Introduction

AI technology has evolved from being a “nice to have” into a necessity. Within retail, AI initially gained popularity thanks to its usefulness in personalization and automation, but it is capable of doing much more.

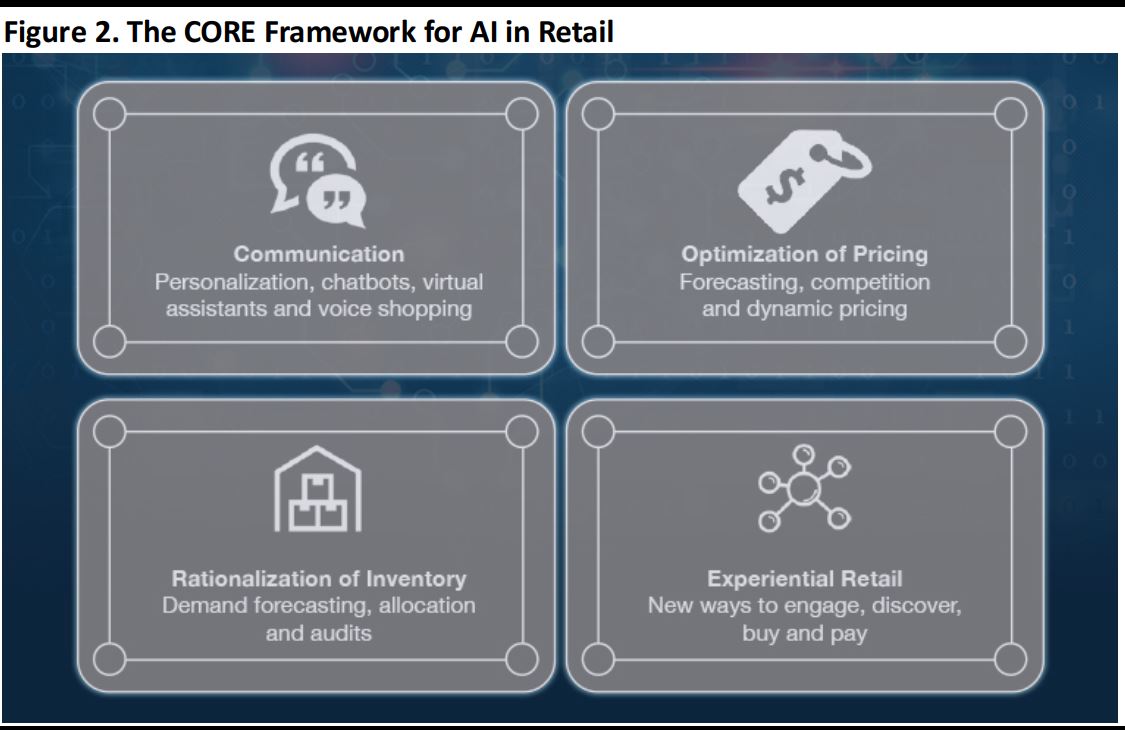

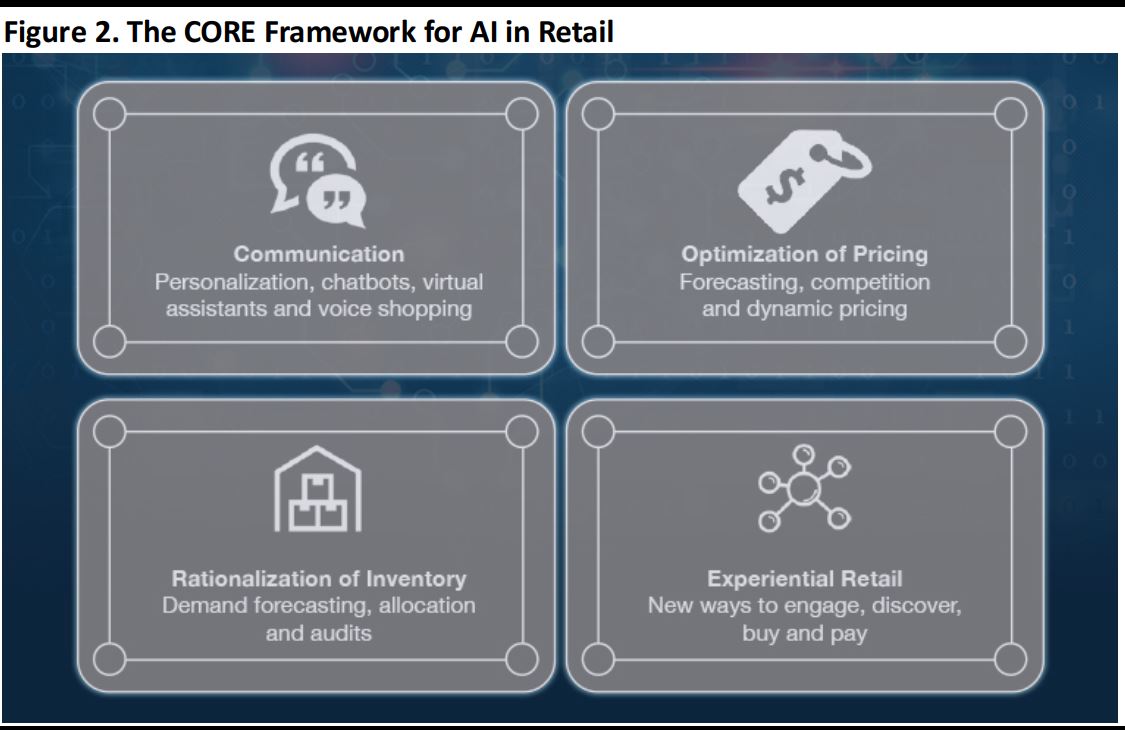

This report is the first in a series that explores AI in retail. Here, we look at the context and use cases for AI in functions that are primarily customer-facing. We introduce our CORE (communication, optimization of pricing, rationalization of inventory and experiential retail) framework and outline how retailers can use AI to interact with customers in a more engaging way, manage inventory better and price products optimally. We also discuss a number of vendors and startups that can help retailers deploy AI technology in their operations.

