Introduction

Artificial intelligence (AI) is fast becoming the cornerstone of digitalized retail, from the supply chain to the customer experience. While many legacy retailers are building AI-centric infrastructure in-house, innovative startups have also emerged to fill the gaps in the retail sector, creating opportunities for retailers and brands to enhance the customer experience, increase sales and connect more deeply with shoppers.

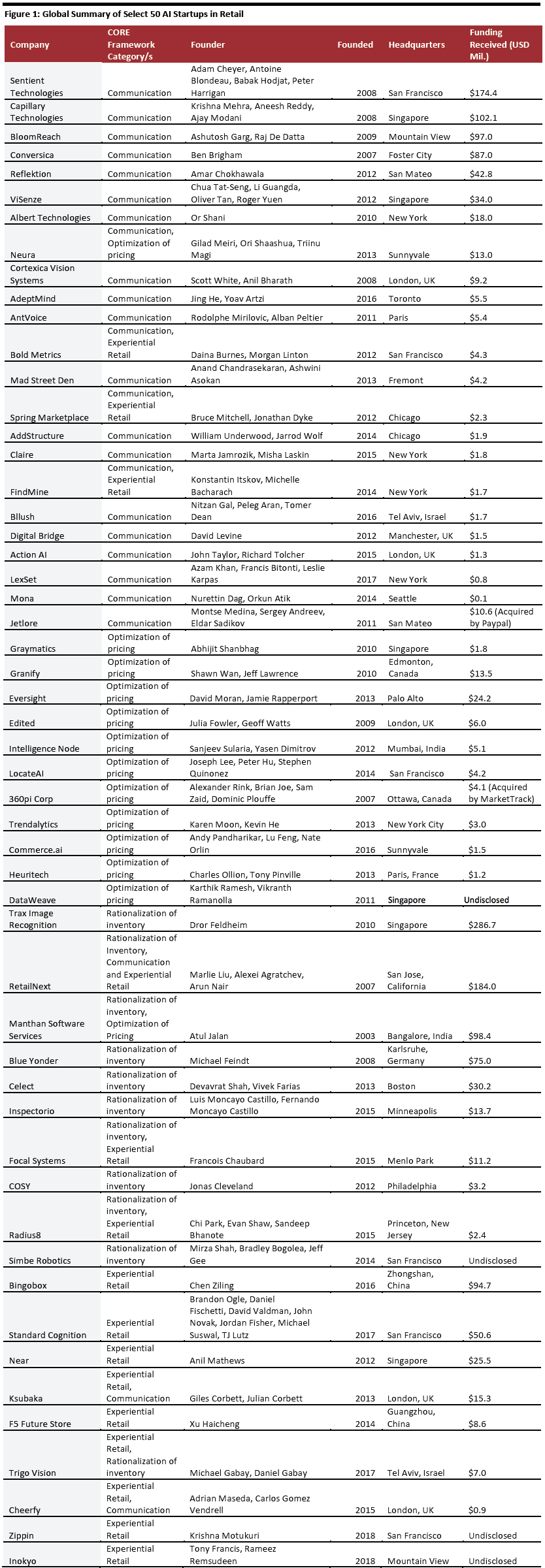

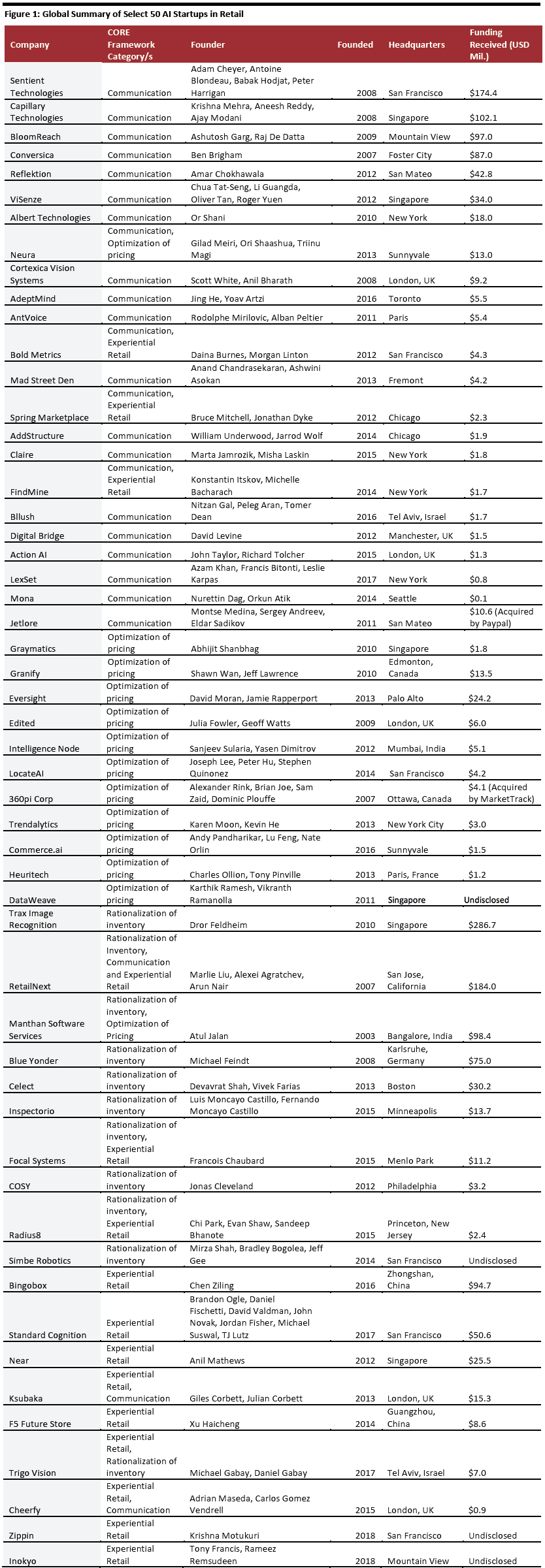

In this, the third report in our

Artificial Intelligence in Retail series, we explore how AI startups are developing applications, software and other tools for retailers. We examine in detail how 50 global startups are using AI and how that usage aligns with our propriety CORE framework for AI in retail. CORE includes Communication, Optimization of pricing, Rationalization of inventory and Experiential retail. We discussed this framework in our

first report in the series, while our second report discusses how major retailers use AI across various functions.

The CORE Framework

The CORE framework for AI in retail outlines the value of AI in four areas of retail.

Communication

A majority of shoppers now expect a personalized experience: some 63% of Americans want personalized recommendations, according to a 2018 survey by trade association Retail Industry Leaders Association and global consultancy Accenture. To cater to this demand, retailers are deploying AI to create homepages, emails and apps customized to individual preferences and to help shoppers more easily find the right products from the endless choices available online. Beyond personalization, AI offers better and more efficient communication between retailers and shoppers through conversational robots, chatbots and voice assistants.

Optimization of Pricing

With growing competition from e-commerce platforms such as Amazon, traditional retailers are forced to adjust their prices more frequently. With the help of AI, retailers and brands can automatically adjust prices based on market conditions and other data such as competitors’ sales and promotions, calendar events and weather conditions.

Rationalization of Inventory

Many retailers face challenges in maintaining stock at optimal levels – and often end up holding too much inventory, or having inventory in the wrong place. With the help of AI-powered data analytics, retailers can more easily manage inventory through automated replenishment, demand forecasting, planogram and gap analysis.

Experiential Retail

Store-based retailers are increasingly compelled to offer better in-store experiences to draw traffic and compete with online retailers. To engage more deeply with customers, reduce friction in the shopping process and close the information gap between e-commerce and physical stores, retailers can use AI technology in the form of in-store robots, facial recognition and fully automated self-checkout stores among others.

[caption id="attachment_81498" align="aligncenter" width="700"]

Source: Crunchbase/company websites

Source: Crunchbase/company websites[/caption]

Several of these startups’ products and industry applications may evolve with time as they collect new data and find additional uses for their innovations. We profile select startups below and outline their key offerings and other details.

