albert Chan

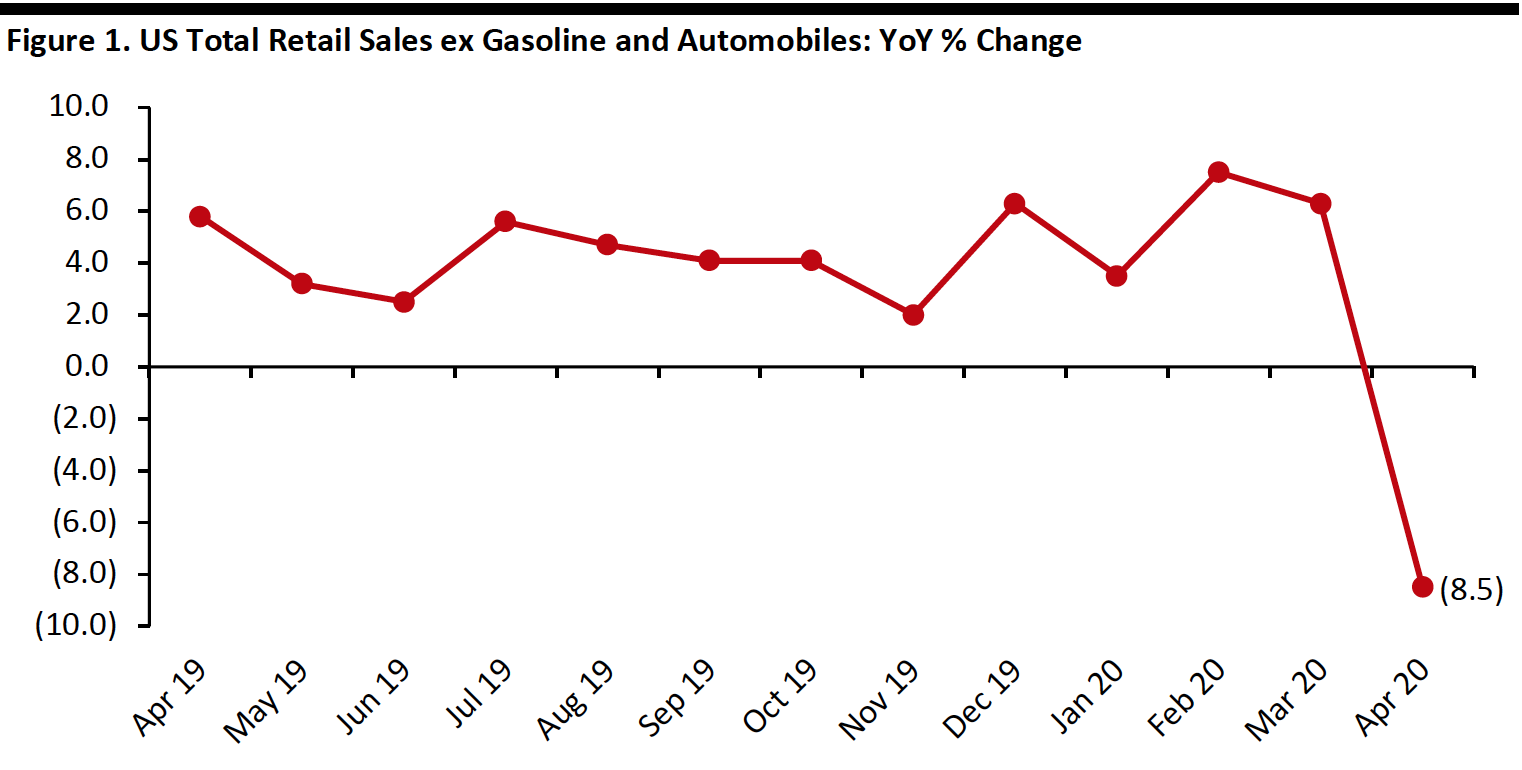

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric turned negative in April at (8.5)%, compared to March’s 6.3% rate. This total figure reveals a deep divide in performance by sector, as we detail later.

A full-month shutdown of nonessential retail in April, coupled with lower levels of grocery stockpiling after an initial surge, resulted in a high-single-digit decline in total year-over-year retail sales. In the US, temporary store closures began in the week of March 8–14 and peaked in the week of March 15–21. In May, some of the stores around the country are reopening as states and local governments ease lockdowns and travel restrictions. However, we expect the recovery in retail sales to be gradual as reopening occurs in phases and consumers exhibit caution on the back of economic and labor-market shocks.

