Nitheesh NH

Introduction

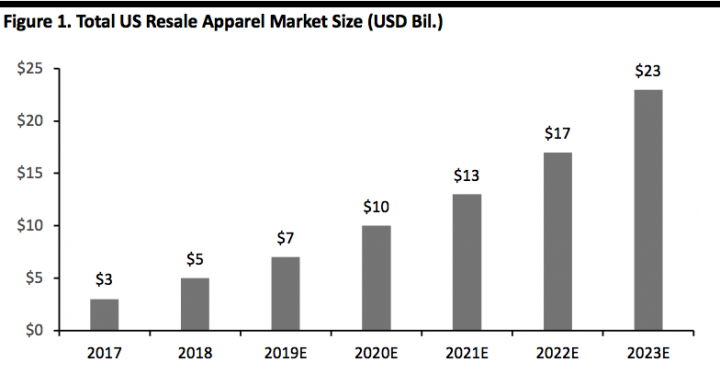

Understanding Recommerce “Recommerce” is buying and selling previously owned goods, sometimes pristine and new, or more often, gently used. In the past few years, a number of digitally native recommerce companies have emerged to make the process easier for buyers and sellers, adopting a variety of business models. The RealReal provide sellers with augmented logistics services such as item photography, pricing, posting inventory information online and customer service, plus authentication of branded goods for buyers. Thrift shops such as Goodwill sell secondhand clothes and other goods, generally at low prices because the goods are donated or may include end of season goods donated by retailers and brands. Some companies are upcycling, a process to convert used goods or materials into new products, sometimes . Brands and retailers such as Eileen Fisher and Urban Outfitters have joined the movement through their recycling programs. A Growing Market The marketplace for online fashion resale continues to evolve and expand rapidly. The global secondhand market for luxury goods was €22 billion in 2018, according to Bain. This year, ThredUP published its seventh annual resale trend report and valued the at $7 billion in 2019. The company expects the market to reach $23 billion in 2023, reflecting a projected 34.6% CAGR. The report also points out that the number of women who bought secondhand products grew 27% to 56 million in 2018 and projects the secondhand market will become 1.5 times the size of the fast fashion market by 2028. The stigma of secondhand is evaporating, to be replaced by conscientious consumption. This is mirrored in by the growing scale of The RealReal’s cumulative members (reported at 11.4 million in March 2019) and its growing assortment, which rose 52% in 2018 as its consignors provided around 2.6 million items to the marketplace. [caption id="attachment_93427" align="aligncenter" width="720"] Source: ThredUP[/caption]

The value of the US thrift market has been growing in the past few years as well, and is expected to reach $10.2 billion in 2019, according to IBIS. The Association of Resale Professionals reports that the number of physical resale locations grew 7% in 2016 and 2017 and that there are approximately 25,000 resale, consignment and not-for-profit shops in the US. We believe positive consumer sentiment towards thrifting will fuel continued growth in retail and subsequently benefit this industry.

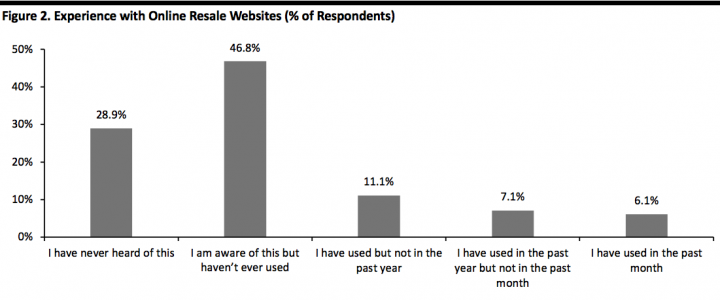

Despite significant growth in the past few years, many consumers are still not aware of or participating in recommerce. A 2019 Coresight Research consumer survey revealed that 28.9% of US respondents had never heard of online resale websites, which indicates the potential for future growth.

[caption id="attachment_93428" align="aligncenter" width="720"]

Source: ThredUP[/caption]

The value of the US thrift market has been growing in the past few years as well, and is expected to reach $10.2 billion in 2019, according to IBIS. The Association of Resale Professionals reports that the number of physical resale locations grew 7% in 2016 and 2017 and that there are approximately 25,000 resale, consignment and not-for-profit shops in the US. We believe positive consumer sentiment towards thrifting will fuel continued growth in retail and subsequently benefit this industry.

