DIpil Das

What’s the Story?

While the Covid-19 pandemic continues to impact consumers, communities and companies around the world, apparel retailers are reopening stores and trying to get back to business. It is encouraging to see that apparel retailers have been launching curbside-pickup services to meet the digital shift in fashion retail, as well as offering products that align with changing consumer preferences. In this report, we explore the products and services that apparel retailers and brands are launching to adapt to the new retail environment.Why It Matters

More than seven in 10 consumers are buying more online than they used to (across any category), according to Coresight Research’s latest survey of US consumers on August 12, 2020. The growth of e-commerce due to the coronavirus crisis requires retailers and brands to deepen their digital capabilities in order to adapt to consumer trends and shopping habits and thus survive in the fast-changing competitive retail landscape. It is important for apparel retailers to know and invest in omnichannel fulfillment, virtual services and innovative products to keep up with consumer demand for convenience, value and flexibility.Apparel Retailers and Brands Are Launching New Products and Services

Convenience and Curbside Pickup Consumer demand for omnichannel shopping is continuing to grow, particularly with the implementation of social-distancing measures impacting the in-store experience. BOPIS, (buy online, pick up in store) is one omnichannel retail strategy that was gaining momentum among consumers and retailers across the globe prior the crisis. We are now seeing more apparel retailers offering curbside pickup, a variation of BOPIS. According to a CommerceHub survey in July 2020, 14% of US consumers have started using curbside pickup for online apparel purchases, and our August 2020 analysis found that 76% of the top 50 store-based retailers in the US now offer curbside pickup (as discussed in our separate Retail Reimagined report). [caption id="attachment_114790" align="aligncenter" width="700"] Source: Company reports[/caption]