[caption id="attachment_109792" align="aligncenter" width="700"] Data is not seasonally adjusted

Data is not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption]

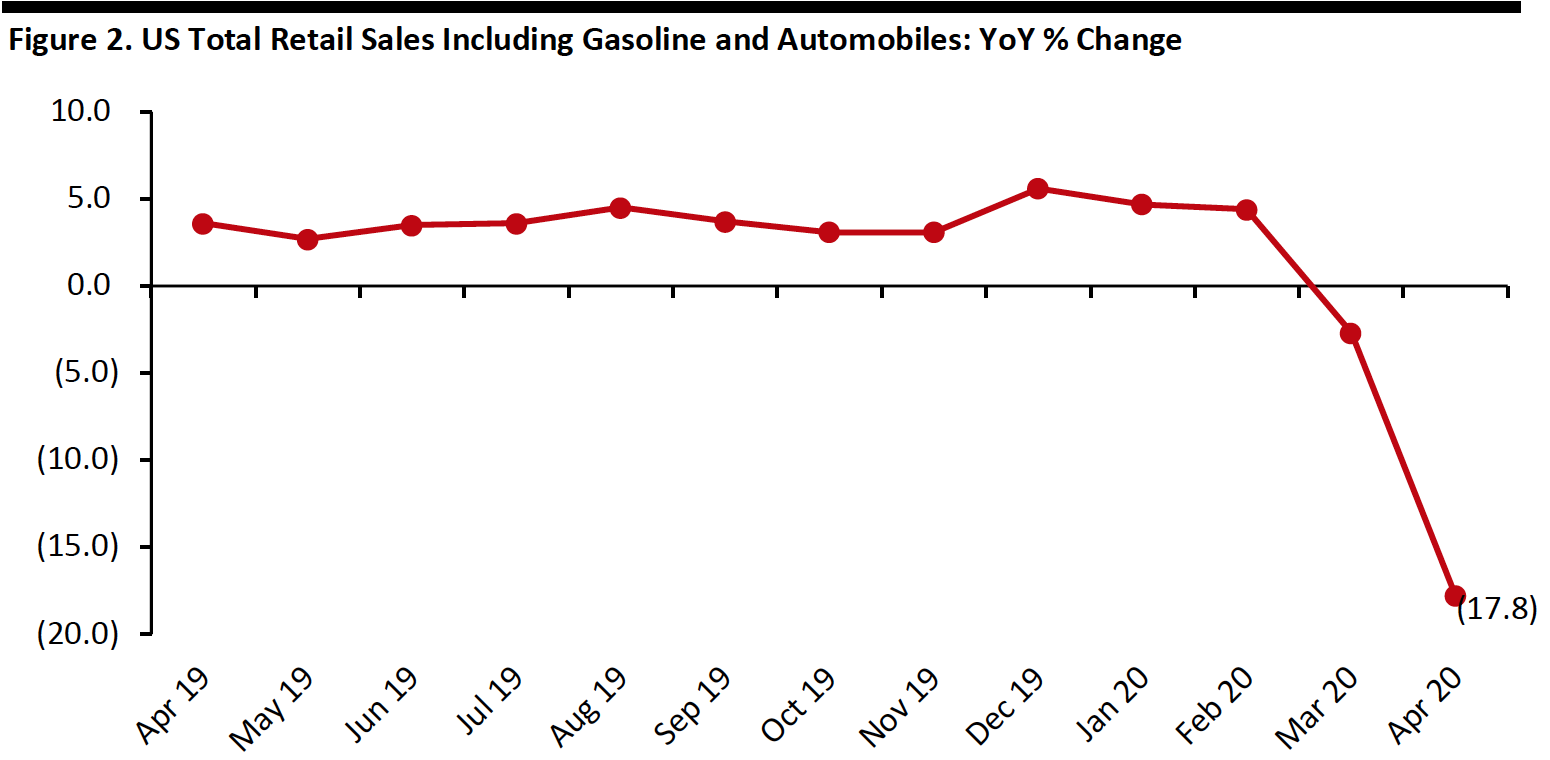

Retail Sales Decline Month over Month

The Census Bureau’s core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure declined 17.8% year over year in April, following March’s 2.7% slide.

On a month-over-month basis and seasonally adjusted, retail sales declined by 15.1% in April.

[caption id="attachment_109793" align="aligncenter" width="700"] Data is seasonally adjusted

Data is seasonally adjustedSource: US Census Bureau[/caption]