Despite significant growth in the past few years, many consumers are still not aware of or participating in recommerce. A 2019 Coresight Research consumer survey revealed that 28.9% of US respondents had never heard of online resale websites, which indicates the potential for future growth.

[caption id="attachment_93428" align="aligncenter" width="720"] Base: 1,037 consumers in the US in 2019

Base: 1,037 consumers in the US in 2019Source: Coresight Research[/caption] Many start-ups have joined the peer-to-peer resale market. Founded in 2009, Tradesy focuses on women’s luxury and contemporary fashion, while Grailed is a peer-to-peer marketplace for men’s fashion that raised $16.5 million in 2018. UK-based social re-commerce app Depop set up a store in SoHo and raised $62 million in June 2019. Drops from streetwear and sneakers have been stimulating the recommerce economy. During a shoe drop, the brands may ask customers to provide several size options to increase the chances of getting one – with the result that the customer may end up with a shoe that does not fit well. In fact, some sneaker drops are so covetable that they sell at a higher price in the aftermarket and some avid sneaker fans have developed thriving businesses selling limited edition sneakers.

Recommerce Landscape

Factors Driving Recommerce Coresight Research sees the dynamic growth of recommerce bucketed loosely into three themes: sustainability and qualitative values; economic values; and, new consumer behaviors. Sustainability and Qualitative Values Sustainability and ecology mindfulness are values shared by an increasing number of consumers. According to Sustain Your Style, the fashion industry is the second largest polluter in the world (after the oil industry): It uses 1.5 trillion gallons of water annually and accounts for 10% of global carbon emissions, not to mention the textile waste that ends up in landfills. Fast fashion is partly to blame. But now, conscious consumption has consumers rethinking their apparel and footwear purchases and increasingly gently used clothing is part of their consideration set. New industry entrants, along with established industry participants, are addressing sustainability as it has become an important differentiator in a crowded market. To reduce the environmental impact of fast fashion on the globe, many consumers are opting for circularity and reduced waste. This eco-mindfulness leads to consumers feeling good about their purchase decisions. Decluttering and simplifying is another trend gaining traction as the popularity of Marie Kondo and her philosophy attests to. Easy access to goods can turn cherished products into commodities. We are witnessing the rapid commodification of many apparel categories and once-loved brands – and growing ease of access and digitalization of the marketplace has accelerated the process. New Consumer Behavior The digital age has brought with it a bevy of new and changing consumer behaviors. For shoppers, the Internet is an endless aisle of alternatives, enabling searching for the lowest price. The Internet facilitates it all. Reducing barriers to entry, consumers participate in marketplace activities, and we have seen a flurry of digitally native brands sprout up alongside new marketplaces. In addition to supporting new retail and recommerce, new forms of retail and commerce are evolving, such as peer-to-peer commerce. Consumers can monetize previous purchases and optimize closet inventory. The rise of social media, such as Instagram, is another force driving recommerce. Consumers, especially influencers, sometimes purchase products to create new content for social media. To keep things interesting, they need new merchandise for the next post. As a result, recommerce is an economic option to salvage value and reduce the cost of content production. And it’s not only the professional influencers: regular consumers often don’t want to appear on social media wearing the same clothing. The taboo of secondhand clothing is diminishing as shoppers enjoy treasure hunt shopping experiences, a sharp price/value proposition and the potential to self-express with unique merchandise that everyone else isn’t wearing. Men are shopping recommerce, too! From designer labels to wear to work apparel, there are dedicated digital recommerce platforms for men as well as shops for both sexes. Streetwear is a growing category for recommerce along with sneakers. Economic Values Baby boomers are downsizing and their millennial offspring aren’t interested in their stuff, despite the fact that they are entering their accumulating years. The result is a steady stream of product for resale, either consigned, donated or sold peer-to-peer. All these unwanted goods can be turned into cash and provide the seller with extra income or a tax deduction when making a donation. Luxury brands, once out of reach for most middle-class consumers, are now attainable via new forms of payment (such as Affirm), rental and subscription (such as Rent the Runway) and second-hand consignment (such as the RealReal and Poshmark). The availability of luxury brands at substantially lower prices is devaluing mid-priced apparel labels and turning fashion brands into commodities as consumers trade up or down the Weinswig Hourglass. Coresight Research CEO and Founder Deborah Weinswig articulated her Hourglass theory more than a decade ago, and we continue to see this play out. This Hourglass model points to the bifurcation of demand in the US consumer market: Retailers and brands in the middle lacking meaningful differentiators are losing share to sharper value/price offerings, and with the savings, trading up to a few choice brands that provide the personalized connection consumers aspire to. A new breed of buyers is meeting new luxury business models, such as resale (often termed recommerce or, where the platform physically processes the products ordered, consignment), rentals and subscriptions. Recommerce is providing consumers the choice of lightly used authenticated designer merchandise at about 80% of the purchase retail full price, attracting new first-time luxury shoppers and propelling recommerce growth. One of the largest luxury consignment startups, The RealReal, is built on authenticating luxury products and eliminating the risk of counterfeit goods. The RealReal provides entry to first-time, value-focused buyers, including younger shoppers. Buyers and sellers get maximum value out of luxury goods. Even the luxury brands have taken notice and are beginning to work with The RealReal. Levesque pointed to the company’s partnership with designer Stella McCartney under which consignors at The RealReal earn a Stella McCartney gift card when they consign a Stella McCartney product, and more partnerships are in the works. Online Marketplace Recommerce Players Online marketplace recommerce companies have been driving growth. Unlike traditional brick-and-mortar stores, online marketplace players significantly expands sellers’ customer reach from people around the corner to millions all over the world. Those companies usually offer a similar end-to-end service. Sellers have the option of the following consignment methods:- In-home consultation and pickup.