In our next report in the series, we will examine how retailers are using AI across various functions within their businesses, and in our third report, we will look more closely at AI startups that are particularly relevant to retail.

As we first defined in our

Artificial Intelligence in Drugstore Retail report, AI, or machine intelligence, is human-like or intelligent behavior exhibited by computers and machines. It is enabled by a computer program or set of programs that help machines make autonomous decisions through cognitive functions similar to those typically exhibited by human beings, such as learning, decision making and problem solving.

The Retail Industry Is One of the Top 10 Investors in AI

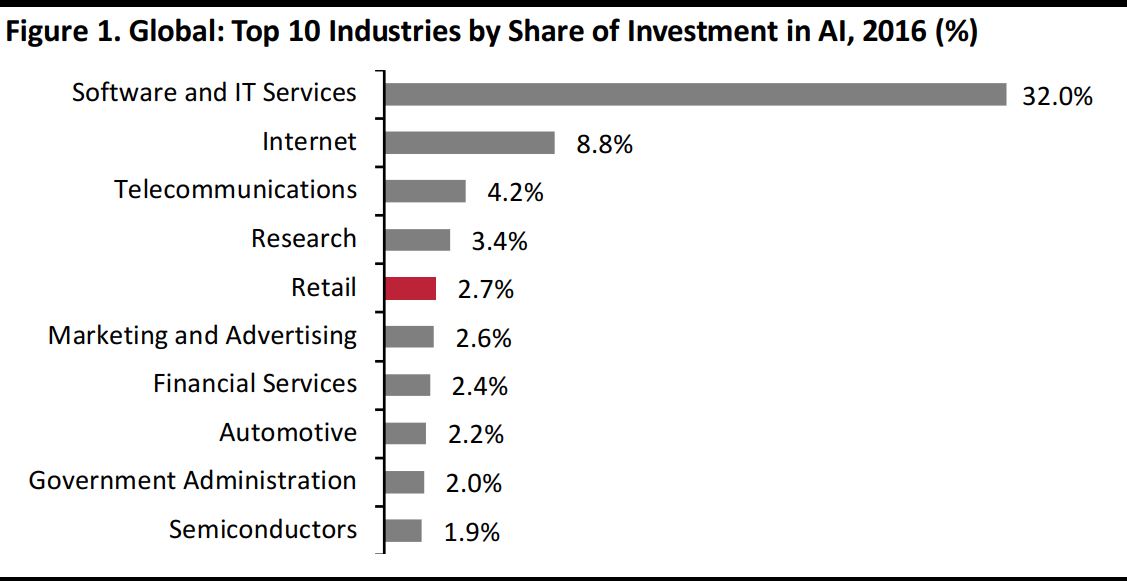

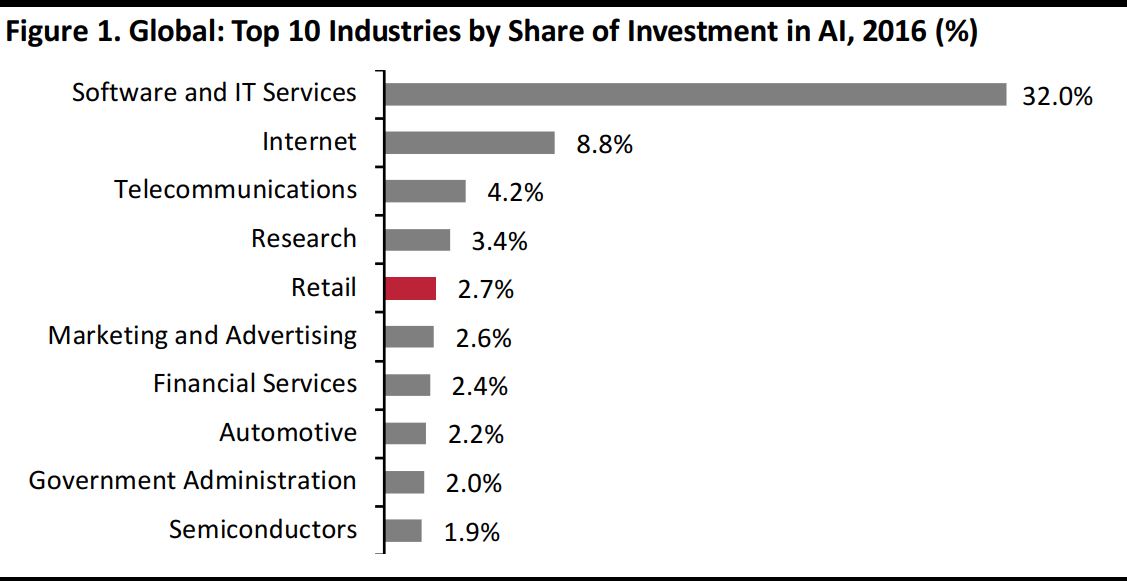

AI applications are not limited to any single industry or sector; there are a myriad of potential uses for AI and some applications are transferable across industries. Software and IT services firms have accounted for the majority of AI investments, according to 2016 data from AI market research firm TechEmergence, but the tools developed as a result of these investments have been used in other sectors.

Retail is among the top 10 industries investing in AI, coming in at number five, according to TechEmergence. We believe that two key functions of AI will contribute to the growth and adoption of the technology in retail and more broadly:

- Its ability to analyze vast pools of data and generate meaningful insights quickly.

- Its ability to learn from its environment and from patterns in a growing data pool and adapt its output accordingly.

Source: TechEmergence

Source: TechEmergence

Although retail is among the top 10 industries investing in AI, adoption levels are still low in retail compared with other sectors. In the following sections of this report, we elaborate on some of the use cases for AI in retail to highlight how retailers can leverage the technology to provide customers with better service and make their operations more efficient.

The CORE Framework for AI in Retail

With this report, we introduce our proprietary CORE framework, which notes the value of AI for retailers in four areas: communication, optimization of pricing, rationalization of inventory and experiential retail.

Source: Coresight Research

Source: Coresight Research

Communication

There are three primary ways to use AI to communicate with shoppers: it can help create a personalized online experience, it can power conversational robots and chatbots, and it can enable voice shopping.

