DIpil Das

US Retail Sales: April 2021

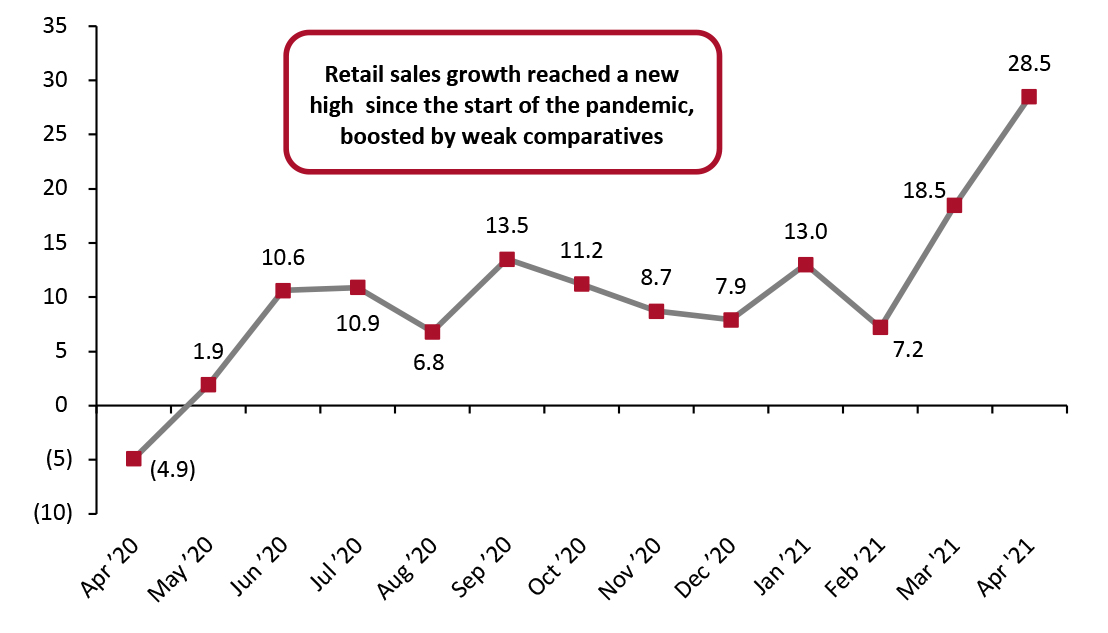

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric accelerated to 28.5% in April, as reported by the US Census Bureau on May 14, 2021. As expected, April’s year-over-year growth set a new high for retail sales growth since the start of the Covid-19 pandemic, in large part because of the very weak comparatives in April 2020 when the pandemic caused nationwide lockdowns and store closures in the US that resulted in a 4.9% year-over-year decline in retail sales that month.Figure 1. US Total Retail Sales ex. Gasoline and Automobiles: YoY % Change [caption id="attachment_127266" align="aligncenter" width="725"]