- Drop off at physical locations.

- Complimentary shipping directly to fulfillent facilities.

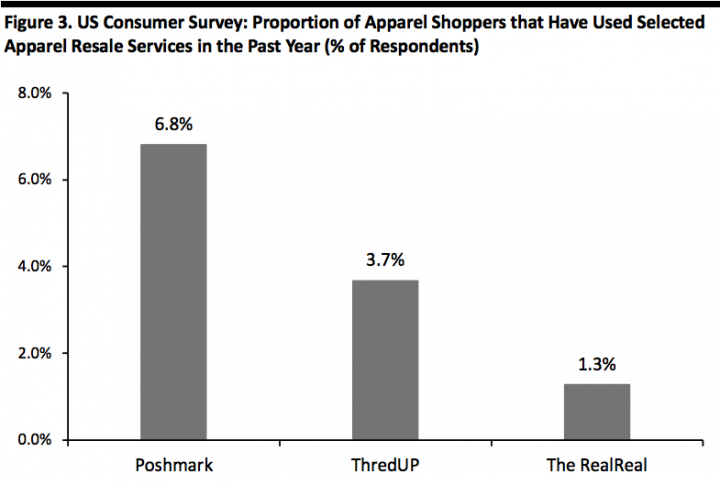

Base: 1628 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months as of January 2019

Base: 1628 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months as of January 2019Source: Coresight Research[/caption] [caption id="attachment_93430" align="aligncenter" width="720"]

Source: Company reports[/caption]

Poshmark

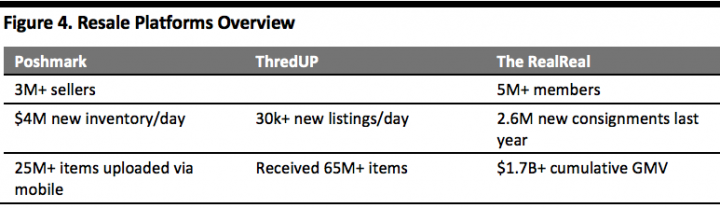

Poshmark is a peer-to-peer social commerce marketplace. Unlike other recommerce platforms, customers can post and share pictures of their styles on Poshmark. The website has over 5,000 brands available for purchase and more than two million Seller Stylists who comment on customer listings.

