Introduction

What’s the Story?

The US retail industry is navigating an unprecedented era of disruption and transformation. Following a large number of bankruptcy filings by traditional and iconic retailers in

2017 and 2018, retail failures continued

apace in 2019 and 2020. In this report, we review major US retail bankruptcies in 2021 in total and by notable retailers. We compare the bankruptcy landscape in 2021 to 2020, to assess the impacts of the Covid-19 pandemic on the US retail sector and its recovery.

Why It Matters

Coresight Research tracked

5,110 US retail store closures in 2021. Although this is down significantly from 8,736 in 2020 (heavily impacted by the Covid-19 pandemic), it is still a sizeable total and reflects the overbuilt retail footprint in the US and the continued growth of e-commerce and shifting consumer preferences: Major retailers continued to face pressures from the ongoing pandemic in 2021.

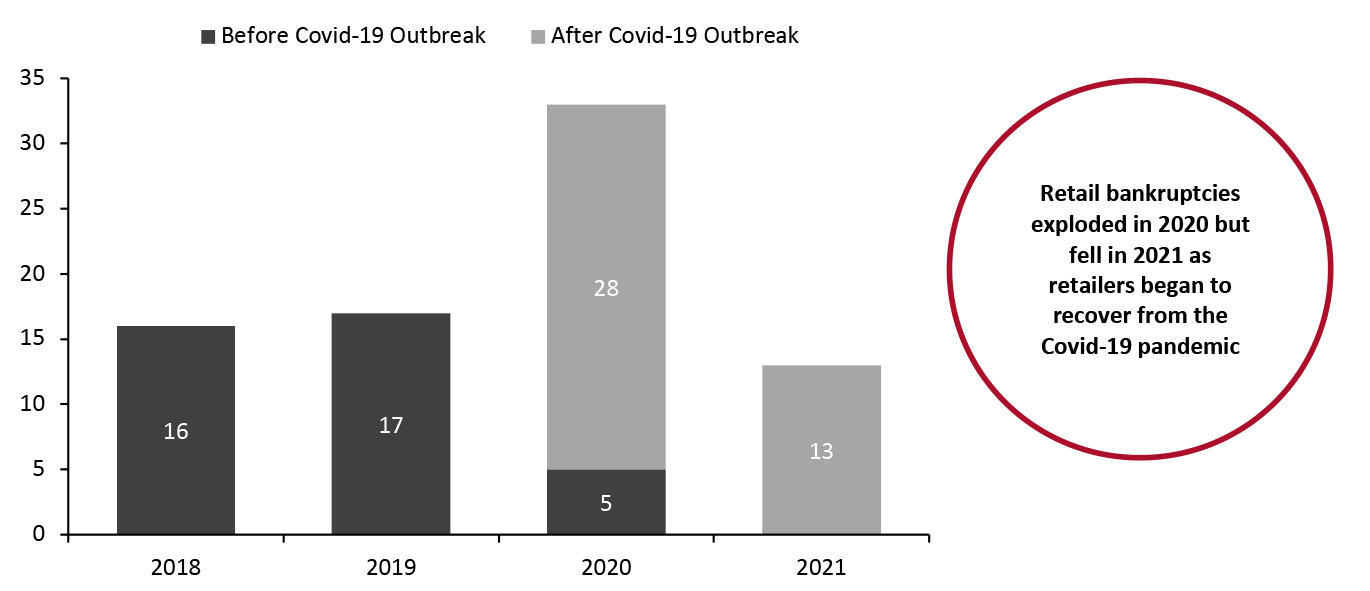

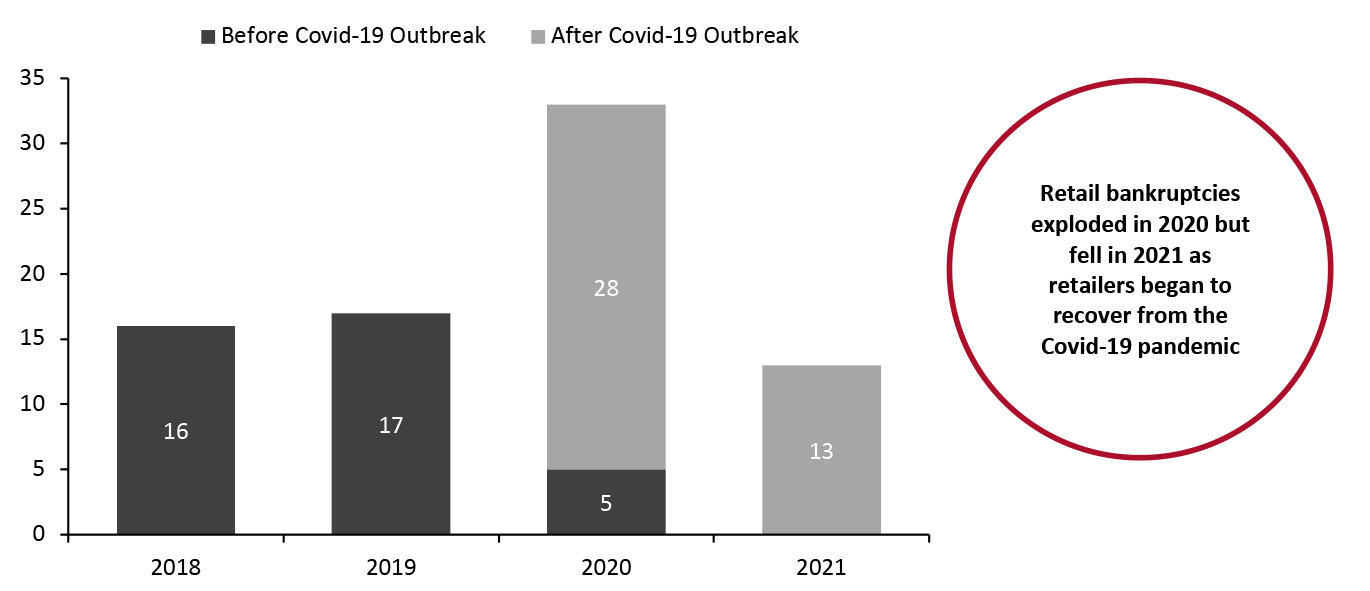

In 2021, 13 major retailers (with more than $50 million in liabilities) filed for bankruptcy in the US—notably lower than the 33 and 17 bankruptcies in 2020 and 2019, respectively (see Figure 1).

Figure 1. US: Total Major Retail Bankruptcies

[caption id="attachment_138874" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

America’s Retail Bankruptcies in 2021: Coresight Research Analysis

Bankruptcies and Store Closures by Major US Retailers and Brand Owners

Of the total 13 major retailers and brand owners that filed for bankruptcy in 2021, two companies—Belk and The Collected Group—have already emerged, while four companies—ABC Carpet & Home, Alex and Ani, L&L Wings and Sequential Brands—entered into the auction/sale process.