Startup Profiles: Communication

Capillary Technologies

Founded: 2008

Funding: $102.1 Mil.

Capillary Technologies, based in Singapore, uses AI and Machine Learning to help brands gain a better understanding of consumer demand and provide a more personalized shopping experience. Capillary Technologies’ software enables brands to gain more insight into its customers and business, engage with customers through personalized messaging, offer a multi-channel experience and loyalty rewards each time customers visit stores to buy products. Some of its key clients include Walmart, Pizza Hut, KFC, Puma and VF Corporation. Capillary Technologies is backed by Warburg Pincus, Sequoia Capital, Northwest Venture Partners, Qualcomm Ventures and American Express Ventures.

BloomReach

Founded: 2009

Funding: $97 Mil.

BloomReach uses its Digital Experience Platform to provide a personalized shopping experience through content across all channels. The software uses a web relevance engine which helps online shoppers find what they’re looking for, and translates this data to give retailers insights in real-time about site visits to improve content performance. BloomReach was founded by Raj De Datta and its customer portfolio includes retailers Neiman Marcus, Staples, Williams Sonoma, Guess? and more. Its key investors are Bain Capital Ventures, Battery Ventures, NEA, Salesforce Ventures and Lightspeed Ventures.

Reflektion

Founded: 2012

Funding: $42.8 Mil.

Startup Reflektion, founded by Amar Chokhawala, provides an AI-powered personalization platform for top retail brands such as TOMS Shoes, Sport Chek and Fashion To Figure. The company uses AI to identify customer preferences and intent and presents the most relevant products for the shopper. Reflektion uses natural language processing to respond to customers’ conversational searches and guide them to products. The company is backed by Intel Capital, Battery Ventures, Hasso Plattner Ventures and Clear Ventures.

Spring Marketplace

Founded: 2013

Funding: $2.3 Mil.

Spring Marketplace, co-founded by Bruce Mitchell and Jonathan Dyke, has developed a mobile application that helps retailers extend their existing customer relationship management (CRM) and marketing efforts beyond traditional methods. It has partnered with payment cards including Visa, MasterCard and American Express to allow shoppers to earn rewards by connecting their debit or credit cards to customized loyalty programs. Spring’s cloud-based marketing platform functions as an extension of retailers’ existing customer relationship management applications. Every store transaction and website visit is an opportunity to use smart messages and incentives to increase patronage across channels. Spring’s clients include large retailers and top US mall operators such as Simon Property Group, GGP, Macerich, PREIT, Starwood Retail Partners and Taubman Centers.

The company is backed by Chicago Ventures, Jump Capital, Pritzker Group Venture Capital and DRW Venture Partners.

Startup Profiles: Optimization of Pricing

Eversight

Founded: 2013

Funding: $24.2 Mil.

Eversight uses AI driven experimentation to predict consumer behavior and helps retailers with pricing and promotions. The company has developed a pricing suite which helps businesses make faster decisions. The company determines when a retailer should adjust its pricing according to competitors’ price changes. It also determines which SKUs are key value items and recommends product and promotions based on the retailers’ sales and margin objectives. Eversight has some of the world’s largest consumer goods and retailers as its clients including Coca-Cola, Johnson’s Baby, Henkel and others. Its investors include Bow Capital, Sutter Hill Ventures and Emergence.

