Competition, rather than Consumer Demand, Is the Principal Challenge for Legacy Retailers

Recent weeks have seen a number of bad news stories for major middleground UK retailers. Retailer struggles are frequently reported as signalling tough market conditions and weak consumer demand. In this report, we argue that recent difficulties are more indicative of undifferentiated stores facing ever-growing competition than they are of soft consumer spending.

The bad news from retailers in recent weeks includes the following:

- Toys“R”Us UK: In December, Toys“R”Us UK applied for a CVA that would cut its liabilities. As part of the CVA, it will shut at least 26 stores.

- Debenhams: This month, midmarket department store retailer Debenhams issued a profit warning after disappointing sales over the holiday trading period, when UK comparable sales were down 2.6% year over year.

- House of Fraser: Privately owned department store House of Fraser has written to landlords asking for rent reductions, according to a January 5 report by Sky News.

- Mothercare: Longstanding baby and maternity retailer Mothercare followed Debenhams in issuing a profit warning, after its UK comparable sales fell 7.2% year over year and UK total sales tumbled 11.0% in the Christmas quarter.

- New Look: Also in January, fashion retailer New Look faced pressure after credit insurer Euler Hermes stopped selling new insolvency cover to its suppliers, according to the The Sunday Times. QBE, another insurer, reportedly reduced its level of cover for New Look suppliers.