Figure 2. US: Major Retail Bankruptcies, 2021

[wpdatatable id=1595 table_view=regular]

*Belk emerged from bankruptcy in February 2021

**The Collected Group emerged from bankruptcy in June 2021

Source: Company reports/Dun & Bradstreet/Zoominfo/Coresight Research

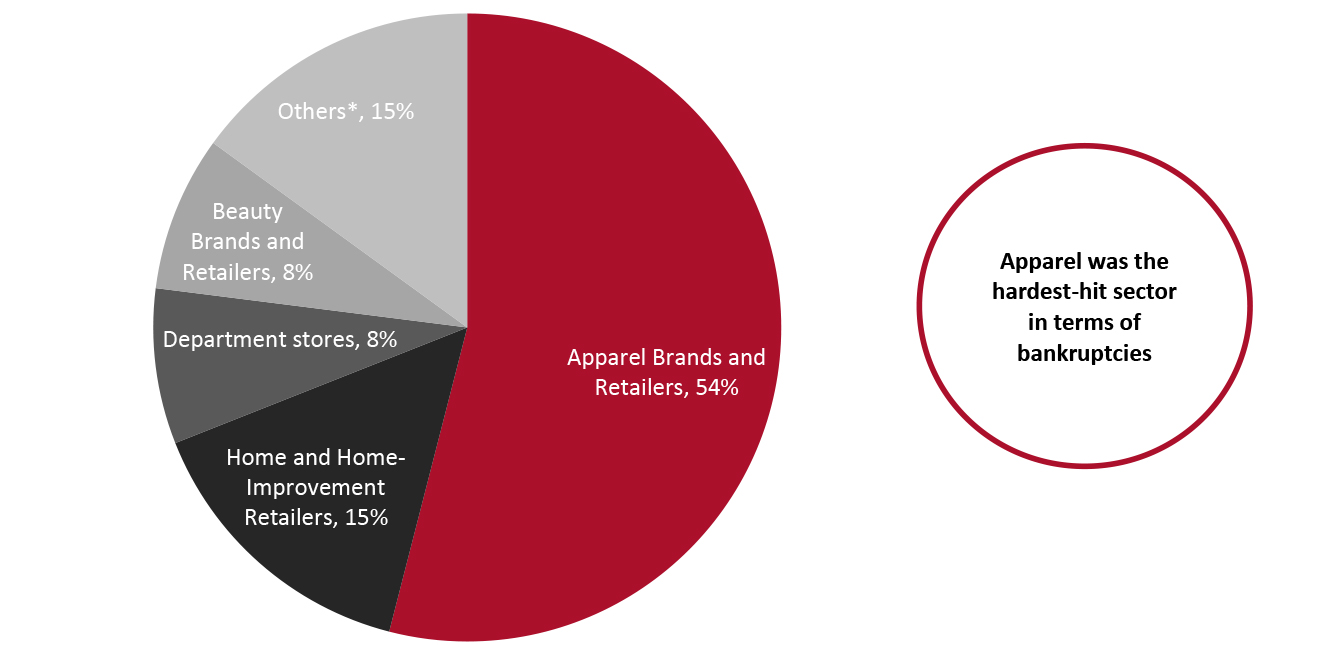

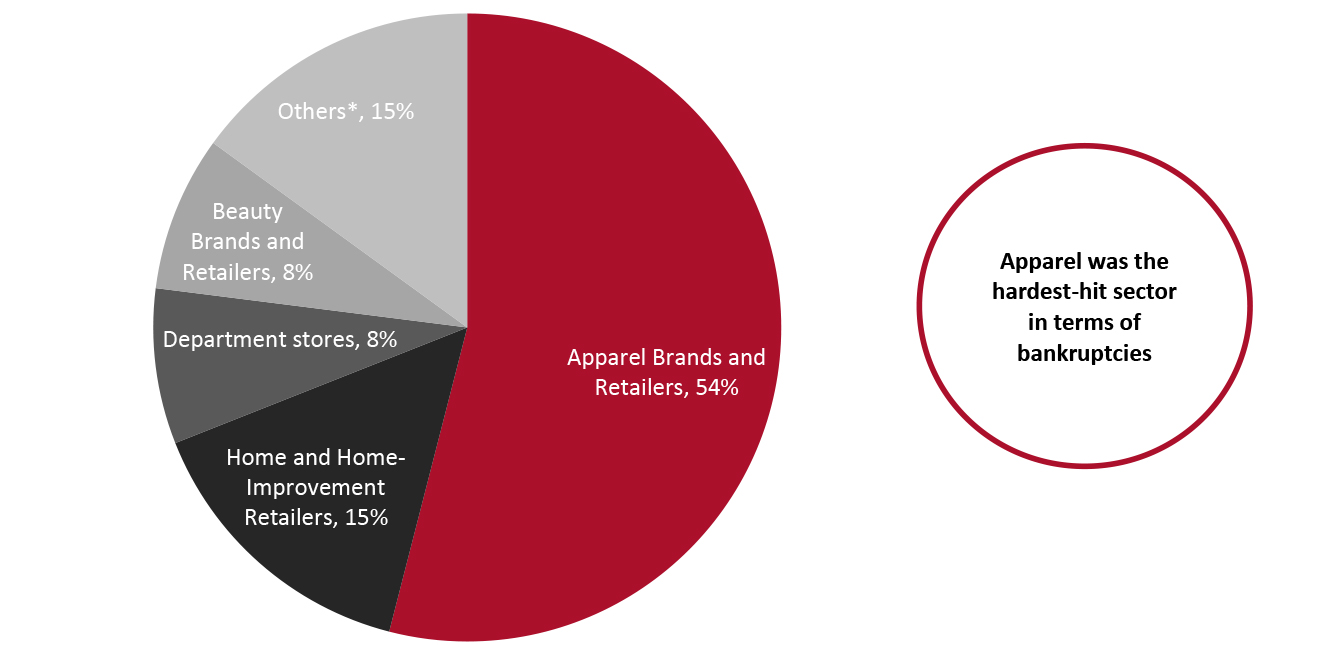

Although most apparel retailers and brand owners witnessed a substantial recovery last year from the impacts of the pandemic, apparel continued to be the hardest-hit sector in terms of bankruptcies, impacted by a slump in sales and, in several cases, high levels of debt and the gradual adoption of e-commerce.

Figure 3. US: Major Retail Bankruptcies by Sector, 2021

[caption id="attachment_138875" align="aligncenter" width="700"]

“Apparel brands and retailers” includes companies such as Christopher & Banks, Global Brands Group and Sequential Brands

“Apparel brands and retailers” includes companies such as Christopher & Banks, Global Brands Group and Sequential Brands

*Others includes jewelry and stationery retailers

Source: Coresight Research [/caption]