Data are not seasonally adjusted

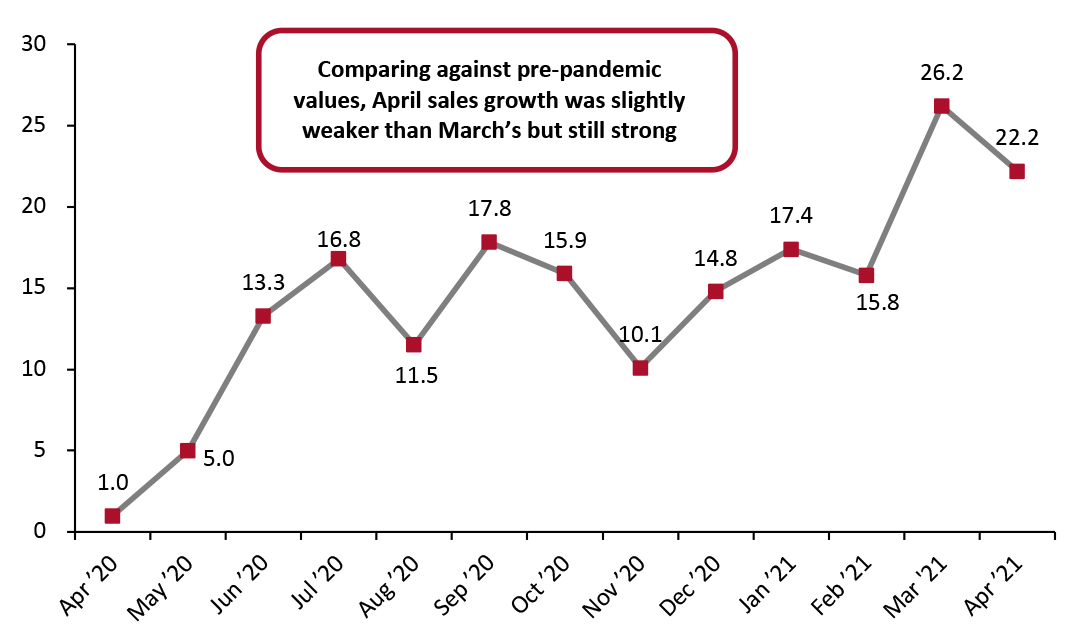

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] While April 2020’s substantial dip in retail sales was a major factor in this month’s strong growth, April 2021 still saw strong sales by any measure. Comparing to 2019 values, April sales still grew by a very strong 22.2%, down slightly from March’s even stronger revised 26.2% growth.

Figure 2. US Total Retail Sales ex. Gasoline and Automobiles: % Change from Two Years Prior [caption id="attachment_127267" align="aligncenter" width="725"]

Source: US Census Bureau/Coresight Research[/caption]

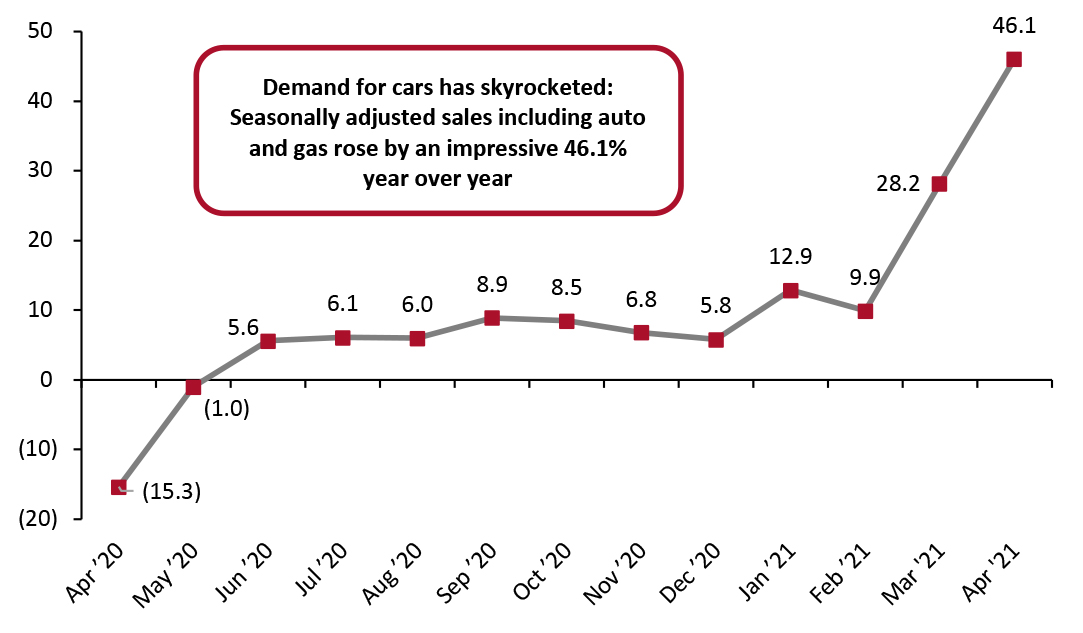

Seasonally adjusted retail sales including automobiles and gasoline saw even greater growth in April. In April 2020, lockdowns drastically reduced the frequency with which people drove while few Americans were confident enough in their financial situations at the time to purchase cars. Since then, demand for cars has skyrocketed to the point where manufacturers are facing shortages, and consumers have in many cases returned to pre-pandemic driving habits, boosting both gasoline and automobile sales.