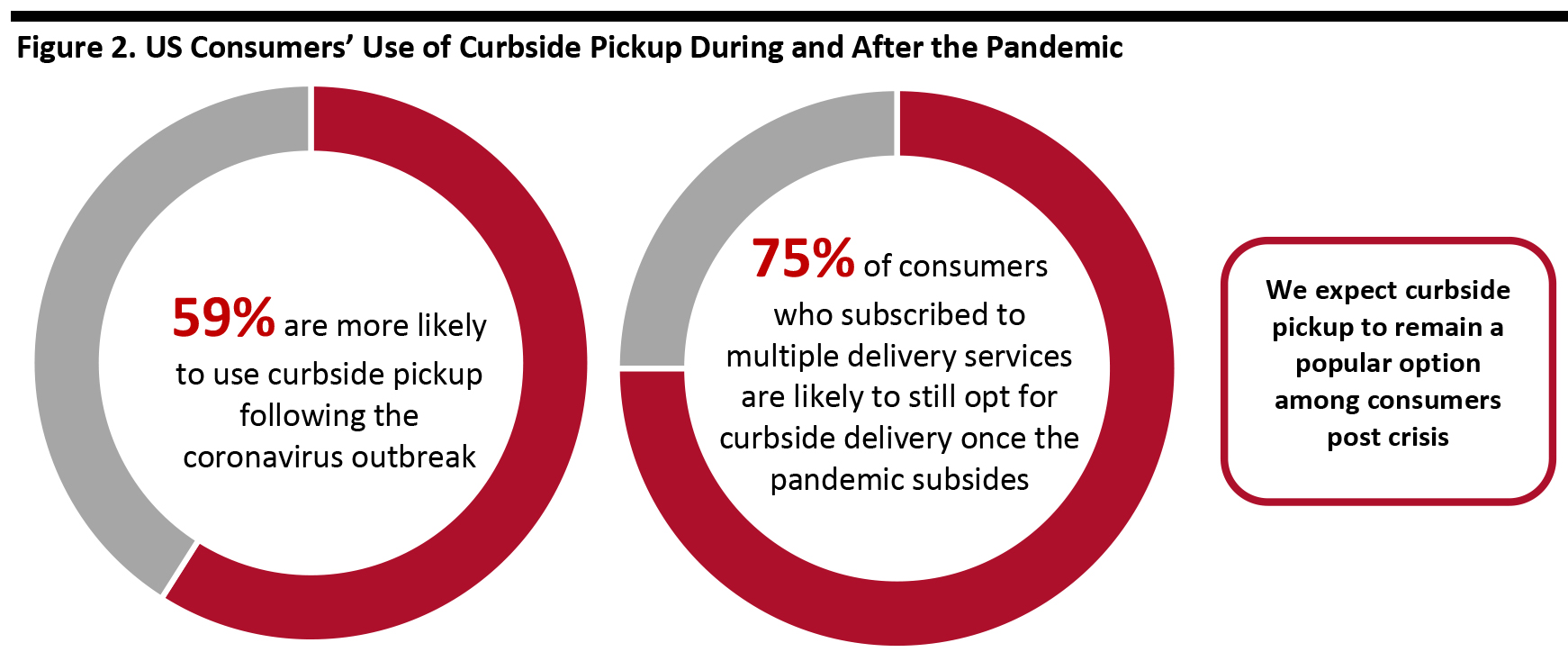

As with BOPIS, curbside pickup can help businesses save on shipping costs and reduce delivery times. We expect curbside pickup to remain a popular option among consumers post crisis: 59% of US consumers said that they are more likely to use curbside pickup following the coronavirus outbreak, and 75% of consumers who subscribed to multiple delivery services said they would likely still opt for curbside pickup once the pandemic subsides, according to CommerceHub’s Consumer Survey in April 2020.

[caption id="attachment_114791" align="aligncenter" width="700"]

Source: Company reports[/caption]

As with BOPIS, curbside pickup can help businesses save on shipping costs and reduce delivery times. We expect curbside pickup to remain a popular option among consumers post crisis: 59% of US consumers said that they are more likely to use curbside pickup following the coronavirus outbreak, and 75% of consumers who subscribed to multiple delivery services said they would likely still opt for curbside pickup once the pandemic subsides, according to CommerceHub’s Consumer Survey in April 2020.

[caption id="attachment_114791" align="aligncenter" width="700"] Base: 1,500+ US consumers