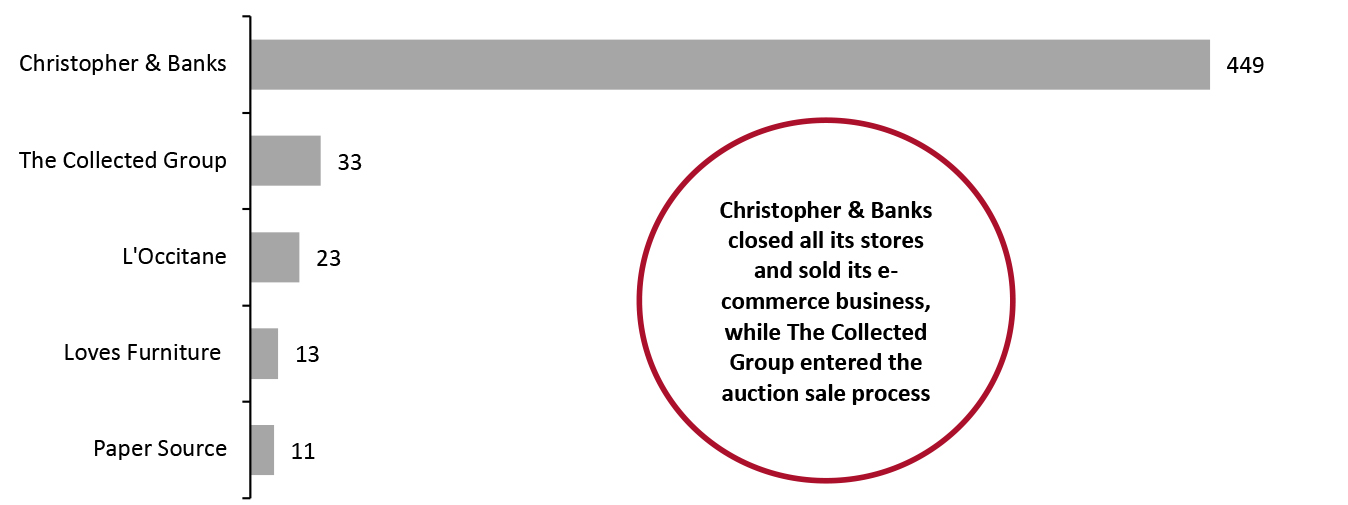

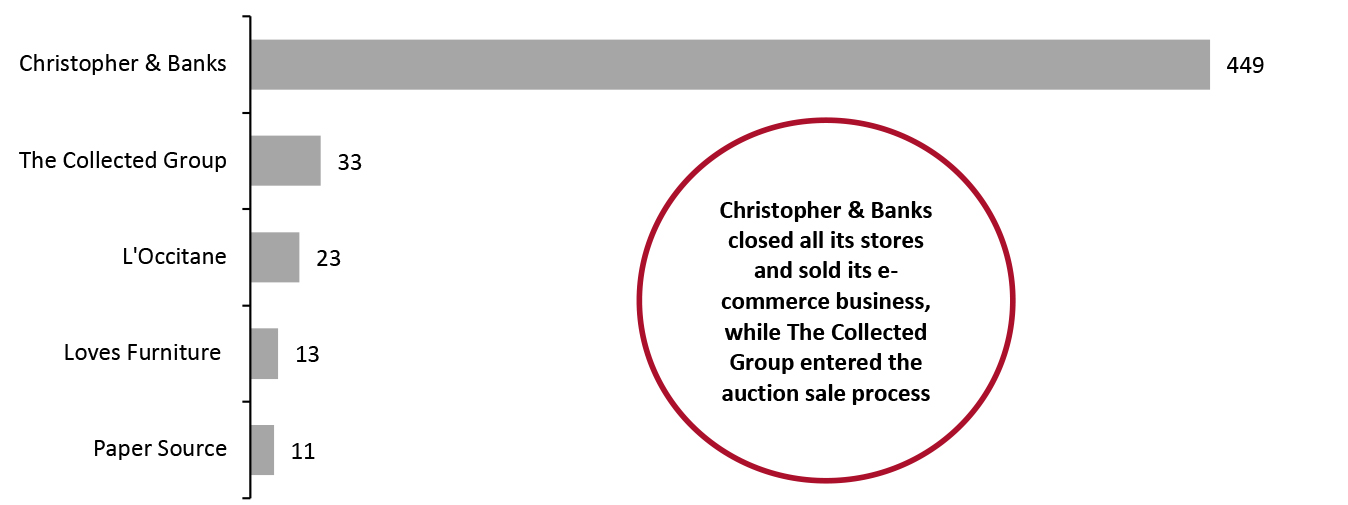

In terms of store closures, 449 of the total 5,110 in 2021 were announced by the bankrupt apparel retailer Christopher & Banks alone. The other bankrupt retailers and brands that announced store closures include The Collected Group, L’Occitane, Loves Furniture and Paper Source (see Figure 4). A few retailers, such as Belk and Solstice Marketing Concepts, filed for bankruptcy protection but did not announce any store closures.

Figure 4. US: 2021 Announced Store Closures by Selected Major Firms That Went Bankrupt in the Same Year

[caption id="attachment_138876" align="aligncenter" width="699"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Key Factors Driving US Retail Bankruptcies

The pandemic compounded structural pressures for brands and retailers by causing massive disruption to sales and consumer demand in 2021. Occupancy limits on stores took a particular toll on liquidity for companies in discretionary sectors—most notably apparel and footwear retailers, companies with high brick-and-mortar exposure and those that are saddled with debt.

Even with lockdowns easing and stores reopening through 2021, several retailers and brands with weak financial and operating profiles continued to struggle–for instance, Alex and Ani, and Christopher & Banks.

To grow brick-and-mortar capacity, a number of retailers such as Christopher & Banks racked up high debt levels and so had trouble making payments as the retail shutdown stemmed cash flows. Huge borrowings, followed by rising repayment and refinancing deadlines, made it difficult for these retailers to invest in e-commerce capabilities and store upgrades that could have helped them compete with their peers and online-only retailers.

To avoid bankruptcy, some debt-laden retailers may choose to roll over debt to buy time amid the current low-interest rate environment; however, this may not be the permanent solution to fix their weak balance sheets, with liabilities substantially exceeding assets. Instead, retailers should look to bolster their sales and cash flow and repair their operating infrastructure.

- Leveraged Buyouts by Private Equity Firms

In 2021, more than 20% of the largest retail-chain bankruptcies were at private equity-acquired chains, according to bankruptcy data compiled by Coresight Research. Historically, this proportion has been much higher: Between 2012 and 2018, more than 70% of the US retailers that went bankrupt were backed by private equity, according to a July 2019 study by The Center for Popular Democracy and other groups, including the Americans for Financial Reform Education Fund. These trends suggest that some private equity owners potentially place substantial debt on retailers, burdening them with high interest expenses and increasing the strain on their resources—leaving little room for investment in stores and technology.

Figure 5. US: Private Equity-Acquired Major Retailers That Have Gone Bankrupt Since 2006

[wpdatatable id=1596 table_view=regular]

Source: Bankruptcydata.com/Debtwire/RetailDive/Reuters/The Center for Popular Democracy/Coresight Research

- The Rapid Rise of E-Commerce

In recent years, e-commerce has grown at a rapid pace in retail: According to Coresight Research’s analysis of US Census Bureau data, e-commerce more than doubled its share of all US nonfood retail sales between 2012 and 2020, rising from 10.3% to 23.5%. For 2021, we expect that the online channel ceded some share (80 basis points) of total nonfood retail sales back to stores: We estimate that

around 22.7% of all nonfood retail sales were online in 2021.

While e-commerce has burgeoned in the past couple of years, many retailers could not match this pace of change and failed to substantially transform themselves. Moreover, the growth of e-commerce stripped many legacy retailers of their USPs (unique selling points)—those companies were focused on the promise of choice, convenience and, in some cases, price, but found that online rivals stole those competitive advantages.

Key Reasons for the Slowdown in Retail Bankruptcy Filings in 2021

While the number of retail bankruptcies was sizeable in 2021, it was still substantially down compared to the totals from the previous two years.

