albert Chan

ASOS

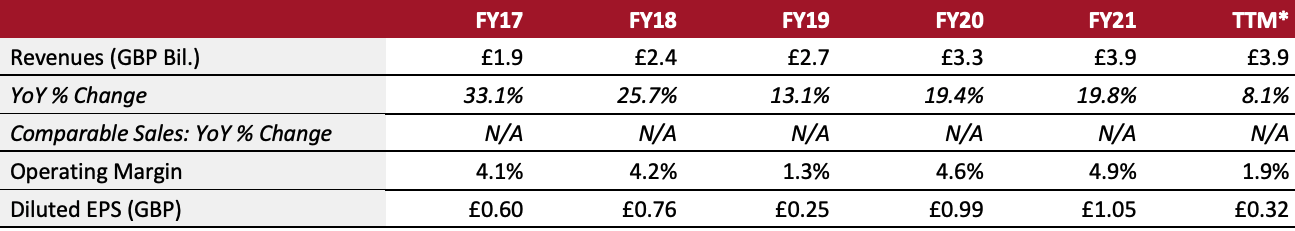

Sector: Apparel and footwear Countries of operation: Sells online and ships to over 200 countries Key product categories: Accessories, apparel, cosmetics, footwear and skin care Annual Metrics [caption id="attachment_147162" align="aligncenter" width="700"] *Trailing twelve months ended on February 28, 2022

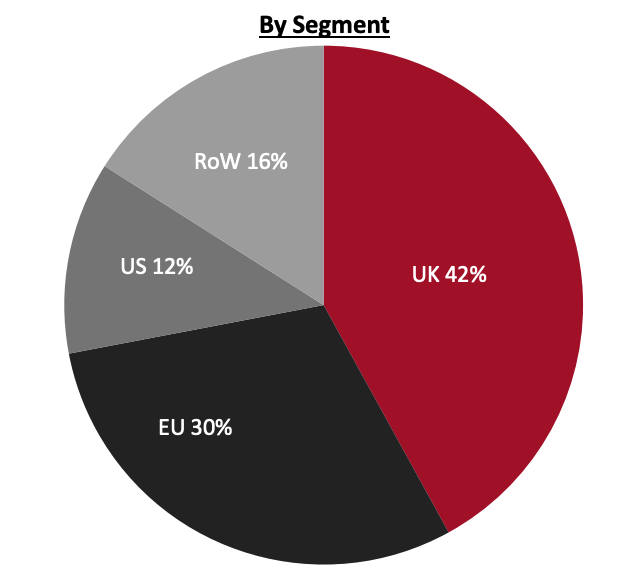

*Trailing twelve months ended on February 28, 2022Fiscal year ends on August 31 of the same calendar year[/caption] Summary Founded in 2000 and headquartered in London, the UK, ASOS is an online retailer that offers branded and own-label products in a range of categories, including accessories, clothing, cosmetics, footwear and skin care. It targets consumers aged 20–30 and ships to more than 200 countries from its fulfillment centers in Europe, the UK and the US. The company has more than 26 million active customers. In the first half of fiscal 2022 ended February 28, 2022, ASOS’s active customers increased by 6% year over year. ASOS operates through four geographical segments: the UK, the US, Europe and “Rest of World.” Company Analysis Coresight Research insight: ASOS continues to leverage both the global, pandemic-accelerated shift toward online shopping and current consumer preferences for casual wear, driving the company’s sales growth. It has converted most of its US fulfillment facilities to local warehouses due to increased freight costs, lowering overall fulfillment expenditure. We expect ongoing automation of ASOS’s fulfillment centers to improve the company’s delivery efficiency and reduce fulfillment costs in the long term—ASOS remains on track to automate its Atlanta and Lichfield warehouses by the end of fiscal 2023. Additionally, we believe that the acquired Topshop and Topman brands (which saw triple-digit sales growth between February 2021 and February 2022), and the strategic partnership with the US-based department store Nordstrom, which now sells the acquired brands, along with ASOS’s venture brands and ASOS Design, will drive ASOS’s growth in the US. Moreover, we believe that ASOS’s recent initiatives, such as the rollout and expansion of the Partner Fulfill program geared toward becoming a fashion marketplace, growth of marketing services and testing of an alternate wholesale/drop shipping model—to serve customers by receiving and fulfilling orders which have been taken on a non-ASOS platform (brand partner platforms) in new geographies—are steps in the right direction to expand the company’s total addressable market.

| Tailwinds | Headwinds |

|

|

- Replace legacy infrastructure with cutting-edge retail capabilities to support its global growth ambitions.

- Expand and automate distribution centers, supporting global growth plans.

- Capitalize on its partnership with Nordstrom to drive increased customer awareness across the US.

- Expand ASOS brands in key Nordstrom stores in 2022 and beyond.

- Launch and expand its BOPIS offering over the course of 2022.

