DIpil Das

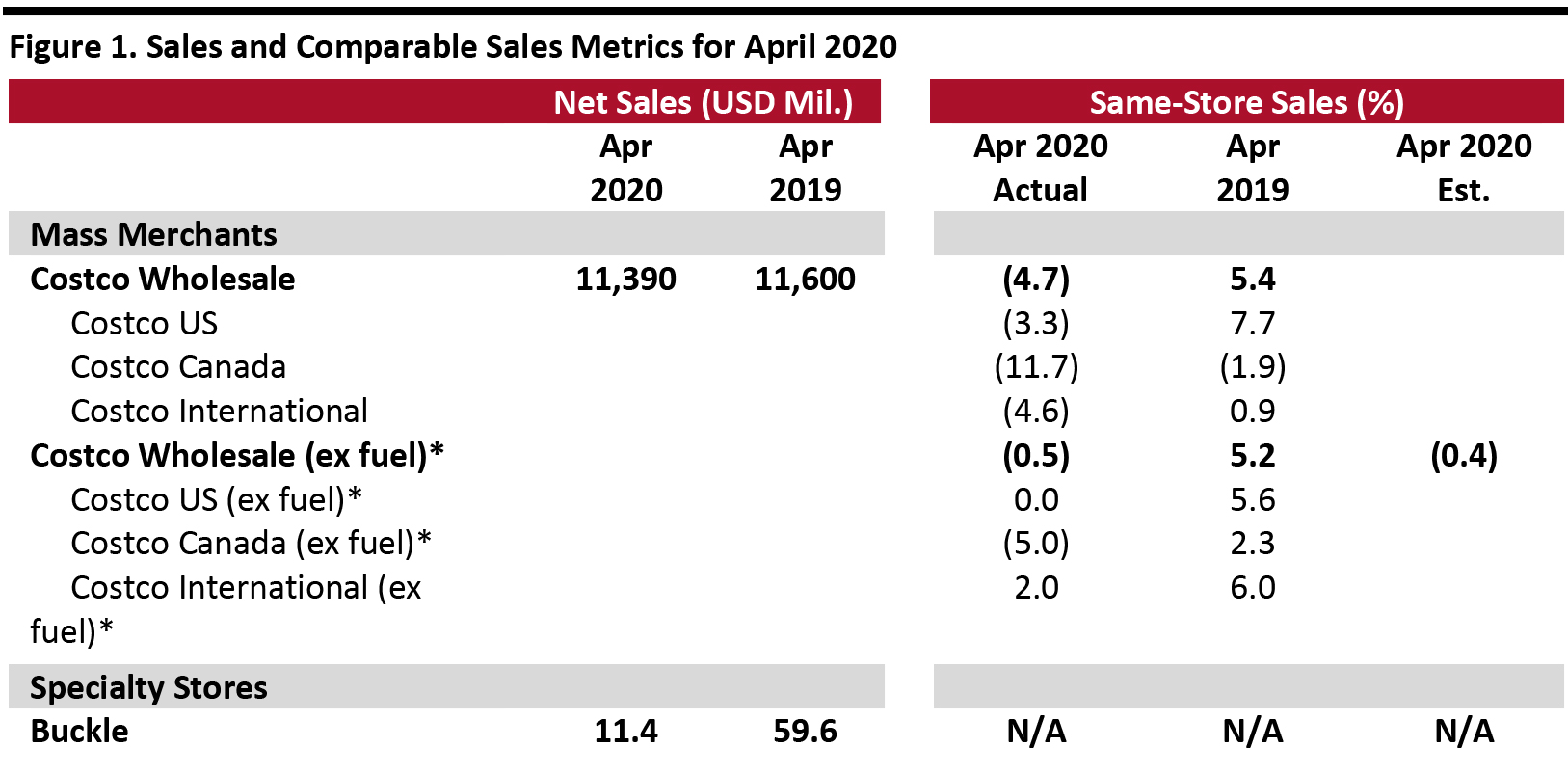

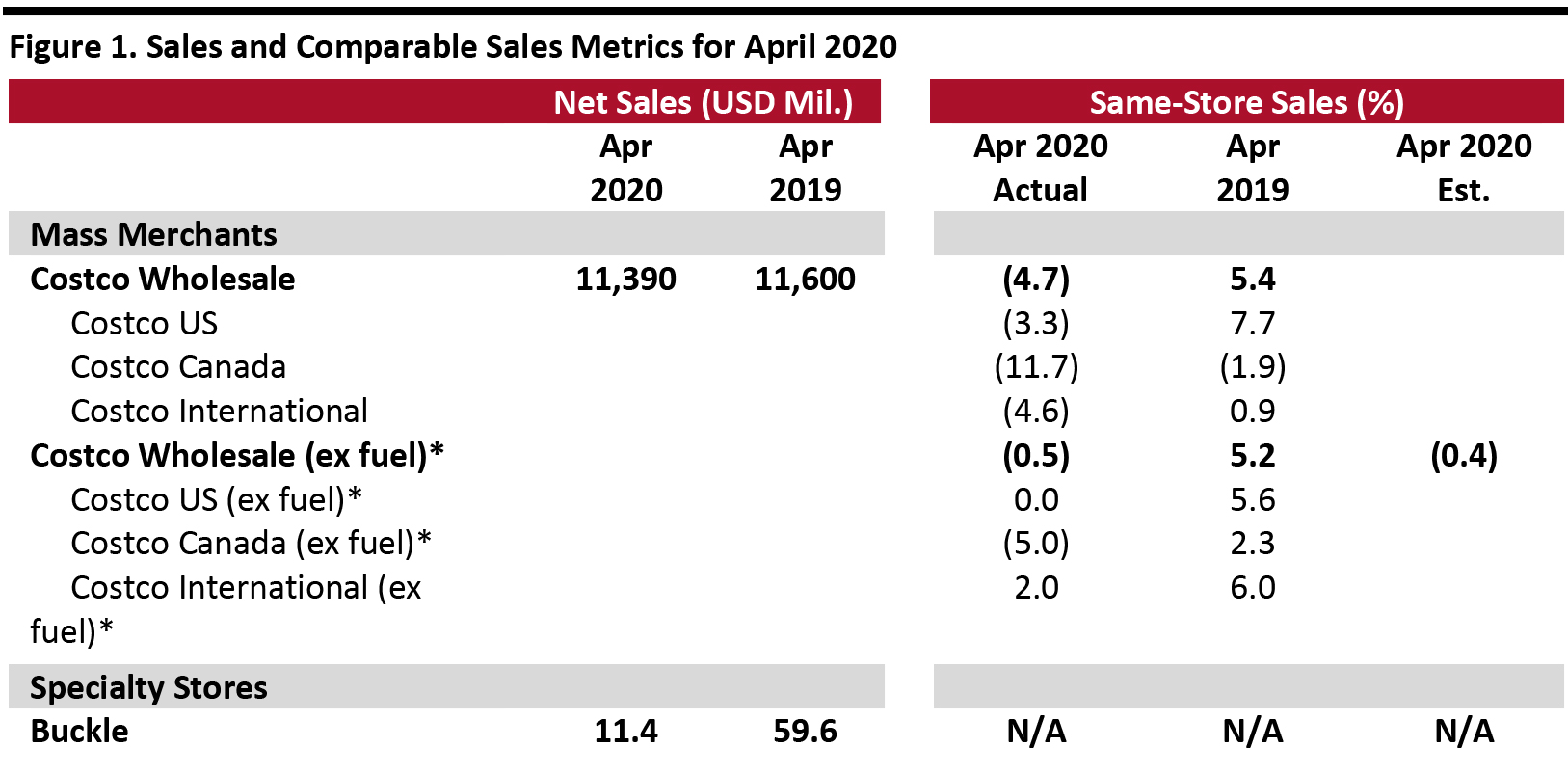

[caption id="attachment_109446" align="aligncenter" width="700"] *Excluding the impact from changes in gasoline prices and foreign exchange

*Excluding the impact from changes in gasoline prices and foreign exchange

Source: Company reports/StreetAccount [/caption] Costco Comps Decline; Online Comp Growth Accelerates

*Excluding the impact from changes in gasoline prices and foreign exchange

*Excluding the impact from changes in gasoline prices and foreign exchange Source: Company reports/StreetAccount [/caption] Costco Comps Decline; Online Comp Growth Accelerates

- In April (specifically, the four weeks ended May 3), Costco’s global same-store sales were down 4.7%, declining from March’s 9.6% growth. Excluding the impact from changes in gasoline prices and exchange rates, global comps were down 0.5% in April, declining from 12.3% growth in March and below the consensus estimate of a 0.4% decline recorded by StreetAccount.

- Costco’s US comps were down 3.3% compared to March’s 10.7% growth. Excluding gasoline price changes, Costco US comps were flat in April, versus 12.1% in March. In the US, the regions with the strongest results were the Northeast, San Diego and Texas. Internationally, Costco saw the strongest results in Korea, Taiwan and the UK.

- Excluding currency effects, Costco’s global online comparable sales grew 87.7% in April, compared to March’s 49.8% growth.

- Owing to the limited services at food courts, closures of the majority of its optical, hearing aid and photo departments, and lower volume and price deflation in the gasoline business, Costco’s April sales were negatively impacted by about 12 percentage points, of which 70% is related to gasoline.

