Source: Company reports/Fung Global Retail & Technology

1H17 Results

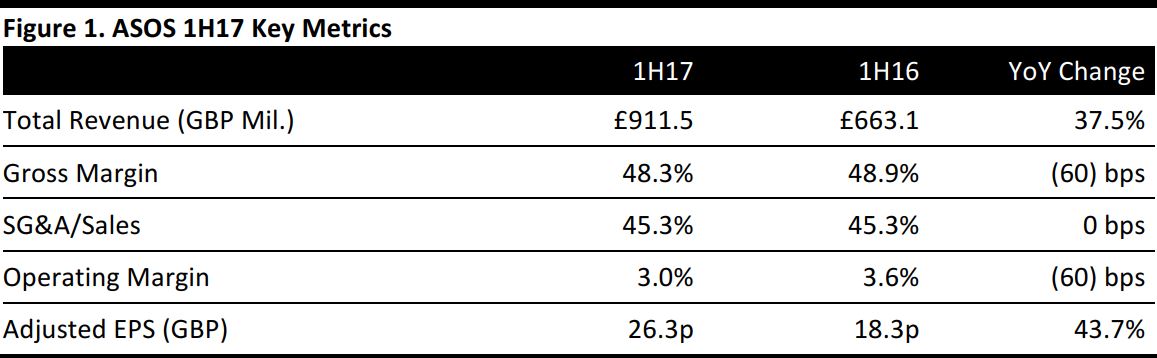

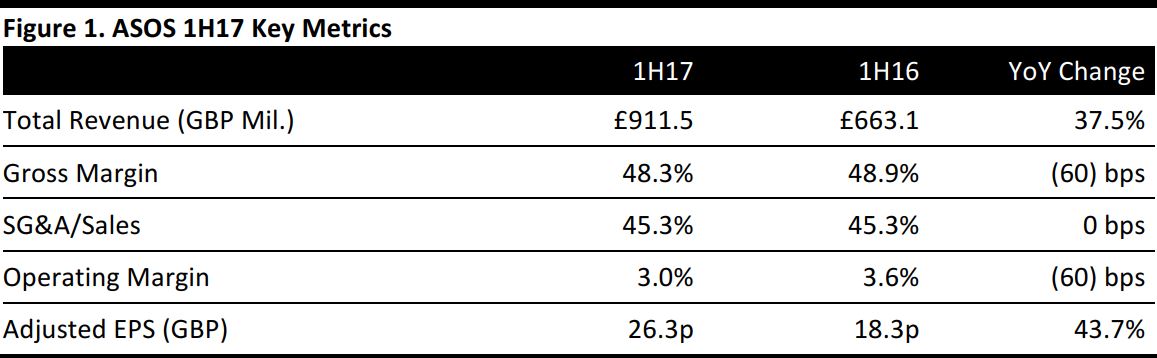

British online fashion retailer ASOS reported 1H17 total revenue of £911.5 million, representing growth of 37.5% year over year (31% at constant currency). International sales, which account for 62% of total retail sales, mainly drove the growth.

The gross margin softened by 60 basis points to 48.3%, which ASOS attributed to an increase in customers using free standard shipping options instead of paid-for delivery options, particularly in the UK and the US.

The SG&A margin remained flat at 45.3%, while the operating margin contacted by 60 bps to 3.0%.

Net profit jumped by 44% to £21.9 million and adjusted EPS increased by 43.7% to 26.3 pence. S&P Capital IQ, which is our source for consensus estimates, recorded just one advance estimate for 1H17: this was for revenue of £926 million and EPS of 25 pence.

Performance by Geography

UK

- Retail sales in the UK grew by a strong 18% to £340.8 million.

- Management noted that it was a highly promotional market in the UK and that its loyalty scheme partially helped increase average order frequency and conversion.

International Sales

- International retail sales stood at £548.4 million, indicating 54% year-over-year growth (42% at constant currency).

- US sales bounced by 62% (39% at constant currency), driven by increases in conversion and average basket sizes.

- EU retail sales jumped by 48% (36% at constant currency), helped by continued price investments and the expansion of offers, such as free returns in the region.

- Sales in the rest of world leapt by 59% (53% at constant currency), benefiting from price and proposition investments. ASOS highlighted Russia as the best performer, where sales grew by 200%.

Outlook

ASOS stated that currency tailwinds helped it invest in price and its proposition above previously planned levels. Therefore, it expects sales growth for FY17 to be in the range of 30%–35%, driven by an acceleration in international performance. ASOS emphasized that this projection is for the current financial year only and expects growth to normalize to be in the range of 20%–25% in the medium term.

Taking into account its transition costs into a new warehouse facility in Europe, sourcing inflation and headwinds from structural costs, ASOS expects to deliver profit before tax (PBT) broadly in line with market consensus.

For FY17, the single analyst estimate recorded on S&P Capital IQ shows the following:

- Total revenue of £1,864 million, representing 29.0% growth.

- PBT of £82 million, representing 28.1% growth.

- Adjusted EPS of 77 pence, representing 24.2% growth.

Note that the above figures were collated before the 1H17 results.