albert Chan

Introduction

During May 16‒19, 2022, software provider Aptos hosted its seventh annual Engage event in Scottsdale, Arizona—the first in-person iteration of the conference since it was held in Orlando in 2019. The Coresight Research team attended Aptos Engage 2022, along with an estimated 200 other people.

The conference featured presentations from across the Aptos ecosystem, including executives from customers and technology partners—such as Adyen, AWS, Boot Barn, Google, New Balance, Tommy Bahama and The Vitamin Shoppe—as well as industry press and analysts. In the presentations, Revionics, a provider of science-based pricing, promotion and markdown solutions for retailers, received near-equal billing. Revionics operates as a business unit within Aptos after being acquired in September 2020 for an undisclosed sum.

In this report, we present our key insights across four major themes that emerged during multiple sessions and conversations during the conference.

About Aptos

Aptos offers software that enables retailers to engage in unified commerce (i.e., merging online and offline commerce), including its next-generation, microservices-based platform, Aptos ONE. The company’s range of solutions helps retailers better manage and optimize customer experiences and inventory, inclusive of retail pricing strategies as supported by its Revionics division.

Privately held Aptos was spun off from Epicor in 2015 and acquired by Goldman Sachs in March 2020 from Apax Partners for an undisclosed figure. Aptos has around $300 million in annual revenue and is on track to reach $500 million in a couple of years, according to a quote from CEO Pete Sinisgalli in the Atlanta Business Chronicle in June 2021. Sinisgalli joined Aptos in November 2020, with his prior roles including serving as President and CEO of Manhattan Associates.

In addition to Revionics, Aptos also owns Icelandic-based software provider LS Retail, which it acquired in February 2021. LS Retail, which operates as a standalone business unit within Aptos, offers unified commerce solutions that are built on Microsoft technology.

Aptos Engage 2022: Key Insights

Aptos Humbly Aims To Evolve from Good to Great

Sinisgalli kicked off the conference with a presentation titled, “What Comes Next: Transforming Change into Opportunity.” He outlined his humble vision of evolving the company from “good” to “great,” under the vision of being “the leading global provider of technologically advanced, innovative unified commerce solutions and services that deliver significant business benefit” to its clients.

The company’s key objectives for 2022 include the following:

- Improve customer satisfaction—To achieve this, 20% of all employees’ bonuses are based on improvement in customer satisfaction.

- Improve colleague satisfaction—Management cited its goal of positioning Aptos as an employer of choice in the current “insane” war for IT talent.

- Deliver on product roadmaps—Aptos aims to achieve satisfied customers and quality delivery on a consistent basis. The company plans to continue to spend at least 15% of revenues on R&D (research and development).

- Improve quality in products and services—To achieve this, the company has changed its organizational structure to be territory based, launched a global customer success program, created a formalized solution design team and made strategic new hires in customer operations and professional services.

- Meet its financial objectives—Sinisgalli showed an unlabeled graph with revenues and EBITDA that were nearly right on plan for both fiscal 2021 and the first half of fiscal 2022, underscoring how the company’s customer-centric focus and operating discipline were translating to solid and profitable results.

Sinisgalli also made the following comments regarding product investment:

- Aptos has continued to invest strongly in products throughout the pandemic; both established products and its next-generation offerings.

- The company’s Order Management solution is central to its unified commerce strategy and represents a good product that can be improved.

- Aptos ONE is a cloud-based platform using microservices. Despite great progress, this platform is still early in its product lifecycle, there still remains much work to be done to meet business needs.

Pete Sinisgalli, CEO of Aptos

Pete Sinisgalli, CEO of AptosSource: Coresight Research[/caption]

Aptos Identifies Four Key Retail Trends

Nikki Baird, VP of Strategy at Aptos, outlined the company’s views on four key trends facing retailers:

- Inflation

Price increases are taking place during the lowest retailer and brand loyalty in decades as well as unprecedented demand shifts and extreme price transparency, creating a dynamic, uncertain environment. Consumers have to weigh the purchase of essential versus nonessential items and also contend with shrinkflation (smaller amounts for the same price). Anecdotally, some consumers are enjoying small indulgences—e.g., buying one cupcake versus a whole cake. The question for retailers is, “Will inflation subside before it drives permanent changes in consumer behavior?”; many of the effects of the Great Recession took four years to unwind.