Personalized Online Experience

Shoppers increasingly demand a personalized experience online, and many retailers are already personalizing homepages, emails and apps in order to help shoppers navigate the huge range of products available online. The ongoing growth in mobile browsing and shopping adds greater urgency to the demand for personalization, for two reasons:

- First, the mobile channel sees low conversion rates, so retailers must work harder to convert visitors into customers.

- Second, mobile devices have small screens, which means that retailers can present only a limited number of products at a time via mobile. Shoppers see fewer products on each visit when shopping on their mobile device than they do when browsing on a laptop or desktop computer.

AI can help retailers present content that is relevant to each consumer and, so, make the best use of screen real estate on mobile devices. By deploying AI, retailers can:

- Generate millions of personalized homepages and email variations and personalize in-app experiences.

- Test alternative options for website design by measuring the conversion rate generated by each variant.

- Adjust what products are displayed in real time based on individual consumer behavior.

- Aggregate data on buying habits, lifestyle and preferences to form a single view of each customer. Retailers can personalize the shopping experience for each customer using data from both inside and outside the business.

Two companies that are developing e-commerce and m-commerce software applications that use AI are Twiggle and Personali. Their solutions are designed to help retailers deliver a more personalized experience to shoppers.

Twiggle, based in Israel, claims that it “helps e-commerce search engines think the way human beings do.” By using natural language processing, Twiggle’s software attempts to mimic online the experience of talking to an in-store sales associate. The software enables online shoppers to search for specific products by speaking instead of typing keywords into a website’s search bar. Twiggle has not disclosed the names of any retailers using its application, but its key investors include Alibaba, Naspers, Yahoo! Japan, State of Mind Ventures and MizMaa Ventures.