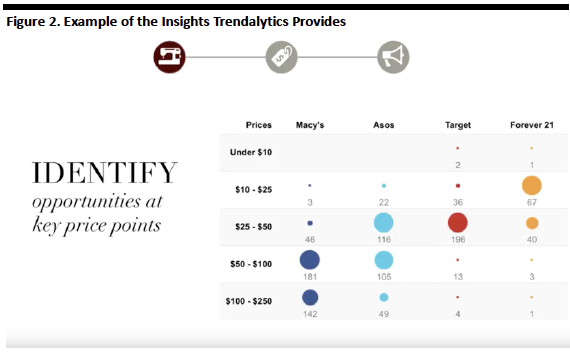

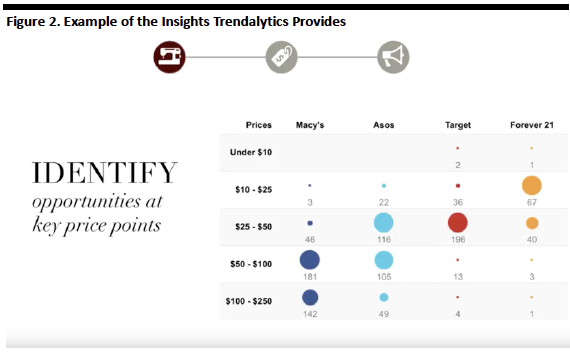

Trendalytics

Founded: 2013

Funding: $3 Mil.

Trendalytics, co-founded by Karen Moon and Kevin He, has developed a product intelligence engine that aggregates billions of consumer demand signals to predict pricing and relevant trends for retailers, to help companies better focus promotional efforts. The company crunches data from competitors’ products across categories and regions. This helps retailers compare product attributes and capitalize on trends, and time product deliveries and marketing campaigns with consumer shopping patterns by region and season. The company is backed by Runway Venture Partners.

[caption id="attachment_80461" align="aligncenter" width="570"]

Source: Trendalytics

Source: Trendalytics[/caption]

DataWeave

Founded: 2011

Funding: Undisclosed

DataWeave, a company based in Singapore, with offices in Bangalore, Seattle, and San Francisco, uses AI to extract and analyze web data at massive scale to provide competitive insights to businesses. DataWeave helps e-commerce businesses identify and act on price improvement opportunities and achieve desired competitive price positions across product categories. Consumer brands use DataWeave’s Brand Analytics product suite to govern their online presence, enhance product discoverability and Share of Voice, glean consumer sentiment from online reviews, and optimize shelf velocity. DataWeave uses proprietary AI technologies to match millions of product listings across hundreds of websites, detect possible counterfeit listings, achieve highly nuanced product categorization by analyzing catalog images and content, and more. DataWeave’s key clients include major brands such as Adidas, Metro Cash & Carry and Dorel. It is backed by Blume Ventures, FreakOut Group, M&S Partners, Times Internet, NB Ventures and WaterBridge Ventures.

Startup Profiles: Rationalization of Inventory

Trax Image Recognition

Founded: 2010

Funding: $286.7 Mil

Trax has developed a retail image repository and uses deep learning algorithms to help consumer goods companies and retailers get actionable insights on inventory. Store staff take pictures of the shelf and Trax returns detailed product and category information including out-of-shelf, share of shelf, planogram, pricing and more to a mobile phone within minutes.

The company says it has helped Coca-Cola Hellenic Bottling Company, one of its clients in Russia, cut out-of-stock occurrences 63% and audit time from 20 minutes to two. The system uses shelf-mounted cameras and augmented reality on mobile phones to monitor products on open shelves and categorizes them based on size, shape and color. Then a “panoramic stitching engine” puts together in-store images to recreate the full shelf while analytic software recognizes each product. Trax’s system immediately informs the company if any product is out of place or missing from the shelves.

Trax is backed by investors including Boyu Capital, Warburg Pincus, Investec and Broad Peak Investment.

RetailNext

Founded: 2007

Funding: $184 Mil.

RetailNext has developed an all-in-one AI and IoT sensor called Aurora which provides insights on in-store and pass-by traffic, visit duration, visit frequency and entrance path analytics. RetailNext’s deep-learning system automatically excludes store staff from traffic counting and key performance indicator (KPI) metrics. The companies can use traffic counting data to manage customer-to-staff ratio in traffic power hours. It helps companies build smart stores which provide a more personalized shopping experience. For instance, Aurora has developed fitting room screens that show a range of products from which the customer can choose, and alerts sales associates to help the customer find the products. RetailNext has worked with over 400 retail brands, including Sun & Sand Sports, Bloomingdale’s, Club Monaco, Thomas Pink and more. It is backed by Activant Capital, NGP Capital, StarVest Capital and August Capital among others.

Celect

Founded: 2013

Funding: $30.2 Mil.