- Labor Costs

The current environment features a record number of job openings alongside a low labor participation rate, and retailers are coping with wage increases, fewer hours, lower staffing levels, automation and cross-training. Store operations will have to change to adapt to the current labor environment.

- Customer Loyalty

Consumer loyalty was disrupted by the pandemic, shifting shopping patterns. The discontinuation of the use of tracing cookies online makes targeting more challenging, and customer acquisition costs are skyrocketing. The good news is that consumers are returning to stores—unfortunately, this is happening at a time when retailers are ill prepared to provide good experiences due to labor shortages and other factors.

- Omnichannel Profitability

Retailers’ ability to sell online saved those that closed physical stores during the pandemic. Omnichannel fulfillment drives sales, yet omnichannel without the right inventory optimization and order management strategies in place can quickly destroy profits. Unfortunately, due to the dynamic nature of omnichannel demand, retailers’ inventory needs are harder to predict, impacting everything from allocation to replenishment to returns.

[caption id="attachment_148472" align="aligncenter" width="550"] Nikki Baird, Vice President of Strategy at Aptos

Nikki Baird, Vice President of Strategy at AptosSource: Coresight Research[/caption]

A Vision of Unified Commerce Centers on Connecting Customers to Products

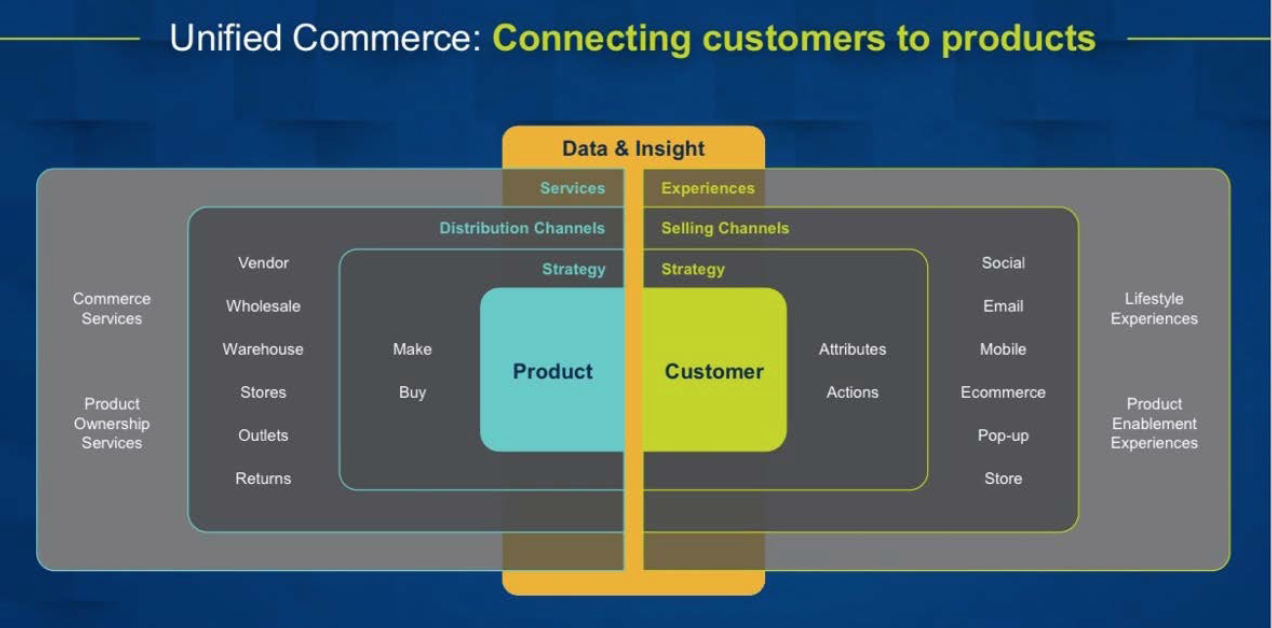

According to Baird, Aptos has a vision of unified commerce (see image below) that connects customers to products but also emphasizes the need for retailers to add experiences to make shopping more entertaining, such as Tommy Bahama’s restaurant, L.L.Bean’s addition of outdoor trips and experiences, and NIKE’s basketball court in its House of Innovation.