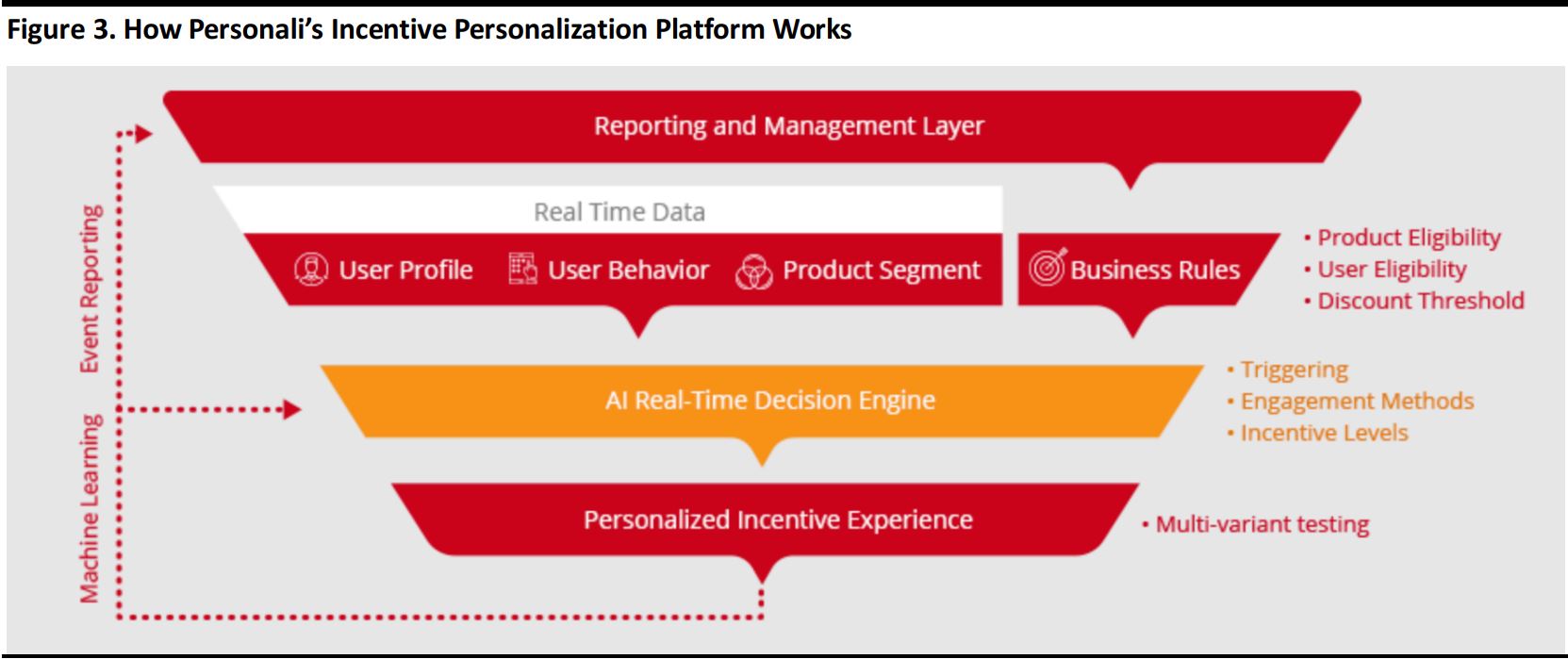

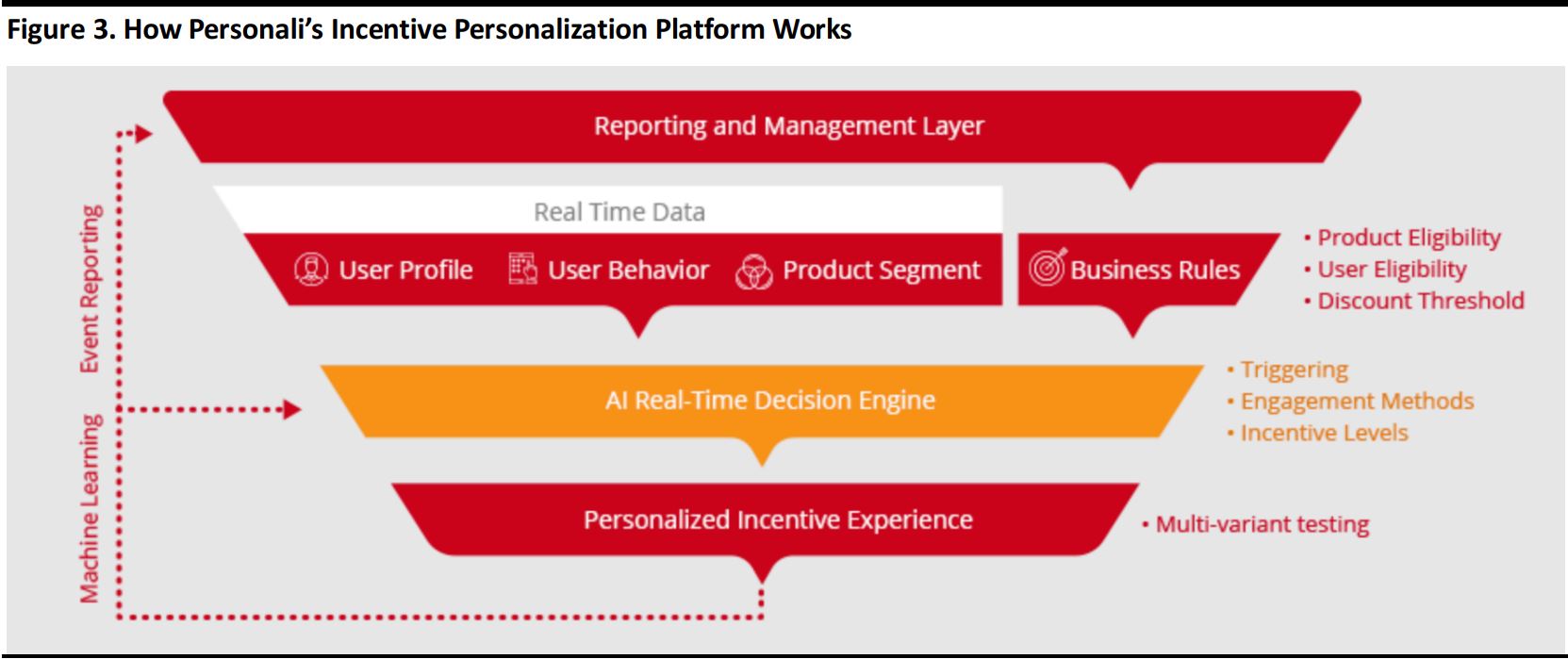

Personali uses behavioral economics and AI to provide a personalized online shopping experience. The software uses current and past behavior patterns to segment shoppers based on purchase probability and willingness to pay, and then generates targeted and personalized incentives to increase conversion. Personali is backed by Norwest Venture Partners, Cedar Fund and Gemini Partners.

Source: Personali

Source: Personali

Conversational Robots and Chatbots

Consumers are likely to soon be conversing with robots and other electronic devices when shopping thanks to advances in AI-powered natural language processing. Humanoid conversational robots are still clunky, so their use in stores is still limited, but they have evolved since the famous Pepper robot was first introduced in 2015. In 2016, Hanson Robotics debuted Sophia, a robot whose skin, voice and body closely resemble a human’s. Sophia was stationary until the company unveiled an updated version with legs in 2018. The robot is able to make eye contact, blink, converse and move its arms to mimic human gestures, and it has appeared at several exhibitions and industry conferences around the world. However, its AI is not completely self-learning and it is not yet ready for independent commercial use.

Conversational chatbots are a different story. They have been sufficiently developed to help shoppers with queries both online and in stores. Chatbots are well established in retail and many retailers already use them to provide customer service that goes beyond offering basic responses.

Point Inside, a company based in Washington, provides digital mapping and indoor location-based services for top retailers such as Target and Lowe’s. The company has developed a chatbot that can help shoppers find products in stores. Shoppers can access the chatbot through a retailer’s app in order to receive information about products they wish to buy. Point Inside uses a shopper’s smartphone location and in-store beacons to guide the shopper to whichever products he or she is looking for.

Clustaar, a Parisian startup, uses natural language processing and historical data to power its chatbot. The bot converses with users in human-like language and can even address some complex customer queries before handing the reins over to human support staff.

Voice Shopping

AI voice assistants such as

Amazon’s Alexa and

Google Assistant are moving AI-powered consumer engagement from text to voice. However, voice assistants offer fewer opportunities for direct interaction between retailers and shoppers, as the tech giants that make the assistants manage the interactions themselves—shoppers speak to

Alexa or

Google instead of to the retailer.

British grocer Tesco and US retailer Target are two retailers that have integrated with Google Assistant and the accompanying smart speaker Google Home to enable owners of the device to shop through it using voice commands. It is impractical for most retailers to develop their own devices with proprietary, AI-driven shopping assistants. By partnering with providers of such devices, and giving the providers control of the shopping process, retailers open up a new touchpoint for interaction with customers. For now, Amazon leads the race in voice shopping through its Alexa-powered Echo devices, according to a number of published market share and consumer survey data points.

Optimization of Pricing

Digital-first retailers such as Amazon can rapidly change the price of millions of products in response to consumer demand or competitor pricing, and this ability leaves their traditional retail rivals standing when it comes to matching them on price. AI services from third-party vendors can help traditional retailers even the playing field, automatically adjusting prices based on market conditions and other data such as weather conditions, calendar events, and competitors’ sales and promotions.

AI software applications can help retailers optimize pricing and promotions by:

- Identifying the various factors that influence pricing through real-time monitoring of localized weather and market conditions as well as in-store metrics.

- Automating price decisions for each product, by channel and store.

- Determining optimal entry price points for newly launched products that have no previous sales history through comparisons to competitor products.

Salesforce’s

Einstein Discovery tool integrates historical data from other Salesforce applications used by a retailer with attributes such as customer footprint, market segment and competitive status to recommend promotions.