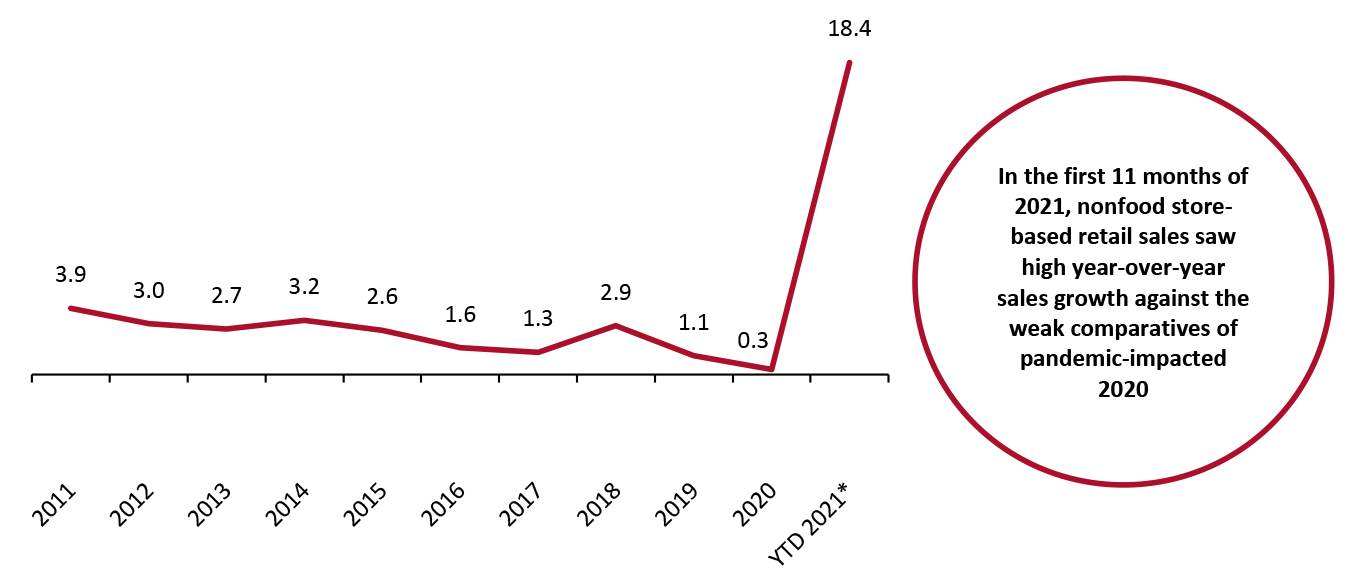

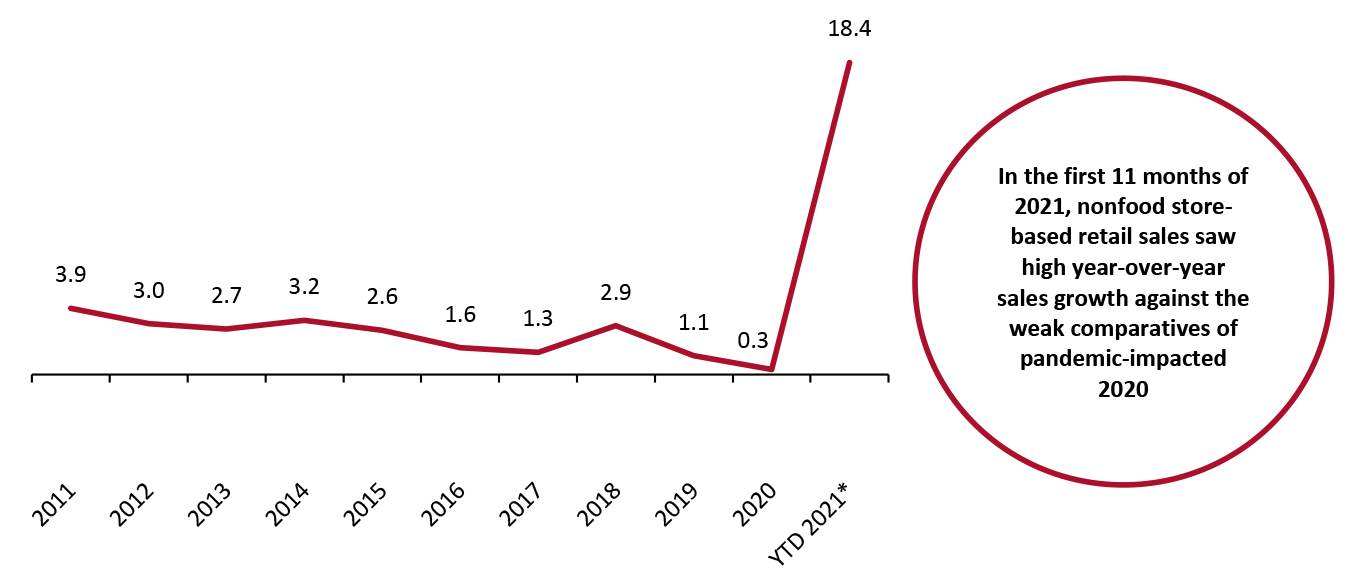

- Strong Sales Rebound in the Retail Sector

The US retail sector saw a very strong rebound in 2021. Focusing on nonfood retail sales by store-based retailers (so excluding food retailers and nonstore retailers), there was an 18.4% year-over-year surge in the first 11 months of 2021 (December 2021 numbers are yet to be reported by the US Census Bureau). This strong growth was partly due to weak comparatives, with the first 11 months of 2020 having recorded soft growth as the Covid-19 pandemic hit the US. However, comparing sales to 2019 paints a similarly positive picture of strong growth in the first 11 months of 2021, with a two-year increase of 18.3%, we calculate. Even in the hardest-hit apparel sector, we are seeing most brands and retailers closing the gap between current and pre-pandemic performance.

Figure 6. US Total Retail Sales (ex. Gasoline, Automobiles, Food and Beverage Stores and Nonstore Retailers): YoY % Change

[caption id="attachment_138877" align="aligncenter" width="699"]

*First 11 months of 2021 (Jan–Nov)

*First 11 months of 2021 (Jan–Nov)

Source: US Census Bureau/Coresight Research [/caption]

- Broader Economic Recovery

We saw GDP recover strongly in the US in the second half of 2020 and the first half of 2021. According to the most recent estimates from the Bureau of Economic Analysis (BEA), the US economy saw 6.7% quarter-over-quarter growth in the second quarter of 2021 (annualized and seasonally adjusted), following an increase of 6.3% in the first quarter of 2021, and growth of 4.5% and 33.8% in the fourth and third quarter in 2020, respectively. We believe that this growth momentum will likely continue in the near future, driving increases in personal consumption expenditure and further fueling the ongoing recovery of the US retail sector.

- Vaccinations and Consumers’ Return to Normal Behavior

While 2020 saw pandemic-led retail shutdowns, 2021 brought vaccine rollouts in the US, which offered a path out of the pandemic. In the US, 73% of the population had received at least one vaccine, and 62% of the population were fully vaccinated as of December 30, 2021, according to the Centers for Disease Control and Prevention. The US has also been easing Covid-19 lockdowns and has allowed stores and restaurants to reopen—albeit with policies varying by state.

With increasing vaccinations rates and the easing of restrictions, consumers are returning to more normal ways of living. However, the recent rise of the Omicron variant could be a cause of concern for retailers.

- Stimulus and Other Relief Efforts

The

stimulus checks by the US federal government in response to the Covid-19 pandemic played a crucial role in boosting US retail sales, with many consumers spending parts of their stimulus checks on retail categories. Relief and notable benefits to consumers provided by each round of stimulus in 2020 and 2021 totaled $1.67 trillion. We believe that high levels of savings (supported by stimulus payments) and ongoing wage growth will drive consumers’ continued willingness to spend in the near future.

