Nitheesh NH

China Retail Sales: April 2021

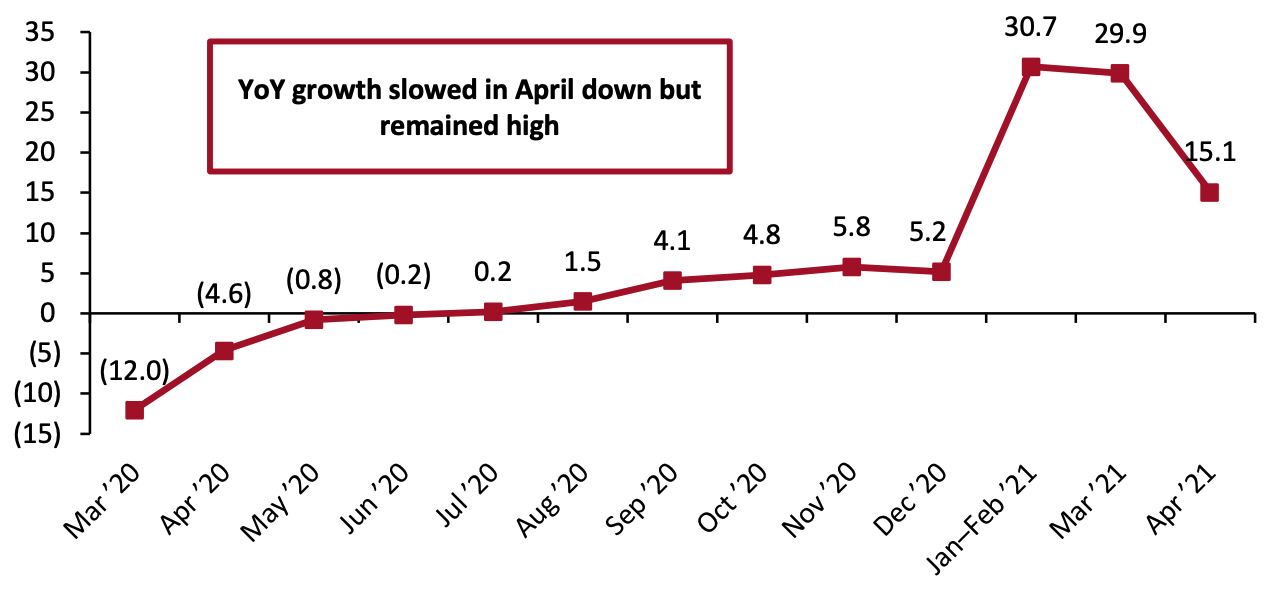

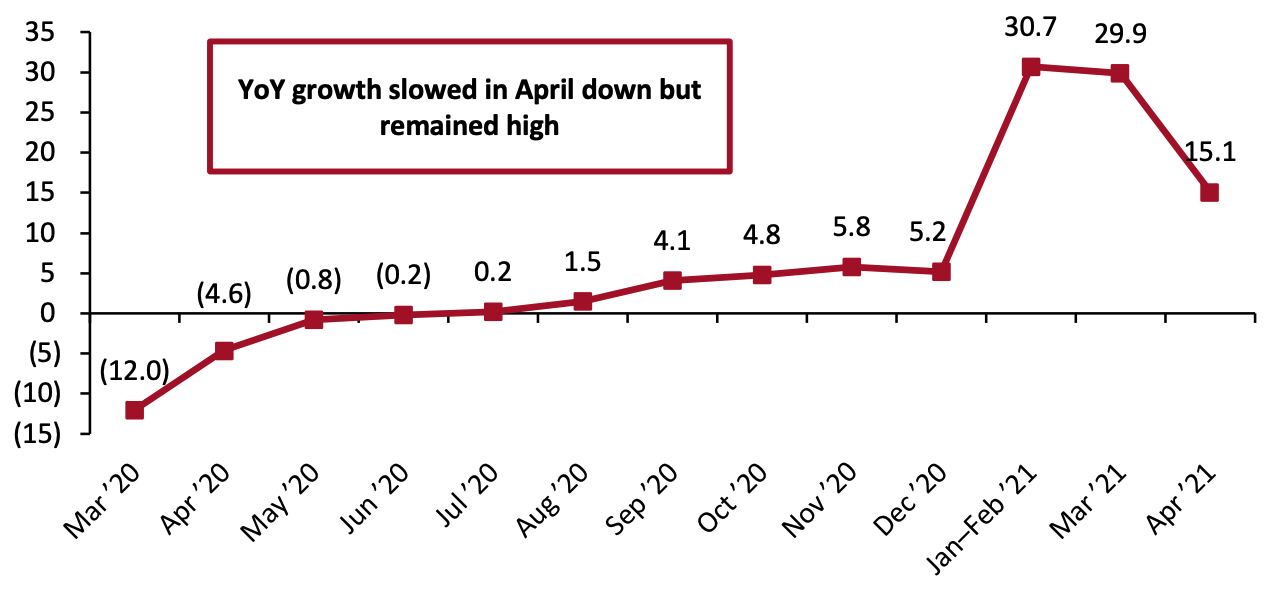

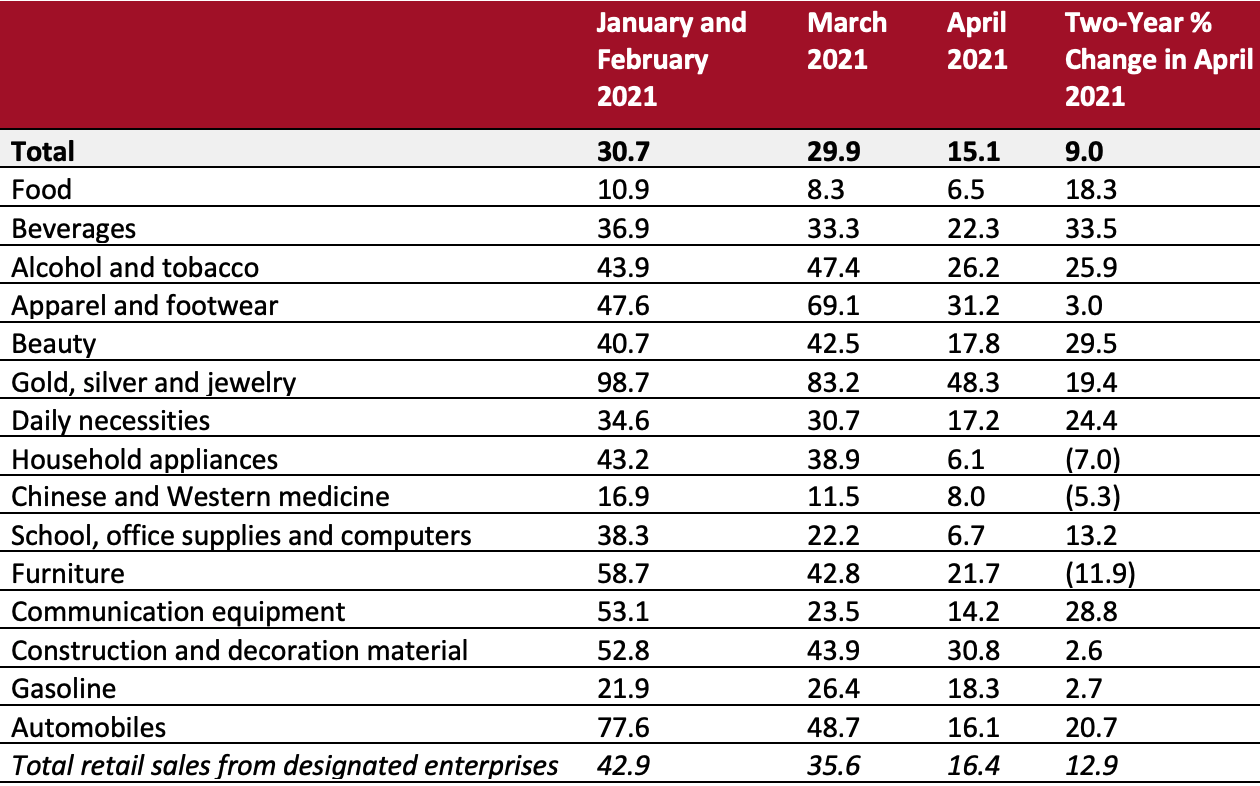

Following the 30.7% year-over-year growth in January and February and 29.9% growth in March, year-over-year growth in China’s total retail sales (ex. food service, incl. automobiles and gasoline) remained strong in April 2021, albeit slowing to a mid-teens percentage rate. Total retail sales grew by 15.1% year over year, reaching ¥3.0 trillion ($461.7 billion).