- Currency fluctuations negatively impacted overall comps by about 130 bps. Same-store sales in Canada were negatively impacted by around 420 bps by foreign exchange rates, while Costco’s “other international” segment was hurt by about 540 bps.

- In the merchandise segment, excluding currency effects, comparable growth for food and sundries was positive, in the mid-teens in percentage terms: Food, frozen foods and cooler departments showed the strongest results. Hardlines posted positive comps in the low, single digits: Consumer electronics, seasonal and lawn and garden performed better than other departments. Softlines were down, in the low-20s in percentage terms: Luggage, apparel and jewelry performed worse than other departments.

- Fresh-food comparable sales were up in the low-20s in percentage terms, with meat and produce performing better than other departments.

- The ancillary businesses were down 50% as a result of store closures and low gasoline sales during the coronavirus lockdown.

- Gasoline price deflation negatively impacted total comps by about 3%, with the overall average selling price decreasing to $1.94 per gallon this year from $3.12 last year.

- As of May 6, 2020, the company operated 787 warehouses (547 in the US), versus 772 warehouses (535 in the US) on May 9, 2019.

- Buckle’s total net sales for the four-week period ended May 2, 2020 nosedived 80.8.% year over year after March’s 50.2% decrease.

- Due to the coronavirus outbreak, Buckle closed all of its brick-and-mortar stores for an indefinite period beginning March 18, 2020. Following the relaxations in state and local guidelines, the company began reopening select stores on April 26, 2020, and it had reopened 37 stores as of May 2, 2020. Buckle also stated that it plans to report only total net sales each month and would not separately report comparable store sales during this time due to the store closures.

- As of May 7, 2020, the company operates 446 stores across 42 states.