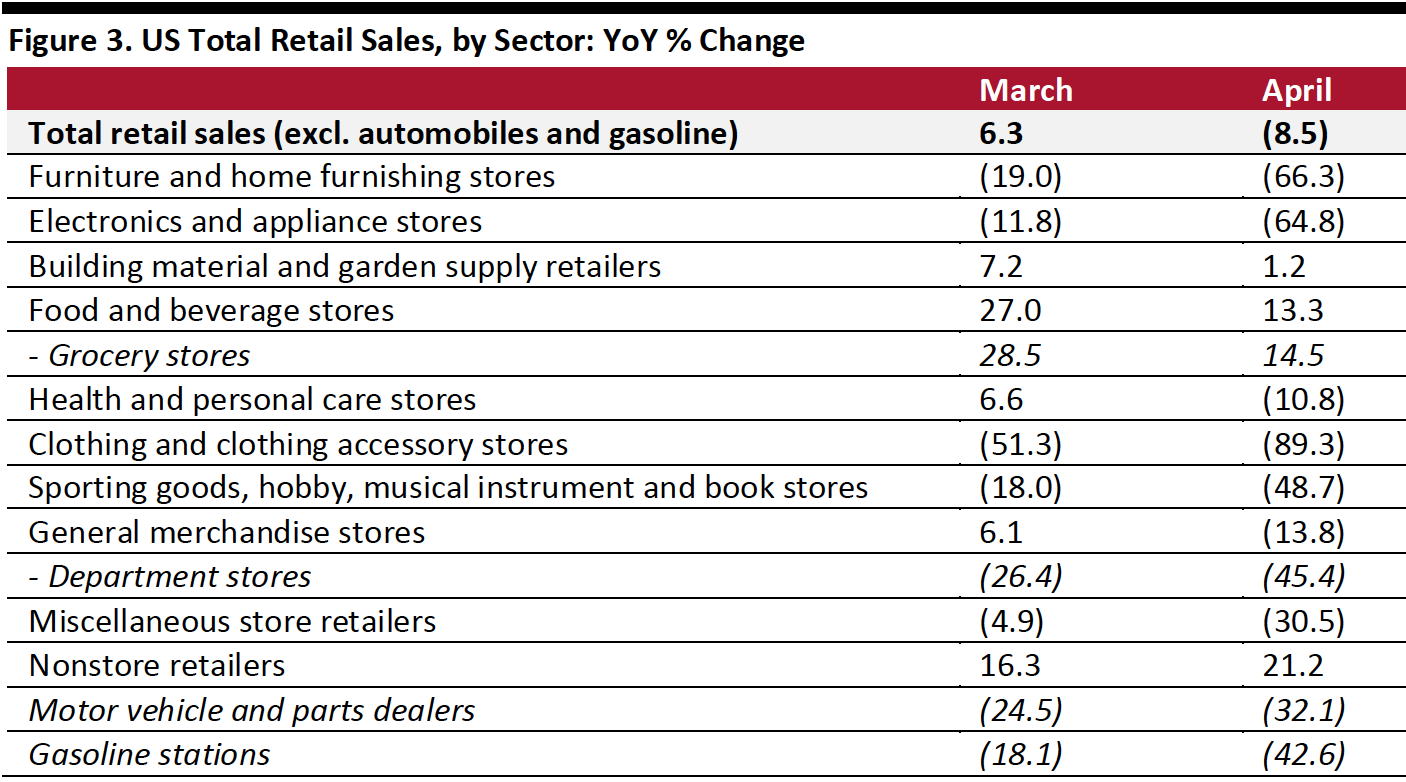

Retail Sales Growth by Sector

Most sectors witnessed deeply negative sales growth in April—including furniture and home-furnishing stores, clothing stores, department stores, electronics and appliance stores and sporting goods stores—due to the almost total shutdown of stores and a further cut back in discretionary buying amid the coronavirus crisis.

As we recently estimated from our weekly survey findings, apparel continues to be the number-one category for cutbacks. Clothing-store sales nosedived 89.3% in April after plunging 51.3% in March, hit by store closures coupled with the sharp decline in the demand for outfits for work and leisure. Sales at department stores (a subset of general-merchandise stores and weighted toward apparel) plunged 45.4% in April after March’s 26.4% slide.

Given nonessential stores were closed, we see the figures reported for department stores as surprisingly robust, particularly given the disparity with the decline at clothing stores. We estimate e-commerce accounts for approximately one-fifth of department-store sector sales; in order to retain the 55% of sector sales implied by the Census Bureau data, online sales in the sector would have had to have more than doubled—and this was in the context of much-reduced demand for discretionary goods such as apparel. We believe these advance estimates may be adjusted lower in subsequent months.

Similarly, the performance reported for big-ticket retailers—furniture and electronics/appliance stores—were less deep than may have been expected, given the context of restricted supply and muted demand. Sales in these sectors were down by around two-thirds, implying substantial sales retention through e-commerce.

Sales growth at grocery stores decelerated to 14.5%, from 28.5% in March, due to lower levels of stockpiling after an initial surge in late February and March. In April, grocery-store sales growth remained slightly above the overall food sector’s 13.3% growth.

Health and personal care stores saw a sales decline of 10.8% in April versus March’s 6.6% increase. This total figure will mask a polarization between essential retailers such as pharmacies and discretionary retailers such as beauty stores—which had shuttered stores from March.

Home-improvement stores were deemed to be essential retailers, explaining the positive 1.2% growth for building material and garden-supply retailers.

Online-only retailers continued to gain momentum, including for essentials: Nonstore retailers, which include e-commerce firms, saw sales growth accelerate to 21.2% in April from 16.3% in March. The decline of gasoline-station sales worsened to 42.6% in April.

[caption id="attachment_109796" align="aligncenter" width="700"] Data is not seasonally adjusted

Data is not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption]