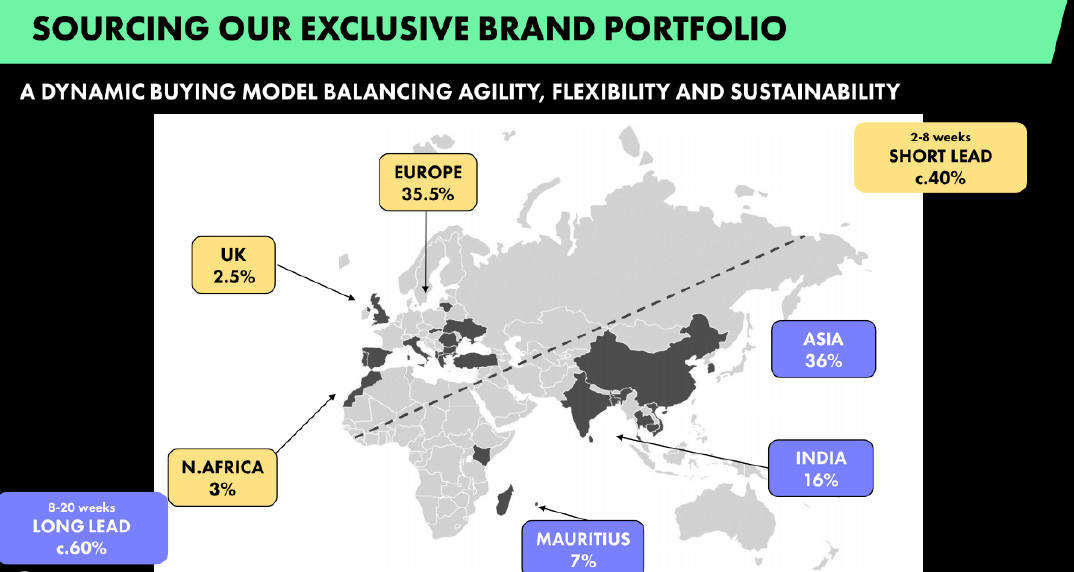

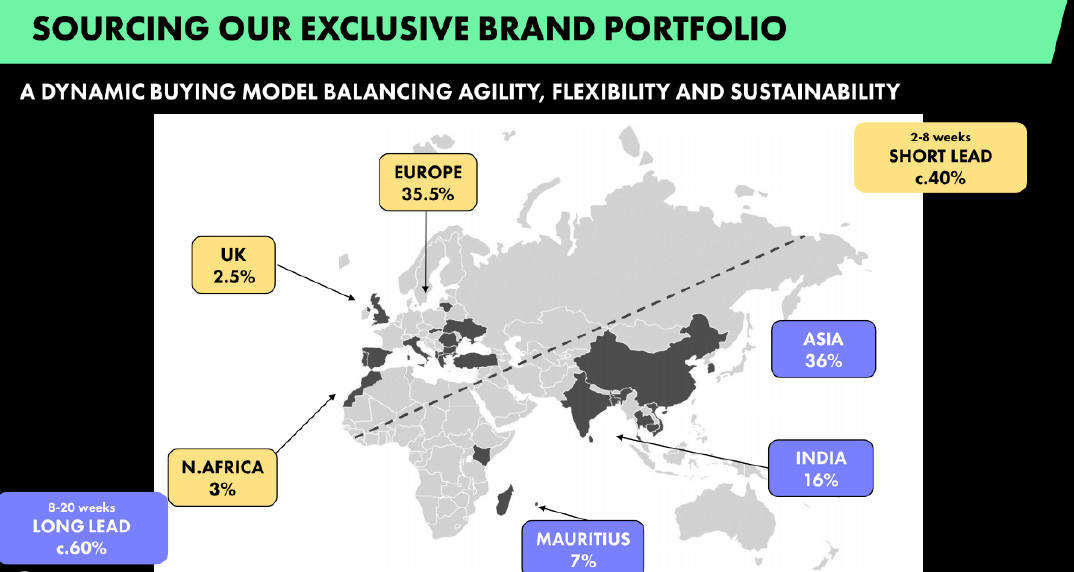

Dynamic and Reactive Buying Model

Management stated that the retailer is prioritizing a dynamic and reactive buying model that balances agility, flexibility and sustainability. ASOS will continue to explore new sourcing routes to enhance its flexibility in order fulfillment and to reduce lead times.