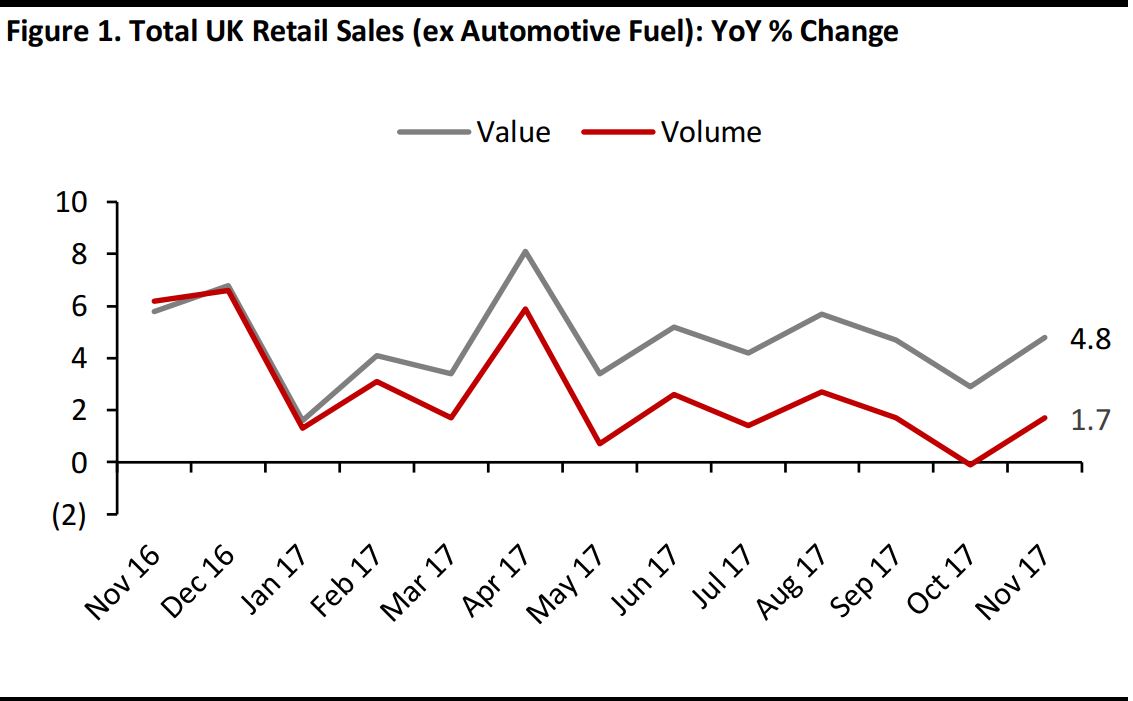

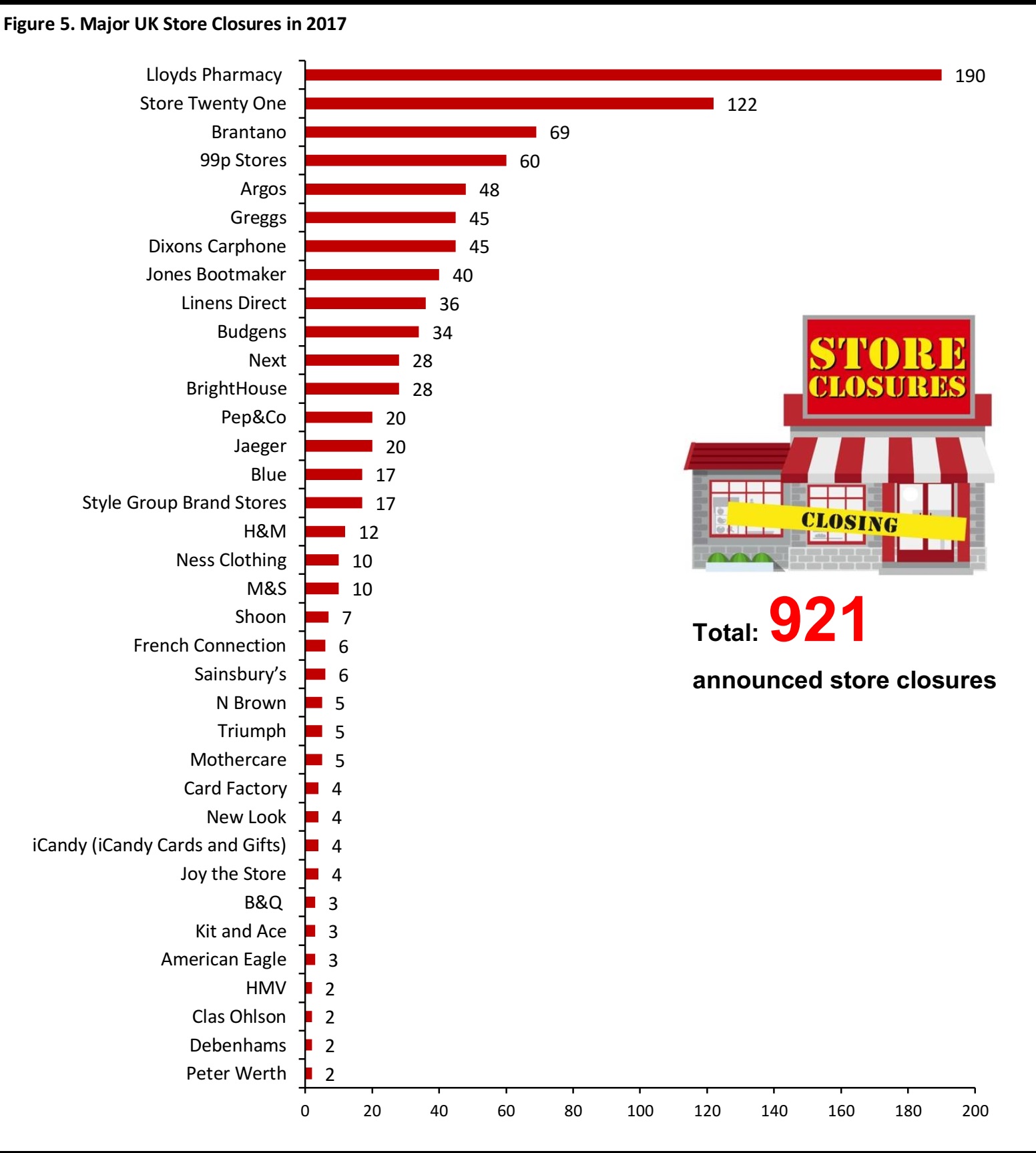

The popular narrative is that these retailers’ woes are indicative of “bleak” times for an “embattled” retail sector, driven by shoppers cutting their spending, but the truth is that retail sales continue to grow above inflation and many retailers are flourishing.