Celect uses predictive analytics and machine learning to optimize retail inventory by providing models of future buying patterns and behavior. The company’s Plan Optimization application helps retailers understand how various products affect overall assortments. By identifying poorly performing products, the application identifies space that could be made available for better-performing products. Celect’s application also allows retailers to see which categories are overallocated and which have growth potential, so they can rearrange assortments accordingly. Celect’s cloud-based platform integrates with retailers’ existing merchandise-planning systems and uses product descriptions, customer information, inventory, online and offline sales transaction data, product catalogs, and online browsing histories to build models to predict shoppers’ future buying patterns. Celect is currently working with department stores Neiman Marcus and Saks Fifth Avenue, and with specialty retailers Anthropologie, Urban Outfitters and Free People, among others.

Inspectorio

Founded: 2015

Funding: $13.7 Mil.

Inspectorio provides supply chain management solutions to retailers including Target, Kohl’s and Inditex. Inspectorio’s applications use AI and machine learning technology to manage and supervise inventory by digitalizing quality control and compliance monitoring processes. Inspectorio offers an automated service for booking, managing, monitoring and reviewing inspection results. The company seeks to minimize the risk of negligence and unreported defects by identifying high risk areas. After the inspection is completed, the data is instantly converted into an inspection report and delivered to managers. Inspectorio was a 2016 participant in the Target + Techstars Retail Accelerator Program and received $3.7 million in funding from Target the following year. Other investors include Techstars, Matchstick Ventures, Twilio and Ecolab. In 2018, the company secured a further $10 million in a Series A Financing Round.

Radius8

Founded: 2015

Funding: $2.4 Mil.

Radius8, co-founded by Sandeep Bhanote, Evan Shaw, Chi Park and Brendan Phelan, helps retailers merchandise products by collecting data in and around store locations such as inventory, weather, events, shoppers’ online browsing behavior and online sales trends. Its Pre-Shop tool allows customers to view inventory available in local stores, reserve products for pickup and receive localized product recommendations. Radius8’s Smartbar tool lets shoppers see what inventory is available in nearby stores and retailers can offer localized promotions based on events in the area or trending products. Radius8 works with major retail brands including Coach Outlet, Guess?, Academy Sports + Outdoors and more. Its investors include Newark Venture Partners and Commerce Ventures.

Startup Profiles: Experiential Retail

BingoBox

Founded: 2016

Funding: $94.7 Mil.

China-based BingBbox, founded by Chen Ziling, has opened several cashier-free convenience stores across China. Previously, Bingobox stores used radio-frequency identification (RFID) technology to label products, but in late 2017 Bingobox unveiled a new AI application called “Fan AI” which uses cameras and image recognition technology to capture shopper actions and product information. BingoBox has partnered with grocery retailer Auchan to manage store inventory. Bingobox investors include GVV Capital, Qiming Venture Partners, Source Code Capital and Ventech China.

Near

Founded: 2012

Funding: $25.5 Mil.

Singapore-based Near has developed Allspark, a software-as-a-service offering that helps retailers use their own data to identify brand affinity for specific audiences, where they live, work and shop. Near uses AI and machine learning algorithms to deliver insight into companies’ target customers, including amount of money spent on shopping, visit frequency, dwell time and distance travelled to reach a particular place. The company also helps retailers identify “lookalike audiences” similar to existing audiences (or its competitors’ customers) to drive conversion. Near works with P&G, Coca-Cola, Ikea and Nike. It is backed by venture capitalists Sequoia Capital, JP Morgan Private Equity Group, Telstra Ventures and Global Brain.

Standard Cognition

Founded: 2017

Funding: $10.6 Mil.

Standard Cognition offers AI-powered autonomous checkout, no humans required. Customers download the checkout app and press the “check in” button when they enter the store. Overhead cameras calculate and identify items in customers’ baskets, so shoppers just pick up items and walk out with them. Investors include CRV, Y Combinator, Social Capital, Initialized Capital and Locus Ventures.

Why Working with Established Organizations Will Help AI Startups

While many of startups have made a name for themselves by creating innovative products, they need established organizations as customers to gain access to large datasets, which provide the essential Vs of Big Data — volume, variety and velocity.

Large volumes of data help the AI engine improve accuracy: Lots of data with myriad variables improves machine learning capabilities such as “learning” patterns, identifying nuances and spotting deviations. The velocity of data, which means how fast data is collected, conveyed and processed, helps AI engines learn to generate solutions faster. In many sectors, speed is key to staying ahead of the market. Retailers, for instance, need to know when they are running out of stock and this information needs to be conveyed and acted upon in time. AI engines that receive the data quickly can also learn process and deliver responses quickly.

Why Working with Startups is Good for Large Retailers

Established retailers can benefit from startup innovations: Developing these capabilities in-house would require substantial investments in developing technology that may already exist – diverting important management attention away from the core business.

Key Insights

A number of AI startups focus on the four areas of the Coresight Research CORE framework. With rapid advances in technology and shifting consumer trends, retailers need to adapt quickly. Retailers can look to our CORE framework to identify areas that they can use AI for to better serve shoppers.

Building sophisticated AI technology and the infrastructure to support it in-house is not practical for most companies, due to cost and management time diverted away from the core business. Most retailers would probably do better to partner with an established technology company to leverage specific solutions. Most startup applications are ready to plug-and-play or can be modified to suit the users’ needs. Coresight Research’s CORE framework can help retailers can assess which areas need the most attention and look for an AI specialist startup that can fill the gaps in those areas.

Source: Crunchbase/company websites[/caption]

Several of these startups’ products and industry applications may evolve with time as they collect new data and find additional uses for their innovations. We profile select startups below and outline their key offerings and other details.

Source: Crunchbase/company websites[/caption]

Several of these startups’ products and industry applications may evolve with time as they collect new data and find additional uses for their innovations. We profile select startups below and outline their key offerings and other details.

Source: Trendalytics[/caption]

DataWeave

Founded: 2011

Funding: Undisclosed

DataWeave, a company based in Singapore, with offices in Bangalore, Seattle, and San Francisco, uses AI to extract and analyze web data at massive scale to provide competitive insights to businesses. DataWeave helps e-commerce businesses identify and act on price improvement opportunities and achieve desired competitive price positions across product categories. Consumer brands use DataWeave’s Brand Analytics product suite to govern their online presence, enhance product discoverability and Share of Voice, glean consumer sentiment from online reviews, and optimize shelf velocity. DataWeave uses proprietary AI technologies to match millions of product listings across hundreds of websites, detect possible counterfeit listings, achieve highly nuanced product categorization by analyzing catalog images and content, and more. DataWeave’s key clients include major brands such as Adidas, Metro Cash & Carry and Dorel. It is backed by Blume Ventures, FreakOut Group, M&S Partners, Times Internet, NB Ventures and WaterBridge Ventures.

Startup Profiles: Rationalization of Inventory

Trax Image Recognition

Founded: 2010

Funding: $286.7 Mil

Trax has developed a retail image repository and uses deep learning algorithms to help consumer goods companies and retailers get actionable insights on inventory. Store staff take pictures of the shelf and Trax returns detailed product and category information including out-of-shelf, share of shelf, planogram, pricing and more to a mobile phone within minutes.

The company says it has helped Coca-Cola Hellenic Bottling Company, one of its clients in Russia, cut out-of-stock occurrences 63% and audit time from 20 minutes to two. The system uses shelf-mounted cameras and augmented reality on mobile phones to monitor products on open shelves and categorizes them based on size, shape and color. Then a “panoramic stitching engine” puts together in-store images to recreate the full shelf while analytic software recognizes each product. Trax’s system immediately informs the company if any product is out of place or missing from the shelves.

Trax is backed by investors including Boyu Capital, Warburg Pincus, Investec and Broad Peak Investment.

RetailNext

Founded: 2007

Funding: $184 Mil.

RetailNext has developed an all-in-one AI and IoT sensor called Aurora which provides insights on in-store and pass-by traffic, visit duration, visit frequency and entrance path analytics. RetailNext’s deep-learning system automatically excludes store staff from traffic counting and key performance indicator (KPI) metrics. The companies can use traffic counting data to manage customer-to-staff ratio in traffic power hours. It helps companies build smart stores which provide a more personalized shopping experience. For instance, Aurora has developed fitting room screens that show a range of products from which the customer can choose, and alerts sales associates to help the customer find the products. RetailNext has worked with over 400 retail brands, including Sun & Sand Sports, Bloomingdale’s, Club Monaco, Thomas Pink and more. It is backed by Activant Capital, NGP Capital, StarVest Capital and August Capital among others.

Celect

Founded: 2013

Funding: $30.2 Mil.

Celect uses predictive analytics and machine learning to optimize retail inventory by providing models of future buying patterns and behavior. The company’s Plan Optimization application helps retailers understand how various products affect overall assortments. By identifying poorly performing products, the application identifies space that could be made available for better-performing products. Celect’s application also allows retailers to see which categories are overallocated and which have growth potential, so they can rearrange assortments accordingly. Celect’s cloud-based platform integrates with retailers’ existing merchandise-planning systems and uses product descriptions, customer information, inventory, online and offline sales transaction data, product catalogs, and online browsing histories to build models to predict shoppers’ future buying patterns. Celect is currently working with department stores Neiman Marcus and Saks Fifth Avenue, and with specialty retailers Anthropologie, Urban Outfitters and Free People, among others.

Inspectorio

Founded: 2015

Funding: $13.7 Mil.

Inspectorio provides supply chain management solutions to retailers including Target, Kohl’s and Inditex. Inspectorio’s applications use AI and machine learning technology to manage and supervise inventory by digitalizing quality control and compliance monitoring processes. Inspectorio offers an automated service for booking, managing, monitoring and reviewing inspection results. The company seeks to minimize the risk of negligence and unreported defects by identifying high risk areas. After the inspection is completed, the data is instantly converted into an inspection report and delivered to managers. Inspectorio was a 2016 participant in the Target + Techstars Retail Accelerator Program and received $3.7 million in funding from Target the following year. Other investors include Techstars, Matchstick Ventures, Twilio and Ecolab. In 2018, the company secured a further $10 million in a Series A Financing Round.

Radius8

Founded: 2015

Funding: $2.4 Mil.

Radius8, co-founded by Sandeep Bhanote, Evan Shaw, Chi Park and Brendan Phelan, helps retailers merchandise products by collecting data in and around store locations such as inventory, weather, events, shoppers’ online browsing behavior and online sales trends. Its Pre-Shop tool allows customers to view inventory available in local stores, reserve products for pickup and receive localized product recommendations. Radius8’s Smartbar tool lets shoppers see what inventory is available in nearby stores and retailers can offer localized promotions based on events in the area or trending products. Radius8 works with major retail brands including Coach Outlet, Guess?, Academy Sports + Outdoors and more. Its investors include Newark Venture Partners and Commerce Ventures.

Source: Trendalytics[/caption]

DataWeave

Founded: 2011

Funding: Undisclosed

DataWeave, a company based in Singapore, with offices in Bangalore, Seattle, and San Francisco, uses AI to extract and analyze web data at massive scale to provide competitive insights to businesses. DataWeave helps e-commerce businesses identify and act on price improvement opportunities and achieve desired competitive price positions across product categories. Consumer brands use DataWeave’s Brand Analytics product suite to govern their online presence, enhance product discoverability and Share of Voice, glean consumer sentiment from online reviews, and optimize shelf velocity. DataWeave uses proprietary AI technologies to match millions of product listings across hundreds of websites, detect possible counterfeit listings, achieve highly nuanced product categorization by analyzing catalog images and content, and more. DataWeave’s key clients include major brands such as Adidas, Metro Cash & Carry and Dorel. It is backed by Blume Ventures, FreakOut Group, M&S Partners, Times Internet, NB Ventures and WaterBridge Ventures.

