Coresight Research was an exhibiting sponsor at this year’s Ascent Conference,held October 3–4 in New York City. This preeminent technology conference brings together senior leaders and startup founders in the East Coast Tech community, and features more than 2,000 senior leaders across venture capital and technology companies, and over 150 technology-focused startups, including Oracle, Foursquare, Insight Ventures, Techstars and Lyft.

Presentations and round table discussions at the conference focused on:tactics that accelerate innovation; changes in the technology investment landscape; strategic needs of startups in different tech verticals; and,ways of achieving hyper-growth.

Our takeaways from the first day of the conference are given below.

The Second Wave of Fintech and the Inevitable Rise of Autonomous Finance

Kenneth Lin, Founder and CEO of Credit Karma, a personal finance technology company with more than 80 million members, outlined the complexities within financial services and how autonomous fintech solutions will one day make financial decisions for consumers.

Lin discussed the growing ecosystem of players and investments within fintech and how new digital services are improving processes such as cross-border payments and bank underwriting. However, according to Lin, advances in fintech today have done little to simplify the lives of consumers, especially the millennials. He believes the “second wave of fintech” will provide more autonomous and simplified solutions.

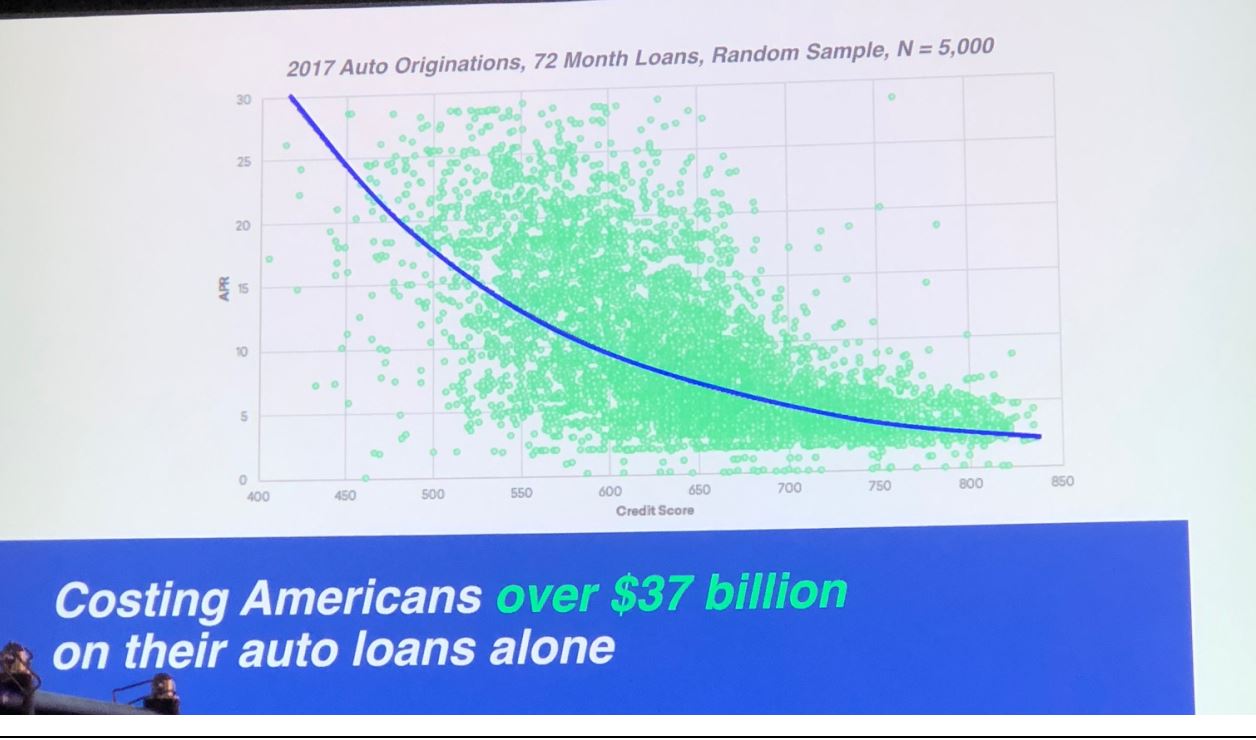

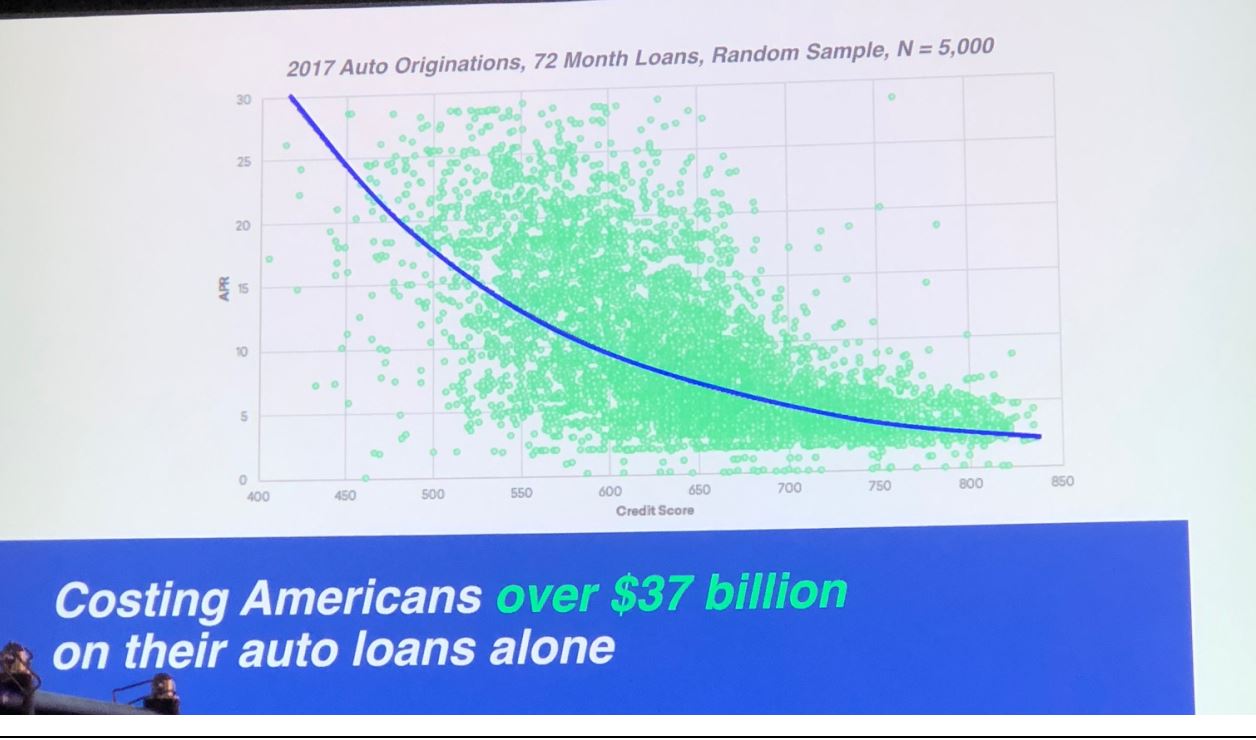

Lin said that according to a Credit Karma consumer survey, 46% of millennials are “overwhelmed when it comes to their finances.” Lack of education is impacting expenditure and savings, he continued, and American overspending amounted to $37 billion on auto loans and around $100 billion on home mortgages last year.He believes that fintech is going through a transition that could be just as revolutionary as self-driving cars, and will eventually start providing automated financial decisions and advice, such as when one should refinance his or her mortgage and what portion of one’s money should be invested in long-term investments.

