DIpil Das

[caption id="attachment_90178" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

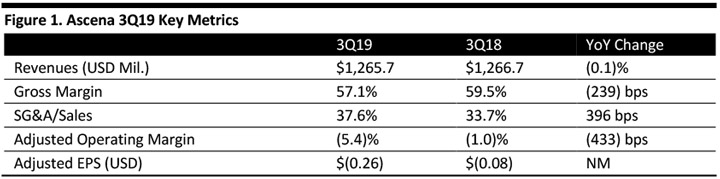

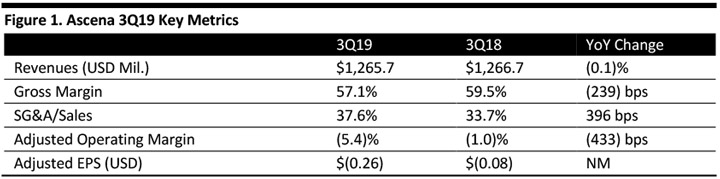

Ascena Retail Group reported fiscal 3Q19 revenues of $1.27 billion, below the consensus estimate of $1.43 billion, and down 0.1% year over year. The company reported adjusted 3Q19 earnings per share (EPS) of $(0.26), higher than the consensus estimate of $(0.36) but lower than the year-ago period.

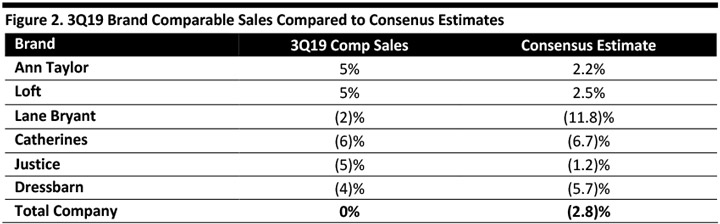

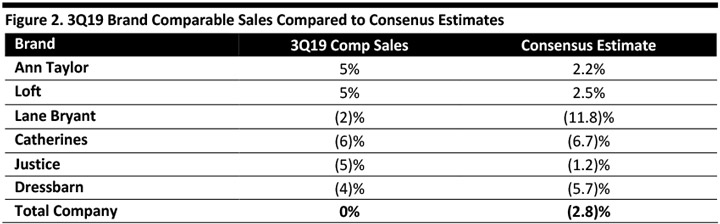

Ascena’s third quarter comparable sales were flat, above the consensus estimate of (2.8)%. The table below summarizes comps by brand compared to the StreetAccount consensus estimate.

Management reported that in its premium brands, Ann Taylor comps were driven by its full-price business and strength in its accessory categories. The company reported that Lane Bryant saw an improvement in comps, at (2)% compared an 8% decline in the prior quarter. Customers responded positively to merchandise assortment adjustments in dresses and denim, which comped positively in the third quarter.

Management reported it is working to balance fashion with basics. At tween/kids’ brand Justice, comps were down mid-single digits, and the company is seeking to refine its assortment and stay ahead of trends.

[caption id="attachment_90182" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Ascena Retail Group reported fiscal 3Q19 revenues of $1.27 billion, below the consensus estimate of $1.43 billion, and down 0.1% year over year. The company reported adjusted 3Q19 earnings per share (EPS) of $(0.26), higher than the consensus estimate of $(0.36) but lower than the year-ago period.

Ascena’s third quarter comparable sales were flat, above the consensus estimate of (2.8)%. The table below summarizes comps by brand compared to the StreetAccount consensus estimate.

Management reported that in its premium brands, Ann Taylor comps were driven by its full-price business and strength in its accessory categories. The company reported that Lane Bryant saw an improvement in comps, at (2)% compared an 8% decline in the prior quarter. Customers responded positively to merchandise assortment adjustments in dresses and denim, which comped positively in the third quarter.

Management reported it is working to balance fashion with basics. At tween/kids’ brand Justice, comps were down mid-single digits, and the company is seeking to refine its assortment and stay ahead of trends.

[caption id="attachment_90182" align="aligncenter" width="720"] Source: Company reports[/caption]

Management identified an additional $150 million of cost savings it expects to realize in fiscal 2020, aside from the $300 million savings the company already identified in its Change for Growth program.

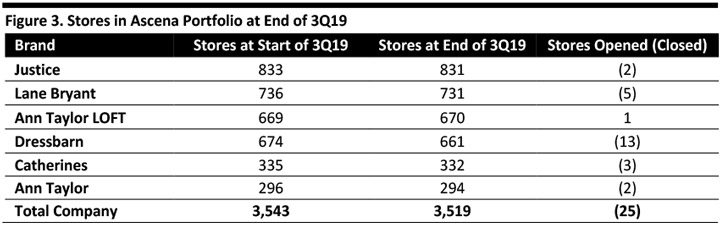

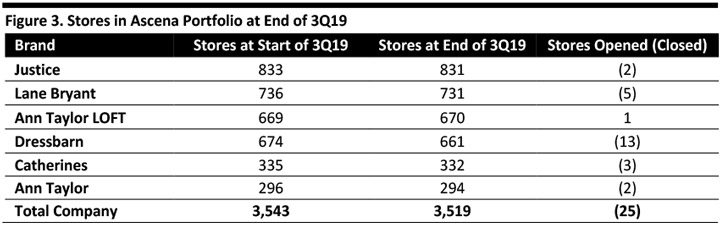

The company ended the quarter with 3,519 stores, closing 25 stores across its banners as shown in the table below. On May 20, 2019 Ascena announced it would close its Dressbarn business. After the company closes Dressbarn stores, Ascena will have 2,858 stores in its portfolio.

