Source: Company reports/Fung Global Retail & Technology

Fiscal 2Q17 Results

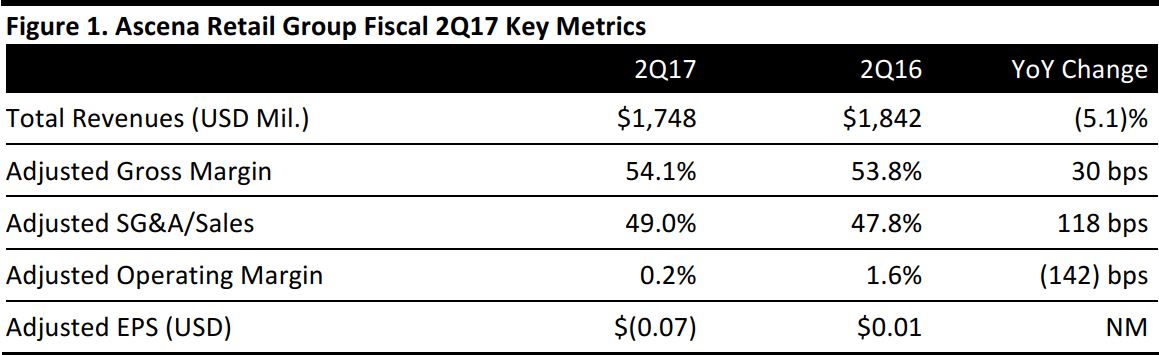

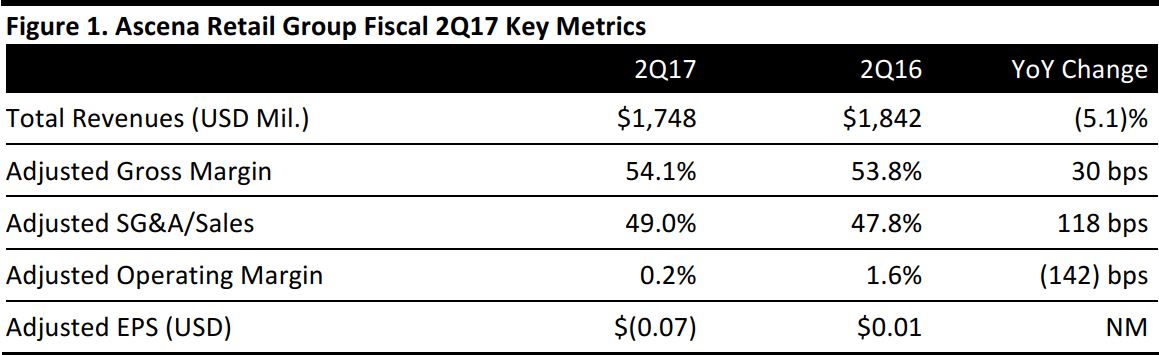

Ascena Retail Group reported fiscal 2Q17 revenues of $1.75 billion, down 5.1% year over year and in line with the consensus estimate. Total company comps were down 4%, in line with consensus.

Adjusted EPS was $(0.07), versus a profit of $0.01 per share in the year-ago quarter and beating the consensus estimate by two cents. GAAP EPS, which includes the impact of noncash accounting adjustments, acquisition and integration-related expenses, and restructuring and related charges, in addition to the tax effect of the adjustments, was $(0.18), compared with ($0.12) in the year-ago quarter.

Management commented that it saw a continuation of existing trends, such as a soft base business alongside ongoing store traffic headwinds and overall customer price sensitivity. The company had to be much more promotional than planned to achieve the level of performance reported in the quarter.

Performance by Segment

- Revenues from Premium Fashion (Ann Taylor and LOFT) were $608.2 million, down 5% year over year. Comps for Ann Taylor decreased by 9% and LOFT’s comps decreased by 2% year over year.

- Revenues from Value Fashion (Maurices and Dressbarn) were $481.6 million, down 6% year over year. Comps for Maurices decreased by 8% and Dressbarn’s comps decreased by 3% year over year.

- Revenues from Plus Fashion (Lane Bryant and Catherines) were $347.3 million, down 4% year over year. Comps for Lane Bryant decreased by 5% and Catherines’ comps were flat year over year.

- Revenues from Kids Fashion (Justice) were $311.1 million, down 5% year over year. Comps for Justice decreased by 1% year over year.

Outlook

Looking ahead, management plans to continue to evolve the organization to embrace and serve customers in addition to developing advanced analytics and customer experience management capabilities to drive revenue and margin. Moreover, management plans to pursue cost structure opportunities, including refinement of the company’s operating model and ongoing fleet optimization.

For FY17, the company expects adjusted EPS of $0.37–$0.42, which brackets the $0.39 consensus estimate.

For fiscal 3Q17, the company expects adjusted EPS of $0.07–$0.12, below the $0.15 consensus estimate.