DIpil Das

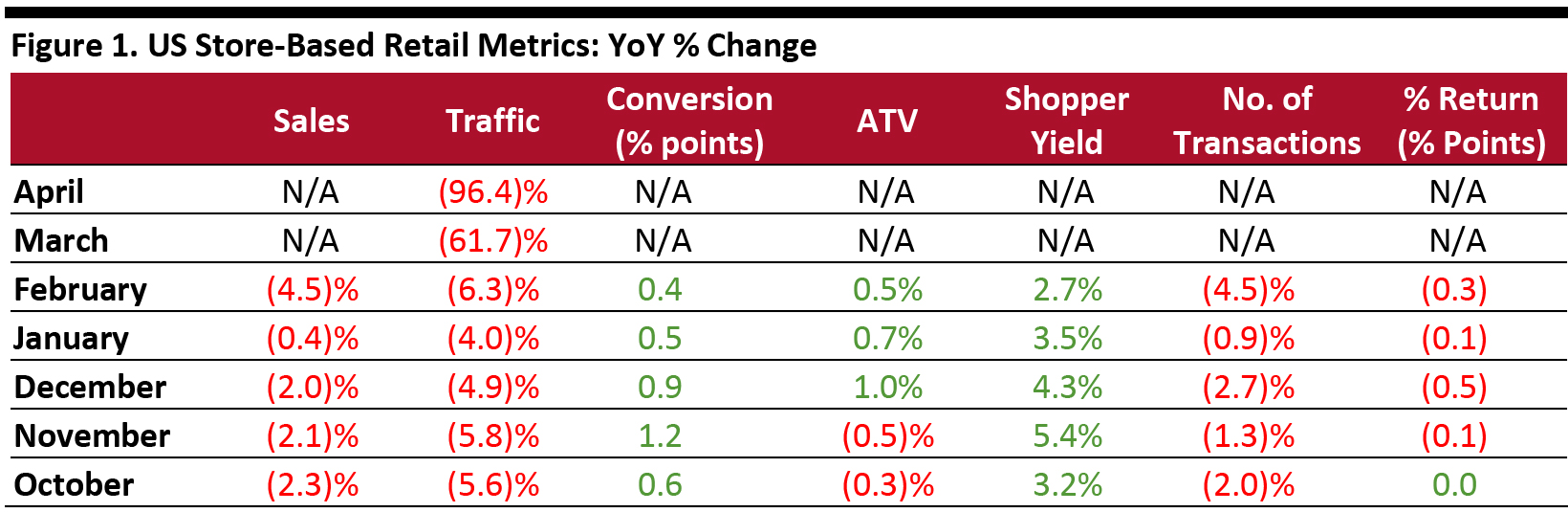

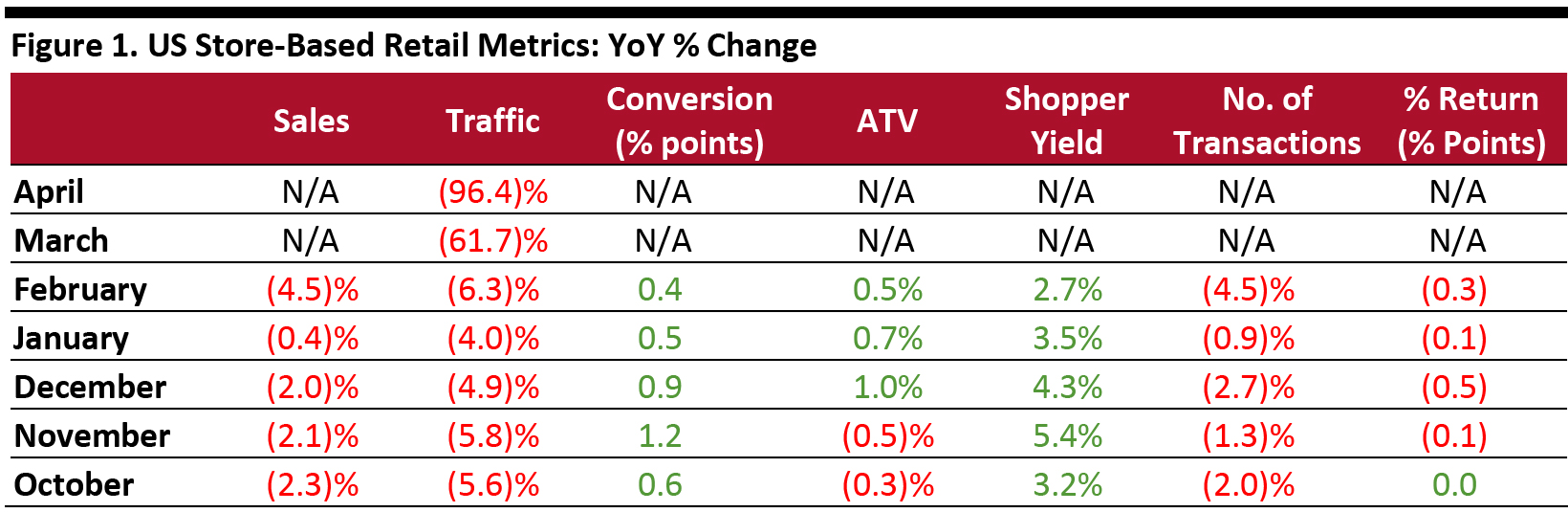

The Coresight Research US Retail Traffic and In-Store Metrics report reviews year-over-year changes in selected store-based metrics, as reported by RetailNext. In this month’s report, we review store traffic changes through April, when nonessential businesses were shutdown throughout most of the month across the country due to coronavirus lockdowns. However, in the last week of April, several states started to relax their restrictions and implemented reopening plans for nonessential businesses.

RetailNext’s coverage does not include food retailers but does include some other retail sectors deemed essential; the exclusion of food retail means the figures cited below almost certainly overstate recent declines in total retail traffic.

Retail traffic dropped by 96.4% year over year in April, following a sharp decline of 61.7% in March.

Weekly data for April tracks the progress of store closures over four weeks (April 5–May 2, 2020):

ATV = average transaction value, % return = percentage of goods returned to stores

ATV = average transaction value, % return = percentage of goods returned to stores

Source: RetailNext [/caption] Nonessential retailers have been severely impacted by lockdowns, with several sectors seeing near-100% declines across April.

- The first week saw a decline of 97.0%, in line with the reported 97% of retailers that closed their stores, according to survey data from RetailNext’s CEO Retailer Pulse, which surveyed retail CEOs and other business leaders in March and April to understand their views on how the lockdown was affecting their businesses.

- Declines stood at 97.7% in the second week and 97.5% in the third week.

