Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

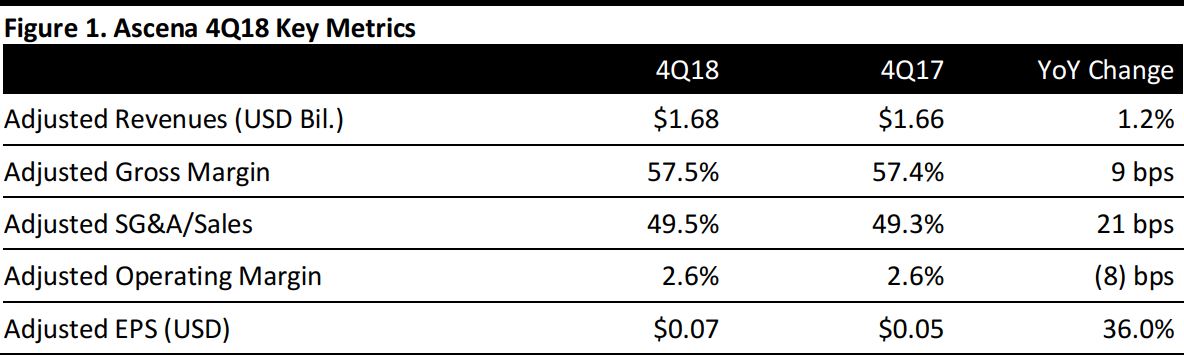

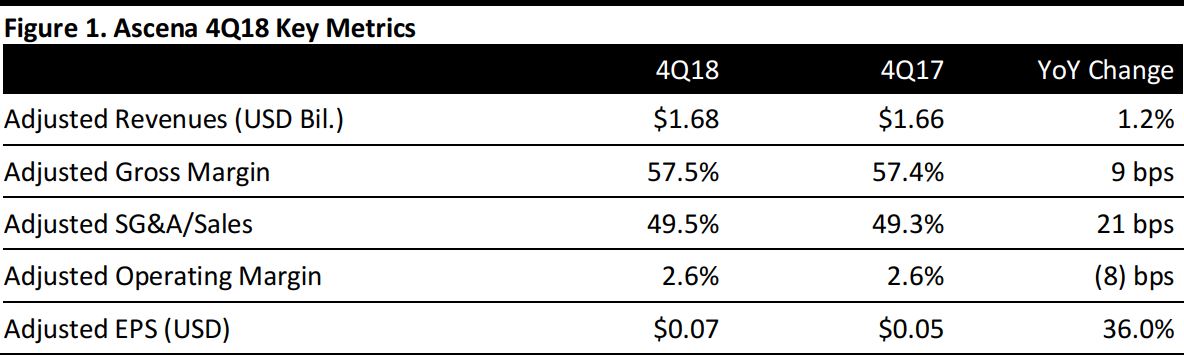

Fiscal 4Q18 Results

Ascena reported adjusted revenues of $1.68 billion for fiscal 4Q18, up 1.2% year over year and above the $1.47 billion consensus estimate. The GAAP figure was $1.77 billion, which includes an extra week of sales.

Total comps were 4%, beating the +0.6% consensus estimate.

Adjusted EPS was $0.07, up 36.0% from a year ago and beating the consensus of $0.02. GAAP EPS was $0.17, compared with ($0.08) in the year-ago quarter.

Results by Segment

Premium Fashion: Revenues were $620.4 million, up 3.5%. Comps were 5%, comprising up 1% at Ann Taylor and up 7% at LOFT.

Value Fashion: Revenues were $485.9 million, up 1.4%. Comps were 2%, comprising 1% at maurices and (5)% at dressbarn.

Plus Fashion: Revenues were $382.5 million, up 6.2%. Comps were 2%, comprising 2% at Lane Bryant and 3% at Catherines.

Kids Fashion: Revenues were $277.5 million, up 26.7%. Justice comps increased 15%.

Details from the Quarter

Management commented that the company saw sequential comp increases across all brands and the first positive company-wide comp since fiscal 2015. Specifically, dressbarn delivered a nine percentage point sequential comparable sales improvement, and the brand’s inventory position has been reset heading into FY19.

Management also commented that that the company continues to make good progress on its Change for Growth transformation program and remains on track to achieve $300 million in annual run-rate savings by July 2019. The company is also implementing the two remaining large capability-building components of its transformation program: localized planning and our customer experience management ecosystem.

Company management believes that the company entered FY19 with good base momentum, and key growth initiatives beginning to gain traction across its brands. In addition, the company is making headway with stabilization of the dressbarn brand, and will continue to explore opportunities across the brand portfolio to create shareholder value. The transformation program has delivered significant expense reductions, including improved comp performance exiting the quarter.

Quarter-to-date comps are up by mid-single digits.

Fiscal 2018 Results

For the fiscal year, adjusted revenues were $6.47 billion, down 2.8%. This GAAP figure was $6.58 billion, which includes an extra week of sales.

Adjusted EPS was $(0.02), compares with $0.22 in the prior year. GAAP EPS was $(0.20), compared with ($5.48) in the prior year.

Outlook

The company offered the following guidance:

Fiscal 2019

- Net sales of $6.45–$6.55 billion.

- Comparable sales up low single digits.

- Adjusted EPS of $0.00–$0.10.

- Capital expenditures of $180–$210 million.

- Close approximately 5% of its FY18 year-end fleet, with store count dropping into the range of 4,375 to 4,425 by July 2019.

Fiscal 1Q19

- Net sales of $1.54–$1.56 billion.

- Comparable sales flat to up 2%.

- Adjusted EPS of $(0.04)–$0.06.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research