Since its launch in 2011, the company has seen over 25 million items uploaded via mobile phone and over 3 million sellers posting $4 million worth of inventory on the platform every day. In total, sellers have made more than $1 billion, according to CEO and founder Manish Chandra.

ThredUP

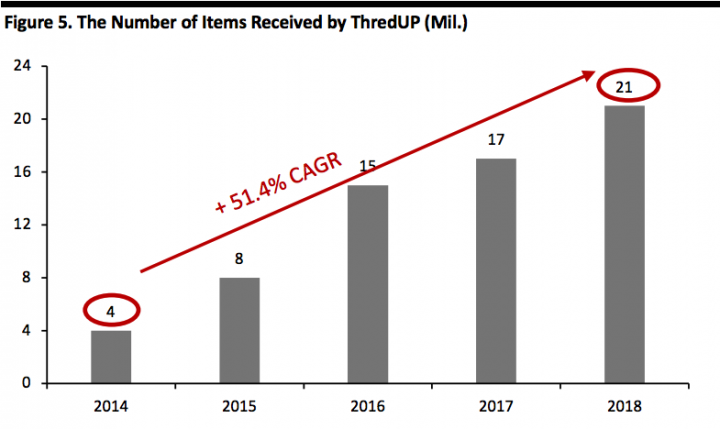

ThredUP is an online marketplace for used products from over 35,000 brands, including H&M and Louis Vuitton. Launched in 2009 as a men’s shirt exchange company, the company has been growing significantly. Last year, ThredUP received 21 million items, reflecting a four-year-CAGR of 51.4%.

In its 2019 annual resale trend report, the company provided the following information:

Source: Company reports[/caption]

Poshmark

Poshmark is a peer-to-peer social commerce marketplace. Unlike other recommerce platforms, customers can post and share pictures of their styles on Poshmark. The website has over 5,000 brands available for purchase and more than two million Seller Stylists who comment on customer listings.

Since its launch in 2011, the company has seen over 25 million items uploaded via mobile phone and over 3 million sellers posting $4 million worth of inventory on the platform every day. In total, sellers have made more than $1 billion, according to CEO and founder Manish Chandra.

ThredUP

ThredUP is an online marketplace for used products from over 35,000 brands, including H&M and Louis Vuitton. Launched in 2009 as a men’s shirt exchange company, the company has been growing significantly. Last year, ThredUP received 21 million items, reflecting a four-year-CAGR of 51.4%.

In its 2019 annual resale trend report, the company provided the following information:

- ThredUP has received 65 million items since 2014.

- ThredUP recycled 576,000 fast fashion items in 2018.

- There are 30,000 new listings on ThredUP every single day.

Source: ThredUP[/caption]

ThredUP sees growth potential in resale, especially for millennials and Gen Zers, and expects more than one in three Gen Zers will purchase used items in 2019.

The RealReal

The RealReal is an online marketplace for consigned luxury goods in various categories. Unlike other selling platforms, the company authenticates the consignments before accepting them. After authentication, the company handles the selling process, including photograph, price, fulfillment and returns logistics.

The company went public on the NASDAQ under the symbol REAL on June 28, 2019, raising $300 million at $20 per share. The stock rose 44.5% to $28.9 per share in its first day of trading, pushing the company’s market capitalization above $2 billion, but has more recently settled at around the $25 level.

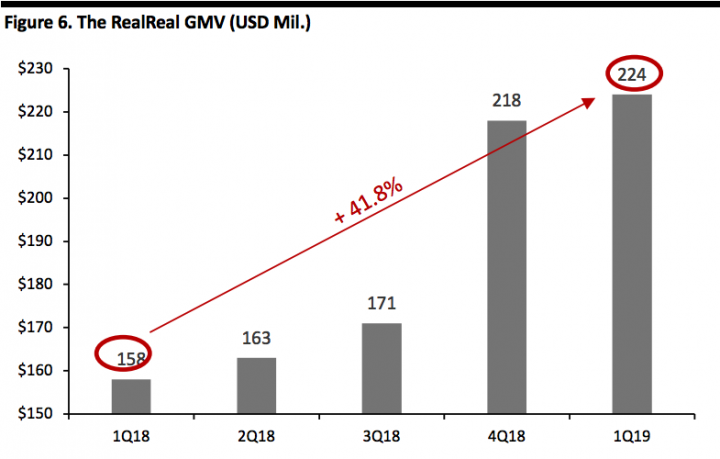

The RealReal reported 1Q19 GMV of $224 million, up 41.8% year over year. In 2018, GMV increased 44% to $711 million. Since inception, the company has sold a total of 9.4 million items and topped $1 billion in cumulative gross merchandise volume (GMV) on the platform since 2017.