- The company has already accelerated the utilization of its UK sourcing region to reduce fulfillment-center lead times.

- In 2020, ASOS introduced a North Africa sourcing region, which gave the company flexibility to deliver coats to fulfillment centers within seven weeks, reducing its existing lead time by up to 10 weeks.

- Specifically for footwear, ASOS opened new sourcing routes in Italy, Portugal and Spain in the last 12 months.

ASOS also cited its efforts in 3D design technology testing as part of its goal to maintain a dynamic buying model. The technology enables the company to send digital samples to suppliers for production based on the design data it collects, with the aim of reducing lead times associated with physical samples.

Furthermore, ASOS is using digital technology to improve the sizing and fit of its assortments across most of the company’s short lead routes, such as the UK and North Africa, and plans to expand its usage to its longer lead routes, such as Asia.

ASOS CEO Nicholas Beighton stated that the company sees virtual fulfillment as a big part of its future development—enabling the company to optimize its owned and third-party brand inventory pool. For instance, if ASOS is understocked in a particular item color or size that is ordered by a customer and one of the company’s partner brands has the item required, a virtual fulfillment platform would enable the product to be directly shipped to the customer by the brand.

[caption id="attachment_126169" align="aligncenter" width="725"]

Source: Company reports

Source: Company reports [/caption]