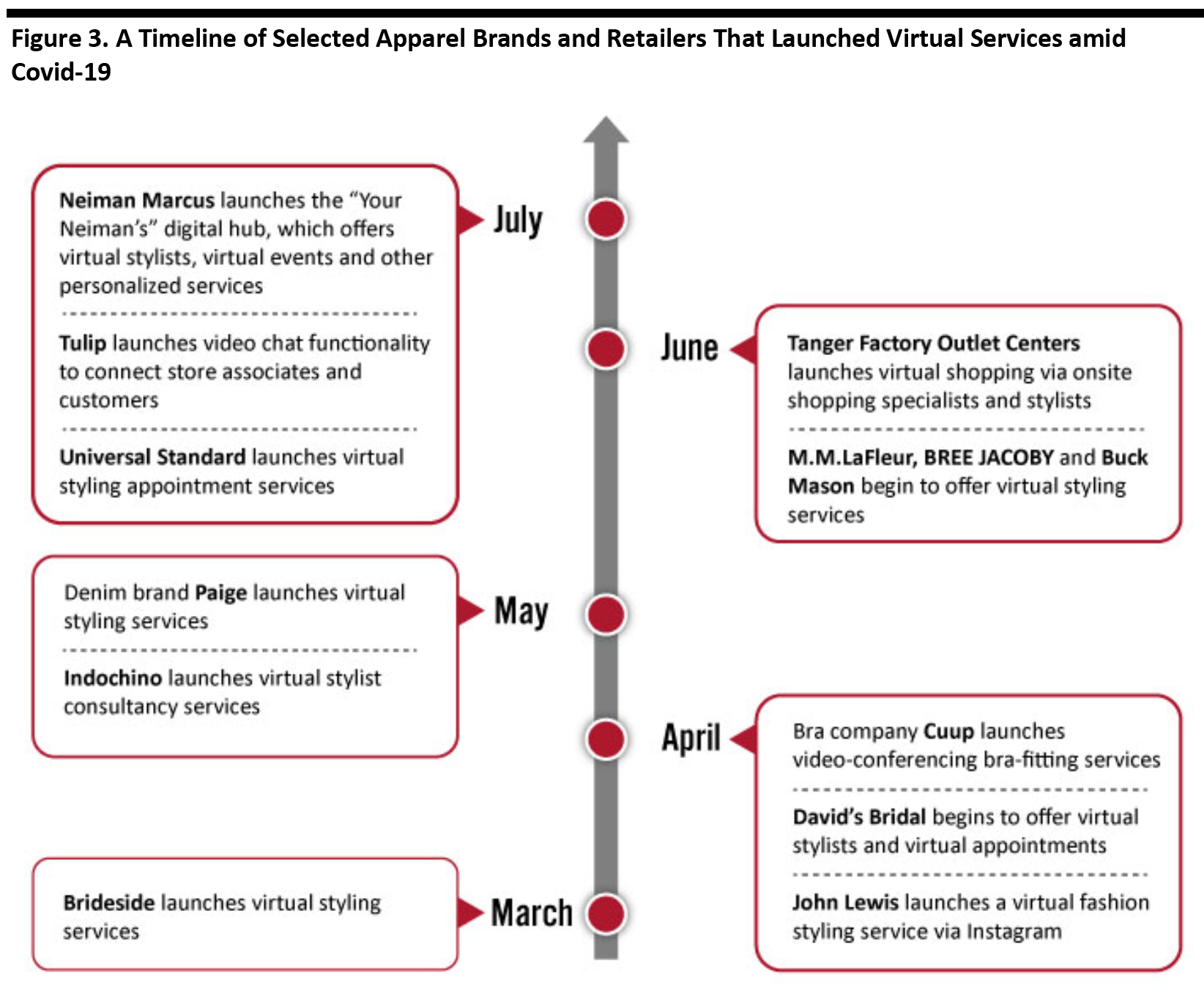

Base: 1,500+ US consumers Source: CommerceHub [/caption] Virtual Services: Transforming the Shopping Experience and Providing More Personalization With retail stores having closed during Covid-19 lockdowns, apparel companies turned to virtual services to communicate with their customers—providing personalized experiences and boosting sales. The majority of apparel retailers that launched virtual services did so through their own websites, although some utilized social media: UK department-store chain John Lewis launched virtual fashion styling services via Instagram. Selected brands and retailers that have launched virtual services in the apparel market are as follows:

- Bra company Cuup launched video-conferencing bra-fitting services in April 2020. During each session, which normally last for around 20 minutes, a member of Cuup’s fit therapist team helps the customer to find the perfect-fitting bra and talk through any issues that the consumer typically has with bras.

- Wedding dress providers such as David’s Bridal and Brideside, and size-inclusive apparel provider Universal Standard, launched virtual stylists and virtual appointments to keep their business operating and attract target customers.

- Bigger retailers that aggregate fashion pieces for sale—such as Neiman Marcus and Tanger Factory Outlet Centers launched digital platforms that offer virtual services, in order to remain competitive.

Source: Coresight Research[/caption]