Growth was against undemanding comparatives from one year earlier, when the country was suffering from the outbreak of Covid-19 and sales declined by 4.6% year over year in April 2020. However, comparing against pre-pandemic values, total sales in April 2021 saw solid growth: Two-year growth from April 2019 totaled 9.0%.

Figure 1 shows the recovery trajectory of total retail sales in China. We expect retail sales to continue to see low- to mid-teens-percentage year-over-year growth in the coming months against weak 2020 comparatives.

Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change

[caption id="attachment_127361" align="aligncenter" width="720"] January and February figures reported together

January and February figures reported together

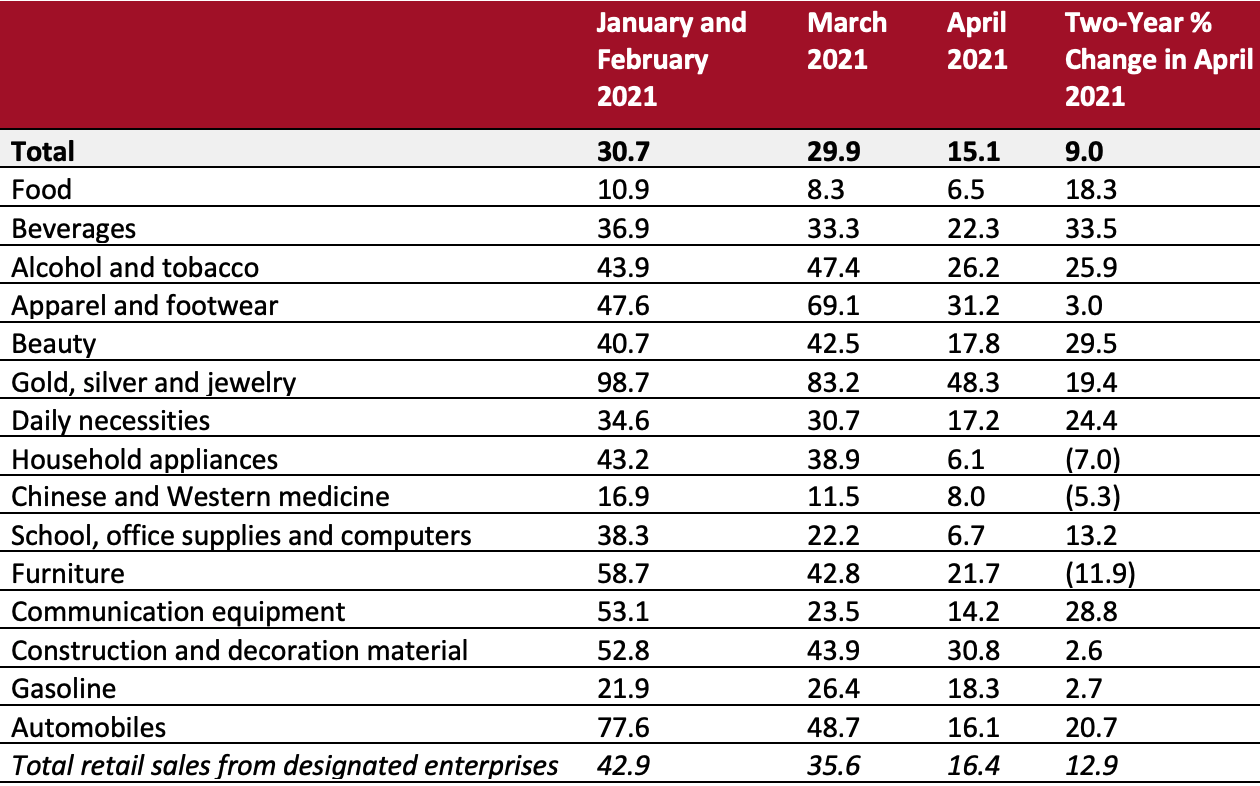

Source: National Bureau of Statistics/Coresight Research [/caption] Retail Sales Growth by Sector All sectors saw positive year-over-year sales growth in April: The sector breakdown is based on surveys from enterprises above a designated size, which refers to those with annual sales of ¥5 million (around $730,000) and above

The sector breakdown is based on surveys from enterprises above a designated size, which refers to those with annual sales of ¥5 million (around $730,000) and above