- In the fourth week, traffic declines improved marginally to 93.5%, as a few states began to ease lockdown restrictions and initiate reopening plans. Alabama, Alaska, Georgia, Kentucky, Michigan, Minnesota, Mississippi, Montana, Oklahoma, South Carolina, Tennessee and Vermont allowed reopenings (some with conditions) toward the very end of April.

- Other than traffic, RetailNext did not publish the metrics for which it typically provides data, such as shopper yield and conversion rate.

RetailNext's traffic data are based on visits to specialty and larger-format nonfood retail stores.

[caption id="attachment_110389" align="aligncenter" width="700"] ATV = average transaction value, % return = percentage of goods returned to stores

ATV = average transaction value, % return = percentage of goods returned to stores Source: RetailNext [/caption] Nonessential retailers have been severely impacted by lockdowns, with several sectors seeing near-100% declines across April.

- The apparel sector experienced the largest traffic decline at 99.7%, followed by the footwear sector with a 99.4% decline in traffic.

- The home sector posted the lowest decline in traffic at 89.0%. The jewelry sector saw traffic decline at 99.1%.

- The Northeast saw the largest, consistent traffic decline of almost 100% in the first three weeks, due to travel bans and lockdown restrictions—with New York City and surrounding areas considered to be the epicenter of the Covid-19 pandemic. The fourth week saw a slightly improved decline of 96.8%.

- The South region posted the lowest decline in traffic, at 95.0%, as southern states were the last to mandate restrictions and started to reopen businesses in the fourth week, lowering the impact of the lockdowns.

- The Midwest and West saw traffic decline at 96.5% and 96.6% respectively.