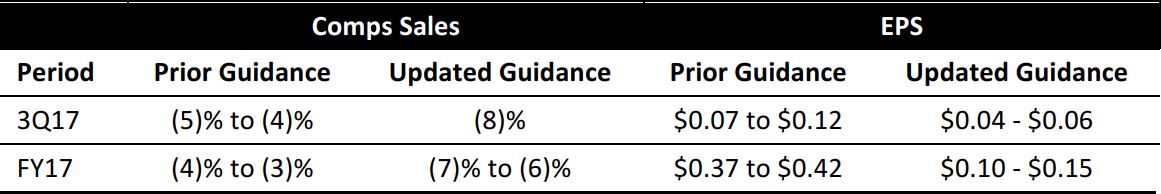

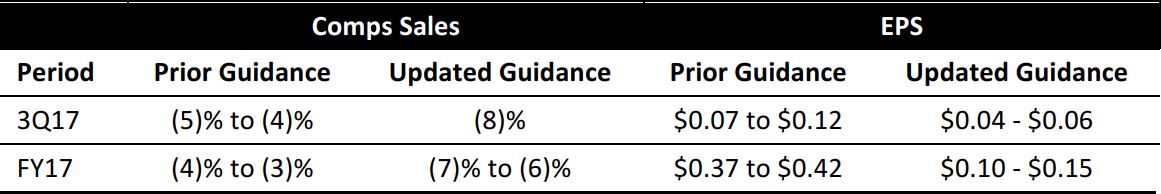

Changes to Guidance

Source: Company reports/Fung Global Retail & Technology

Ascena Retail updated its 3Q17 and fiscal year 2017 guidance in response to the rapidly evolving retail environment. The company reported that industrywide traffic headwinds and a highly promotional environment have continued at levels above expectations, resulting in a reduction of its sales and earnings outlook for 3Q. Management said that it adjusted the second half outlook to reflect the environment, and no longer believes it is appropriate to expect a stabilization of traffic and normalization of comp sales against softer demand.

The company also announced a significant increase to its Change for Growth transformation program savings target, from a prior target of $150 million to $250–$300 million in cost savings.

Accelerated Implementation of Change for Growth

Ascena announced that the implementation of its Change for Growth enterprise transformation program is under way, and the company is accelerating the transformation to help to ensure it emerges from industry disruption as a stronger, more agile company. These initiatives, along with an expanded structural cost reduction scope, are now expected to deliver $250–$300 million in cost savings compared to the prior target of $150 million. The company is in the process of implementing technology platforms to support sales and margins, and has begun executing a fleet optimization program.

Changes to Guidance

Ascena updated its guidance for both the 3Q and the full fiscal year 2017 as follows:

- Lowered 3Q17 comparable sales guidance to (8)% from prior guidance of (5)% to (4)%.

- Lowered the full fiscal year 2017 comparable sales guidance range to (7)% to (6)%, from (4)% to (3)% previously.

- Lowered 3Q EPS guidance to $0.04–$0.06 from $0.07–$0.12 previously.

- Lowered full fiscal year 2017 EPS guidance to $0.10–$0.15 from the prior range of $0.37–$0.42.

Ascena’s 3Q17 earning’s call is scheduled for June 5, 2017.