albert Chan

Introduction

What’s the Story?

In this report, we analyze selected US apparel brands and retailers and identify their key areas of investment in 2022 by examining their reported capital expenditures (CapEx). We find that supply chain is the top investment area for US apparel brands and retailers, followed by stores, information technology, digital commerce, and corporate programs.

Why It Matters

Capital expenditures (CapEx) refer to the spending necessary for a company to maintain and grow its long-term assets, such as the purchase, maintenance and improvement of warehouses, stores, software and intangible assets such as goodwill, patents and licenses. CapEx is important for companies to maintain existing businesses and develop new revenue growth opportunities. Our analysis offers implications for brands, retailers, marketplaces, technology vendors and innovators in the industry.

Apparel Brands and Retailers Increase Capital Expenditures: Coresight Research Analysis

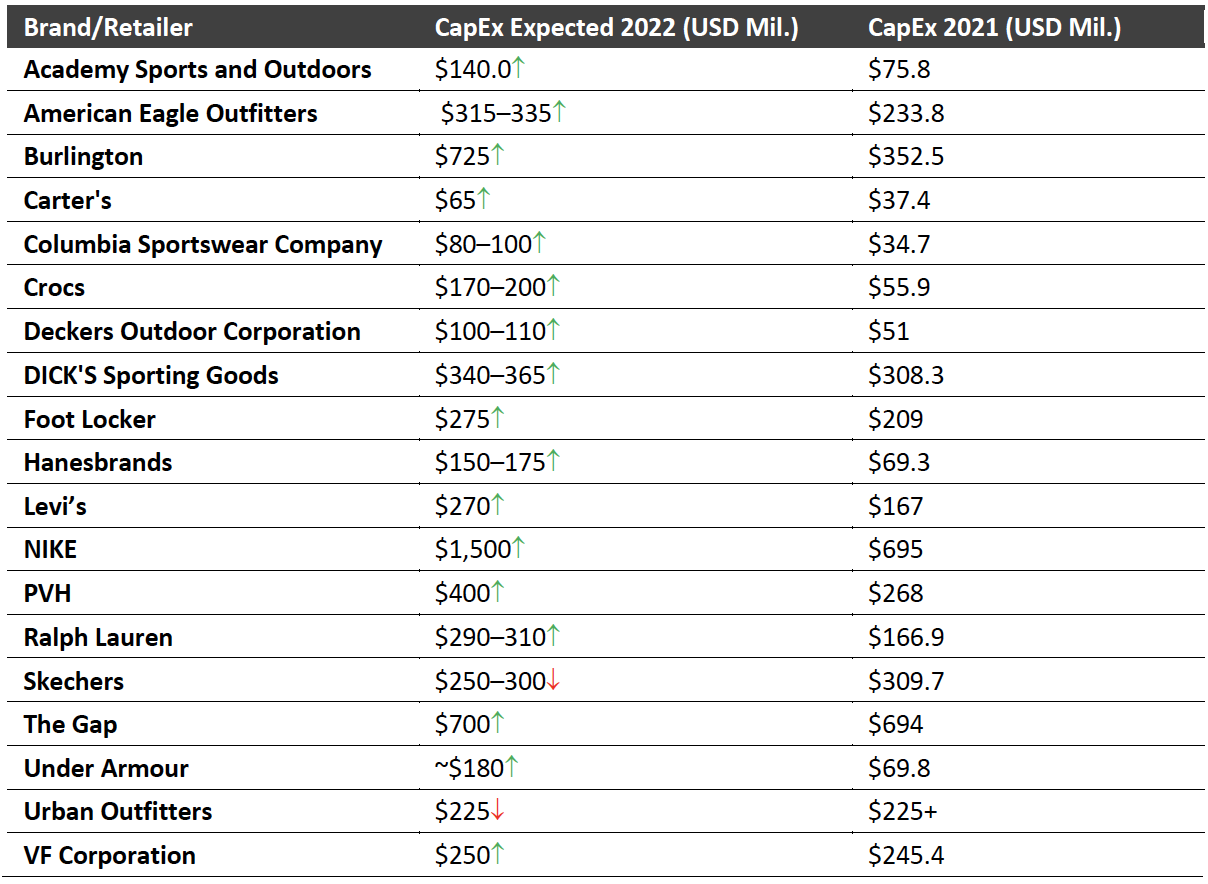

We are seeing apparel brands and retailers increase CapEx in 2022. Among 20 selected apparel brands and retailers from the Coresight 100, our watch list of key brands and retailers, 19 companies reported capital expenditures in 2021 and their expected CapEx in 2022. Among these 19 companies, 17 expect to increase capital expenditures in 2022. Only Skechers and Urban Outfitters expect lower capital expenditures in 2022. We estimate that capital expenditures will be up over 60% year over year among these 17 selected apparel brands and retailers.

Figure 1. Capital Expenditures Reported by Selected Apparel Brands and Retailers

[caption id="attachment_150707" align="aligncenter" width="700"] Source: Company reports[/caption]