[caption id="attachment_90183" align="aligncenter" width="720"]

Source: Company reports[/caption]

Management identified an additional $150 million of cost savings it expects to realize in fiscal 2020, aside from the $300 million savings the company already identified in its Change for Growth program.

The company ended the quarter with 3,519 stores, closing 25 stores across its banners as shown in the table below. On May 20, 2019 Ascena announced it would close its Dressbarn business. After the company closes Dressbarn stores, Ascena will have 2,858 stores in its portfolio.

[caption id="attachment_90183" align="aligncenter" width="720"] Source: Company reports[/caption]

Outlook

Due to the the wind down of the company’s Dressbarn business, for 4Q19, the company only provided guidance for the continuing operations of its premium fashion brands, plus fashion brands and kids segments; it projects net sales of $1.175 billion to $1.215 billion. Management expects comparable sales of (5)% to (3)%.

The company expects a gross margin of 55.0-55.5%, depreciation and amortization of $64 million and an operating loss of $15 million to operating income of $5 million.

Source: Company reports[/caption]

Outlook

Due to the the wind down of the company’s Dressbarn business, for 4Q19, the company only provided guidance for the continuing operations of its premium fashion brands, plus fashion brands and kids segments; it projects net sales of $1.175 billion to $1.215 billion. Management expects comparable sales of (5)% to (3)%.

The company expects a gross margin of 55.0-55.5%, depreciation and amortization of $64 million and an operating loss of $15 million to operating income of $5 million.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Ascena Retail Group reported fiscal 3Q19 revenues of $1.27 billion, below the consensus estimate of $1.43 billion, and down 0.1% year over year. The company reported adjusted 3Q19 earnings per share (EPS) of $(0.26), higher than the consensus estimate of $(0.36) but lower than the year-ago period.

Ascena’s third quarter comparable sales were flat, above the consensus estimate of (2.8)%. The table below summarizes comps by brand compared to the StreetAccount consensus estimate.

Management reported that in its premium brands, Ann Taylor comps were driven by its full-price business and strength in its accessory categories. The company reported that Lane Bryant saw an improvement in comps, at (2)% compared an 8% decline in the prior quarter. Customers responded positively to merchandise assortment adjustments in dresses and denim, which comped positively in the third quarter.

Management reported it is working to balance fashion with basics. At tween/kids’ brand Justice, comps were down mid-single digits, and the company is seeking to refine its assortment and stay ahead of trends.

[caption id="attachment_90182" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Ascena Retail Group reported fiscal 3Q19 revenues of $1.27 billion, below the consensus estimate of $1.43 billion, and down 0.1% year over year. The company reported adjusted 3Q19 earnings per share (EPS) of $(0.26), higher than the consensus estimate of $(0.36) but lower than the year-ago period.

Ascena’s third quarter comparable sales were flat, above the consensus estimate of (2.8)%. The table below summarizes comps by brand compared to the StreetAccount consensus estimate.

Management reported that in its premium brands, Ann Taylor comps were driven by its full-price business and strength in its accessory categories. The company reported that Lane Bryant saw an improvement in comps, at (2)% compared an 8% decline in the prior quarter. Customers responded positively to merchandise assortment adjustments in dresses and denim, which comped positively in the third quarter.

Management reported it is working to balance fashion with basics. At tween/kids’ brand Justice, comps were down mid-single digits, and the company is seeking to refine its assortment and stay ahead of trends.

[caption id="attachment_90182" align="aligncenter" width="720"] Source: Company reports[/caption]

Management identified an additional $150 million of cost savings it expects to realize in fiscal 2020, aside from the $300 million savings the company already identified in its Change for Growth program.

The company ended the quarter with 3,519 stores, closing 25 stores across its banners as shown in the table below. On May 20, 2019 Ascena announced it would close its Dressbarn business. After the company closes Dressbarn stores, Ascena will have 2,858 stores in its portfolio.

[caption id="attachment_90183" align="aligncenter" width="720"]

Source: Company reports[/caption]

Management identified an additional $150 million of cost savings it expects to realize in fiscal 2020, aside from the $300 million savings the company already identified in its Change for Growth program.

The company ended the quarter with 3,519 stores, closing 25 stores across its banners as shown in the table below. On May 20, 2019 Ascena announced it would close its Dressbarn business. After the company closes Dressbarn stores, Ascena will have 2,858 stores in its portfolio.

[caption id="attachment_90183" align="aligncenter" width="720"] Source: Company reports[/caption]

Outlook

Due to the the wind down of the company’s Dressbarn business, for 4Q19, the company only provided guidance for the continuing operations of its premium fashion brands, plus fashion brands and kids segments; it projects net sales of $1.175 billion to $1.215 billion. Management expects comparable sales of (5)% to (3)%.

The company expects a gross margin of 55.0-55.5%, depreciation and amortization of $64 million and an operating loss of $15 million to operating income of $5 million.

Source: Company reports[/caption]

Outlook

Due to the the wind down of the company’s Dressbarn business, for 4Q19, the company only provided guidance for the continuing operations of its premium fashion brands, plus fashion brands and kids segments; it projects net sales of $1.175 billion to $1.215 billion. Management expects comparable sales of (5)% to (3)%.

The company expects a gross margin of 55.0-55.5%, depreciation and amortization of $64 million and an operating loss of $15 million to operating income of $5 million.