Source: Office for National Statistics/FGRT

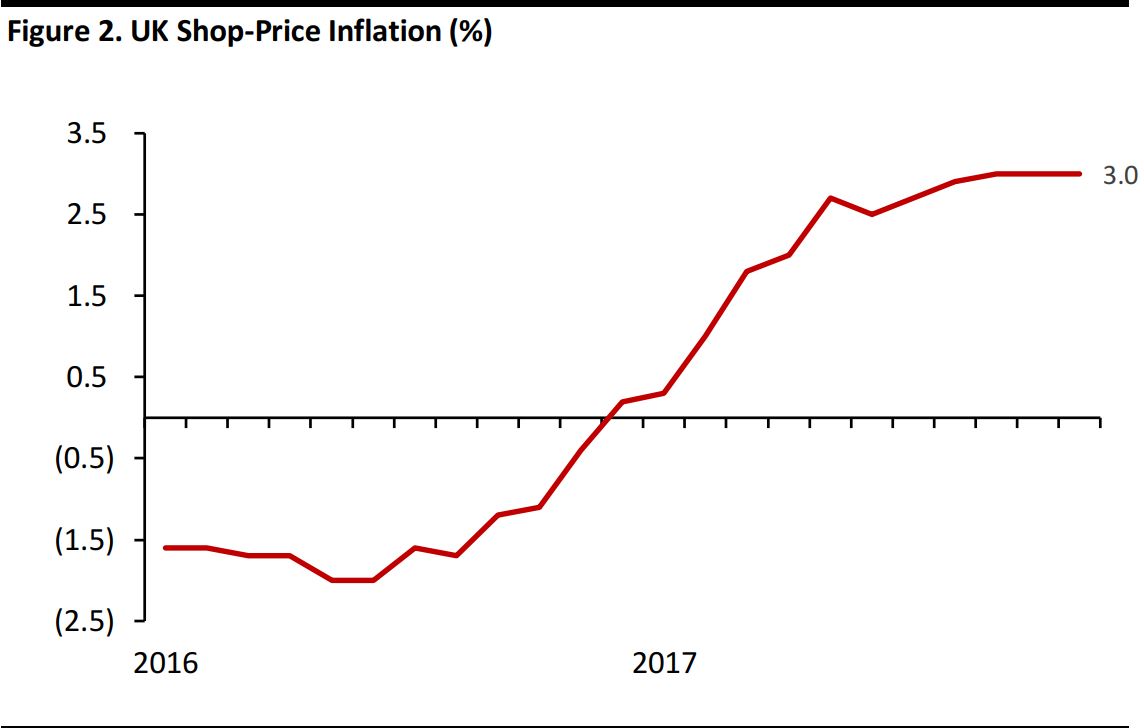

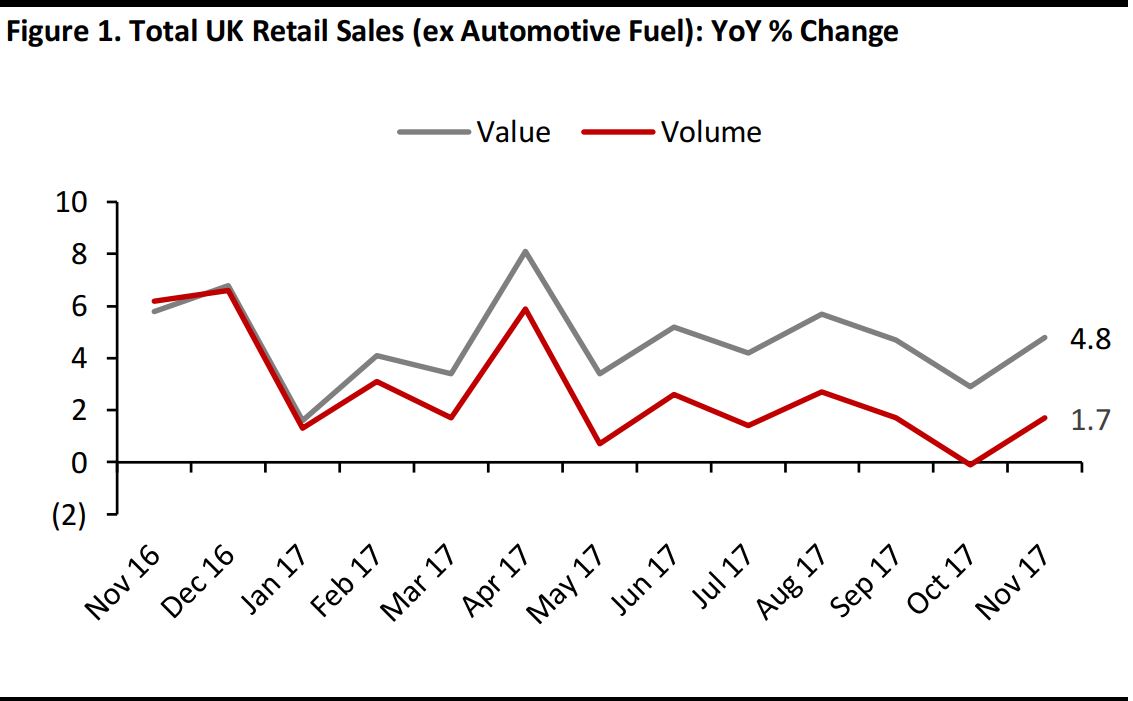

The UK retail sector has been pinched by two macro challenges since the depreciation of the pound in mid-2016:

- Raised inflation has caused a mild erosion of British consumers’ real income growth: This income squeeze is sometimes incorrectly reported as having prompted shoppers to cut their spending. In fact, British shoppers have kept spending over and above inflation, as we chart in Figure 1. Shoppers have supported their spending by increasing their borrowings and cutting their savings.