A Slide from Credit Karma’s presentation depicting the high level of interest consumers’ pay on auto loans

Source: Coresight Research

A Slide from Credit Karma’s presentation depicting the high level of interest consumers’ pay on auto loans

Source: Coresight Research

According to the Credit Karma survey, consumers are more comfortable with autonomous financial advice than they are with self-driving cars and planes, and over 50%of the millennials that responded in the survey said they would like artificial intelligence (AI) to provide them with personalized financial recommendations.Lin said that for making such recommendations, data (behavioral, transactional, income, tax information, and propensity score) will be a critical requirement.Autonomous finance could become a reality in around the next five years and, “If all goes well, ordinary people will soon have the benefit of optimized finances,” he concluded.

How the Venture Capital Landscape Has Changed in the Last 10 Years

Zach Noorani, partner at technology-focused venture capital firm Foundation Capital, said that the amount of capital and VC dollars flowing into software-focused startups has grown exponentially over the past 10 years. He said this trend was, in all likelihood, driven by the profit potential of software solutions.

Paul Martino, General Partner of early-stage fund Bullpen Capital, said that 10 years ago there were around 10 firms like Bullpen and that number is around 500 today. To illustrate how the investment landscape has changed, Martino said the number of seed deals has dropped by almost 25% since 2016 but the overall amount of seed capital has increased. This means, he said, that individual seed rounds are closing with a lot more capital than they used to. PitchBook estimates that two-thirds of all seed-fund deals struck in 2017 were in the range $1–5 million, compared to an average of $500k a couple of years before that.

Andrea Moffitt, President and Cofounder of the crowdfunding investment company Plum Alley, said the availability of capital to entrepreneurs has been driven by new and growing interest of private and institutional investors who want to invest in the asset class.

The venture capital landscape has witnessed technology and structural disruptions, according to Martino, who said that new investment vehicles such as crowdfunding and ICOs are democratizing the investment process. Moffitt said she has seen disruption in terms of new discovery tools changing the way VCs research and find startup companies to invest in. Noorani said the biggest change he has seen is firms adding later stage and growth capital rounds, and he gave the example of Sequoia Capital taking a company from a Series A to Series D. “Access to Series B projects could go away in the future,” said Noorani.

Panel discussion on “Investing in 2018: What’s Changed in Venture Capital, and Where It’s Going Next”

Source: Coresight Research

Panel discussion on “Investing in 2018: What’s Changed in Venture Capital, and Where It’s Going Next”

Source: Coresight Research

The Importance of Building Gender-Diverse Startup Teams

Hilary Gosher, Managing Director of Insight Venture Partners, discussed the importance of forming gender-diverse startup teams. Gosher said that the VC industry has been historically stacked against women-led startups. She quoted from a study conducted by Columbia University and the Wharton School of Business that looked at the TechCrunch Disrupt startup competition and the questions asked by VCs to male and female competitors. The survey showed that male competitors received more questions about their project’s potential for growth, and female competitors had to field more negatively-framed questions about potential risks and losses—and that this had a very measurable impact on the funding they received. Only around 2% of VC funding goes to women entrepreneurs, despite the fact women own 38% of businesses in the US.

But that landscape, Gosher said, is changing as VCs and businesses are, in general, increasingly looking for gender-diverse teams because such teams offer diverse opinions and less like-minded individuals are better at problem solving. “Diversity is top of mind in the VC community,” said Gosher. Startups are also looking at growth funds such as Insight Ventures to help build more gender-diverse teams as they look to scale. In fact, California became the first state to require women on corporate boards on September 30 this year. The law, signed by Governor Jerry Brown, requires public companies whose principal executive offices are located in California to comply by the end of 2019.

The Importance of Growth Hacking and Key Strategies

The goal of growth hacking is to acquire as many users or customers as possible at the lowest possible cost. Growth hacking often focuses on creative, low-cost strategies to help businesses acquire and retain customers and a growth hacker knows how to: set growth priorities; identify channels for customer acquisition;measure success;and, scale growth.