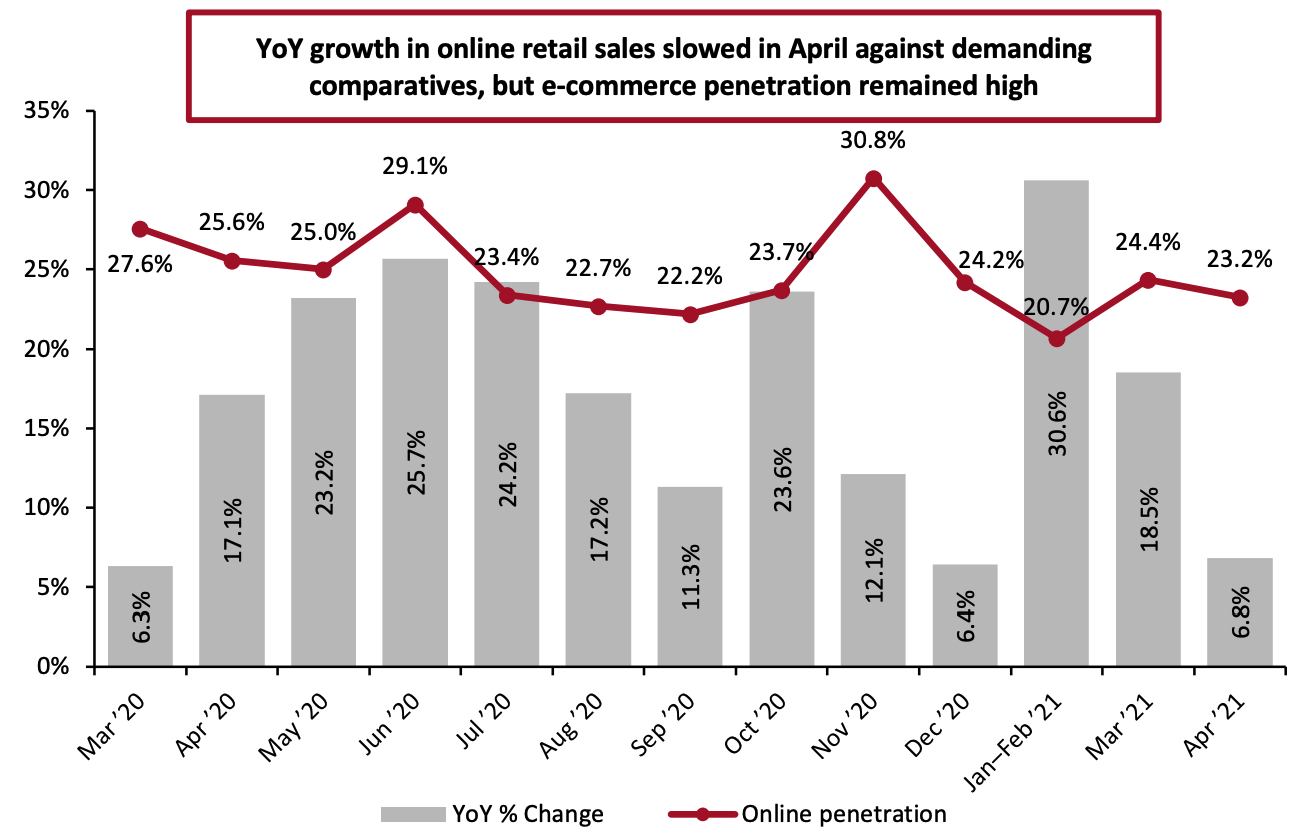

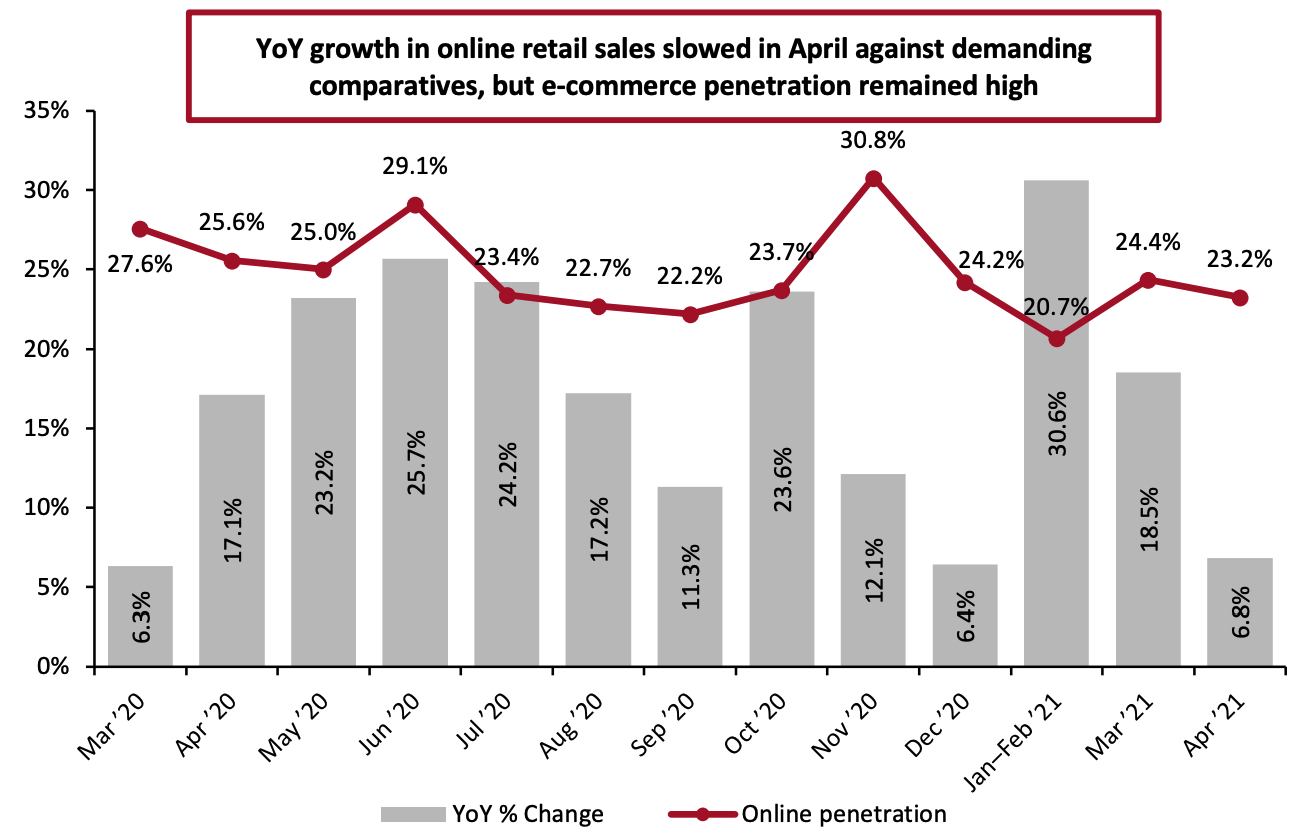

Source: National Bureau of Statistics[/caption] Online Retail Sales Account for 23.2% of Total Retail Sales In April, online retail sales growth in China reached 6.8% year over year. The channel accounted for 23.2% of total retail sales in the period, a slight decline from 24.4% in March. Online retail sales include food service, as the National Bureau of Statistics does not provide online data that excludes food service. In Figure 3, online sales are benchmarked to total retail sales. Figure 3. Online Retail Sales as % of Total Retail Sales (incl. Automobiles, Gas and Food Service) [caption id="attachment_127363" align="aligncenter" width="720"] Online retail sales include food service