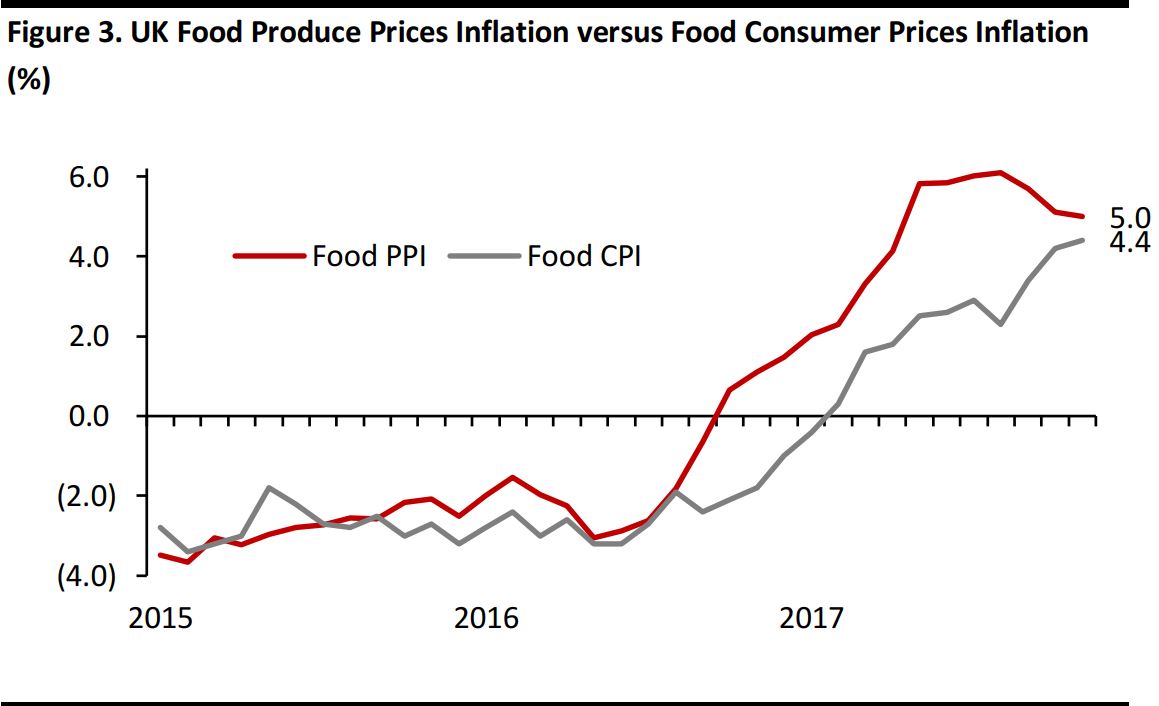

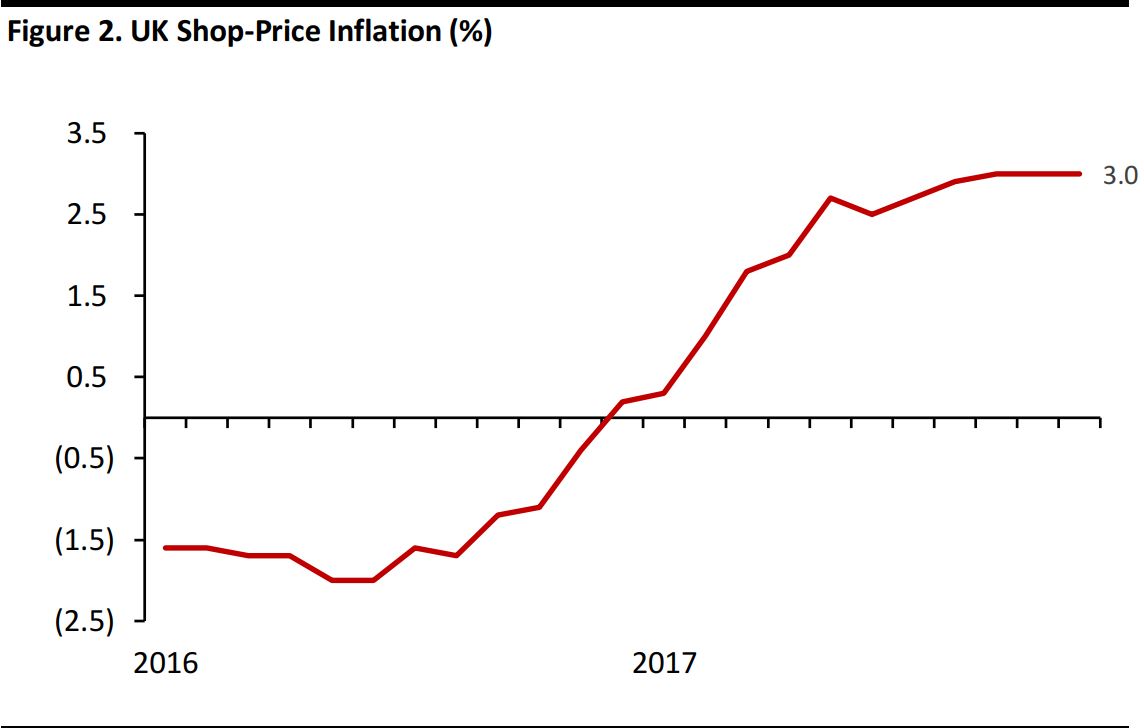

- In a highly competitive environment, retailers have generally been unable to pass on the full effects of raised input prices: The consequent margin erosion is a meaningful challenge for retailers. As an example, in Figure 3, we show the gap between food input prices and consumer prices.

Through November 2017.

Source: Office for National Statistics

Through November 2017.

Source: Office for National Statistics

However, the underlying vulnerability for some longstanding retailers is not consumer demand. It is that they remain undifferentiated generalists in an era of almost-unlimited choice.