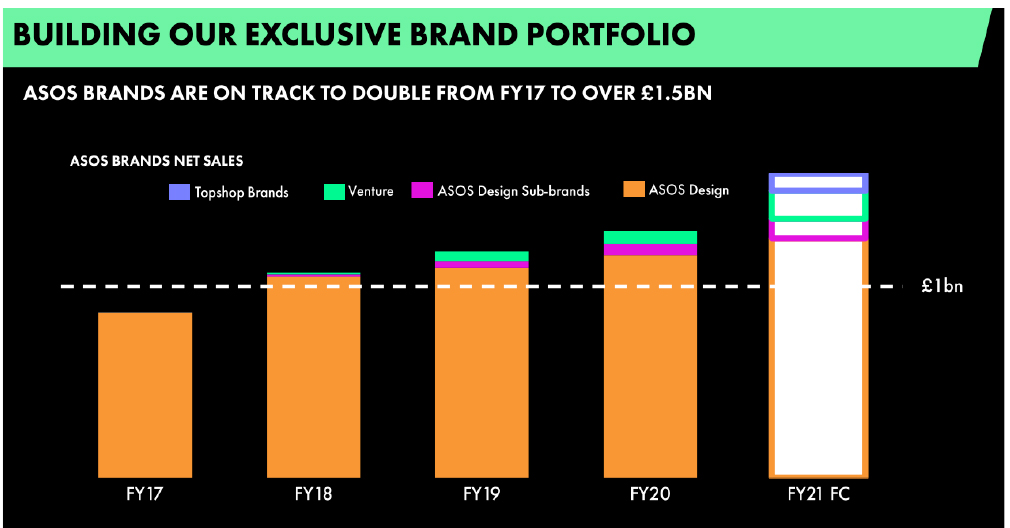

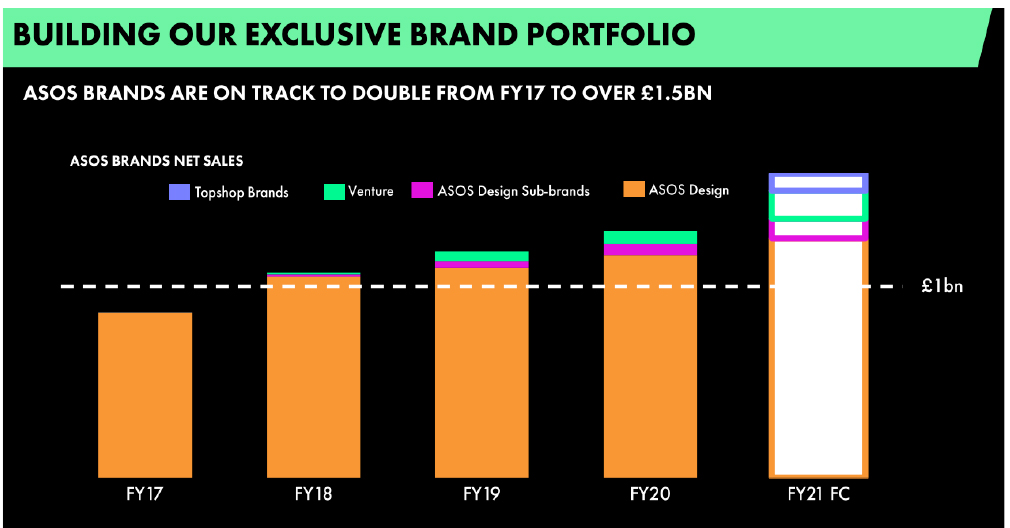

2. In-House Brand Sales

ASOS reported that its in-house brands are on track to see sales double from fiscal 2017 to over £1.5 billion ($2.1 billion) in fiscal 2021, accounting for about 40% of the company’s sales mix.

[caption id="attachment_126170" align="aligncenter" width="725"]

Source: Company reports

Source: Company reports [/caption]