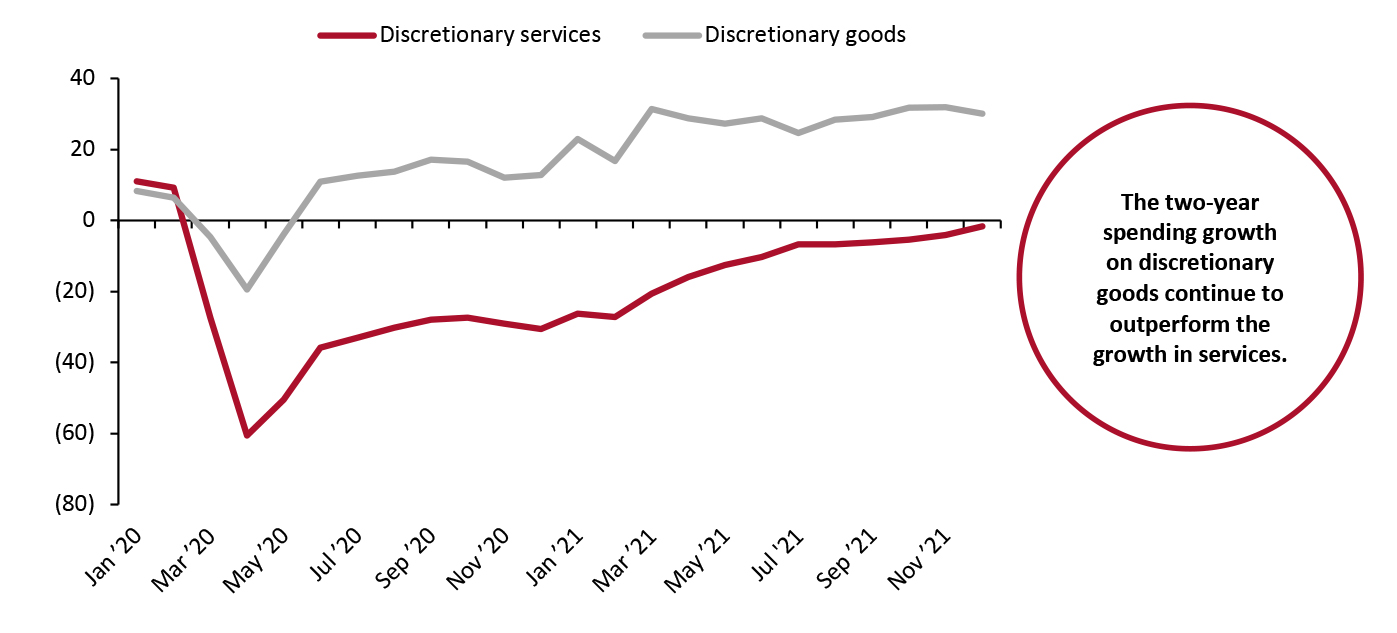

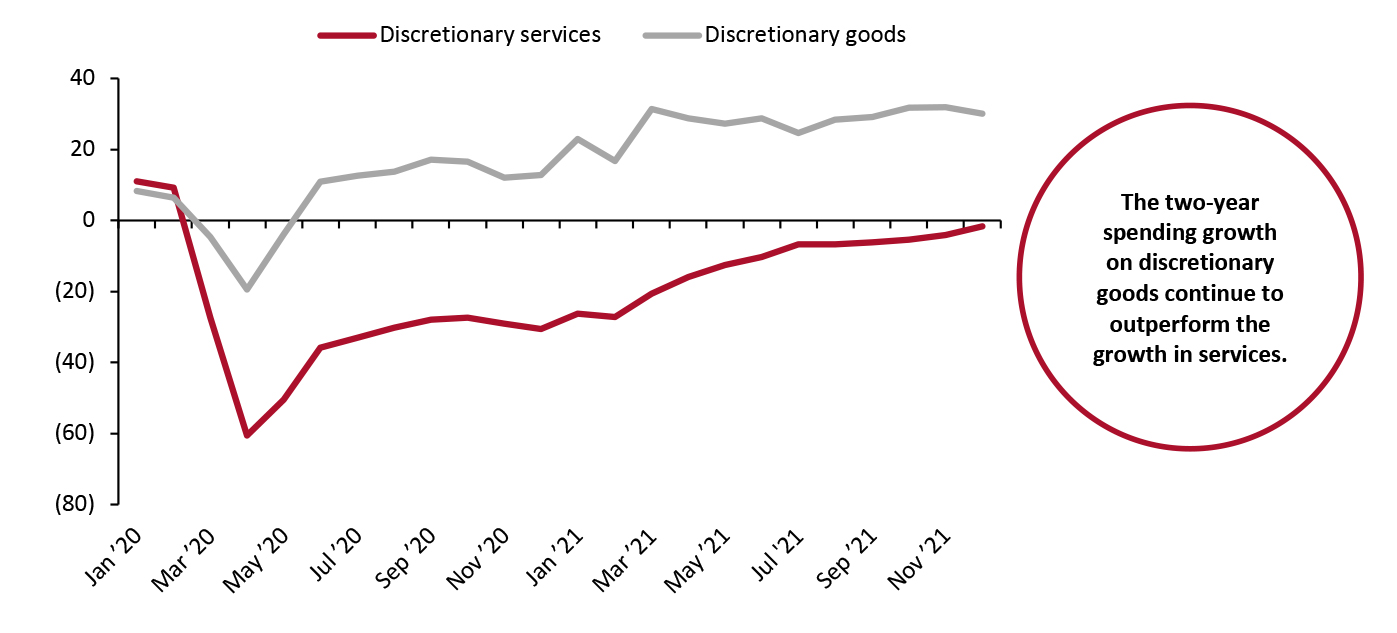

- A Shift in Consumer Spending from Services to Goods

The retail sector has been a great beneficiary of the shift in consumer spending from services to goods. Discretionary goods sectors have substantially benefitted from the extra cash that consumers accumulated thanks to money saved from avoiding experiential activities such as vacations and restaurants amid pandemic-related safety concerns.

Based on data from the BEA, we calculate that, on a two-year basis (compared to pre-pandemic 2019), US monthly consumer spending on discretionary goods has been substantially outperforming spending on discretionary services since March 2020 (see Figure 7). We expect overall demand for goods to remain strong amid the recent rises in Covid-19 cases.

Figure 7. US Consumer Spending on Discretionary Goods and Services: % Change from Two Years Prior

[caption id="attachment_138878" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

- Low Interest Rates and a Strong Equity Market

The US Federal Reserve System continues to keep interest rates low, which, combined with strong equity performance, is facilitating overleveraged companies in finding cheaper and convenient refinancing options. As a result, several retailers and brand owners are rolling over debt to buy time—deleveraging their balance sheets after taking on new debt in 2020. This is reducing overall distressed debt (bonds or debenture of companies that are on the verge of being bankrupt) in the retail industry. The amount of distressed debt tied to the US retail industry has shrunk from $60 billion in late March 2020 to about $1.1 billion in early September 2021, according to Bloomberg.

While the low-interest-rate environment continues to prevail, the potential threat of inflation could force the US Federal Reserve System to raise interest rates, which could make refinancing expensive and the rollover of debt challenging—pushing more distressed retailers into bankruptcy.

- Mall Landlords’ and Lenders’ Flexible Approaches

Mall landlords are trying to keep retail tenants from fleeing, even if it means agreeing to discounted rent—instead of canceling the lease contract. For instance, in late 2020, one of the leading US mall operators, Simon Property Group, agreed to lower its initial base rent in exchange for lower artificial sales breakpoints. Under artificial or unnatural sales breakpoints, the tenant pays rent equal to a certain proportion (say around 5%) of its gross sales over a certain benchmark, in addition to minimum base rent. While the flexible rent approach helped distressed retailers, the mall owner also benefited from this strategy: In the second quarter of fiscal 2021, ended June 30, 2021, occupancy at Simon’s malls and outlets increased by 100 basis points, quarter over quarter, to 91.8%. In the company’s second-quarter earnings call, CEO David Simon said, “The strategy we adopted in the height of the pandemic is playing out better than we could have expected: We got the renewals done; we accommodated the vast majority of retailers, assuming they were reasonable in their approach; we bet on the rebound—and we’re seeing the benefits of that.”

In a similar manner, US lenders are supporting borrowers by providing flexible refinancing and offering the option to extend debt maturity in exchange for higher collateral, which we believe makes more sense than liquidating or acquiring a distressed business in the current uncertain economic environment.

However, these flexible approaches adopted by landlords and lenders are not permanent solutions to retailers’ underlying operating and financial problems. For instance, any defaults on restrictive covenants by borrowing retailers, such as taking additional loans or issuing dividends, could stress lenders’ patience, leading them to withdraw some of their support.

Selected 2021 Retail Bankruptcies in Detail

In this section, we review the details of selected major retailers that entered bankruptcy in 2021.

Established: 1897

Retail sector: Home goods

Bankruptcy filing date: September 8, 2021

Various factors contributed to the breakdown of home décor, gifts and accessories retailer ABC Carpet & Home, including the Covid-19 crisis. While the company initially survived the onset of the pandemic, it eventually succumbed to the pressure of declined foot traffic and supply chain disruption. From January 1 to July 31, 2021, the retailer’s sales totaled around $26 million, according to company reports—57% down from the comparable period in 2017. In its filing statement, ABC Carpet & Home cited the coronavirus pandemic as a root cause of the failure, including the “mass exodus” of current and potential customers who fled New York City amid the crisis.

ABC Carpet & Home had been severely hit in the years prior to the pandemic by the US retail industry’s rapid shift toward online shopping, as the retailer had been very slow to embrace the digital channel. When the crisis accelerated this shift in 2020, ABC’s digital platform was still in the development phase and so was not ready to meet the massive online demand, according to the company’s management team.