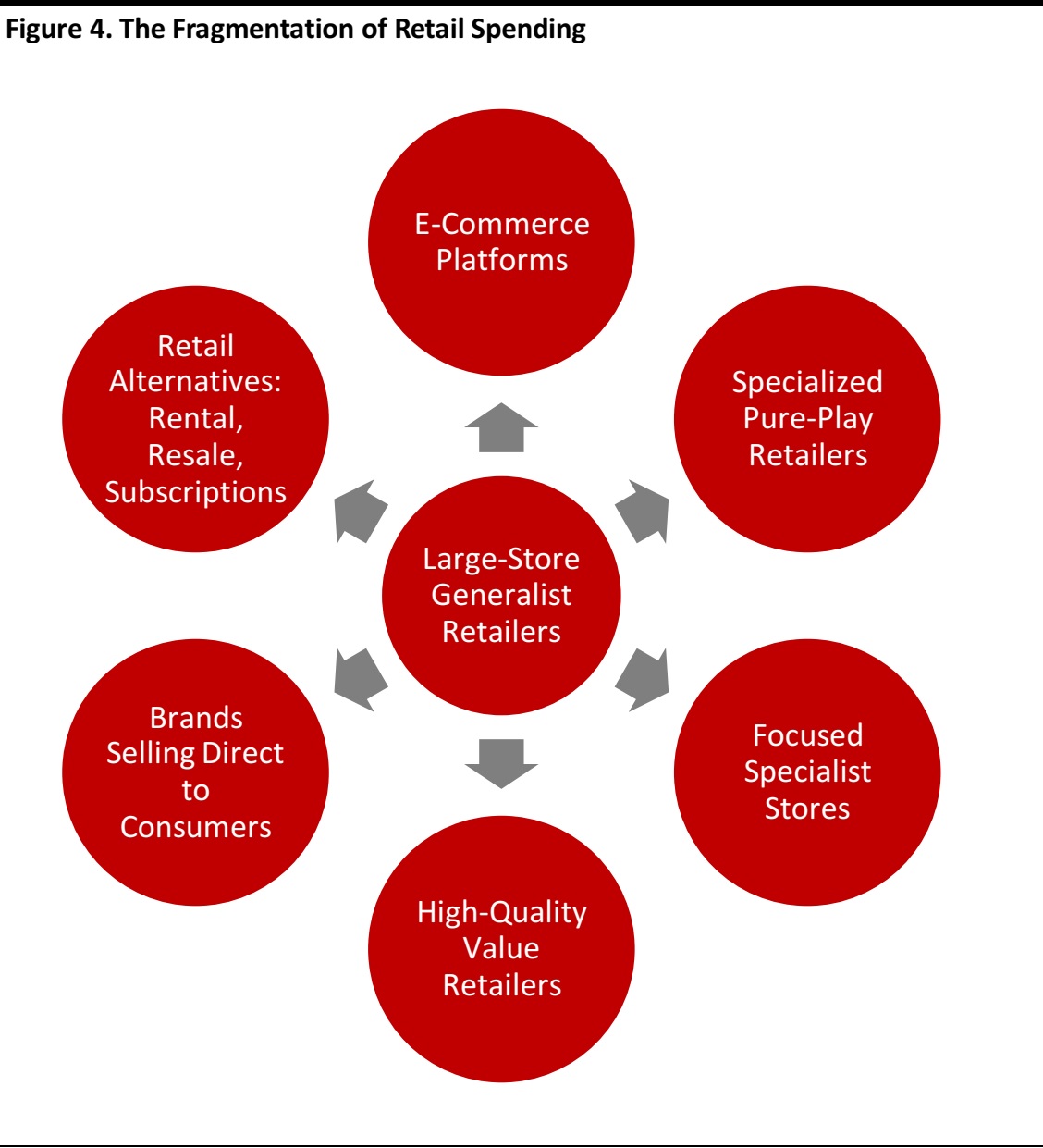

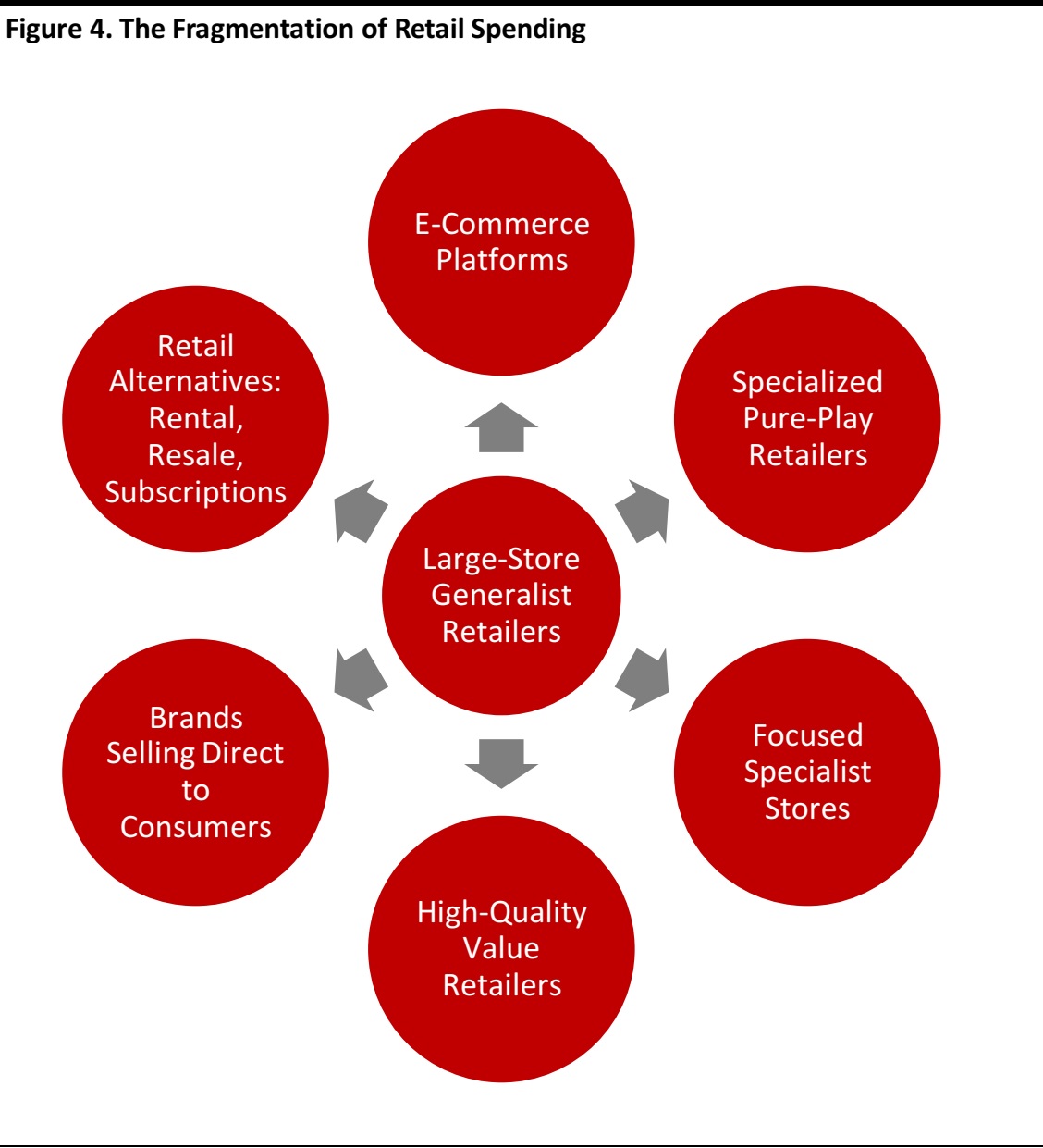

Large-store generalists that have traded on unique selling points (USPs) of choice, convenience and proximity have had those advantages eliminated by e-commerce. Meanwhile, the sizable growth of more targeted retailers—both online and offline—has attracted customers looking for products and brands that cater to their individual tastes and demands.