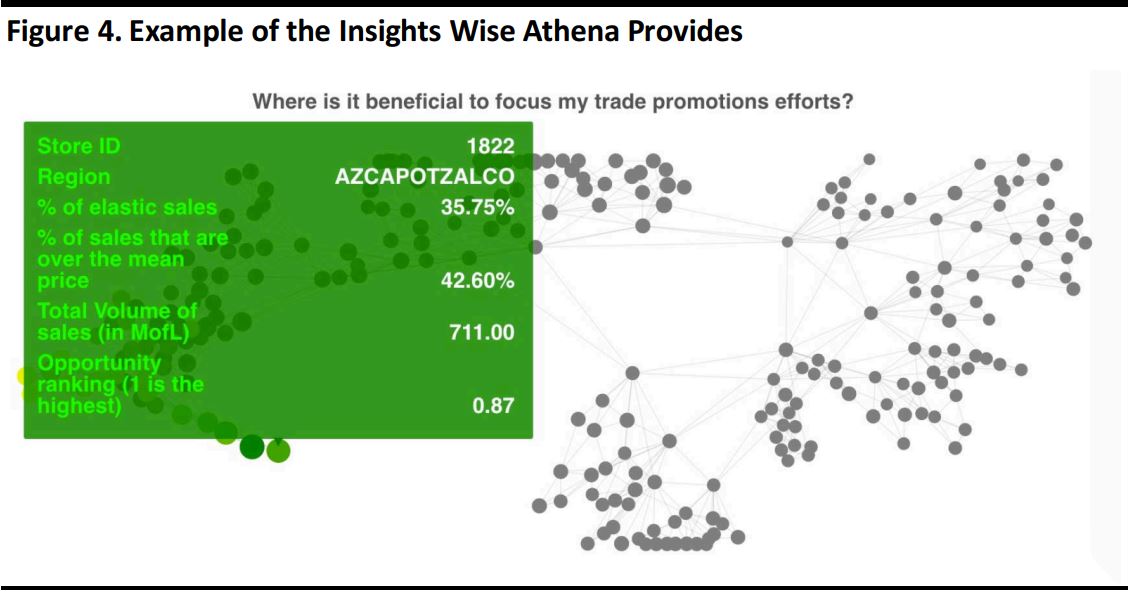

Startup

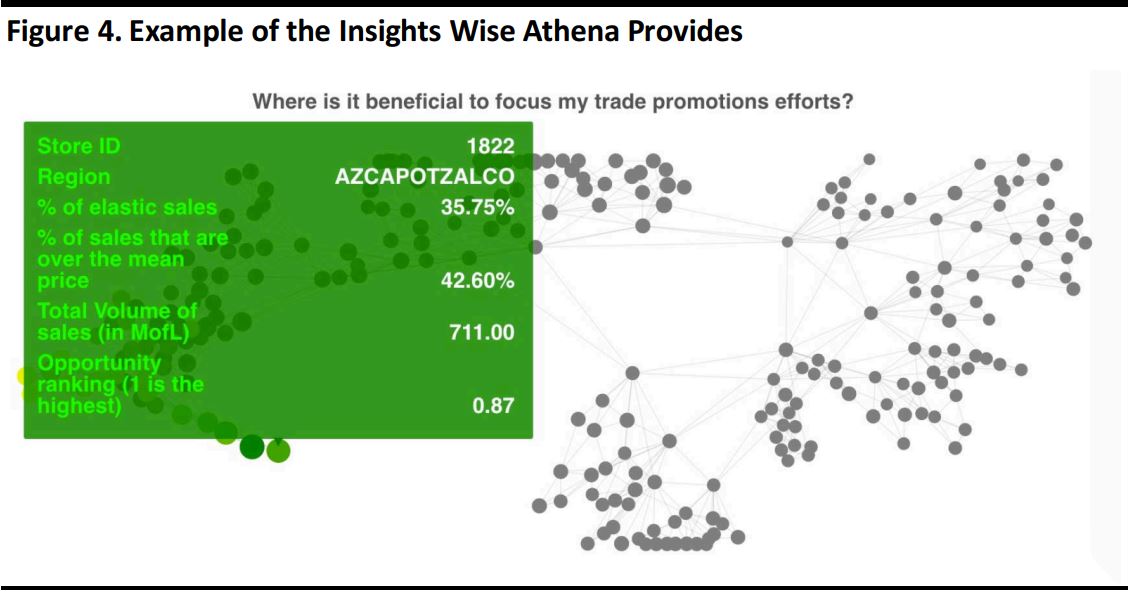

Wise Athena has developed an application that uses machine learning and econometric science to predict pricing and demand for SKUs for consumer packaged goods (CPG) companies, to help them determine where they should focus their promotional efforts. The application crunches data from competitors’ products across retailers, regions and categories as well as data on how a company’s own products interact with each other. This helps CPG companies see how pricing may affect cannibalization and cross-elasticity of their products, so they can determine the optimal promotion strategies to deliver to retailers. Wise Athena was a 2017 participant in global accelerator SAP.iO Foundry’s startup program in Berlin.

Source: Wise Athena

Source: Wise Athena

Other vendors in this space include

Singular Intelligence (which has developed a system called Si-DAX),

Market Track (which acquired 360pi),

Revionics and

First Insight.

Rationalization of Inventory

Having the right stock at the right place at the right time is a retail essential. But many retailers hold too much inventory and allocate it inefficiently. AI-powered data analytics can help retailers maintain efficient and lean inventory, forecasting demand and enabling automatic replenishment. AI can also be used to perform planogram and gap analysis and to help reduce excess stock buildup.

Planogram and Gap Analysis

Planograms, a function of visual merchandising, are diagrams that depict the optimal placement of items on retail shelves or in display windows to maximize sales. Retailers vary their visual merchandise layouts in stores based on the local community’s preferences and demand. AI can be used to formulate planograms based on various data to ensure that the appropriate items are stocked in quantities suited to each store and that they are displayed optimally with other items that can be cross-promoted.

Retailers can also use AI to perform gap analysis, i.e., to identify the shortfall between estimated and actual sales of products, to enable better inventory planning.

Lakeba’s

Shelfie robot helps retailers with planogram compliance, resolving incorrect price tickets displayed on shelves and performing gap analysis. The robot, a tall, cylindrical machine with scanner cameras across its body, travels on a circular base across the shop floor. It uses computer vision and AI to scan shelves and alert retail staff when shelves need to be tidied up, rearranged or replenished.

Two other companies,

Simbe Robotics and

Bossa Nova, make robots that work in a similar fashion. The robots audit shelves for out-of-stock items, low-stock items, misplaced items and pricing errors. Bossa Nova’s robots are currently being tested at selected Walmart stores.