Key CapEx Focus Areas Reported by Brands and Retailers

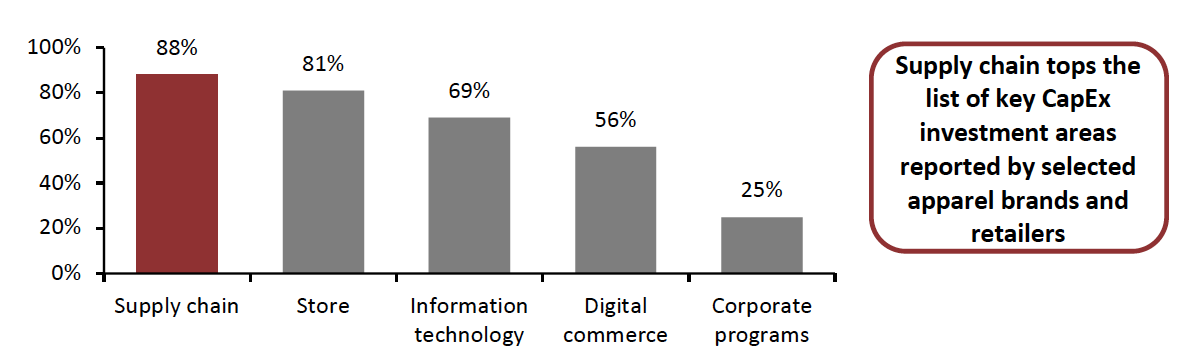

Among 20 selected apparel brands and retailers from the Coresight 100, 16 briefly list out their focus areas of CapEx in 2022 in their financial reports or earnings call transcripts. Supply chain is the top investment area, according to our analysis, followed by stores, information technology, digital commerce and corporate programs.

Source: Company reports[/caption]

Key CapEx Focus Areas Reported by Brands and Retailers

Among 20 selected apparel brands and retailers from the Coresight 100, 16 briefly list out their focus areas of CapEx in 2022 in their financial reports or earnings call transcripts. Supply chain is the top investment area, according to our analysis, followed by stores, information technology, digital commerce and corporate programs.

Figure 2. Selected US Apparel Brands and Retailers: CapEx Focus in 2022 (% of Companies That Reported) [caption id="attachment_150708" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Supply Chain

Supply chain tops the list of key CapEx investment areas reported by selected apparel brands and retailers. Of 16 selected apparel brands and retailers, 88% reported that they would allocate a part of CapEx to supply chains in 2022.

More than 60% of apparel and footwear companies in our Coresight 100 reported higher freight costs and their negative impacts on gross margins in their most recent quarterly earnings. In addition, some companies are negatively impacted by slower supply chains. For instance, Burlington reported on May 26, 2022, that in February, the company experienced significant receipt delays, which created big gaps in its assortment, especially in its fastest-trending businesses. These assortment caps critically impacted the company’s sales trend, according to the company.

We are seeing most companies accepting higher freight costs, but also seeking alternative shipping options such as air freight for the purpose of improving efficiency. Meanwhile, we are seeing brands and retailers also turning to investments in supply chains to improve efficiency.

Specifically, we are seeing two areas of supply chain investment.

Source: Company reports/Coresight Research[/caption]

Supply Chain

Supply chain tops the list of key CapEx investment areas reported by selected apparel brands and retailers. Of 16 selected apparel brands and retailers, 88% reported that they would allocate a part of CapEx to supply chains in 2022.

More than 60% of apparel and footwear companies in our Coresight 100 reported higher freight costs and their negative impacts on gross margins in their most recent quarterly earnings. In addition, some companies are negatively impacted by slower supply chains. For instance, Burlington reported on May 26, 2022, that in February, the company experienced significant receipt delays, which created big gaps in its assortment, especially in its fastest-trending businesses. These assortment caps critically impacted the company’s sales trend, according to the company.

We are seeing most companies accepting higher freight costs, but also seeking alternative shipping options such as air freight for the purpose of improving efficiency. Meanwhile, we are seeing brands and retailers also turning to investments in supply chains to improve efficiency.

Specifically, we are seeing two areas of supply chain investment.

- Additional warehouse space: Apparel brands and retailers, including Deckers Outdoor, Gap Inc., and PVH are expanding warehouse space, in order to plan for additional inventory and manage replenishment. We estimate that the US apparel and footwear market will grow mid-single-digits in 2022, including high-single-digit growth in e-commerce, presenting opportunities for apparel brands and retailers.

- Distribution center efficiency: Apparel brands and retailers, including Under Armour and Urban Outfitters, are allocating CapEx to improve distribution center efficiency. More efficient distribution centers help improve products’ speed to market and capture incremental demand. Companies such as Gap Inc. and Urban Outfitters are in the process of installing automation equipment in distribution facilities to increase efficiency.

- Store remodeling: Apparel brands and retailers are executing redesigns of in-store components to enhance brand image, create consistency across all stores and offer interesting experiences for consumers. Burlington is using CapEx to plan smaller-format stores in the US while Guess? is updating store floors, walls, ceilings and displays, hoping to revitalize its store look.

- Store opening: We see apparel brands and retailers opening more stores to prepare for a post-pandemic world. Foot Locker is opening more stores with localized product assortments, events and activities and testing large-format concept stores, Decker’s Outdoor is opening strategic new locations for HOKA and Ugg and Guess? is opening more stores internationally.

What We Think

We are seeing apparel brands and retailers increase capital expenditures in 2022. With ongoing global pressure in transportation and manufacturing, supply chain is the top investment area, according to our analysis. Companies are focusing on additional warehouse space and distribution center efficiency. Brands and retailers are also allocating capital to building new stores or upgrading stores, strengthening information technology capabilities, improving digital commerce and building corporate programs such as offices.

Implications for Apparel Brands and Retailers

- We suggest that apparel brands and retailers should consider investing more in supply chains, as consumer demand for apparel and footwear products confronts shipping constraints, product delays and inventory shortages continue internationally.

- We recommend apparel brands and retailers that haven’t yet built strong digital capabilities prioritize investment in digital commerce capabilities, such as e-commerce infrastructures, amid a structural shift to digital shopping channels.

Implications for Technology Platforms

- Opportunities exist for suppliers of robotics technology and other automation solutions to work with brands and retailers to increase warehouse management and inventory distribution efficiency.