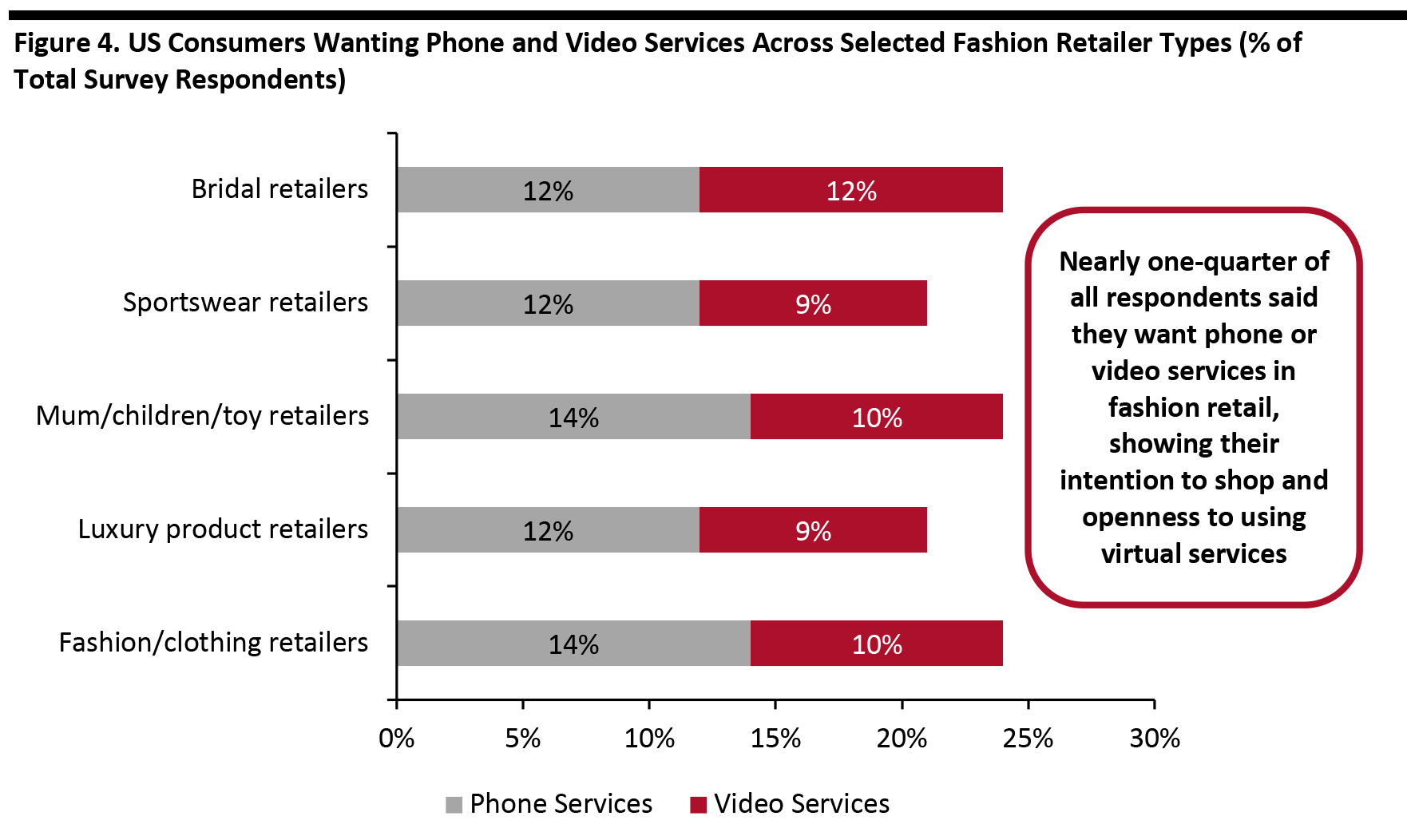

Virtual services provide a channel for consumers to communicate with retailers and brands. Nearly one-quarter of consumers said they want access to phone or video services across fashion retailers, according to a survey conducted in May by Qudini, a retail software company.

[caption id="attachment_114793" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Virtual services provide a channel for consumers to communicate with retailers and brands. Nearly one-quarter of consumers said they want access to phone or video services across fashion retailers, according to a survey conducted in May by Qudini, a retail software company.

[caption id="attachment_114793" align="aligncenter" width="700"] Base: 2,000+ US consumers

Base: 2,000+ US consumers Source: Qudini [/caption] Another important virtual service in the apparel sector is virtual try-on. Before the pandemic, apparel retailers and brands such as NIKE and Rebecca Minkoff incorporated virtual try-on in physical stores but not online. During the pandemic, retailers such as ASOS have incorporated augmented reality (AR) technology into their website or app to allow consumers to digitally see clothing items on different models—although not on themselves. We expect to see AR technology more widely used in both physical stores and online for virtual try-on. We have already seen FIT:MATCH, 3DLOOK team up with mall owners to open spaces where shoppers can receive a 3D body scan to identify their apparel sizes and shop for clothes. The Comfort Trend Stay-at-home measures and self-quarantines due to the coronavirus crisis have prompted consumers to shop for comfortable clothing, as people are staying inside instead of dressing more formally for work—80% of consumers are seeking comfort in clothes, according to a survey conducted by Cotton Incorporated in March 2020. In the US, online sales of pajamas surged by 143% from March to April, while purchases of pants declined by 13% and bra sales declined by 12% in the same period, according to data from Adobe Analytics. Activewear sell-throughs increased by 40% in early April, according to EDITED. We believe that this trend will last for the rest of year and into early 2021. We are seeing brands and retailers adapt to this trend. Multiple apparel retailers are playing with comfortable designs and fabrics to suit consumers’ needs:

- American Eagle Outfitters reported on its recent first-quarter 2021 earnings call that its collections of comfortable soft apparel are in strong demand. High-performing categories during the first quarter included AE's jeans, joggers and fleece and Aerie’s leggings, fleece, bralettes and swimwear.

- Levi’s is in the process of innovating with a focus on comfort, style and sustainable design practices, according to its recent earnings call. The company has introduced cottonized hemp denim, the “High Loose” and “Stay Loose” jeans series, as well as comfortable truckers and denim shirts.

- Old Navy, a Gap Inc. brand, recently launched an apparel collection in partnership with POPSUGAR, to offer an assortment of inclusive styles that are focused on providing comfort.

What We Think

Implications for Apparel Brands and Retailers- To keep up with changed consumer shopping behaviors that we expect to persist post pandemic, brands and retailers could look to launch smarter virtual services and deepen their omnichannel capabilities, such as by offering curbside pickup and alternative fulfillment options for online orders.

- Brands and retailers should optimize their assortment and launch new products to align with consumer preferences and thus boost sales—such as meeting the increased demand for comfortable apparel.