albert Chan

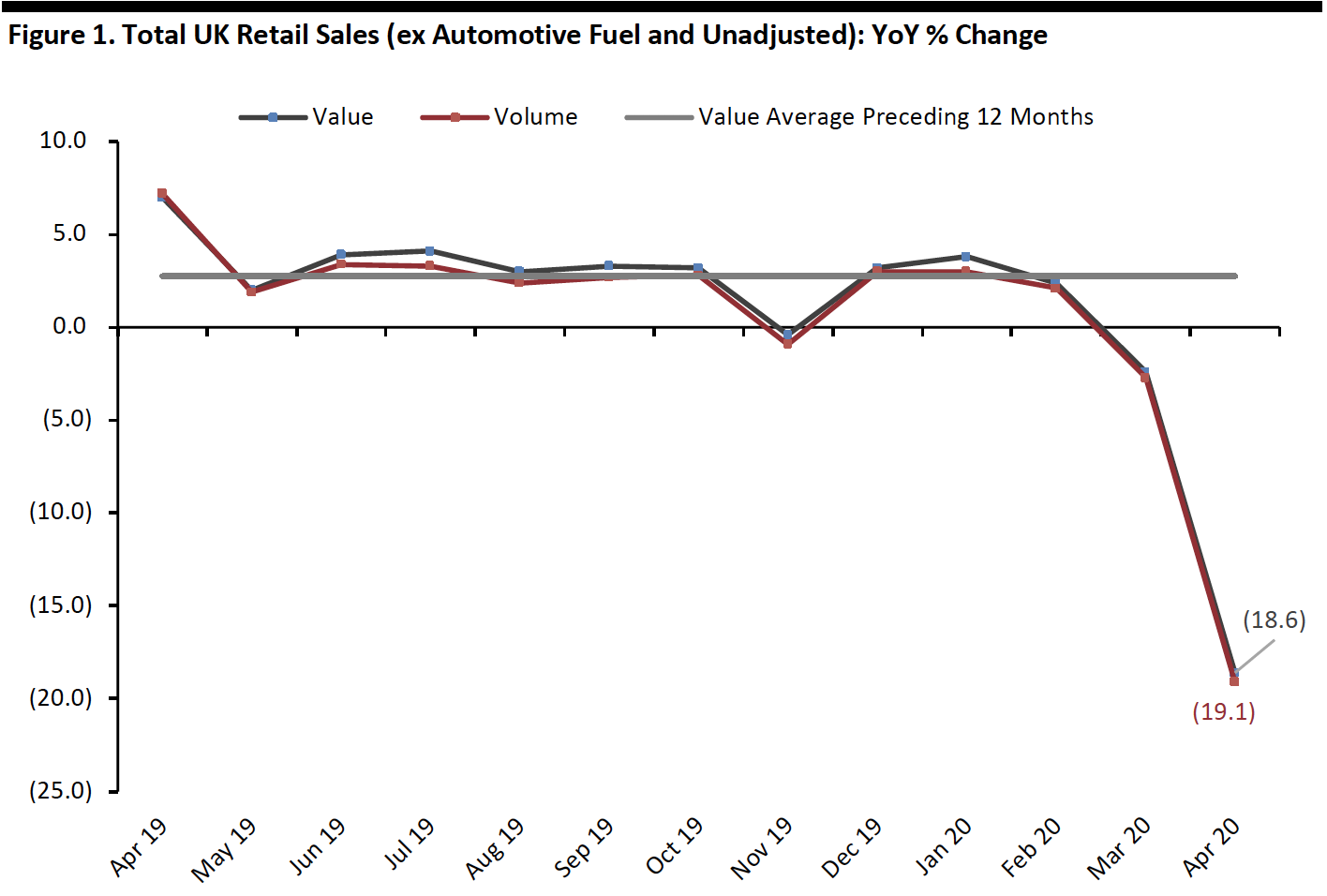

UK retail sales slumped 18.6% in April 2020, reflecting the impact of the lockdown measures that were implemented to contain the spread of the coronavirus—with all nonessential stores being closed throughout April.