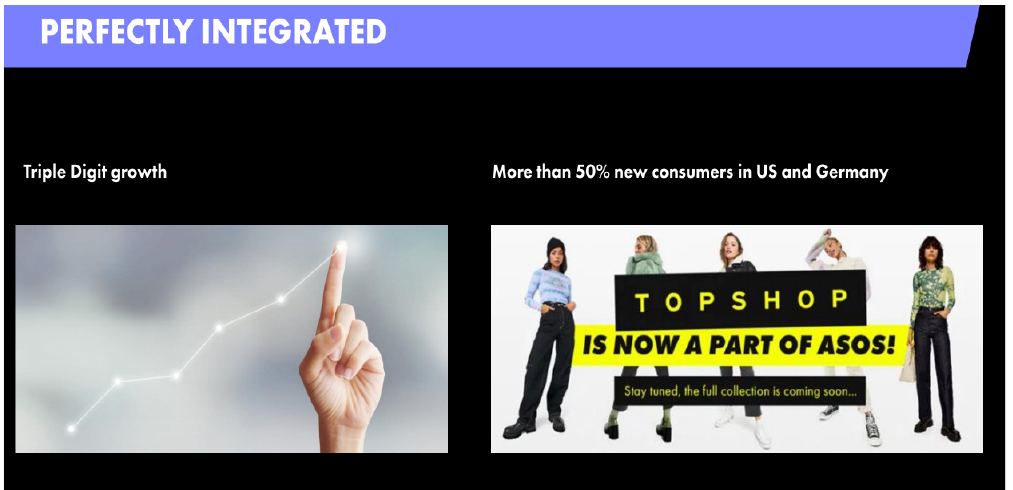

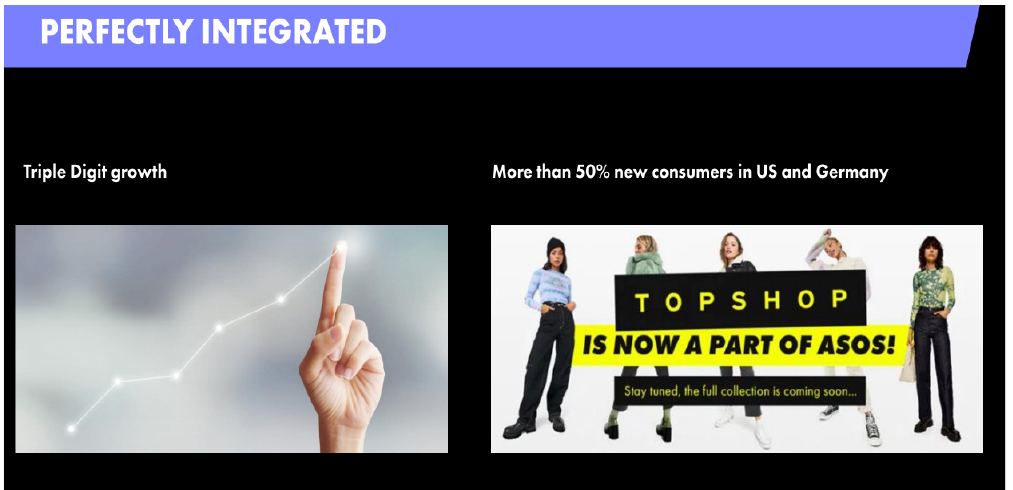

ASOS is looking to attract new customers and reinforce its value proposition after acquiring HIIT, Miss Selfridge, Topman and Topshop in February 2021. In the US and Germany, the company saw that 50% of consumers shopping these four acquired brands are new to ASOS. Furthermore, management stated that Topshop witnessed triple-digit sales growth on the ASOS platform after the integration in February 2021, versus the same period last year.

ASOS management believe that Topshop and Topman present a significant opportunity in its US market through a partnership with department store Nordstrom—for both acquired brands as well as ASOS’s venture brands and ASOS Design. The company also noted that the acquired brands have enabled it to discover a wider selection of suppliers, with a positive impact on its own selection of suppliers for the rest of the ASOS brands. Moreover, the company expects the acquired brands to benefit from ASOS’s strength in global territories where they were not previously available.

[caption id="attachment_126171" align="aligncenter" width="725"]

Source: Company reports

Source: Company reports [/caption]