A New Wave of Retail Failures?

This year is likely to see a new round of closures, CVAs and bankruptcies among legacy generalist retailers, in our opinion. While the inflationary environment may be a trigger for this, we do not view it as the underlying cause.

The previous major wave of closures and bankruptcies occurred during the financial crisis of 2008–2009. During that period, a number of UK retailers entered administration (bankruptcy); some of these were saved, while many closed down completely. Almost all were middleground generalists. Woolworths, Clinton Cards, Barratts Shoes, MFI, Stead & Simpson, Dolcis Shoes and Land of Leather were among the names to fail—and none were particularly distinctive or sharply positioned.

In their place grew retailers better positioned to cater to modern demands—from high-quality discount operators to specialists more sharply focused on a particular consumer segment. The UK consumer arguably benefitted from the recession-prompted shakeout.

The current macroeconomic context is far more benign than in 2009, though the trend for legacy generalists to fail has continued, BHS in 2016 and Brantano in 2017 being more recent examples. Meanwhile, choice continues to grow. As we chart in Figure 4, this choice spans specialized pure-play retailers, focused specialist stores, high-quality value retailers, brands selling direct to consumers—online and through flagship stores—and alternatives to conventional retail such as rental, resale and subscriptions.

Source: FGRT

This year, the abundance of choice will further fragment spending and supress margins.