The lockdown measures not only exposed a sharp contrast between essential and discretionary sectors but also between online and in-store retail, as many physical stores were temporarily closed. While store-based sectors took a big hit, online sales continued to gain momentum.

[caption id="attachment_110149" align="aligncenter" width="700"] Data in this report is not seasonally adjusted

Data in this report is not seasonally adjustedSource: ONS/Coresight Research[/caption] The UK was put into lockdown on March 23, initially for three weeks, in an attempt the limit the spread of the coronavirus. On April 16, the government announced the extension of the lockdown by another three weeks. On May 11, Prime Minister Boris Johnson announced that the government would ease restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. We expect that the recovery in retail sales will be gradual as consumers exercise caution in the wake of the economic shock and dislocation of precrisis behaviors.

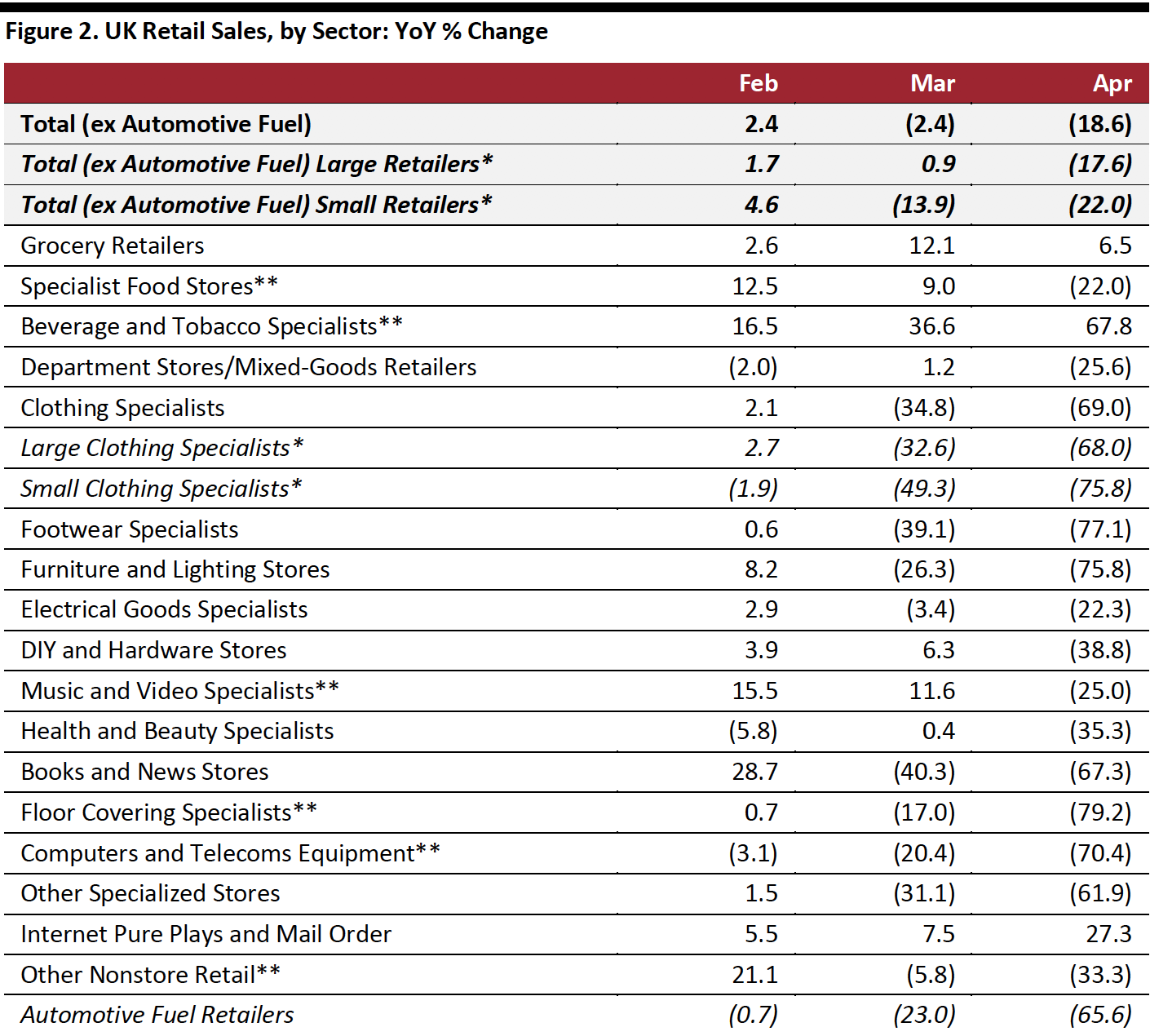

Retail Sales Growth by Sector

In total, store-based nonfood retailers’ sales fell 54.6% in April. Stores selling clothing and footwear, furniture and lighting, and floor coverings were hit especially hard in April. However, a few bright spots included grocery retailers, alcohol and tobacco stores, and Internet pure plays.

After sales in March surged to 12.1% due to stockpiling trends, the grocery sector reported an increase of 6.5% in April. Alcohol and tobacco store sales remained at elevated levels, suggesting that stay-at-home Brits have been drinking more during lockdown.

Clothing stores took the biggest hit, with sales plummeting by 69.0%, while footwear slid 77.1%. Although these declines were deep, they do imply that clothing specialists were able to retain 31.0% of sales, and footwear specialists 22.9% of sales, during widespread, coronavirus-led store closures, predominantly through e-commerce.

The health and beauty sector reported a lower decline of 35.3%; healthcare stores such as pharmacies were allowed to remain open in lockdown, and sales by non-healthcare stores will have been captured predominantly by e-commerce.

Across nonfood retail, the deep declines conceal meaningful retention of sales through online retail: The figures in the table below imply a near-one-quarter retention of sales at furniture and lighting retailers and a very substantial 77.7% retention of sales at electrical goods specialists—which broadly aligns with indications from market leader Dixons Carphone in late-April that it had recouped almost two-thirds of store-based sales through e-commerce.