Vin Clancy is a famous growth hacker who went from being on social welfare in the UK to winning best speaker at SXSW V2V for his talk on growth hacking. A common misconception that Clancy talked about is how entrepreneurs and startups think they need millions of followers if they want to standout in the crowd, but,according to him,a community of just 1,000 people who genuinely believe in a product/service is more powerful.At the end of the day, Clancy said, if one knows the target audience well, one’s social media strategy can be molded to fit its behavior and preferences.

Clancy’s growth hacking techniques revolve around lead generation, and he said there is a very fine line between using lead-generation techniques in a productive, consistent way that builds connections and using them in a borderline spammy way that has negative effects. One can get away with a lot of outreach because people are generally more forgiving than startups think when it comes to receiving e-mails on an almost daily basis. The caveat,though, is that content has to be relevant and they have to have opted in to receive e-mails, to start with.

In a separate presentation, Josh Fechter, CEO and Cofounder of BAMF Media, stressed the importance of having an “omnipresent” marketing strategy across platforms such as Instagram, Twitter and Facebook. He also commented on the importance of creating smaller, more targeted groups of potential customers. He said startup founders should discuss the team, culture, case studies and genuine stories to draw a more personal connection with their audience: “vulnerability is powerful,” said Fechter. He recommended Linked Helper and Phantom Buster as tools to expand one’s network.

Adjusting Business Models to Adapt to the Modern Consumer

Nick Rockwell, CTO at The New York Times (NYT), discussed how technology has impacted NYT. He said the company is on the path to eventually fully digitalize its subscription business. NYT has seen enormous growth in its digital audience in the past two years, and Rockwell informed the audience that mastheadhas2.6 million digital subscribers, which is more than two-and-a-half times the number of subscribers its print edition has.

One challenge facing NYT, Rockwell said, is the fact that while the digital audience is much larger, it is much harder to monetize.“Tech cuts both ways. It disrupts but also enables,” Rockwell said.NYT is looking at machine learning to offer content that has more relevance for every individual reader.

Marketing strategies for reaching out to new customers have changed. It is no longer about solely focusing on the conversion of a subscriber but about “activization moments” such as getting their e-mail addresses or making them download the NYT app. Rockwell said that the importance of studying and understanding customers’ journey is crucial for marketing.

Blockchain Investment is Accelerating in Retail, Bringing Major Long-Term Benefits

The lack of trust and control of personal data in online commerce, along with fraud becoming more common and individual privacy concerns, makes blockchain the ideal tool for several industries. LuRae Lumpkin, CEO and Cofounder of blockchain development and consultancy firm Custom Blockchain Solutions, said that there is close to $20 billion of advertising frauds happening every year. “The lack of trust between brands and ad agencies has exponentially increased and blockchain offers a solution for this,” Lumpkin said. Lumpkin noted five key benefits of using blockchain technology: trust; transparency; security; quality/certainty;and, reduced costs.

The financial services industry may be the most impacted by blockchain, according to Ravi Sarkar, Head of Blockchain and Fintech at Hexaware, which helps companies combine their IT staff with offshore resources and co-develop innovative IT capabilities. Financial transactions require an intermediary to manage transactions between two parties and blockchain provides a seamless experience by eliminating the intermediary using digital currencies. Many global transactions are not financed due to the complexity of exchanging funds. Sarkar said that $1.5 trillion in global trade is not getting financed due to the complexity of exchanging funds and there is a tremendous opportunity for blockchain to provide fund-exchange capability to these trades.

A Slide from Credit Karma’s presentation depicting the high level of interest consumers’ pay on auto loans

Source: Coresight Research

A Slide from Credit Karma’s presentation depicting the high level of interest consumers’ pay on auto loans

Source: Coresight Research Panel discussion on “Investing in 2018: What’s Changed in Venture Capital, and Where It’s Going Next”

Source: Coresight Research

Panel discussion on “Investing in 2018: What’s Changed in Venture Capital, and Where It’s Going Next”

Source: Coresight Research