In the current environment, retailers need to use every lever they possess, including commerce, customer acquisition, customer targeting, inventory, omnichannel, order management, and pricing and promotions.

Baird commented that due to the dramatic rise in omnichannel purchases, obtaining product is a free for all, and retailers are motivated to secure inventory in whichever channel they can find it.

The Aptos ONE platform has largely been focused on store commerce, which matters most (since in-store purchases still comprise the vast majority of US retail sales). Looking at the future of omni-commerce, Aptos anticipates expanding on the inventory and customer sides. The company also cited the importance of the Revionics acquisition, which added an AI (artificial intelligence)-based platform that is able to adapt to changing conditions with speed and quality.

[caption id="attachment_148473" align="aligncenter" width="550"] Aptos’ Vision of Unified Commerce

Aptos’ Vision of Unified CommerceSource: Company reports[/caption]

Configurability Versus Extensibility Is a Major Tech Theme

The lifecycle of cloud-based SaaS (software-as-a-service) platforms differs from traditional monolithic software updates. Although modern software (such as with microservices) is extremely modular in nature, it does not easily lend itself to customization, given frequent update schedules—for example, Aptos mentioned updates every eight weeks.

Given that every retailer is different, has different stores and different fulfillment methods—such as BOPIS (buy online, pick up in-store), curbside pickup, dropshipping, etc.—with myriad legacy systems and systems from diverse vendors, what can be done?

Extensibility refers to using extensions—integrations and connectors—to add the few functions that are unique to the retailer while making use of the basic and standard functions that are provided in microservices. These extensions increasingly do not require the use of writing computer code. In contrast, configuration refers to prior monolithic software platforms, which endeavor to offer something to everyone, with a long list of features to be turned on or off, or tuned via configuration settings.

Revionics Uses AI To Help Retailers Manage Pricing

Mike Ryan, SVP of Science at Revionics, offered an overview of the business and its operations at Aptos Engage 2022. The Revionics platform is built to embrace change with retailers’ needs and uses AI/ML (machine learning) at a large scale to manage base pricing, promotion and markdowns, in four dimensions:

- Using its Pricing Insights Engine (PIE)

- Offering an elevated experience

- “Hands off the wheel” AI—i.e., running automatically

- Using a data mesh structure for maximum performance

Ryan also summarized the function of the platform as including real-time competitive price matching, price sensitivity by channel and loyalty-driven personalized offers.

One key concept mentioned was “price image protection,” which refers to consumers believing that a retailer offers attractive prices, even when a survey of competitors indicates that the retailer could raise prices to meet the market level. (Revionics commented that it had exited providing competitive intelligence data, as this data is readily available from a host of third parties.)

Revionics claims much of its success lies in its user interface, which offers personalized workflows, dashboards and alerts. The company highlighted its 90% client-renewal rate since 2012. Revionics claims to serve 12 of the top 50 NRF/Supermarket News global retailers, with 30% of its client base being Tier 1 retailers.

Its platform is built on Google Cloud’s core infrastructure, which has strengths in big data and machine learning, with substantial computing horsepower. Its analytical capabilities also enable the running of A/B tests, which can find the elasticity of the demand curve for a given item and also consider the consumers’ ability and propensity to purchase substitutes based on price (for example, substituting apples for cherries.)

[caption id="attachment_148474" align="aligncenter" width="550"] Mike Ryan, SVP of Science at Revionics

Mike Ryan, SVP of Science at RevionicsSource: Coresight Research[/caption]