Source: US Census Bureau/Coresight Research[/caption]

Seasonally adjusted retail sales including automobiles and gasoline saw even greater growth in April. In April 2020, lockdowns drastically reduced the frequency with which people drove while few Americans were confident enough in their financial situations at the time to purchase cars. Since then, demand for cars has skyrocketed to the point where manufacturers are facing shortages, and consumers have in many cases returned to pre-pandemic driving habits, boosting both gasoline and automobile sales.

Figure 3. US Total Retail Sales incl. Gasoline and Automobiles: YoY % Change [caption id="attachment_127268" align="aligncenter" width="725"]

Data are seasonally adjusted

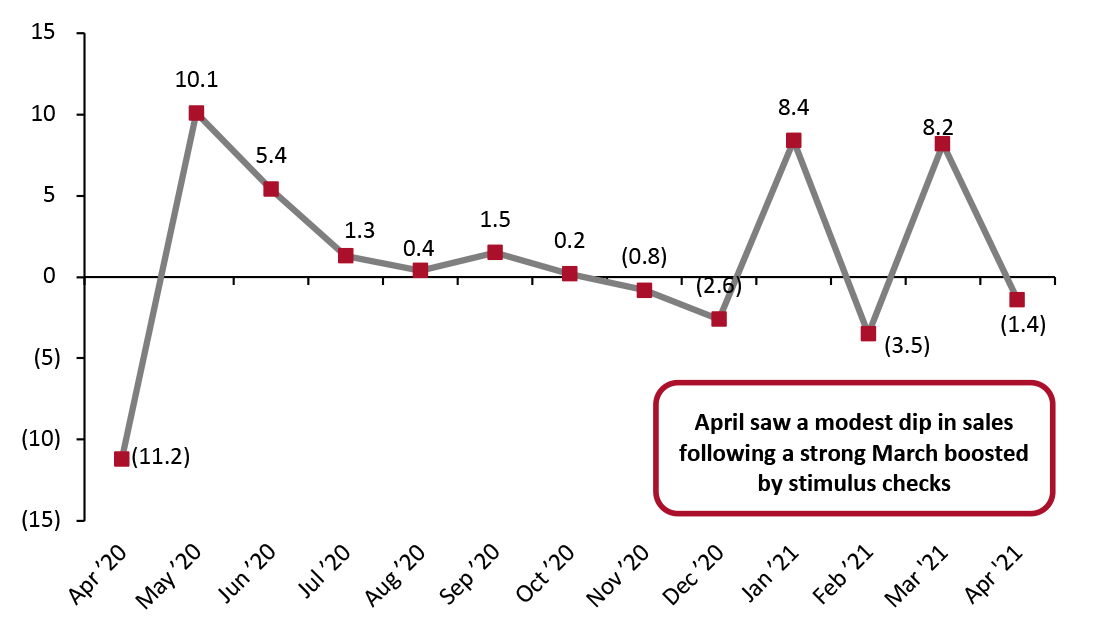

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Sales Drop Slightly Month over Month but Mostly Keep Pace with March’s Stimulus Spending Spree Looking to month-over-month growth in seasonally adjusted retail sales (excluding gasoline and automobiles), April saw a modest 1.4% dip in sales following a strong March that was boosted by the issuance of government stimulus checks, as we predicted in last month’s report. In May, the relaxing of virus restrictions and growing consumer confidence will combat a projected switch to service spending, likely combining to drive a moderate increase in sales, month over month.

