DIpil Das

China Retail Sales: April 2022

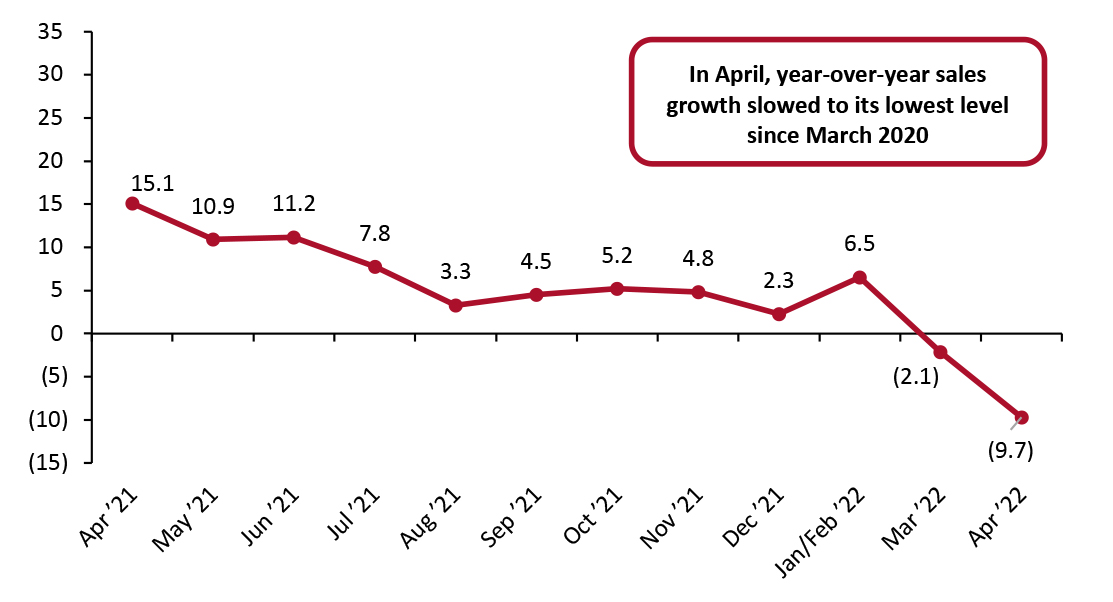

In April, China's total retail sales growth (ex. food service, incl. automobiles and gasoline) declined by 9.7% year over year, the steepest decline since March 2020 (when sales were down 12.0%), as widening Covid-19 lockdowns took a heavy toll on consumption. We anticipate that retail sales will recover in the coming months with Covid-19 outbreaks in Jilin, Shanghai and other places coming under control as Shanghai plans to allow restaurants to reopen gradually, with an aim to resume normal production and life by the middle of June.Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_147735" align="aligncenter" width="700"]

January and February figures are reported together

January and February figures are reported together Source: National Bureau of Statistics/Coresight Research [/caption] Retail Sales Growth by Sector Many sectors saw double-digit sales declines year over year in April, as total sales slowed to the lowest point since March 2020.

- Grocery demand remains positive in April as many consumers continued to stay under lockdown. Food retailers saw year-over-year sales growth of 10.0% and beverage sector saw sales growth of 6.0% year over year.

- In April 2022, school, office supplies and computers specialists posted negative sales growth of 4.8% year over year, the first negative growth since January and February 2020.

- The apparel and footwear sector has continued to post sales declines since August 2021, except in January and February 2022. Sales declined by 22.8% compared to a 12.7% decline in March 2022.

- Gold, silver and jewelry retailers continue their weak sales momentum with a steep sales decline of 26.7% year over year.

- Auto retailers were significantly affected by the lockdowns. Auto sales declined by 31.6% compared to April 2021, as car makers slashed production amid empty showrooms and parts shortages.

- Furniture specialists’ sales continued to decline in April and decelerated from sales declines in March 2022. Furniture sales declined by 14.0% in April, down from March’s 8.8% sales decline.

- The alcohol and tobacco sector posted negative sales growth of 7.0% year over year, the first negative sales growth since March 2020.

- The beauty sector declined by 22.3% year over year compared with March’s sales decline of 6.3%.

- Construction and decoration sales decreased by 11.7% year over year.

- Communication equipment retailers’ sales declined steeply by 21.8% year over year.

Figure 2. China Retail Sales (ex. Food Service; incl. Gasoline and Automobiles), by Sector: YoY % Change [wpdatatable id=1993 table_view=regular]

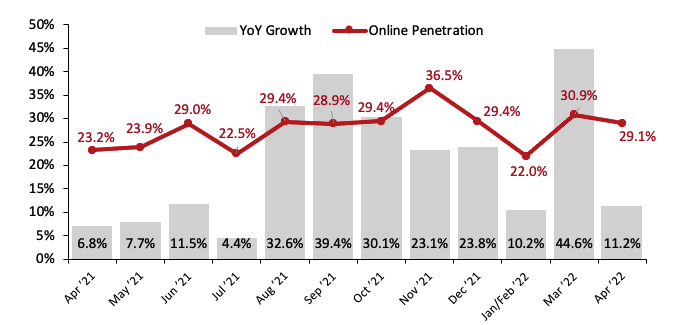

The sector breakdown is based on surveys from enterprises with annual sales of ¥5 million (around $730,000) and above Source: National Bureau of Statistics Online Retail Sales Account for 29.1% of All Retail Sales In April, online retail sales in China grew 11.2% year over year. The channel accounted for 29.1% of total retail sales in the period, in line with March 2022’s online penetration of 30.9%. Online penetration in April remains strong, due to the extended Covid-19 induced lockdowns in many regions of the country. Online retail sales include food service, as the National Bureau of Statistics does not provide online data that exclude food service. In Figure 3, online sales are benchmarked to total retail sales.

Figure 3. Online Retail Sales (YoY % Change) as a Proportion of Total Retail Sales (%) (incl. Automobiles, Gas and Food Service) [caption id="attachment_147736" align="aligncenter" width="681"]

Online retail sales include food service January and February figures are reported together

Online retail sales include food service January and February figures are reported together Source: National Bureau of Statistics [/caption]