Other factors that contributed to ABC’s failure are as follows:

- Challenges in order fulfillment, mainly owing to manufacturing delays and supply chain shortcomings amid the crisis

- Construction delays with respect to the retailer’s flagship location in New York in recent years

- A substantial debt load, which the company took to expand its brick-and-mortar operations—at the time of filing bankruptcy, the company listed $50 million in assets and $100 million in liabilities

ABC Carpet & Home entered into bankruptcy with plans to sell its assets via auction by the end of October. The retailer received a $6 million debtor-in-possession (DIP) loan from its existing lender 888 Capital Partners (which is also one of the bidders in the auction sales process), to navigate through the bankruptcy process.

Due to the nature of ABC being a privately owned company, there are no metrics available for its recent financial performance.

Established: 2004

Retail sector: Jewelry

Bankruptcy filing date: June 9, 2021

The demise of Alex and Ani can be attributed to several factors, including the Covid-19 pandemic, a high debt burden, poor leadership, and a failure to restructure its operations to adapt to changing customer needs.

In 2020, the jewelry retailer’s business was substantially impacted by the pandemic, with sales nearly halving from 2019 and the company being overburdened with over $150 million in debt.

In the early years, Alex and Ani saw remarkable growth—reaching a valuation of about $1 billion by 2016. However, the jewelry retailer could not cope with certain operational challenges; for instance, it struggled to keep up with surging demand for its products, mainly in terms of timely product distribution and delivery. To mitigate infrastructure challenges, Alex and Ani expanded its direct-to-consumer (DTC) channel by opening more of its company-owned concept stores, but the retailer gradually contracted its wholesale channel, which accounted for only 19% of revenues at the time of filing for bankruptcy. Nevertheless, this strategy had its own shortcomings: A greater number of company-owned concept stores led to higher operating costs, while lesser retailer accounts led to lesser opportunities for marketing and sales.

A key factor that contributed to the demise of Alex and Ani was the massive change of leadership at the company. Much of the retailer’s sales growth took place between 2010 and 2014—when sales grew over 11,000%, according to company reports—under the leadership of then-CEO Giovanni Feroce. However, in 2014, Carolyn Rafaelian, Founder of Alex and Ani, took over the role of CEO following a rumored split with Feroce. In the following months, the company saw the departure of many senior leaders, including its Chief Finance Officer, Chief Technology Officer, Chief Strategy Officer and Chief Digital Officer—which likely impacted the operational performance of the company.

In 2016, Alex and Ani tried to replicate the vertical integration model of its financially successful rival Pandora. Alex and Ani secured a loan of $170 million from a consortium led by Bank of America (BOA), of which $100 million was utilized to acquire its jewelry supplier and manufacturer Cinerama Jewelry. However, the strategy misfired: In 2018, Alex and Ani witnessed a sharp decline in sales and missed a loan repayment, which resulted in the closing of its access to its line of credit by BOA. As the retailer’s cash flow was severely impacted, it could not pay its vendor, causing delays in product launches and a further decline in sales of about $80 million, according to company management. Subsequently, Alex and Ani’s financial performance further fumbled, and the jewelry retailer defaulted on its renewed credit agreements with BOA three more times.

In September 2021, the US Bankruptcy Court approved Alex and Ani’s restructuring plan, which swaps about $112 million debt for equity and offers nearly $4.5 million in exit financing. The plan will also see Rafaelian sell her stake in the BOA credit facility (which was split between herself and private equity firm Lion Capital, which holds significant stakes in the company).

As Alex and Ani is a privately owned company, there are no metrics available for its recent financial performance.

Established: 1956

Retail sector: Accessories, apparel and footwear

Bankruptcy filing date: January 13, 2021

Number of stores closed: 449

Like a number of legacy apparel retailers with high mall exposure, Christopher & Banks was dealing with declining sales long before the Covid-19 pandemic. However, the crisis exacerbated the situation, substantially impacting the company’s sales and cash flow. Burdened with operating and financial challenges, the retailer suspended rental payments to its mall landlords in November 2020. This resulted in Christopher & Banks receiving several notices of default and landlords locking out the retailer’s stores in Boise and Idaho Falls in late 2020.

Another key factor behind the demise of Christopher & Banks was that the company had been slow to embrace digital commerce and had been facing strong competition from online rivals (such as Amazon) even before the pandemic. Christopher & Banks had also been facing stronger competition from mass merchandisers such as Target and Walmart, which have been investing in innovating their stores and digital platforms.

Christopher & Banks has reported five consecutive years of losses. During its third quarter ended October 31, 2021, the company reported a loss of $10.8 million. Moreover, it could not capitalize on 2021 holiday sales owing to shoppers’ limited demand for dresswear and formal wear, which are Christopher & Banks’ key product category offerings.

Furthermore, Christopher & Banks was burdened with debt, which it took to fund its brick-and-mortar expansion. As of January 13, 2021, the company had $105.6 million of long-term debt on its books. At the time of filing for bankruptcy, Keri Jones, former CEO at the company, said, “The Covid-19 pandemic was the proverbial 'nail in the coffin' for the debtors following years of adverse market trends, including the shifting of sales from traditional brick-and-mortar retailers to online sellers, increased competition from big-box retailers and changing consumer preferences.”

In its earnings call for the third quarter of fiscal 2020 held in December 2020, Christopher & Banks’ Principal Accounting Officer and Corporate Secretary, Richard Bundy, said, “We have taken several steps to optimize liquidity. However, significant uncertainty surrounding the continuing impact of the Covid-19 pandemic on our business remains. As a result, revenues, results of operations and cash flows continue to be materially adversely impacted, which raises substantial doubt about our ability to continue as a going concern within one year after the date of our audited financial statements.”

In March 2021, Christopher & Banks closed all of its 449 stores and sold its online business to ALCC, an affiliate of Hilco Merchant Resources.

We make the following observations over the six quarters prior to Christopher & Banks filing for bankruptcy (see metrics in Figure 8):

- Revenue growth was negative for most of the quarters.

- Same-store sales growth turned negative in the latest quarter.

- Debt levels were very high.

- Operating margins were negative in most of the quarters.

- Unlevered cash flow margins were negative in three of the six quarters.

Figure 8. Christopher & Banks: Latest Financial Metrics Prior to Bankruptcy

[wpdatatable id=1597 table_view=regular]

*Ended October 31, 2020

Source: Company reports/Coresight Research

Established: 1976

Retail sector: Beauty

Bankruptcy filing date: January 26, 2021

Number of stores closed: 23

L’Occitane, the US division of Switzerland-based L’Occitane International, saw its store-based sales be severely impacted by the pandemic (most of the stores are mall-based).

At the time of filing for bankruptcy, the company had $15 million in unpaid rent, and L’Occitane noted that it was looking to exit “burdensome” capital lease obligations at stores where sales have fallen sharply amid the pandemic. Furthermore, the beauty company was saddled with $162 million in debt at the time of bankruptcy filing. In its bankruptcy statement, the company’s management commented that Chapter 11 will help L’Occitane to minimize liabilities from climbing lease obligations and maximize recovery for lenders. L’Occitane noted that filing for Chapter 11 was essential after it could not reach a convincing agreement with mall landlords on store lease terms.

L’Occitane received approval from the US Bankruptcy Court for its reorganization plan in August 2021. The plan provides for the full settlement of all debts, and the company noted that the restructured lease portfolio will create a sustainable store platform for the long term. As part of the restructuring process, L’Occitane reduced its number of stores from 166 to 133.

Due to the nature of L’Occitane being a privately owned company, there are no metrics available for its standalone financial performance. However, we analyzed the financial performance of its parent company, L’Occitane International, to understand the overall financial health of the organization. We make the following observations over the six quarters prior to L’Occitane’s bankruptcy (see metrics in Figure 9):

- Revenue growth was in the positive single digits in percentage terms for all six quarters.

