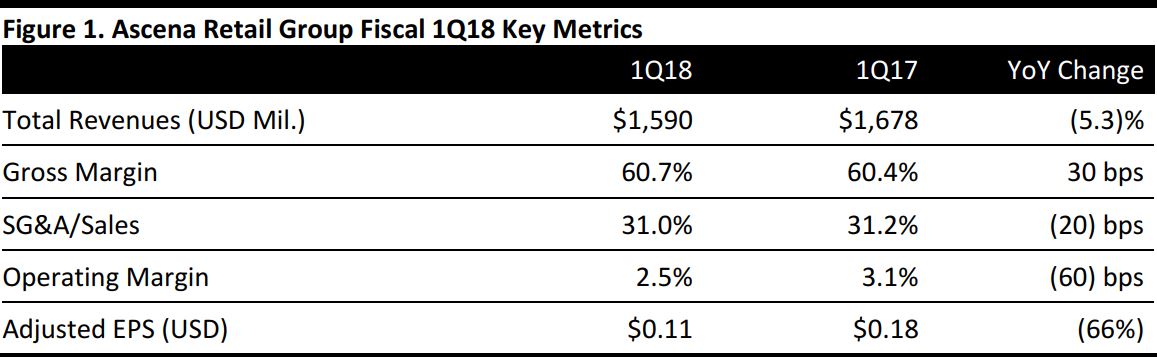

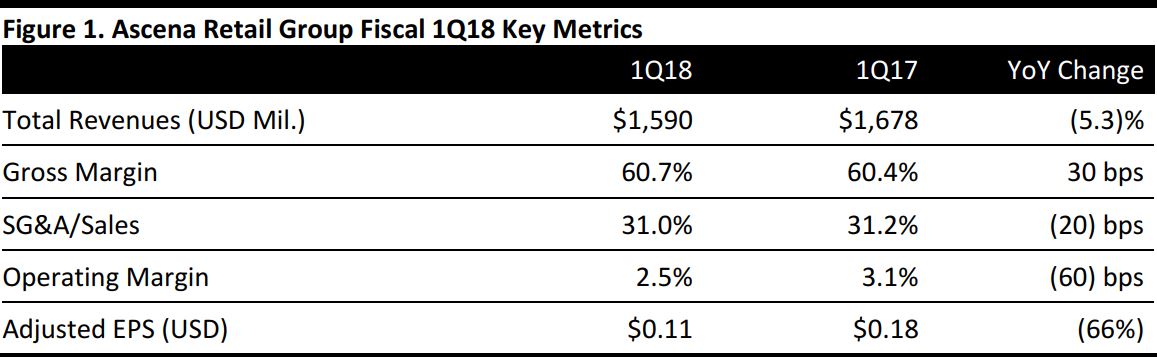

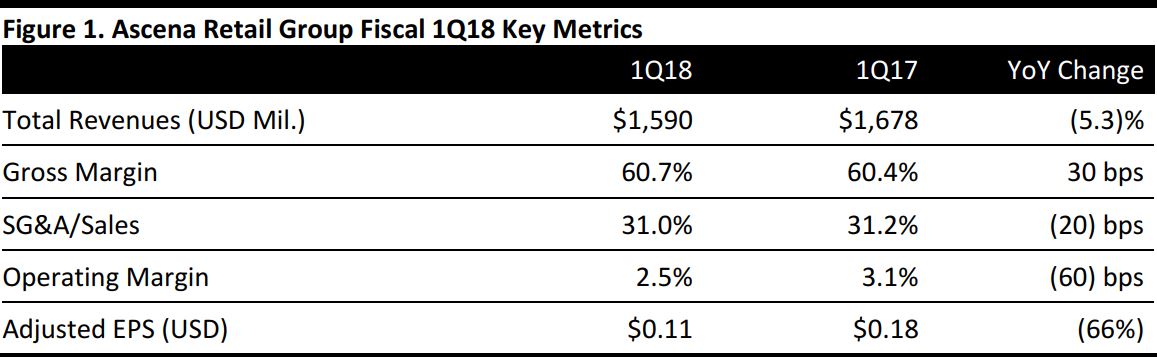

Fiscal 1Q18 Results

Ascena Retail Group reported fiscal 1Q18 revenues of $1.59 billion, down 5.3% year over year. Adjusted EPS was $0.11, in line with consensus expectations. Gross margin was 60.7% versus the consensus estimate of 60.9%. Margin rate improvements in the value fashion and kids fashion businesses were mostly offset by declines in the premium fashion and plus fashion businesses.

Total company comps declined by 5%, missing the consensus estimate of a 4% decline. By brand, Ann Taylor comps were down 6%, missing the consensus estimate of 3%. Justice comps were down 2% versus the 4.3% consensus estimate. Lane Bryant and Maurices both reported comp declines of 5%. Dressbarn and Catherines comps declined by 10% and 3%, respectively, also missing consensus estimates.

Management commented that the adjusted EPS result was in the middle of its guidance range, but still represented a disappointing quarter. Robust, double-digit growth in the e-commerce channel was not enough to offset the loss of traffic and sales in the company’s physical stores. Ascena will continue to roll out a new merchandising strategy over the next 12–18 months, which is expected to improve its top line and gross margin rate.

The company ended the quarter with $744 million of inventory, down 8% from $808 million at the end of the year-ago period. The three hurricanes that impacted the southern US and Puerto Rico during the quarter negatively impacted Ascena’s sales by approximately $11 million.

Outlook

For fiscal 2Q18, the company expects adjusted EPS of $(0.12)–$(0.07), at or below the consensus estimate of $(0.07). The company expects total sales of $1.62–$1.66 billion, below the consensus estimate of $1.67 billion. Ascena expects comp sales to decline by 4%–6% and its gross margin rate to be 55%–55.5%.