[caption id="attachment_93432" align="aligncenter" width="720"]

Source: ThredUP[/caption]

ThredUP sees growth potential in resale, especially for millennials and Gen Zers, and expects more than one in three Gen Zers will purchase used items in 2019.

The RealReal

The RealReal is an online marketplace for consigned luxury goods in various categories. Unlike other selling platforms, the company authenticates the consignments before accepting them. After authentication, the company handles the selling process, including photograph, price, fulfillment and returns logistics.

The company went public on the NASDAQ under the symbol REAL on June 28, 2019, raising $300 million at $20 per share. The stock rose 44.5% to $28.9 per share in its first day of trading, pushing the company’s market capitalization above $2 billion, but has more recently settled at around the $25 level.

The RealReal reported 1Q19 GMV of $224 million, up 41.8% year over year. In 2018, GMV increased 44% to $711 million. Since inception, the company has sold a total of 9.4 million items and topped $1 billion in cumulative gross merchandise volume (GMV) on the platform since 2017.

[caption id="attachment_93432" align="aligncenter" width="720"] Source: The RealReal/Coresight Research[/caption]

The company reported that approximately 80% of the consignments on the marketplace were sold within 90 days in 2018, and the sell-through ratio was 96%.

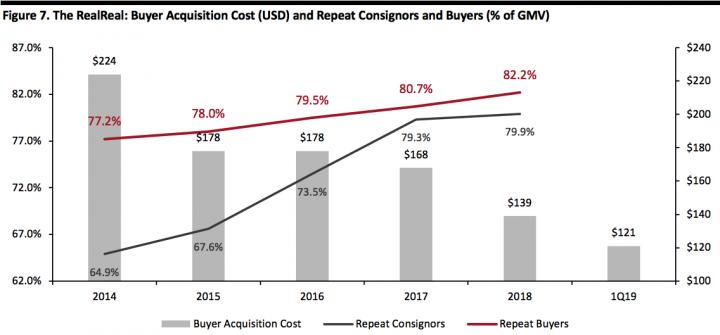

The RealReal said the number of active buyers was 416,000 in 2018, up 58% from the prior year. Repeat buyers and consignors as a percentage of GMV increased from 77.2% to 82.2% and 64.9% to 79.9%, respectively. Buyer acquisition cost has been declining over the past five years, down to $121 in 1Q19, roughly 54% of the cost in 2014.

[caption id="attachment_93433" align="aligncenter" width="720"]

Source: The RealReal/Coresight Research[/caption]

The company reported that approximately 80% of the consignments on the marketplace were sold within 90 days in 2018, and the sell-through ratio was 96%.

The RealReal said the number of active buyers was 416,000 in 2018, up 58% from the prior year. Repeat buyers and consignors as a percentage of GMV increased from 77.2% to 82.2% and 64.9% to 79.9%, respectively. Buyer acquisition cost has been declining over the past five years, down to $121 in 1Q19, roughly 54% of the cost in 2014.

[caption id="attachment_93433" align="aligncenter" width="720"] Source: The RealReal[/caption]

In a similar vein to The RealReal, Vestiaire Collective is a social recommerce platform based in France. It also authenticates merchandise before listing. Backed by Condé Nast International and Balderton Capital, the company raised $45 million in June plans to expand to international markets.

StockX, the world’s first stock market for sneakers, raised $110 million and earned “unicorn” status with a $1 billion valuation in June 2019. This Detroit-based company serves as a live auction marketplace. Once two parties agree on a price, StockX receives the product from the seller for authentication and then ships to the buyer after releasing the funds to the seller. The company has expanded its categories from sneakers to include streetwear, handbags and watches.