- Continue to emphasize the expansion of its multi-brand platform to support growth in two segments: Face and Body as well as Activewear.

- Work on the second phase of its flexible fulfillment program, “Partner Fulfilment,” allowing direct-to-consumer (DTC) fulfillment and augmenting ASOS’ own supply chain with its suppliers’ capabilities—which will enable greater stock availability and product assortment, as well as the ability to directly fulfill customer orders.

- Work on new integration partners and onboard additional fashion brands into the Partner Fulfills program by the end of fiscal 2022 ending August 2022. Currently, the program offers services to only Adidas and Reebok.

- Expand its Partner Fulfills program into additional European countries by the end of fiscal 2022.

- Invest in data infrastructure to deliver a more engaging experience for each customer using data science.

- Launch new features that offer personalized search for customers, provide peer-to-peer review and deliver live feedback for the procurement and merchandising teams.

- Aim to be carbon neutral in its direct operations by 2025 and achieve net zero carbon emissions across its value chain by 2030.

- Ensure 100% of ASOS own-brand products and packaging are made from sustainable or recycled materials by 2030.

- Ensure that third-party brands are signed up to the new ASOS Ethical Trade policy and the Transparency Pledge by 2025.

Company Developments

Company Developments

| Date | Development |

| April 12, 2022 | Expects a £14 million ($19 million) hit to its net profit from suspending its operations in Russia following invasion of Ukraine |

| April 1, 2022 | Welcomes the UK Minister for Exports Mike Freer at its Atlanta fulfilment center in the US, where the company is investing $100 million in automation to increase delivery efficiency by an average of 50% across its operations in the US, Canada and Mexico |

| March 3, 2022 | Suspends its operations in Russia amid rising Russia-Ukraine war tensions |

| March 1, 2022 | ASOS marketplace and its private label COLLUSION launches first ever product collaboration |

| February 28, 2022 | Renews cloud partnership with Microsoft that will see the online apparel retailer continue to use the Microsoft Azure as its preferred cloud platform for the next five years |

| January 25, 2022 | Signs a three-year agreement with human rights organization Anti-Slavery International to advise ASOS on the development of the next phase of its human rights strategy as part of the online retailer’s Fashion with Integrity 2030 program |

| November 28, 2021 | Chairman Adam Crozier steps down from his position to join BT Group, the UK-based telecommunications holding company, in the same role |

| November 16, 2021 | With the Center for Sustainable Fashion (CSF), a research center at London College of Fashion, launches the ASOS Circular Design Guidebook to help designers and fashion brands design and create fashion products that support the circular economy |

| November 15, 2021 | Announces that the company has debuted its first drop of ASOS product with the US-based department store Nordstrom |

| November 5, 2021 | Opens its new £90 million ($122 million) fulfillment center in Lichfield, Staffordshire. The new 437,000 square feet fulfilment center will be used to serve the company’s customers in the UK and over 150 countries across the globe. |

| October 11, 2021 | Announces that Nick Beighton has stepped down as CEO with immediate effect and the company is in search of his successor. The company also announces that CFO Mat Dunn will take on the additional role of COO and Finance Director Katy Mecklenburgh will be promoted to interim CFO. |

| October 5, 2021 | Unveils a multi-territory advertising campaign which will target ASOS’s core demographic, women aged 20–30 years |

| April 28, 2021 | Becomes the first fashion brand to call for the implementation of legislation for mandatory human rights due diligence in the UK, to enhance the 2015 Modern Slavery Act |

| March 18, 2021 | Announces a thorough supply chain review of its acquired HIIT, Miss Selfridge, Topman and Topshop brands to ensure compliance with the retailer’s codes and principles |

| February 4, 2021 | Completes the acquisition of the UK-based apparel brands HIIT, Miss Selfridge, Topman and Topshop from Arcadia Group for £295 million ($405 million) as the online retailer continues to purchase well-known retail names that are closing stores |

| December 1, 2020 | Confirms the permanent appointment of Anna Suchopar as General Counsel and Company Secretary |

| November 12, 2020 | ASOS Marketplace removes commission rates until the end of 2020 to support all boutiques |

| November 5, 2020 | Appoints José Antonio Ramos Calamonte as Chief Commercial Officer |

| April 7, 2020 | Names Patrik Silén as Chief Strategy Officer |

| November 25, 2019 | Appoints Robert Birge as Chief Growth Officer |

| December 3, 2018 | Appoints Mark Holland as Chief Operating Officer |

| October 23, 2018 | Appoints Mathew Dunn as CFO, effective spring 2019 |

- Mathew Dunn—CFO and COO

- Cliff Cohen—Chief Technology Officer

- Jose Calamonte—Chief Commercial Officer

- Patrik Silén—Chief Strategy Officer

- Robert Birge—Chief Customer Officer

Source: Company reports