- The parent company’s ability to service its short-term debt remainedintact.

- Operating and unlevered cashflow margins remainedstrong.

Figure 9. L’Occitane International (Parent of L’Occitane): Latest Financial Metrics Prior to Bankruptcy

[wpdatatable id=1599]

*Ended December 30, 2020

Source: Company reports/Coresight Research

US Retail Bankruptcies in 2020

In 2020, we tracked a total of 33 major retailers filing for bankruptcy protection, versus the 13 major retail bankruptcies in 2021. In both years, most bankruptcies were in the apparel, footwear and accessories segment, as consumers switched a greater share of their spending from physical stores to e-commerce.

Figure 10. US: 2020 Major Retail Bankruptcies

[wpdatatable id=1598 table_view=regular]

Revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019.

*Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017.

**J.Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant, and Lou & Grey banners; Le Tote includes Lord & Taylor banner; Tailored Brands includes Men’s Wearhouse and Jos. A. Bank, Moores Clothing for Men and K&G banners.

N/A – Not Available

Source: Company reports/Coresight Research

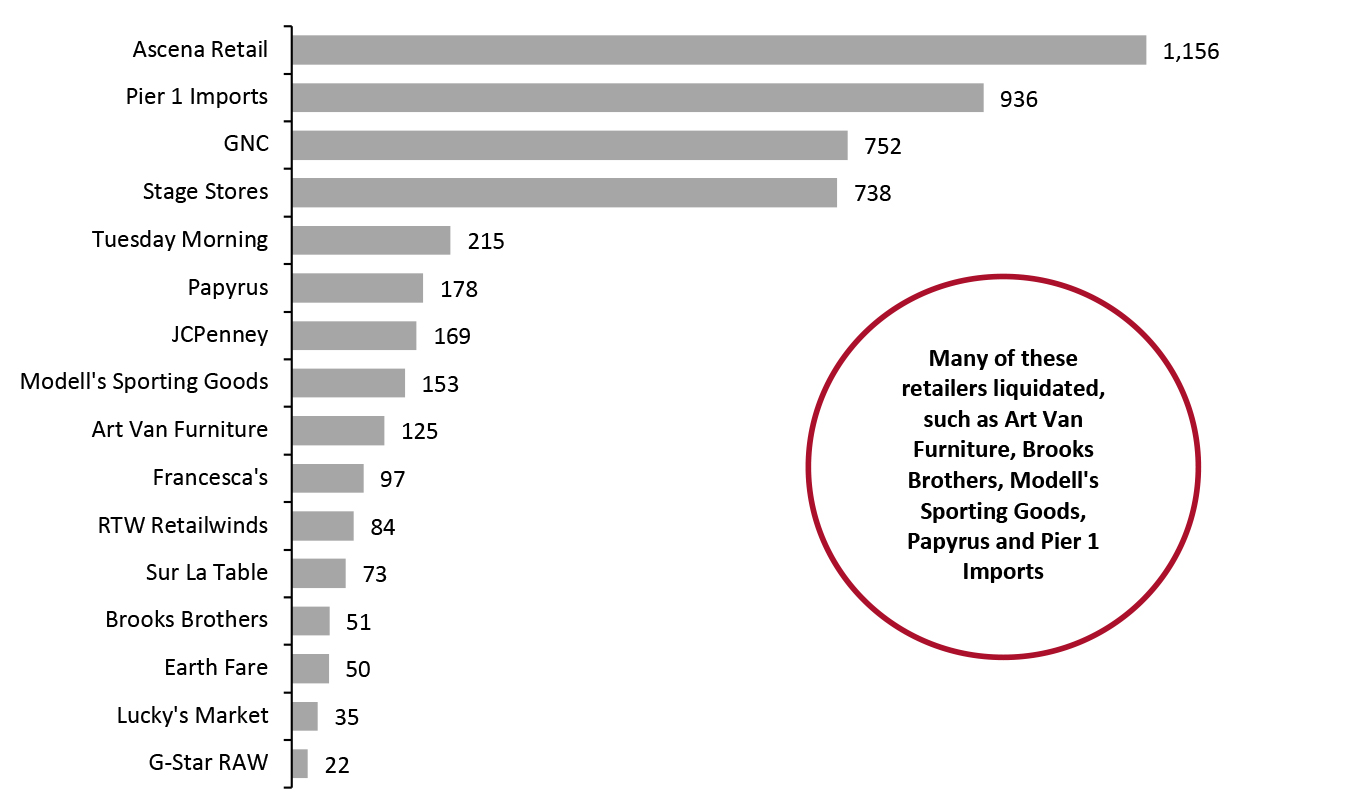

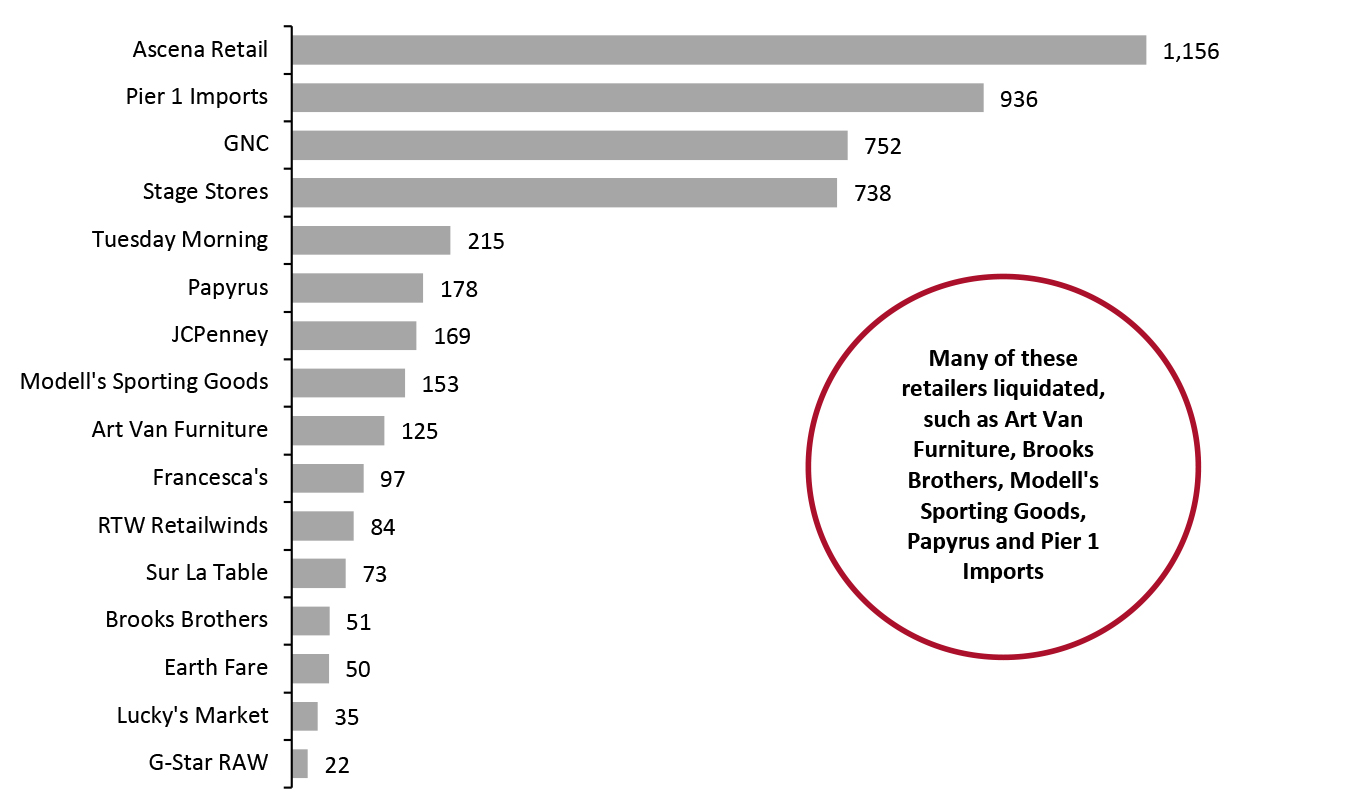

These bankruptcies contributed to the overall high number of store closures in 2020. In total, Coresight Research

recorded 9,591 store closures in the year, which includes many retailers that are closing stores without entering bankruptcy. Some 3,582 of these closures were announced by Ascena Retail Group, Pier 1 Imports, GNC and Stage Stores combined.