Amazon also launched Second Chance last year. Customers can trade in products such as Kindle and tablets for gift cards or other rewards. The website offers repair services and sells open-box items.

Online to Offline at Luxury Reseller The RealReal

The RealReal launched its first retail stores in New York in 2017 and in Los Angeles in 2018. The company opened another retail store in New York in 2019, bringing the total to 11 and intends to open more in the future. Its recent IPO filing shows the store in New York’s SoHo district generated $2,450 in GMV per square foot in 2018, close to the $2,800 sales per gross square foot Tiffany generated in company-operated stores in 2018.

Earlier this year, Rebag, an online resale marketplace for handbags, raised $25 million for expansion. The company has six stores in New York and Los Angeles and opened a new one in Miami in June, with plans to increase the total store count to 30.

Source: The RealReal[/caption]

In a similar vein to The RealReal, Vestiaire Collective is a social recommerce platform based in France. It also authenticates merchandise before listing. Backed by Condé Nast International and Balderton Capital, the company raised $45 million in June plans to expand to international markets.

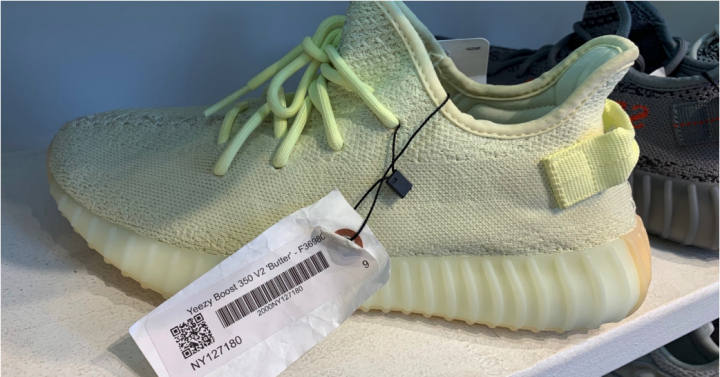

StockX, the world’s first stock market for sneakers, raised $110 million and earned “unicorn” status with a $1 billion valuation in June 2019. This Detroit-based company serves as a live auction marketplace. Once two parties agree on a price, StockX receives the product from the seller for authentication and then ships to the buyer after releasing the funds to the seller. The company has expanded its categories from sneakers to include streetwear, handbags and watches.

Amazon also launched Second Chance last year. Customers can trade in products such as Kindle and tablets for gift cards or other rewards. The website offers repair services and sells open-box items.

Online to Offline at Luxury Reseller The RealReal

The RealReal launched its first retail stores in New York in 2017 and in Los Angeles in 2018. The company opened another retail store in New York in 2019, bringing the total to 11 and intends to open more in the future. Its recent IPO filing shows the store in New York’s SoHo district generated $2,450 in GMV per square foot in 2018, close to the $2,800 sales per gross square foot Tiffany generated in company-operated stores in 2018.

Earlier this year, Rebag, an online resale marketplace for handbags, raised $25 million for expansion. The company has six stores in New York and Los Angeles and opened a new one in Miami in June, with plans to increase the total store count to 30.

Thrift Store Transformation

More Than a Thrift Shop Goodwill Industries is a non-profit organization that provides training to individuals who have barriers to employment. It is funded by a network of retail stores that sells donated secondhand goods, such as clothing and home products. Goodwill NYNJ received 995,000 donations last year and placed one person into employment every hour of every business day, or more than 2,000 newly employed individuals. Goodwill NYNJ is a member of Goodwill Industries International. Goodwill Industries International is #14 on the Forbes list of the 100 Largest US Charities in 2018 with total retail revenues of approximately $4.2 to $4.5 billion. addition to more than 3,200 Goodwill Thrift Store locations in the US, the organization has an online auction site for avid online shoppers. This June, over 100 Goodwill stores offered buy-online, pick-up-in-store and mobile delivery services through OfferUp, a peer-to-peer recommerce website that mainly connects sellers with local buyers. Each store will upload items every day to the platform under the local Goodwill handle. Goodwill NYNJ is undergoing a makeover to remedy the frequent negative associations consumers have regarding thrift store shopping – starting with the stores to create a modern, boutique-y look. Starting with the store front and prime window footage on busy city streets, each Goodwill has a team member charged with visual merchandising display to ensure locally relevant windows with select clothing to drive store traffic. [caption id="attachment_93434" align="aligncenter" width="720"] Goodwill store-front window displays