Online retail sales include food service

Source: National Bureau of Statistics[/caption]

January and February figures reported together

January and February figures reported togetherSource: National Bureau of Statistics/Coresight Research [/caption] Retail Sales Growth by Sector All sectors saw positive year-over-year sales growth in April:

- As was the case in previous months of 2021, gold, silver and jewelry retailers saw the largest year-over-year sales growth in April, of 48.3%. On a two-year basis, these retailers saw growth of 19.4%. According to Orient Securities, Chow Tai Fook, which has the leading share in the gold, silver and jewelry market in China, saw sales on Tmall reach ¥69 million ($10.7 million) in April, representing 12.0% year-over-year growth.

- The apparel and footwear sector grew 31.2% year over year in April, the second-strongest growth rate. The sector saw the largest year-over-year decline in the same period of last year, of 18.5%. The two-year growth rate of this sector was only 3.0%. After a boycott of international brands triggered by Xinjiang incidents, Adidas and NIKE saw sales on Tmall drop by 78% and 59%, respectively, year over year in April, according to research firm Morningstar. Some domestic brands have become the beneficiaries of shifted consumer spending, including Li Ning, which saw sales on Tmall jump by more than 800% in April.

- The construction and decoration material sector saw strong growth of 30.8% in April, the third-strongest growth rate. However, if we compare the absolute value with pre-pandemic numbers, the sector saw only a low-single-digit increase from April 2019, of 2.6%.

- The alcohol and tobacco sector grew 26.2% year over year in April and 25.9% from 2019. Many traditional wine companies have transformed and expanded their online business under the influence of Covid-19 pandemic. According to a 2020 survey conducted by research firm iiMedia Research, 58.2% of consumers who purchased alcohol online did so via multicategory e-commerce platforms, followed by alcohol vertical e-commerce platforms, which accounted for 38.0% of consumers.

- Sales by beverage retailers grew 22.3% year over year and climbed by 33.5% on a two-year basis. Similar to the alcohol and tobacco sector, traditional retailers have been exploring selling via online channels.

- Beauty retailers experienced 17.8% year-over-year growth in April. Compared to the same period of 2019, sales by beauty retailers saw a 29.5% increase. According to financial firm Huachuang Securities, sales of beauty products on Tmall totaled ¥16.9 billion ($2.62 billion) in April, a year-over-year decrease of 11.7%. However, sales of domestic beauty brands surpassed international brands for the first time, with Huaxizi, Perfect Diary and Proya being the top three domestic beauty brands by sales.

- Food retailers saw steady year-over-year growth of 6.5% in April, following 8.3% growth in March and 10.9% in January and February, as shown in Figure 2. The food sector has performed steadily overall, with little fluctuation related to the Covid-19 crisis. Food saw 18.2% year-over-year growth in April 2020 (the highest growth rate among all sectors), and 9.3% growth in the same period of 2019.

The sector breakdown is based on surveys from enterprises above a designated size, which refers to those with annual sales of ¥5 million (around $730,000) and above

The sector breakdown is based on surveys from enterprises above a designated size, which refers to those with annual sales of ¥5 million (around $730,000) and aboveSource: National Bureau of Statistics[/caption] Online Retail Sales Account for 23.2% of Total Retail Sales In April, online retail sales growth in China reached 6.8% year over year. The channel accounted for 23.2% of total retail sales in the period, a slight decline from 24.4% in March. Online retail sales include food service, as the National Bureau of Statistics does not provide online data that excludes food service. In Figure 3, online sales are benchmarked to total retail sales. Figure 3. Online Retail Sales as % of Total Retail Sales (incl. Automobiles, Gas and Food Service) [caption id="attachment_127363" align="aligncenter" width="720"]

Online retail sales include food service

Online retail sales include food serviceSource: National Bureau of Statistics[/caption]