Figure 4. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_127269" align="aligncenter" width="725"]

Data are seasonally adjusted

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Retail Sales Growth by Sector Covid-19’s spread through the US in April 2020 had a major detrimental impact on retail sales, with some sectors hit much harder than others. To control for the effects of the pandemic in 2020’s retail sales figures, we largely compare April 2021 sales to pre-pandemic April 2019 sales in this section. In a very strong month, six sectors saw growth from 2019 levels of more than 20%:

- Nonstore retailers continued strong growth in April, rising 41.7% from April 2019 values. Remarkably, nonstore sales experienced double-digit growth of 14.8% even from 2020 values, when consumers were forced to turn to online channels to many of their usual in-store purchases due to lockdowns.

- Home-improvement retailers saw growth of 40.3% from pre-pandemic values, keeping sales at the heightened levels we have seen for the past year.

- Furniture and home-furnishings stores, which unlike home-improvement retailers did not perform nearly as well in the immediate aftermath of the Covid-19 outbreak, continued its recent strong performance with growth of 24.2% in April 2021 compared to April 2019, roughly level with the 25.2% growth in March and seeing growth from 2020 values of nearly 200%.

- Sporting goods and hobby store sales climbed 42.1% from 2019 levels, slightly lower than the sector’s 51.0% growth in March. Growth did dip slightly from March levels, likely due to high numbers of consumers spending stimulus checks on stores in this sector in the prior month.

- Miscellaneous store retailers saw sales growth of 30.7% from 2019 levels, down slightly from March’s 35.9% growth.

- Electronics and appliance stores saw solid growth in April, with sales rising 12.4% from 2019 values, a slight acceleration from March’s 10.8% growth. Consumers have spent well on electronics throughout the crisis but for much of 2020 directed their spending away from specialty electronics retailers to online-focused channels. The sector appears to be drawing back more consumers, but may soon begin to feel tangible impacts of a growing scarcity of microchips used in electronics and appliances that has already hit the auto industry.

- Food and beverage stores continued to see elevated sales, rising 14.2% from 2019 levels and 0.3% from 2020 levels. Grocery stores saw 13.3% growth from 2019 but a 1.4% growth decline from 2020. While these growth numbers from 2020 are far lower than in most other categories, they represent strong performance from the grocery industry following very demanding 2020 comparables that have caused major grocers to project sales declines in 2021 in the low single digits.

- Health and personal care store sales rose 12.8% from 2019 levels, roughly level with March’s 15.1% growth.

- Eye-watering growth of 711.3% in clothing and clothing accessory store sales from April 2020 levels obscures the sector’s more moderate performance in April 2021. Sales grew just 3.5% from 2019 levels, down from March’s considerably greater 8.9% growth, but still solid for a sector that was already struggling prior to the pandemic. The slowdown in growth suggests that March’s comparatively strong performance was down not to a rapid structural recovery in the sector, but rather due to consumers’ propensity to spend their stimulus checks on apparel. We do still expect the sector to see a rebound over the summer, but the speed and extent of this recovery is called into question by lackluster April sales numbers.

- Mirroring a pattern seen in March, while general merchandise stores as a whole saw sales increase by 8.8% from 2019 values, department store sales fell 6.4%. Revised numbers in March indicate a slight increase in department store sales from 2019 levels, but even in a month in which government stimulus checks were issued, department store growth was just 0.5%—far outpaced by the 15.3% growth of general merchandise stores as a whole in March. However, the sector did bounce back from especially dire April 2020 sales, growing 64.3% in April 2021 from lockdown-deflated sales a year ago.

Figure 5. US Total Retail Sales, by Sector: YoY % Change from 2020 (Top) and 2019 (Bottom) [wpdatatable id=947 table_view=regular] [wpdatatable id=948 table_view=regular]

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research