Goodwill store-front window displaysSource: Goodwill NYNJ[/caption] In the store, merchandising efforts are apparent with like product groupings, assorted by category and color, with clothing hanging, Army style, neat and buttoned up. Upon entering a Goodwill location, a display provides category pricing. Goodwill sets the same price for each category of clothing and home goods. For example, women’s dresses are sold at $12.99 and shoes at $9.99. Without price differentiation, shopping becomes a treasure hunt. The store was clean and merchandise in the same category were organized by color. The average Goodwill customer is now around 45, according to our conversation with Goodwill. Goodwill stores is working to draw in younger customers, for example by curating a section for trending and better brands called “the boutique.” The store manager trains the staff to identify certain brands and choose more trendy or high quality pieces for the curated space. Part of the beauty of the Goodwill model is that on-the-job training provides new skill sets for Goodwill employees, on the path to employability beyond Goodwill, if desired. At the same time, the Goodwill ecosystem benefits via cleaner, nicer stores with an improved ambience that still provides a great deal to Goodwill shoppers. Goodwill has a strong focus on helping the disabled and promoting inclusiveness. Almost 9,000 individuals with disabilities have received job training and other employment services from the organization. [caption id="attachment_93435" align="aligncenter" width="720"]

Goodwill in-store displays

Goodwill in-store displaysSource: Coresight Research[/caption] Goodwill is also , many with 100,000 followers, to promote local awareness. Stores also sponsor events and programs to engage the community. For example, the Livingston location will host a LGBTQ event to support trans community in late June in celebration of pride month. Brands and Retailers Join the Field In ThredUP’s 2019 resale report, the company claimed that 96% of retail executives want to test the resale market by 2020. Stores as varied as Banana Republic, Club Monaco and Macy’s Backstage are selling luxury vintage handbags (Louis Vuitton, Prada, Hermes) in response to consumer demand for vintage and pre-owned luxury items. Neiman Marcus just invested in luxury reseller Fashionphile, taking a minority stake. Farfetch acquired Stadium Goods, a streetwear-focused consignment reseller, for $250 million late in 2018 and more recently launched a pilot program, Second Life, that will allow customers to trade in their old designer handbags for Farfetch credit that can be spent on new merchandise. The ThredUP report also pointed out that the average number of items in consumers’ closets declined to 136 this year from 164 in 2017. Driven by consumers’ rising awareness of sustainability, many brands and retailers also joined the recommerce market. However, instead of recycling, Stella McCartney partnered with The RealReal to encourage resale activities. The RealReal offers a $100 Stella McCartney store credit in exchange for Stella McCartney consignments. Similarily, thredUP offers Reformation credits for eligible items. American Eagle partnered with the Las Vegas based consignment store Urban Necessities in March 2019. The company started with the sneaker category then expanded to others. Sellers can bring goods, get them authenticated, set their own price for sale or sell to the store at a negotiated price. To use real-time pricing, Urban Necessities does not put price tags on the merchandise: instead, customers scan a code attached to the item for real-time market pricing and inventory. [caption id="attachment_93436" align="aligncenter" width="720"]

E-price tags inside the Urban Necessities store: Customers use the camera in their cellphones to scan the code for price and inventory.

E-price tags inside the Urban Necessities store: Customers use the camera in their cellphones to scan the code for price and inventory.Source: Coresight Research[/caption] Urban Necessities also set up a pop-up inside the American Eagle store in SoHo in March 2019. Unlike the store in Las Vegas, this pop-up location accepts only unworn sneakers and new items from Superme and A Bathing Ape. [caption id="attachment_93437" align="aligncenter" width="720"]

Urban Necessities pop-up in SoHo, New York

Urban Necessities pop-up in SoHo, New YorkSource: Coresight Research[/caption]