Forecasting and Automatic Replenishment

Forecasting demand accurately across a store estate can be challenging for retail executives and planners, as they must factor in a number of variables, including market conditions, weather conditions, regional trends and historical data. AI applications can combine a variety of such metrics to estimate which products will need timely restocking and to forecast demand per store, per time period, as specified by the retailer. Software applications using AI can also use these forecasts to automatically signal warehouses to send the right products and quantities to stores, so that retailers can replenish shelves appropriately.

Blue Yonder has developed a system that can analyze around 3 billion historical transactions and 200 other variables (such as weather conditions and website searches) to predict future purchases. The company says that it has enabled one of its clients, German retailer Otto Group, to automatically process orders with partner suppliers for about 200,000 items a month.

The system helps Otto stock what its customers are likely to buy, enabling the retailer to achieve faster deliveries and reduce returns. The solution can reportedly predict with 90% accuracy what will be sold within a 30-day period. It also allows Otto to dramatically reduce its delivery schedule for partner products, from seven days to one or two days. Often, the system enables products to be delivered directly from the supplier to the customer without passing through Otto’s warehouse.

France-based

Vekia provides supply chain management solutions to several retailers, including Leroy Merlin, Mr. Bricolage, Undiz, Tape A L’oeil, Etam, Okaidi and Jacadi. Vekia’s applications use AI to manage and supervise inventory for each store daily across several product attributes, including color and size. The application calculates the optimal stock level for each store several times a day and uses historical store and item sales data to place replenishment orders automatically.

Reducing Excess Stock Buildup

AI-powered applications not only identify gaps, forecast inventory and place orders, but also help reduce excess stock buildup, making retail more efficient. Excess stock often ends up being marked down, but AI applications can help identify products that are prone to being stocked in excess based on their historical tendencies, and prevent them from building up.

