Web Developers

Coresight Research was an exhibiting sponsor at this year’s Ascent Conference, held October 3–4 in New York City. This technology conference brings together senior leaders and startup founders in the East Coast Tech community, and features more than 2,000 senior leaders across venture capital and technology companies, and over 150 technology-focused startups, including Oracle, Foursquare, Insight Ventures, Techstars and Lyft.

Presentations and roundtable discussions on the second and final day of the conference focused on ways of accelerating innovation, improving investor pitches, and raising money outside of Silicon Valley. The day ended with an investment pitch competition in which the 15 top startups at the conference participated.

Our takeaways from the second day of the Ascent Conference are given below:

3. Startup founders have not spent enough time with customers and, therefore, do not understand their startup’s problem intuitively. He said that “every founder should know the problem more than I do. If I ask I startup about a company in his or her category’s space and the answers are, I don’t know them, that is a problem.” Founders need to be category experts.

4. Startups do not ask for enough funding, said O’Donnell and he continued, “If you need $1 million, then ask for it. Too often startups do not ask for what they really need and it is easier to get $1 million of funding than $200K.”

Lein said that there is a bit of inertia when it comes to investing in companies that are in geographically close locations. Her company, she informed the audience, has hired an associate in Midwest and Central US to look for startups to invest in. There was a big advantage in having someone on the ground, she said, and continued that “the future of startups comes from a variety of cities.” Lein highlighted Utah as an example of an unexpected blossoming enterprise hub.

Startups May Fail to Get VC Funding Because They Are Afraid to Ask The Hard Questions

In his presentation titled, “How to Fail at Fundraising,” Charlie O’Donnell, Founder and Partner at Brooklyn Bridge Ventures, said that just because a startup is getting a lot of no’s from VCs, it does not mean there is something wrong with it. According to O’Donnell, following are four main reasons why startups do not get funding: 1. They do not understand the basics of “Sales 101” and, therefore, run out of money. O’Donnell described the typical startup scenario where a startup’s founder or core team pitches to a few investors, and gets passed on to analysts who are not decision makers. Through this initial process, O’Donnell said, startups should be asking VCs questions such as: What is your budget?; How many people need to vote on this?; and, What is the approval process? He suggested that not enough startups are willing to ask a VC, “Why wouldn’t you do this?” O’Donnell also recommended that prior to pitching, startups should create a spreadsheet in which VCs are ranked by their likelihood of saying yes to funding. This helps founders get an idea of how many VCs they should be speaking with. He said the funding process is slow and too many startups are depending on “that one VC” to buy their pitch. 2. Too many startups focus on past achievements and expect funding as a reward for accomplishments of the past. But, O’Donnell said, all VCs look into the future and want to know how a startup will fare in the future. O’Donnell speaking on: How to Fail at Fundraising

Source: Coresight Research

O’Donnell speaking on: How to Fail at Fundraising

Source: Coresight Research

3. Startup founders have not spent enough time with customers and, therefore, do not understand their startup’s problem intuitively. He said that “every founder should know the problem more than I do. If I ask I startup about a company in his or her category’s space and the answers are, I don’t know them, that is a problem.” Founders need to be category experts.

4. Startups do not ask for enough funding, said O’Donnell and he continued, “If you need $1 million, then ask for it. Too often startups do not ask for what they really need and it is easier to get $1 million of funding than $200K.”

Today’s Athletes Have More Than Financial Capital; They Have Social Capital

In the panel discussion on, “From Athlete to Entrepreneur: How Sports Figures Play a Role in Startups that Change the World,” Ryan Howard, former MLB Superstar, and Wayne Kimmel, partners at SeventySix Capital, spoke on the emerging role of the athlete as a brand. Howard said, “Everyone is a business today. Everyone is a brand. For example, athletes like LeBron and KD (Kevin Durant), people can see what their value is when they have millions of followers on different social media platforms.” Ryan Howard, Former MLB Superstar and Partner, and Wayne Kimmel, partners at SeventySix Capital

Source: Coresight Research

Ryan Howard, Former MLB Superstar and Partner, and Wayne Kimmel, partners at SeventySix Capital

Source: Coresight Research

VC Panel: Raising Money Outside Silicon Valley; Moderated by Alex Konrad, Associate Editor at Forbes; Panelists include: Erik Norlander, Partner, GV; Garrick Brown, Partner, Lerer Hippeau; Julie Lein, Cofounder and Managing Partner at Urban Innovation Fund

Source: Coresight Research

VC Panel: Raising Money Outside Silicon Valley; Moderated by Alex Konrad, Associate Editor at Forbes; Panelists include: Erik Norlander, Partner, GV; Garrick Brown, Partner, Lerer Hippeau; Julie Lein, Cofounder and Managing Partner at Urban Innovation Fund

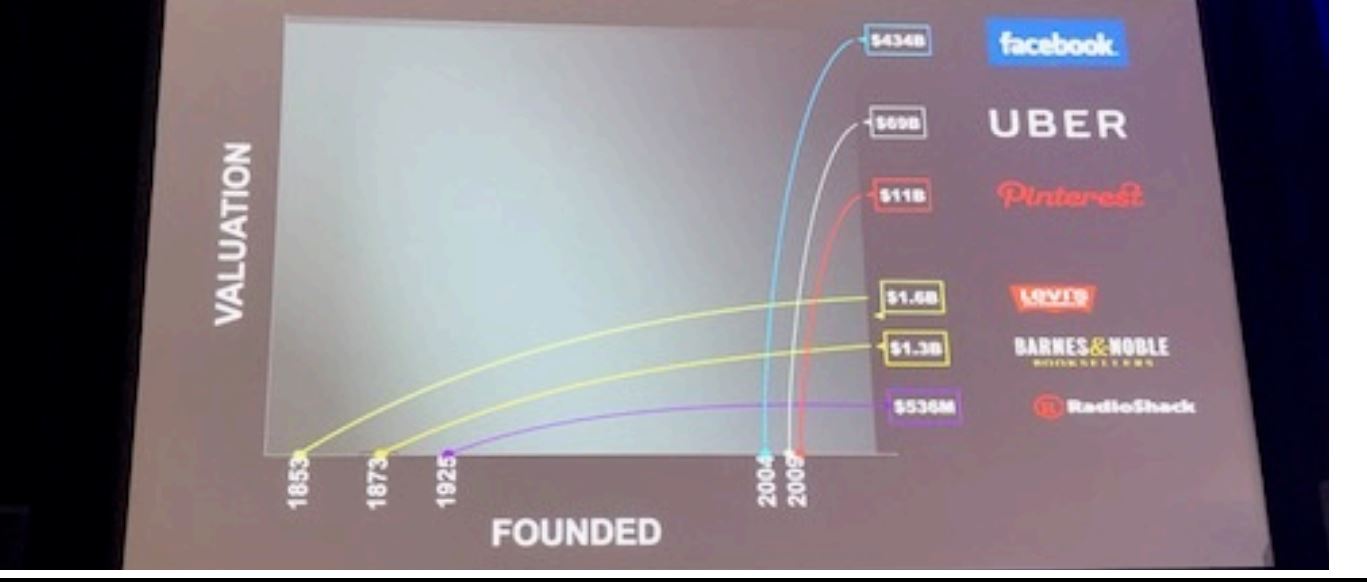

Source: Coresight Research Perksy, a Next-Gen Consumer Insights Platform Geared to Millennials and Gen-Z

Source: Coresight Research

Perksy, a Next-Gen Consumer Insights Platform Geared to Millennials and Gen-Z

Source: Coresight Research