Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

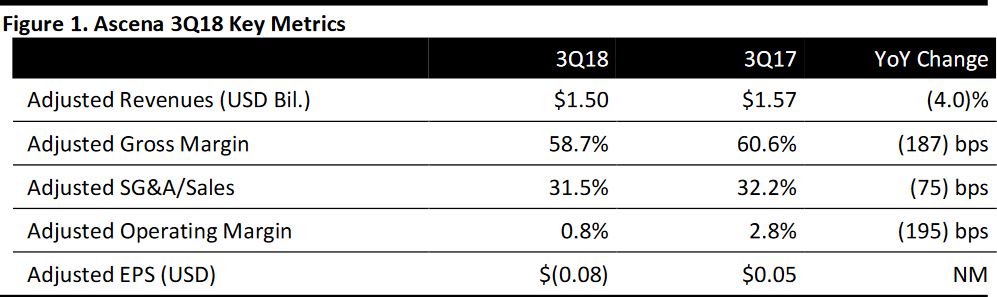

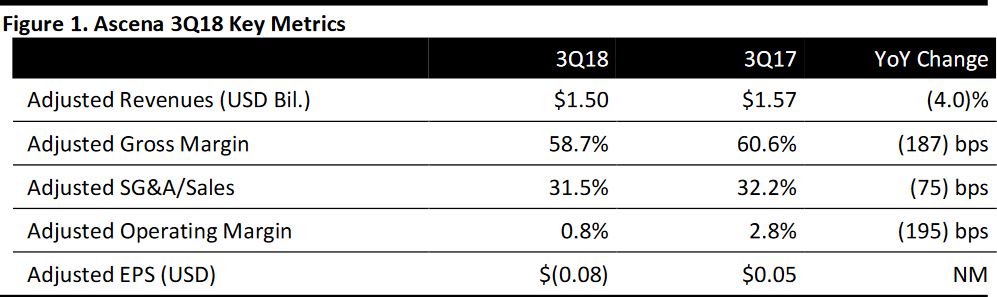

Fiscal 3Q18 Results

Ascena reported adjusted revenues of$1.50 billion for fiscal 3Q18, down 4.0% year over year and above the $1.47 billion consensus estimate. The year-ago figure includes a $0.6 million benefit for the impact of non-cash expenses associated with the accounting adjustments of ANN’s assets and liabilities to fair market value.

Comps declined 3%, beating the (3.4)% consensus estimate.

The adjusted gross decline of 187 basis points was due primarily to performance at the Value Fashion segment, where both the Maurices and Dressbarn brands experienced significant declines.

The 75-basis-point decline in SG&A as a percentage of sales was primarily due to synergies and cost-reduction initiatives, mainly reflecting headcount and non-merchandise procurement savings, lower store expenses and lower performance-based compensation, partially offset by inflationary increases and higher write-downs of store-related fixed assets.

The company ended the quarter with 4,663 store locations, a decline of 27 locations, reflecting closures at all banners. The company closed 261 stores from January 2017 through April 28, 2018, realizing approximately $40 million in annualized rent reductions through landlord negotiations.

Details from the Quarter

Management commented that the results reflected a soft start in February, with sequential improvement over the combined March/April period. Another strong quarter at Justice was offset by continued challenges at the Value segment, particularly at dressbarn.

The company further commented that its transformation program delivered significant expense reductions, including improved comp performance exiting the quarter. This momentum has continued into our 4Q with quarter-to-date comps up by mid-single digits.

Premium Fashion: Revenues were $523.7 million, down 0.6%. Comps were (7)% at Ann Taylor and (1)% at Loft.

Value Fashion: Revenues were $523.7 million, down 12.6%. Comps were (5)% at Maurices and (14)% at Dressbarn.

Plus Fashion: Revenues were $21.8 million, down 4.8%. Comps were (1)% at Lane Bryant and (9)% at Catherines.

Kids Fashion: Revenues were $233.8 million, up 8.4%. Justice comps increased 10%.

Outlook

Looking ahead, management plans to drive its enterprise transformation to realize the full value of the brand portfolio and are working to quickly stabilize performance at the Value segment. Management further expects to leverage its leaner cost structure and growing competitive capabilities to support sustained, profitable comp growth. At the same time, the company will evaluate opportunities across its brand portfolio.

Ascena continues to expect to end fiscal 2018 with a store count of 4,600–4,650 stores.

The company’s guidance for fiscal 4Q18 includes the following:

- Net sales of $1.62–$1.66 billion, above the consensus estimate of $1.58 billion.

- Compsof flat to up 2%.

- Gross margin of 56.5%–57.0%.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research