Startup Profiles: Rationalization of Inventory

Trax Image Recognition

Founded: 2010

Funding: $286.7 Mil

Trax has developed a retail image repository and uses deep learning algorithms to help consumer goods companies and retailers get actionable insights on inventory. Store staff take pictures of the shelf and Trax returns detailed product and category information including out-of-shelf, share of shelf, planogram, pricing and more to a mobile phone within minutes.

The company says it has helped Coca-Cola Hellenic Bottling Company, one of its clients in Russia, cut out-of-stock occurrences 63% and audit time from 20 minutes to two. The system uses shelf-mounted cameras and augmented reality on mobile phones to monitor products on open shelves and categorizes them based on size, shape and color. Then a “panoramic stitching engine” puts together in-store images to recreate the full shelf while analytic software recognizes each product. Trax’s system immediately informs the company if any product is out of place or missing from the shelves.

Trax is backed by investors including Boyu Capital, Warburg Pincus, Investec and Broad Peak Investment.

RetailNext

Founded: 2007

Funding: $184 Mil.

RetailNext has developed an all-in-one AI and IoT sensor called Aurora which provides insights on in-store and pass-by traffic, visit duration, visit frequency and entrance path analytics. RetailNext’s deep-learning system automatically excludes store staff from traffic counting and key performance indicator (KPI) metrics. The companies can use traffic counting data to manage customer-to-staff ratio in traffic power hours. It helps companies build smart stores which provide a more personalized shopping experience. For instance, Aurora has developed fitting room screens that show a range of products from which the customer can choose, and alerts sales associates to help the customer find the products. RetailNext has worked with over 400 retail brands, including Sun & Sand Sports, Bloomingdale’s, Club Monaco, Thomas Pink and more. It is backed by Activant Capital, NGP Capital, StarVest Capital and August Capital among others.

Celect

Founded: 2013

Funding: $30.2 Mil.

Celect uses predictive analytics and machine learning to optimize retail inventory by providing models of future buying patterns and behavior. The company’s Plan Optimization application helps retailers understand how various products affect overall assortments. By identifying poorly performing products, the application identifies space that could be made available for better-performing products. Celect’s application also allows retailers to see which categories are overallocated and which have growth potential, so they can rearrange assortments accordingly. Celect’s cloud-based platform integrates with retailers’ existing merchandise-planning systems and uses product descriptions, customer information, inventory, online and offline sales transaction data, product catalogs, and online browsing histories to build models to predict shoppers’ future buying patterns. Celect is currently working with department stores Neiman Marcus and Saks Fifth Avenue, and with specialty retailers Anthropologie, Urban Outfitters and Free People, among others.

Inspectorio

Founded: 2015

Funding: $13.7 Mil.

Inspectorio provides supply chain management solutions to retailers including Target, Kohl’s and Inditex. Inspectorio’s applications use AI and machine learning technology to manage and supervise inventory by digitalizing quality control and compliance monitoring processes. Inspectorio offers an automated service for booking, managing, monitoring and reviewing inspection results. The company seeks to minimize the risk of negligence and unreported defects by identifying high risk areas. After the inspection is completed, the data is instantly converted into an inspection report and delivered to managers. Inspectorio was a 2016 participant in the Target + Techstars Retail Accelerator Program and received $3.7 million in funding from Target the following year. Other investors include Techstars, Matchstick Ventures, Twilio and Ecolab. In 2018, the company secured a further $10 million in a Series A Financing Round.

Radius8

Founded: 2015

Funding: $2.4 Mil.

Radius8, co-founded by Sandeep Bhanote, Evan Shaw, Chi Park and Brendan Phelan, helps retailers merchandise products by collecting data in and around store locations such as inventory, weather, events, shoppers’ online browsing behavior and online sales trends. Its Pre-Shop tool allows customers to view inventory available in local stores, reserve products for pickup and receive localized product recommendations. Radius8’s Smartbar tool lets shoppers see what inventory is available in nearby stores and retailers can offer localized promotions based on events in the area or trending products. Radius8 works with major retail brands including Coach Outlet, Guess?, Academy Sports + Outdoors and more. Its investors include Newark Venture Partners and Commerce Ventures.