Startup

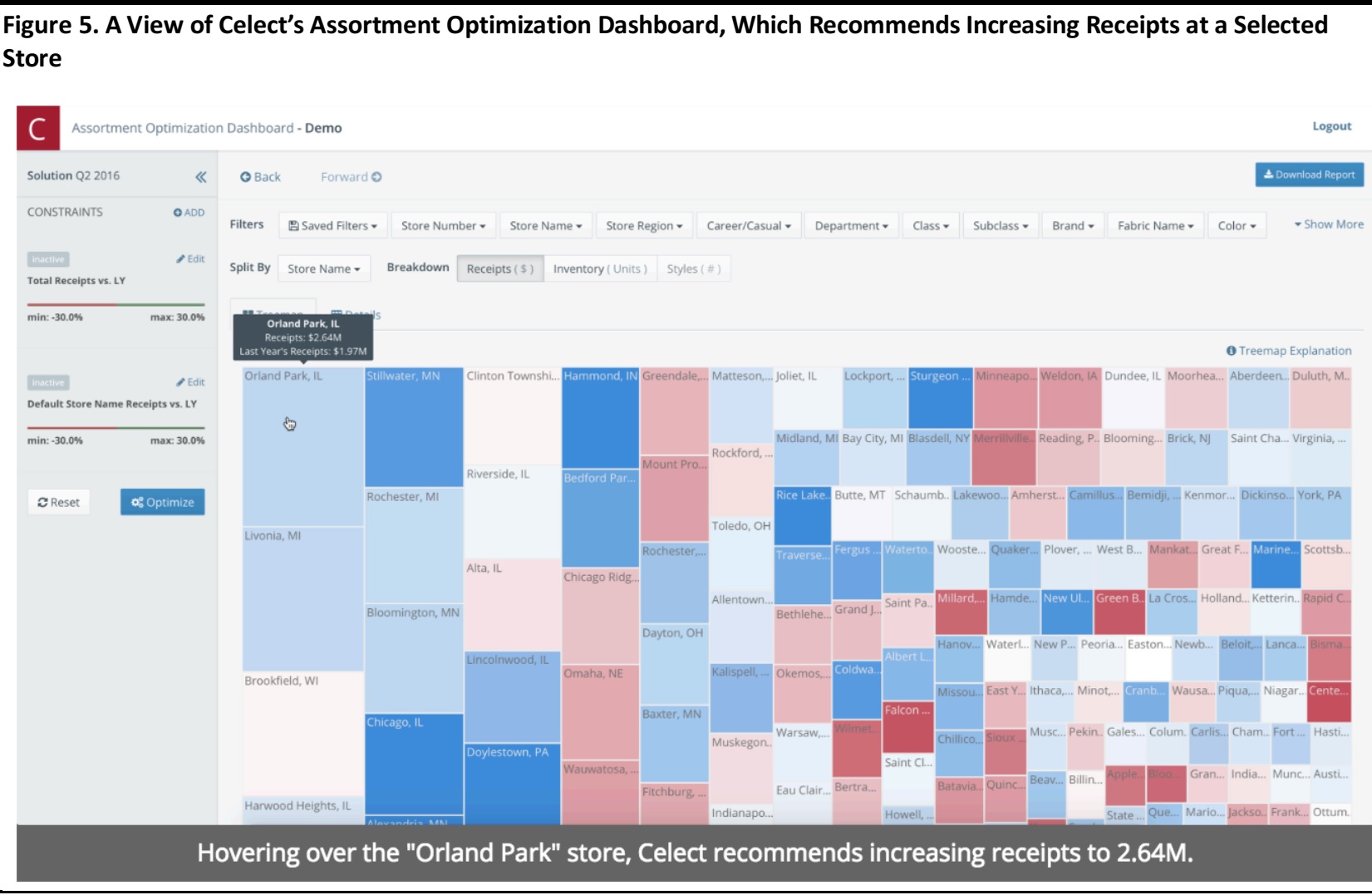

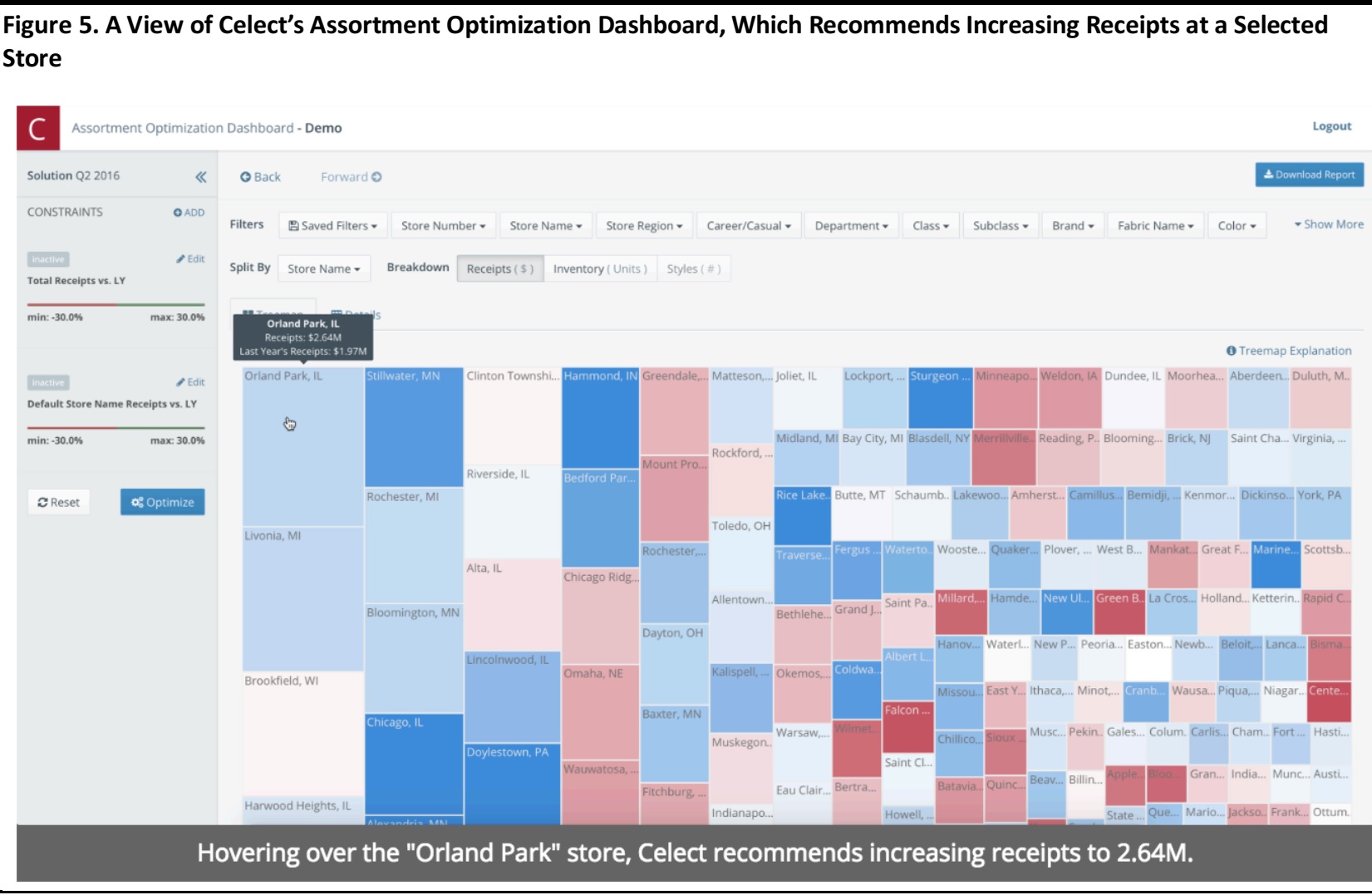

Celect offers an Inventory Optimization Suite that uses predictive analytics and machine learning to optimize retail inventories by providing models of future buying patterns and behavior. The company’s Plan Optimization application helps retailers understand how various products affect overall assortments. By identifying poorly performing products, the application highlights which space could be made available for better-performing products. Retailers can also see which categories are being overallocated and those that have growth potential, so that they can rearrange assortments accordingly.