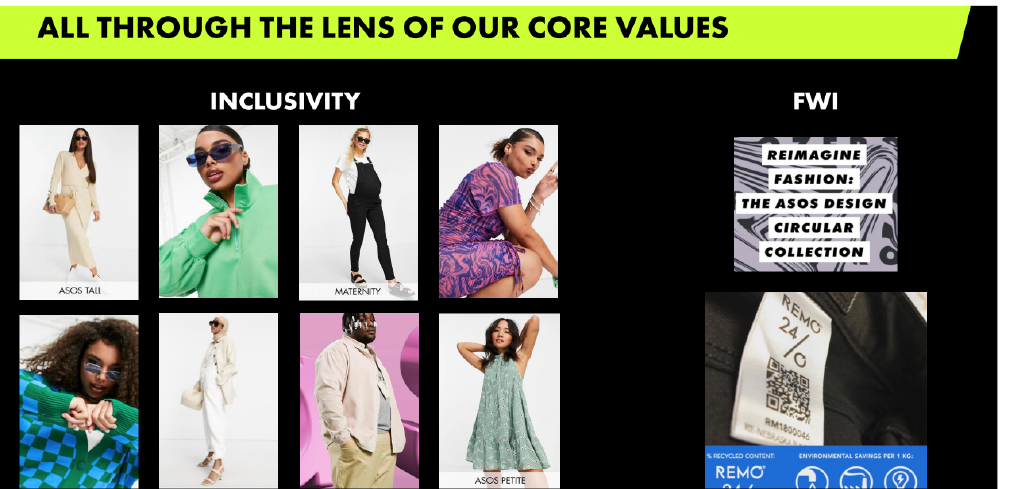

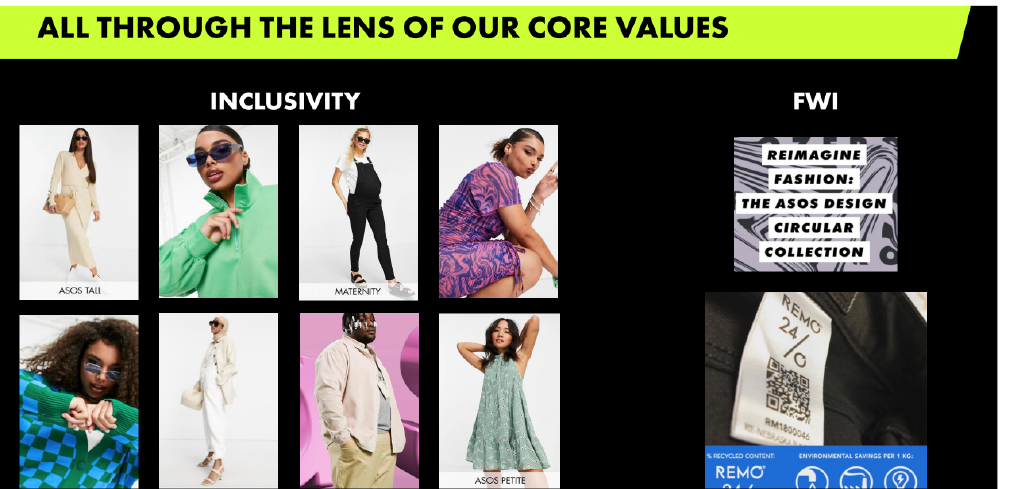

3. Sustainability and Inclusivity Goals

ASOS stated that it will continue to enhance its sustainability initiatives, both from an environmental and an ethical perspective. Below, we discuss the sustainability and inclusivity actions highlighted at the company’s Capital Markets Day.

Sustainability

To be featured on the ASOS platform, each brand must meet the following five minimum requirements:

- Ethical trade policies—Adopt a responsible and sustainable approach to sourcing and supply chain management.

- Chemical compliance: Understand the use of chemicals and ensure the use of safer products with lower environmental impacts.

- Abolition of modern slavery practices—Ensure that employees’ conditions in supplier factories are socially responsible, including wage payment.

- Animal welfare—Ensure that suppliers do not use certain animal-derived materials, including alpaca wool, cashmere, feathers, horn, mohair, shell or silk, and any part of endangered or wild species.

- Visibility of Tier 1 factories—Trace Tier 1 suppliers to ensure they meet compliance directives, avoid bottlenecks and track products through to delivery.

Womenswear Buying Director Nikki Tattersall stated that around 85% of the cotton used for the company’s in-house brand ASOS Design is either organic or from the Better Cotton Initiative—a non-profit organization that advocates for better standards in cotton farming and practices across 21 countries. Furthermore, the brand’s new denim collection uses 50% less water during the washing and finishing process versus conventional jeans.

Vanessa Spence, Head of Design at ASOS, said that 70% of the company’s swimwear is made from recycled materials. Spence also reported that ASOS will train its whole retail team in circular practices by the autumn of 2021, following on from the launch of its first Circular Collection in September 2020. The products in the collection are made from 20% recycled cotton, use less water than their conventional equivalents and are easy to recycle.

Inclusivity

Management stated that collaborations are a key focus for the company’s inclusivity initiatives. ASOS is set to launch a broader range of sizes in menswear and womenswear in collaboration with leading brands such as Calvin Klein, Levi’s and Tommy Hilfiger.

Furthermore, ASOS plans to incorporate inclusivity actions to its newly acquired brands, including expanding the range of body types and sizes that they represent.

[caption id="attachment_126172" align="aligncenter" width="725"]

Source: Company reports

Source: Company reports [/caption]

Source: Company reports [/caption]

ASOS has two key focus areas as it looks to boost engagement with its target consumers, which we outline below.

Social Media

During its Capital Markets Day event, ASOS stated that its continued investment in social media channels, particularly Clubhouse and TikTok, are a key tool for the company to better understand its global target consumer base. Strong engagement with consumers through social media channels will also enhance the company’s ability to pivot to changing consumer demand.

To get ahead of fashion trends, the retailer’s inventory procurement team is reviewing the social media landscape to identify emerging fashion brands and labels started by fashion entrepreneurs in local markets. Management stated that ASOS also continues to partner with social media celebrities and influencers to produce style edits tailored to different consumer fashion preferences.

[caption id="attachment_126168" align="aligncenter" width="725"]

Source: Company reports [/caption]

ASOS has two key focus areas as it looks to boost engagement with its target consumers, which we outline below.

Social Media

During its Capital Markets Day event, ASOS stated that its continued investment in social media channels, particularly Clubhouse and TikTok, are a key tool for the company to better understand its global target consumer base. Strong engagement with consumers through social media channels will also enhance the company’s ability to pivot to changing consumer demand.

