DIpil Das

US Retail Sales: April 2022

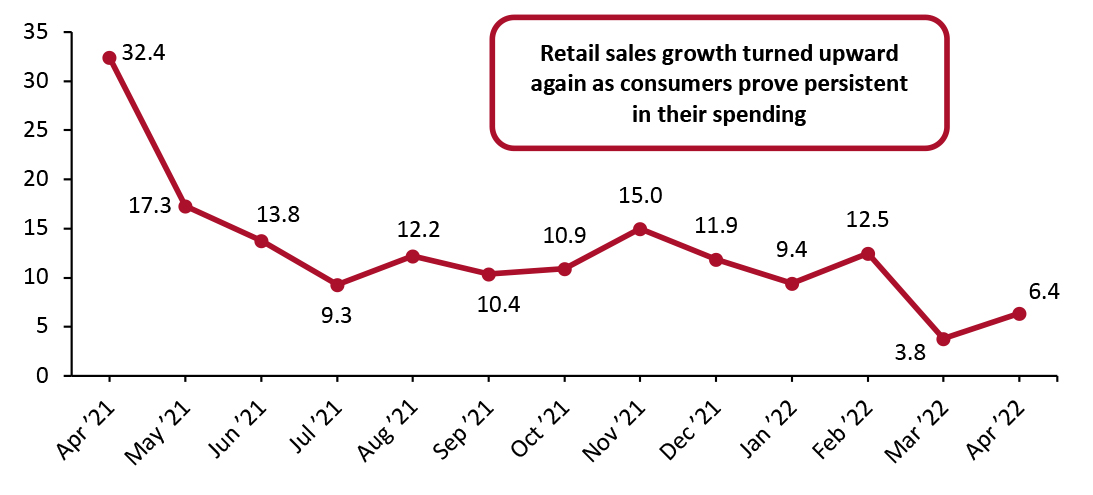

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding sales of gasoline, motor vehicles and parts. This metric performed better than our expectations—outlined in our Leading Indicators of US Retail Sales report—growing 6.4% year over year. April’s 2022 retail sales estimates were against very strong April 2021 retail sales data when pandemic-driven stimulus checks boosted retail spending. On a positive note, the 6.4% growth—on top of the 32.4% growth in April 2021—indicates that retail sales are healthy. However, the retail sales estimates released by the US Census Bureau do not account for inflation. In April, consumer prices grew 8.3% from a year ago, a slight downtick from the 40-year record high 8.5% increase in consumer prices in March. The price increases are driven by essential goods, such as household energy, gasoline and food at home. While sales at gasoline stations are not included in our metric of retail sales, the price of gas is putting pressure on consumers’ ability to spend in discretionary categories. We estimate our retail-only inflation metric to be 7.6% in April. This metric strips out some of the core categories driving overall inflation and focuses on price increases within relevant retail-specific sectors, each of which is weighted to represent their share of total retail sales. With our inferred retail-only inflation metric at 7.6%, 6.4% overall growth in retail sales in April implies a real-terms sales decline of 1.2% year over year. April marked the 11th consecutive month of 40-year high consumer price increases as economic uncertainty remains. On May 4, the Federal Reserve Bank hiked interest rates for the second time in 2022, attempting to slow inflation. In the second interest rate hike, the Fed rose rates by 50 basis points, the largest increase since 2000. Consequently, in early May, the University of Michigan Consumer Sentiment Index declined to 59.1, a year-over-year decline of 28.7%. It sat at its lowest level since September 2011.Figure 1. US Total Retail Sales ex. Gasoline and Automobiles: YoY % Change [caption id="attachment_147535" align="aligncenter" width="700"]

Data are not seasonally adjusted

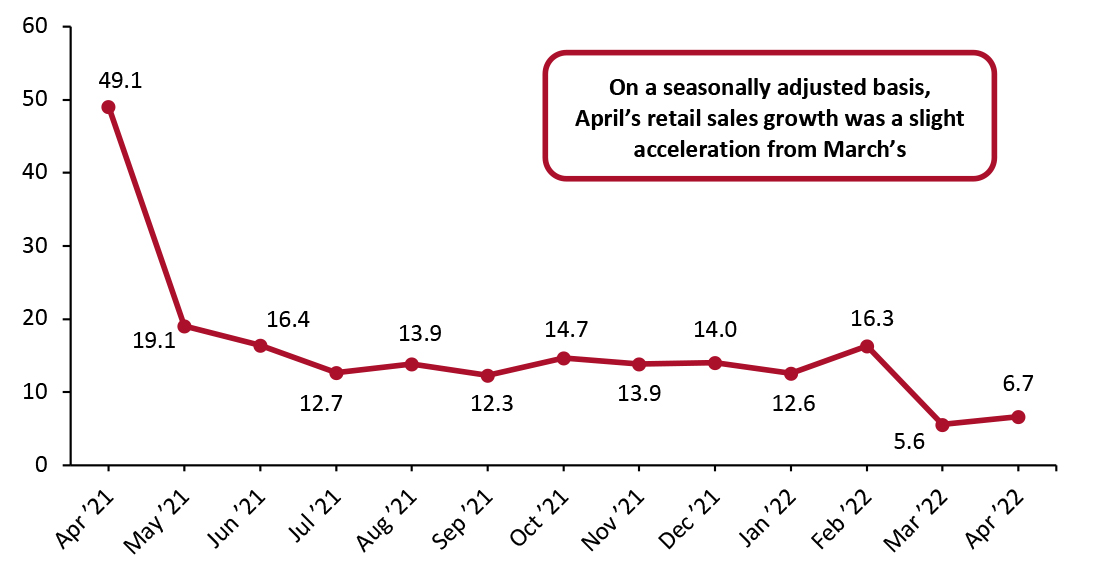

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Seasonally adjusted retail sales, including automobiles and gasoline, grew 6.7% from a year ago. Sales at gasoline stations are artificially surging due to higher prices; however, sales at motor vehicles and auto parts dealers continued to decline year over year, reflecting the impact of both the global microchip shortage and the rising prices of new and used cars.