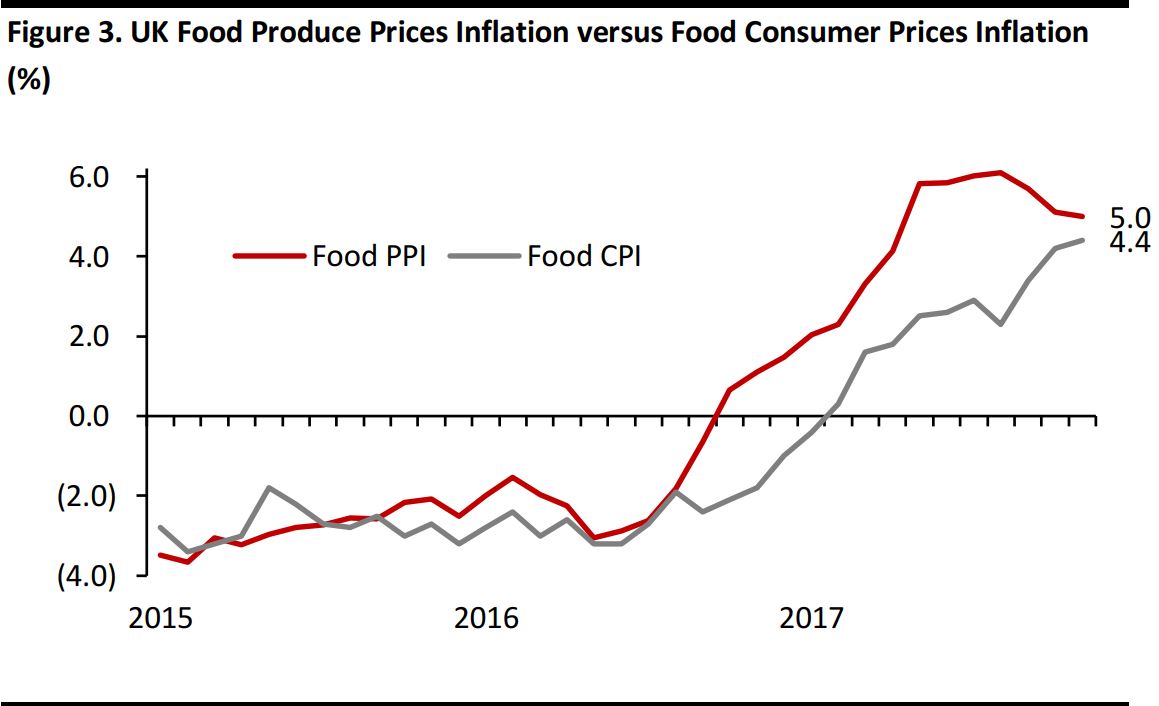

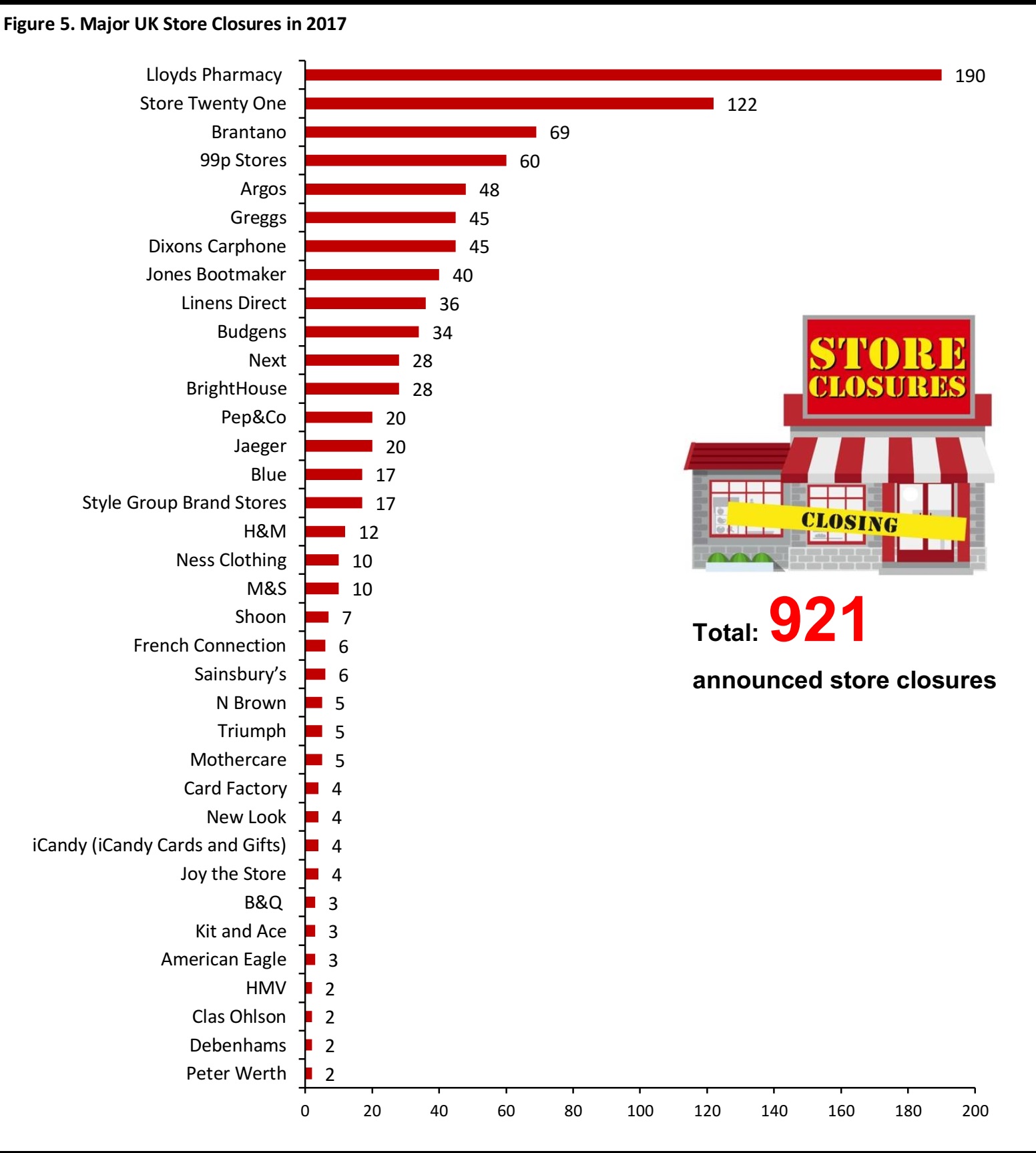

As a consequence, we expect more retailers to join the fray of those noted earlier that are reporting sales downturns, closing stores and seeking the protection of CVAs. Last year, our

weekly Store Openings & Closures Tracker recorded 921 store closures by major UK chains. We expect this total to rise in 2018, led by structurally challenged generalist stores.

FGRT has calendarized the announcements of store openings/closures, which involves an estimation for some retailers. Figures

are gross—they do not net out openings.

Source: Company reports/FGRT

We will publish a full wrap-up of UK Christmas trading and retail sales on January 22.