To get ahead of fashion trends, the retailer’s inventory procurement team is reviewing the social media landscape to identify emerging fashion brands and labels started by fashion entrepreneurs in local markets. Management stated that ASOS also continues to partner with social media celebrities and influencers to produce style edits tailored to different consumer fashion preferences.

[caption id="attachment_126168" align="aligncenter" width="725"] Source: Company reports[/caption]

Dynamic and Reactive Buying Model

Management stated that the retailer is prioritizing a dynamic and reactive buying model that balances agility, flexibility and sustainability. ASOS will continue to explore new sourcing routes to enhance its flexibility in order fulfillment and to reduce lead times.

Source: Company reports[/caption]

Dynamic and Reactive Buying Model

Management stated that the retailer is prioritizing a dynamic and reactive buying model that balances agility, flexibility and sustainability. ASOS will continue to explore new sourcing routes to enhance its flexibility in order fulfillment and to reduce lead times.

Source: Company reports [/caption]

2. In-House Brand Sales

ASOS reported that its in-house brands are on track to see sales double from fiscal 2017 to over £1.5 billion ($2.1 billion) in fiscal 2021, accounting for about 40% of the company’s sales mix.

[caption id="attachment_126170" align="aligncenter" width="725"]

Source: Company reports [/caption]

2. In-House Brand Sales

ASOS reported that its in-house brands are on track to see sales double from fiscal 2017 to over £1.5 billion ($2.1 billion) in fiscal 2021, accounting for about 40% of the company’s sales mix.

[caption id="attachment_126170" align="aligncenter" width="725"] Source: Company reports [/caption]

ASOS is looking to attract new customers and reinforce its value proposition after acquiring HIIT, Miss Selfridge, Topman and Topshop in February 2021. In the US and Germany, the company saw that 50% of consumers shopping these four acquired brands are new to ASOS. Furthermore, management stated that Topshop witnessed triple-digit sales growth on the ASOS platform after the integration in February 2021, versus the same period last year.

ASOS management believe that Topshop and Topman present a significant opportunity in its US market through a partnership with department store Nordstrom—for both acquired brands as well as ASOS’s venture brands and ASOS Design. The company also noted that the acquired brands have enabled it to discover a wider selection of suppliers, with a positive impact on its own selection of suppliers for the rest of the ASOS brands. Moreover, the company expects the acquired brands to benefit from ASOS’s strength in global territories where they were not previously available.

[caption id="attachment_126171" align="aligncenter" width="725"]

Source: Company reports [/caption]

ASOS is looking to attract new customers and reinforce its value proposition after acquiring HIIT, Miss Selfridge, Topman and Topshop in February 2021. In the US and Germany, the company saw that 50% of consumers shopping these four acquired brands are new to ASOS. Furthermore, management stated that Topshop witnessed triple-digit sales growth on the ASOS platform after the integration in February 2021, versus the same period last year.

ASOS management believe that Topshop and Topman present a significant opportunity in its US market through a partnership with department store Nordstrom—for both acquired brands as well as ASOS’s venture brands and ASOS Design. The company also noted that the acquired brands have enabled it to discover a wider selection of suppliers, with a positive impact on its own selection of suppliers for the rest of the ASOS brands. Moreover, the company expects the acquired brands to benefit from ASOS’s strength in global territories where they were not previously available.

[caption id="attachment_126171" align="aligncenter" width="725"] Source: Company reports [/caption]

3. Sustainability and Inclusivity Goals

ASOS stated that it will continue to enhance its sustainability initiatives, both from an environmental and an ethical perspective. Below, we discuss the sustainability and inclusivity actions highlighted at the company’s Capital Markets Day.

Sustainability

To be featured on the ASOS platform, each brand must meet the following five minimum requirements:

Source: Company reports [/caption]

3. Sustainability and Inclusivity Goals

ASOS stated that it will continue to enhance its sustainability initiatives, both from an environmental and an ethical perspective. Below, we discuss the sustainability and inclusivity actions highlighted at the company’s Capital Markets Day.

Sustainability

To be featured on the ASOS platform, each brand must meet the following five minimum requirements:

Source: Company reports [/caption]

Source: Company reports [/caption]