Figure 2. US Total Retail Sales incl. Gasoline and Automobiles: Seasonally Adjusted YoY % Change [caption id="attachment_147536" align="aligncenter" width="700"]

Data are seasonally adjusted

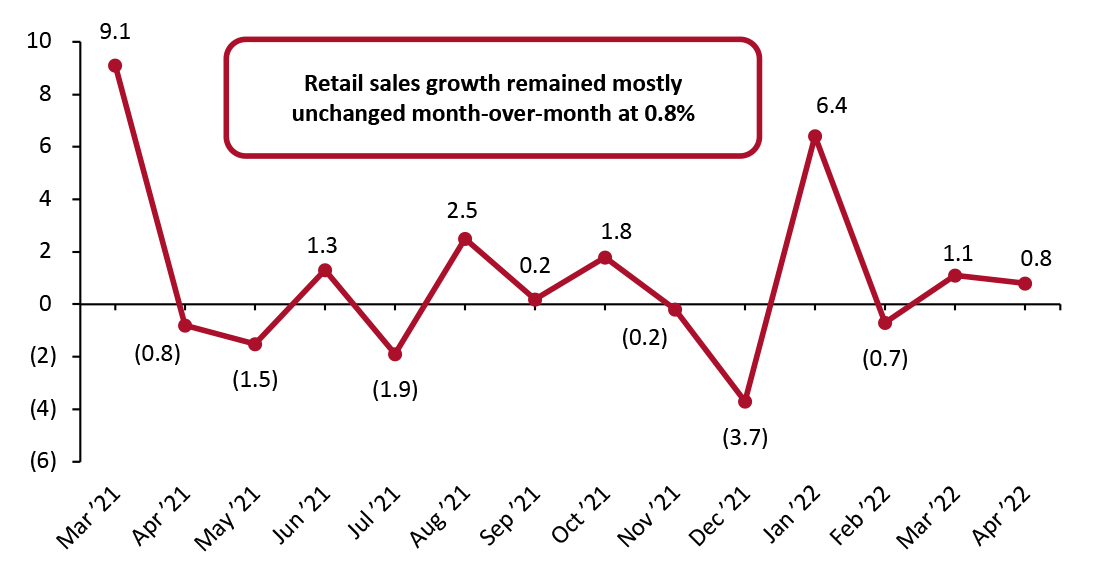

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Retail Sales Growth Decreases Month over Month On a month-over-month basis, seasonally adjusted sales (excluding gasoline and automobiles) grew by 0.8%. More positively, the Census Bureau’s revisions to March’s sales estimate changed it from no growth, at 0.0%, to 1.1% sales growth.

Figure 3. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_147537" align="aligncenter" width="700"]

Data are seasonally adjusted

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Retail Sales Growth by Sector Overall retail sales growth turned upward again in April. While most sectors did post nominal sales growth, three notable sectors saw year-over-year sales declines.

- Electronics and appliance stores saw a second consecutive month of declining sales. Year over year, sales declined by 4.7%, an acceleration from the 2.8% decline in March.

- Sporting goods, hobby, musical instrument and bookstores also saw a second consecutive month of declining sales—this time by 3.1%—reflecting consumers’ reduced ability or willingness to spend on discretionary hobbies within the current inflationary context.

- Sales of building materials and garden supplies declined year over year by 1.2%, reflecting a potential slowdown in home buying as mortgage rates have climbed to their highest point since 2009.

- Relatedly, sales at furniture and home-furnishing stores grew marginally, by 0.9% year over year, remaining in positive territory. This, together with declines in the electronics and appliances sector and at home-improvement retailers, reflects weak demand for big-ticket categories.

- Food and beverage stores’ sales grew a modest 8.9%, while grocery store sales grew 9.8%. However, neither of these two related sectors outpaced foot at home price increases, which grew 10.8% in April, implying a slight real sales decline at grocery and food and beverage stores.

- Clothing and clothing accessory stores’ sales remained healthy with a strong consumer demand to acquire new clothing as people resume more and more pre-pandemic activities. In April, sales rose 11.2% from the previous year, up from the 8.2% growth exhibited in March.

- Sales at general merchandise stores were healthier this month, growing 3.7% from the previous year, with the department store subsector seeing sales rise by 7.9%. Notably, the Census Bureau’s revisions to March data resulted in sales declining year-over-year for both sectors in March.

- Miscellaneous store retailers saw the largest sales gains again this month, with sales growing by 19.9% year over year.

- Nonstore retailers, a proxy for e-commerce spending, remained healthy, with sales growing by 11.3% year over year.

- While it is not included in our definition of retail sales, the Census Bureau’s report of 7% year-over-year growth in sales at foodservice and drinking establishments in April reflects the shift back to public places and services spending.

Figure 4. US Total Retail Sales, by Sector: YoY % Change [wpdatatable id=1970 table_view=regular]

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research