Source: Company reports/FGRT

Fiscal 4Q17 Results

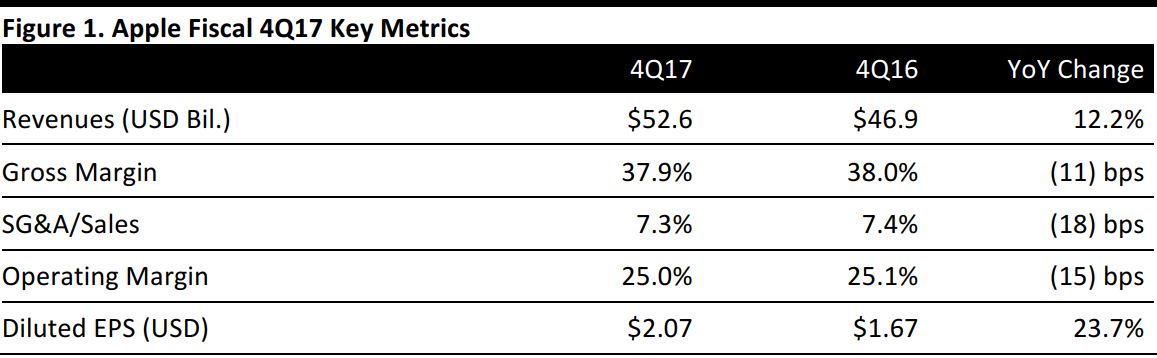

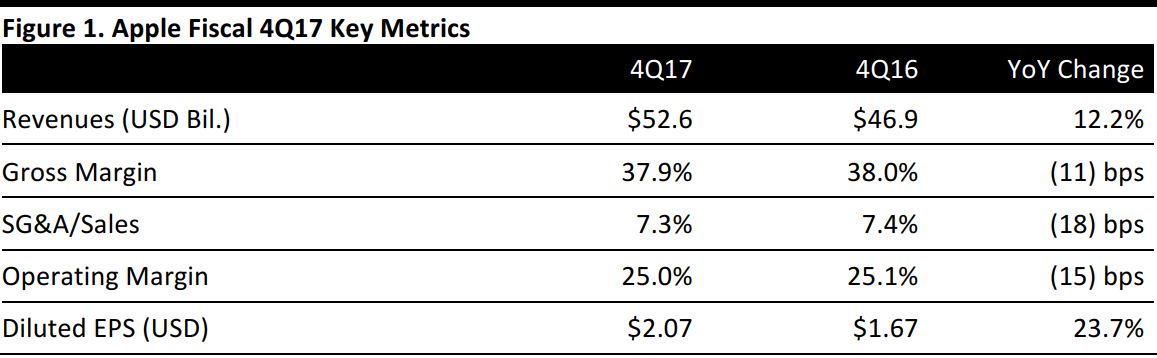

Apple reported fiscal 4Q17 revenues of $52.6 billion, up 12.2% year over year. Revenues were at the low end of the company’s $52–$59 billion guidance range but slightly above the $50.7 billion consensus estimate. The company saw little revenue from its new iPhones in the quarter, since the iPhone 8 began shipping only on September 22 and the iPhone X starts shipping on November 3, i.e., after the quarter’s end.

In the quarter, Apple sold 46.7 million iPhones, above the consensus estimate of 46.4 million units and up 1% year over year, generating revenues of $28.8 billion, up 2% year over year.

Apple sold 10.3 million iPads in the quarter, above the 10.0 million unit consensus estimate and up 11% year over year. iPad revenue was $4.8 billion, up 14% year over year.

Apple sold 5.4 million Macs in the quarter, beating the 5.0 million unit consensus estimate and up 10% year over year. Mac revenues were $7.2 billion, up 25% year over year.

Service revenue—which includes revenue from Digital Content and Services, AppleCare, Apple Pay, licensing, and other services—was $8.5 billion, up 34% year over year.

Revenue from other products—which include the Apple TV and Apple Watch, Beats products, and iPod and Apple-branded third-party accessories—was $3.2 billion, up 36% year over year.

EPS was $2.07, up 23.7% year over year and beating the consensus estimate of $1.87.

Additional Details from the Quarter

CEO Tim Cook called 4Q17 a very strong finish to a great fiscal year, with record fourth-quarter revenue and year-over-year growth in all product categories in addition to being a record quarter for the Service business. New product introductions included the iPhone 8 and iPhone 8 Plus, the Apple Watch Series 3 and Apple TV. Cook offered the following additional points from the quarter:

iPhone

- The iPhone 8 and iPhone 8 Plus began shipping in the last week and a half of September to customers in more than 50 countries, and the launch of the iPhone X is now under way in Australia and Asia.

- The iPhone X includes new technologies such as the TrueDepth camera system, Super Retina display and A11 bionic chip with neural engine.

Mac

- The Mac had its best year ever, posting its highest annual revenue in Apple’s history. The Mac also recorded its best September quarter ever, with revenue growth of 25% driven by notebook refreshes in June and a strong back-to-school season.

iPad

- The iPad saw an 11% increase in unit demand and revenue growth in all geographic segments. iPad results were particularly strong in emerging markets.

- The NPD Group estimates that the iPad had a 54% share of the US tablet market in the September quarter, and that iPad models represented seven of the 10 best-selling tablets.

Apple Watch

- The Apple Watch recorded unit growth of over 50% for the third consecutive quarter, and it remains the best smartwatch in the world. The Series 3, which includes cellular, phone-free connectivity, began shipping just six weeks ago.

Apple TV

- Late in the quarter, Apple launched the Apple TV 4K, which delivers movies and shows in 4K high-dynamic range (HDR) quality and streams live sports and news.

Geography and Apple Stores

- Apple opened a store on Chicago’s Michigan Avenue two weeks ago. It is the first store that brings together Apple’s vision for the future of retail, providing a welcoming place for everyone to experience its products, services and educational programs in the heart of the city.

App Store, Apple Music and Apple Pay

- Both customers and developers have responded positively to the App Store’s new design in iOS 11, as reflected by frequency of customer visits, amount of time spent in-store and number of apps downloaded.

- Apple Music continues to see ever-higher conversion rates.

- Apple Pay was expanded to include Denmark, Finland, Sweden and the United Arab Emirates last month and continues to grow rapidly.

Outlook

Apple guided for fiscal 1Q18 revenues of $84–$87 billion, up 7%–11% year over year and in line with the consensus estimate of $85.2 billion.

The margin and expense ranges the company provided result in a 1Q18 EPS range of $3.56–$3.80 (midpoint: $3.68), in line with the consensus estimate of $3.75.