We show store closures in 2020 by bankrupt retailers in Figure 11.

Figure 11. US: Stores Closed in 2020 by Selected Major Firms That Went Bankrupt in the Same Year

[caption id="attachment_138879" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Changing Bankruptcy Trends

Historically, US retailers have used the bankruptcy process to reorganize by reducing debt significantly and closing most of their stores. However, the updated US Bankruptcy Code, the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA), has shortened the timeline (just 210 days) by which a retailer must assume or reject store leases and has also upped the pressure on retailers by giving “administrative priority” status to vendor claims for the value of inventory sold in the 20 days immediately preceding a bankruptcy filing.

According to Coresight Research analysis of S&P Capital IQ data, the

proportion of retail bankruptcies ending in liquidation has been higher following the implementation of the BAPCPA: From 1997 to 2005, just 33% of bankruptcies ended in liquidation or a going-out-of-business (GOB) sale; however, between 2006 and 2020, about 62% of bankruptcies ended in liquidation or a GOB sale. Nevertheless, we saw contrasting trends in 2020 and year-to-date 2021, with the majority of retailers that filed for bankruptcy looking to restructure/reorganize the business rather than liquidate their operations. Furthermore, we believe recent changes in the US Bankruptcy Code, such as amendments in the Small Business Reorganization Act (SBRA), are supporting small, distressed retailers.

To improve their prospects for a successful turnaround, we suggest that distressed retailers and brand owners reduce their dependency on lenders for DIP financing, negotiate with landlords and lenders for additional time, conduct store-profitability analysis in advance and implement liquidity-generating initiatives such as curtailing capital expenditure.

What We Think

While many of the US retailers that filed for bankruptcy in 2021 were already facing major challenges prior to Covid-19, the crisis aggravated the vulnerabilities of the most challenged and especially the most debt-laden. Even post-lockdown store reopenings did not provide much support to retailers on the edge.

Nevertheless, the number of retail bankruptcy filings was substantially lower in 2021 than we saw in 2020, with a retail recovery having been driven by the broader economic recovery, fiscal stimulus and ongoing rollout of Covid vaccines. Furthermore, strong capital markets and low interest rates, and flexible approaches from mall landlords and lenders, are also helping distressed retailers.

However, we do not think that this is a long-term solution, as the potential threat of inflation could force the US Federal Reserve System to raise interest rates and reduce support, which could impact both debt and equity markets, increasing challenges for debt-laden retailers in the future. Retailers should therefore place more emphasis on improving their operational and financial profiles. Going forward, the survival of brands and retailers will more likely depend on how much cash they have and when their major loans will mature (meaning full payment is due).

Implications for Brands/Retailers

- The ongoing pandemic will continue to primarily hit retailers that were already in financial trouble. Although cheaper refinancing options are helping distressed brands and retailers temporarily, it would be difficult for them to stay afloat in the long term by utilizing low-interest-rate funds.

- More retailers and brand owners filing for bankruptcy in the future would imply more store closures. It would also put pressure on many of the remaining retailers: With malls losing their anchor stores, traffic will decline as shoppers will have less reason to visit.

- While brick-and-mortar retailers will continue to be more vulnerable to structural changes, online retailers may also face financial struggles due to interrupted supply chains.

- A retailer should conduct a comprehensive profitability analysis of stores well in advance of a bankruptcy filing, as well as initiate rent negotiations with mall landlords against the setting of a potential bankruptcy filing. This will enable retailers to make well-informed store-closure decisions with a proper understanding of future lease expenses, and thus achieve rent savings.

Implications for Real Estate Firms

- The rise in the number of retail bankruptcies would create substantial challenges for mall landlords to find new occupants for vacant spaces on account of store closures.

- Landlords should work cooperatively with distressed retailers and look for feasible solutions that would work in the mutual interests of both the parties involved. For example, mall landlords could agree on variable rent or deferrals of rent obligations and offer consent to additional time to assume or reject the capital leases; however, this should be applied on a case-by-case basis.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

“Apparel brands and retailers” includes companies such as Christopher & Banks, Global Brands Group and Sequential Brands

“Apparel brands and retailers” includes companies such as Christopher & Banks, Global Brands Group and Sequential Brands  Source: Company reports/Coresight Research[/caption]

Key Factors Driving US Retail Bankruptcies

Source: Company reports/Coresight Research[/caption]

Key Factors Driving US Retail Bankruptcies

*First 11 months of 2021 (Jan–Nov)

*First 11 months of 2021 (Jan–Nov)  Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Changing Bankruptcy Trends

Historically, US retailers have used the bankruptcy process to reorganize by reducing debt significantly and closing most of their stores. However, the updated US Bankruptcy Code, the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA), has shortened the timeline (just 210 days) by which a retailer must assume or reject store leases and has also upped the pressure on retailers by giving “administrative priority” status to vendor claims for the value of inventory sold in the 20 days immediately preceding a bankruptcy filing.

According to Coresight Research analysis of S&P Capital IQ data, the proportion of retail bankruptcies ending in liquidation has been higher following the implementation of the BAPCPA: From 1997 to 2005, just 33% of bankruptcies ended in liquidation or a going-out-of-business (GOB) sale; however, between 2006 and 2020, about 62% of bankruptcies ended in liquidation or a GOB sale. Nevertheless, we saw contrasting trends in 2020 and year-to-date 2021, with the majority of retailers that filed for bankruptcy looking to restructure/reorganize the business rather than liquidate their operations. Furthermore, we believe recent changes in the US Bankruptcy Code, such as amendments in the Small Business Reorganization Act (SBRA), are supporting small, distressed retailers.

To improve their prospects for a successful turnaround, we suggest that distressed retailers and brand owners reduce their dependency on lenders for DIP financing, negotiate with landlords and lenders for additional time, conduct store-profitability analysis in advance and implement liquidity-generating initiatives such as curtailing capital expenditure.

Source: Company reports/Coresight Research[/caption]

Changing Bankruptcy Trends

Historically, US retailers have used the bankruptcy process to reorganize by reducing debt significantly and closing most of their stores. However, the updated US Bankruptcy Code, the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA), has shortened the timeline (just 210 days) by which a retailer must assume or reject store leases and has also upped the pressure on retailers by giving “administrative priority” status to vendor claims for the value of inventory sold in the 20 days immediately preceding a bankruptcy filing.

According to Coresight Research analysis of S&P Capital IQ data, the proportion of retail bankruptcies ending in liquidation has been higher following the implementation of the BAPCPA: From 1997 to 2005, just 33% of bankruptcies ended in liquidation or a going-out-of-business (GOB) sale; however, between 2006 and 2020, about 62% of bankruptcies ended in liquidation or a GOB sale. Nevertheless, we saw contrasting trends in 2020 and year-to-date 2021, with the majority of retailers that filed for bankruptcy looking to restructure/reorganize the business rather than liquidate their operations. Furthermore, we believe recent changes in the US Bankruptcy Code, such as amendments in the Small Business Reorganization Act (SBRA), are supporting small, distressed retailers.

To improve their prospects for a successful turnaround, we suggest that distressed retailers and brand owners reduce their dependency on lenders for DIP financing, negotiate with landlords and lenders for additional time, conduct store-profitability analysis in advance and implement liquidity-generating initiatives such as curtailing capital expenditure.