Source: Celect

Source: Celect

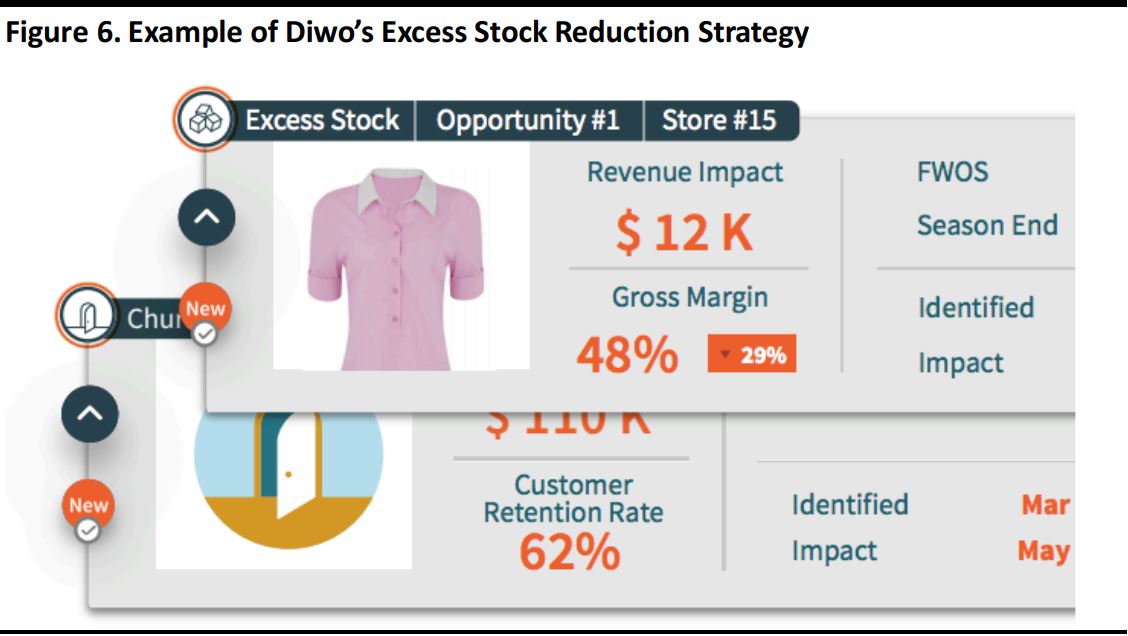

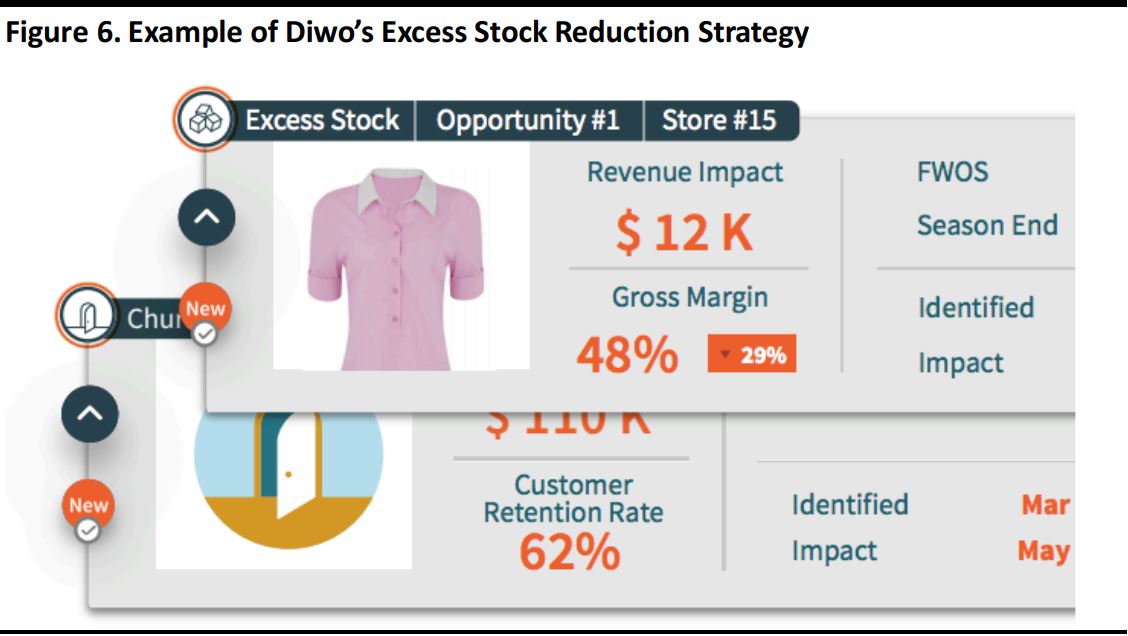

Diwo has created an application that constantly monitors categories of SKUs that have shown a tendency to be stocked in excess. It also analyzes shopper baskets in real time and identifies their impact on products with low sell-through. The application provides a real-time, holistic view of enterprise wide inventory data to help retailers evaluate store inventory requirements based on actual customer demand. For products with low sell-through, Diwo identifies the factors that led to weak sales and provides multiple strategies to help retailers determine the ideal times to promote the stock and sell it.

Source: Diwo

Source: Diwo

Experiential Retail

As consumers switch more and more of their shopping online, store-based retailers across both discretionary and nondiscretionary categories must offer better in-store experiences. They must drive out friction from the shopping process, deepen engagement with their customers and close the information gap between e-commerce and physical stores.

In stores, AI-powered mobile kiosks and points of sale can help retailers deliver a more customized experience to shoppers, as can tablets used by store assistants. India’s

Talespin and US-based

Pega have developed AI-powered mobile-/tablet-ready applications to help store associates provide assistance and recommendations to customers.

Some retailers are deploying facial recognition technology in stores to help sales associates identify VIP shoppers, so they can provide them a heightened level of service.

Kairos’s application can help identify people and detect their age, gender, mood, attention span and facial features. The company’s technology can identify a retailer’s VIP shoppers and alert store staff when one of them walks into the store. It can also trigger past purchase logs and loyalty cards.

Magic mirrors, which allow shoppers to view how clothing items would look on them, employ AI to help shoppers discover new products. The mirrors also deliver recommendations based on the user’s choices and factors such as age, gender, climate and trends.

Holition has created mirrors that allow people to virtually try on clothing in different colors and L’Oréal-acquired

ModiFace developed an augmented-reality mirror that allows shoppers to virtually experiment with different makeup looks.

Checkout-free stores, where consumers do not have wait in line to pay for products, are another way for retailers to provide a low-friction shopping experience.

Aipoly offers checkout-free store technology that also provides instant inventory analysis and automated replenishment. Its system uses computer vision to recognize shoppers and products, enabling shoppers to pick up items and simply walk out with them.

AiFi is another computer vision startup that provides cashier-free retail software. The company says that its system is flexible, easy to set up and easily scalable, so it can be used in stores of all sizes, from smaller mom-and-pop shops to much larger stores.

What We Think

As shoppers shift ever more of their purchases online, retailers are presented with access to ever-larger pools of shopper data. AI technology can help companies use all of that data to deliver better experiences to their customers. Developers continue to find AI applications across business functions, and we think the sooner retailers adopt the technology, the greater the edge they will have versus their peers.

Retailers need to identify their own specific strengths and weakness, and implement AI accordingly in order to engage with customers effectively. The CORE framework can help retailers pin down which of their retail functions need immediate attention.

Greater adoption of AI across customer-facing functions will enable retailers to broaden their reach and capture data that can help them at other points along the retail value chain. Eventually, retailers will see higher returns on AI investment, as the technology works collaboratively across business functions and constantly “learns” from growing pools of data.

In our next report in this series, we will examine AI applications at various points of the retail value chain and discuss how retailers are currently using the technology.

Source: TechEmergence

Source: TechEmergence Source: Coresight Research

Source: Coresight Research Source: Personali

Source: Personali Source: Wise Athena

Other vendors in this space include Singular Intelligence (which has developed a system called Si-DAX), Market Track (which acquired 360pi), Revionics and First Insight.

Source: Wise Athena

Other vendors in this space include Singular Intelligence (which has developed a system called Si-DAX), Market Track (which acquired 360pi), Revionics and First Insight.

Source: Celect

Source: Celect Source: Diwo

Source: Diwo