Source: Company reports/Coresight Research

Fiscal 2Q18 Results

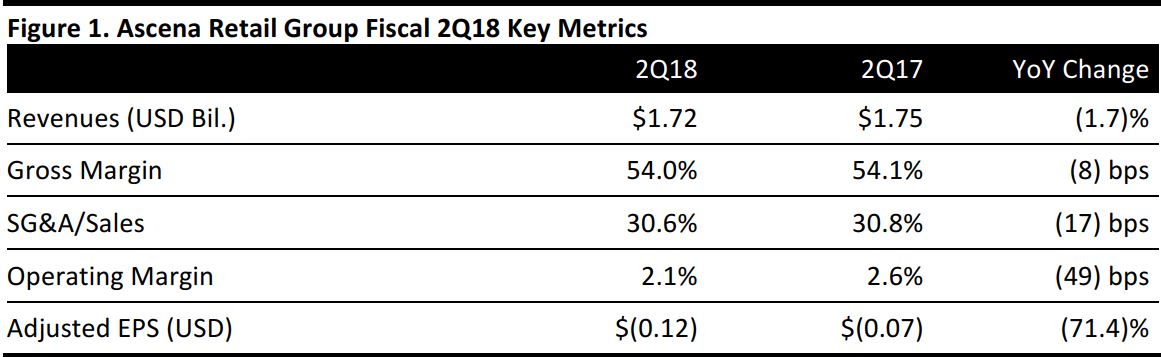

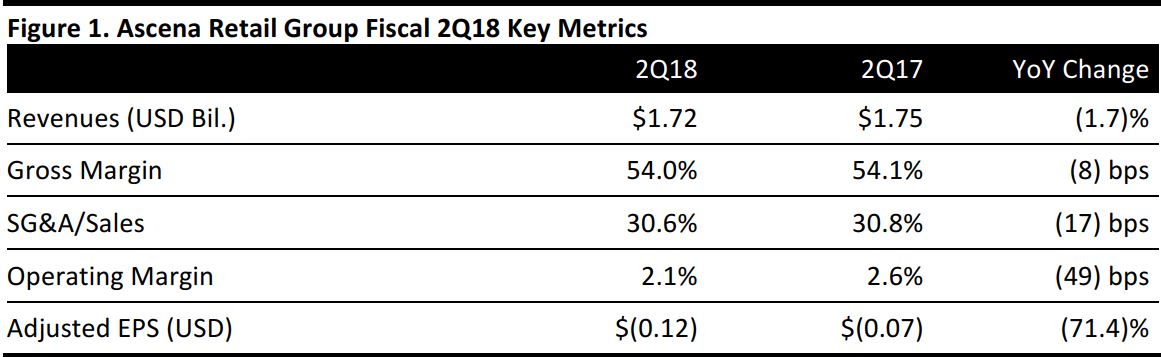

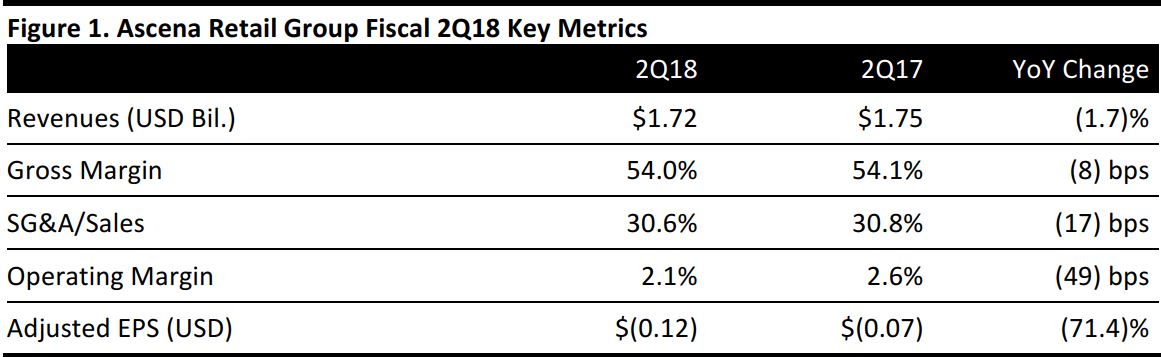

Ascena Retail Group reported fiscal 2Q18 revenues of $1.72 billion, down 1.7% year over year but beating the $1.65 billion consensus estimate. Net sales for the quarter included approximately $25 million in sales associated with the extra week. Non-GAAP adjusted EPS was $(0.12), down from $(0.07) in the year-ago quarter and missing the consensus estimate of $(0.09).

Comparable sales declined by 2.0%, versus the consensus estimate of (2.9)%. The decline was primarily due to merchandise strategy challenges and store traffic declines in the value fashion segment, including at Maurices and Dressbarn, and assortment misses in the premium fashion segment, which includes Ann Taylor and Loft. Declines were partially offset by high-single-digit comps in the kids fashion segment at Justice.

Store closures: AscenaRetail Group closed 110 store locations over the second quarter and opened six stores across its seven brands. The company had 4,794 stores at the start of the quarter and 4,690 at the end of the quarter. Closures included 32 Justice stores, 31 Dressbarn stores, 17 Maurices stores, 12 Ann Taylor stores, five Loft stores and three Catherines stores. The company opened one Ann Taylor and three Loft stores during the quarter.

Outlook

The company offered fiscal 3Q18 adjusted EPS guidance of $(0.12)–$(0.07), compared with the consensus estimate of $0.07. The company expects net sales of $1.48–$1.52 billion, versus the consensus estimate of $1.49 billion, and comparable sales of (3)%–(5)%, compared with the consensus estimate of (2)%.