Department stores/mixed-goods retailers saw a 25.6% decline in April. This sector is a mix of full-line department stores such as John Lewis and mixed-goods retailers such as Argos and B&M. Under lockdown restrictions, department stores are closed, but some mixed-goods retailers can open where their product mix classifies them as essential (for example, they sell food and other essentials). Strong online demand at some retailers supported this relatively modest decline. John Lewis management reported on April 21 that online sales were up 84% year over year from the middle of March. Argos grew its sales by 9% in the seven weeks ended April 25—despite trading online only from March 23 (Argos continues to offer buy-and-collect services from its stores within Sainsbury’s supermarkets, but its 573 standalone Argos stores are shut).

Hardware stores were deemed essential and allowed to open, although such openings were highly selective. DIY market-leader B&Q saw strong online demand, in part due to consumers looking for spring-summer outdoor-living products. As we discuss later, online sales at household-goods retailers (which includes DIY retailers) more than doubled in April, according to the ONS.

The ONS recorded shop-price inflation of 0.6% in April, up slightly from 0.3% in March. In April, food-store inflation stood at 1.2%, versus 1.1% in March. Amid declining demand, deflation among nonfood retailers deepened to (1.1)% in April, versus (0.7)% in March.

[caption id="attachment_110157" align="aligncenter" width="700"] *A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers**A relatively fragmented sector, in which reported figures have traditionally been volatile

Source: ONS[/caption]

Online Retail Sales Surge to 30% of All Retail Sales

Total Internet retail sales were up 32.9% year over year in April, versus 12.9% in March. For food retailers, Internet sales were up 83.6% in April, versus 19.9% in March.

In April, Internet sales were up 35.0% at store-based nonfood retailers, versus 17.8% in March, supported by the strong sales at household-goods retailers, which surged 107.5% (we noted strong demand for DIY retailers online above). Online sales were down 21.0% at clothing and footwear retailers and were up 19.1% at nonstore retailers.Online retail sales accounted for 30.0% of all retail sales in April, up from 21.9% in March. E-commerce accounted for 9.3% of sales at food retailers (versus 5.8% in March) and 43.6% of sales at store-based nonfood retailers in total (versus 21.7% in March).