DIpil Das

What’s the Story?

In the third and final report in our America’s Changing Shopping Centers series, we look at the initiatives taken by mall operators to future-proof their centers against the current backdrop of Covid-19. These include shifting new leases toward non-apparel categories such as grocery, health care, residential spaces and digitally native brands. We discuss the prospects of each tenant type to backfill vacant spaces, as well as mall operators’ efforts to roll out digital programs to support retail tenants and better connect with digital customers.Why It Matters

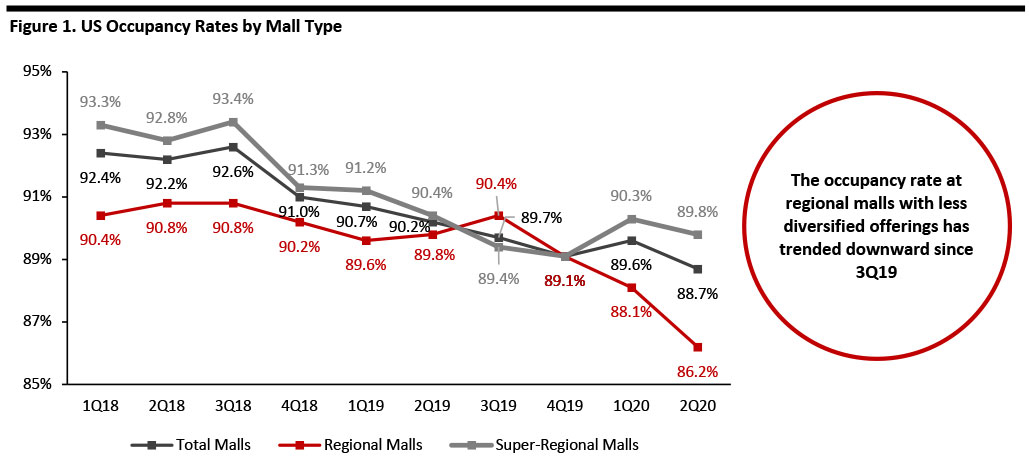

The coronavirus crisis played havoc with an already tenuous situation for America’s shopping centers, and we expect it will pull forward several years of store closures in 2020–21, adding severe occupancy and rental-rate pressure on mall owners. The occupancy rate at US shopping malls had already been trending downward in recent years due to numerous store closures and retail bankruptcies (see Figure 1) [caption id="attachment_120009" align="aligncenter" width="700"] Source: International Council of Shopping Centers (ICSC)/National Council of Real Estate Investment Fiduciaries [/caption]

We believe the demand for mall spaces from traditional tenants, such as department stores, will decline further as many of them shutter stores and scale back their brick-and-mortar expansion plans. As a result, malls are turning toward more resilient, non-traditional tenants—including health care, grocery, residential-use, and online and digitally native brands—to arrest declining occupancy rates and foot traffic.

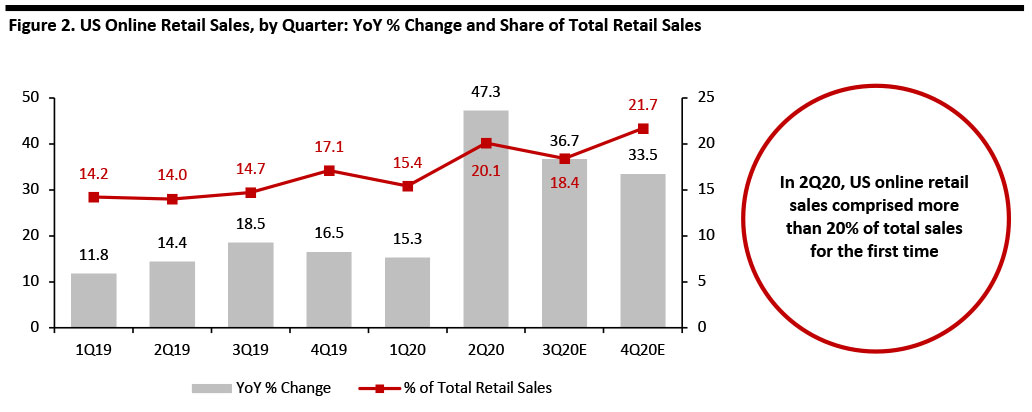

The pandemic has put e-commerce at the forefront of retail. E-commerce captured 20.1% of total US retail sales in the second quarter of 2020, up from 15.4% in the first quarter, we calculate from Census Bureau data.

[caption id="attachment_120010" align="aligncenter" width="700"]

Source: International Council of Shopping Centers (ICSC)/National Council of Real Estate Investment Fiduciaries [/caption]

We believe the demand for mall spaces from traditional tenants, such as department stores, will decline further as many of them shutter stores and scale back their brick-and-mortar expansion plans. As a result, malls are turning toward more resilient, non-traditional tenants—including health care, grocery, residential-use, and online and digitally native brands—to arrest declining occupancy rates and foot traffic.

The pandemic has put e-commerce at the forefront of retail. E-commerce captured 20.1% of total US retail sales in the second quarter of 2020, up from 15.4% in the first quarter, we calculate from Census Bureau data.

[caption id="attachment_120010" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

The e-commerce boom and growth in omnichannel trends during the pandemic galvanized many mall operators to pivot by leveraging technology and multichannel strategies to support their retail tenants and capitalize on changing consumer shopping trends.

Source: US Census Bureau/Coresight Research[/caption]

The e-commerce boom and growth in omnichannel trends during the pandemic galvanized many mall operators to pivot by leveraging technology and multichannel strategies to support their retail tenants and capitalize on changing consumer shopping trends.

Mall Operators’ Three Key Strategies To Future-Proof Shopping Centers

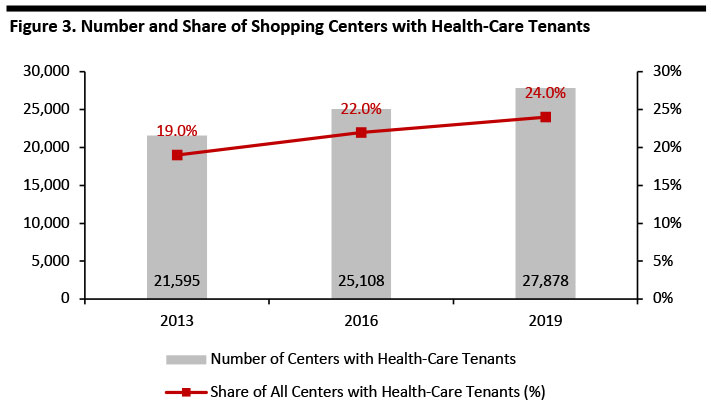

1. Diversifying the Tenant Mix Health-Care Tenants According to ICSC, 21,595 shopping centers (19% of all centers) had health-care tenants in 2013, and these tenants accounted for 1% of total space. By 2019, the number of centers with health-care tenants increased to 27,878 (24% of all centers), occupying a 2% share of total space. According to ICSC, 21,595 shopping centers (19% of all centers) had health-care tenants in 2013, and these tenants accounted for 1% of total space. By 2019, the number of centers with health-care tenants increased to 27,878 (24% of all centers), occupying a 2% share of total space. [caption id="attachment_120011" align="aligncenter" width="700"] Source: ICSC/CoStar Realty[/caption]

The share of shopping-center space taken by health-care tenants is likely to continue growing in the future. Health-care tenants provide benefits for property owners as they have higher credit ratings than the average retail renter and tend to favor longer-term contracts compared to retail brands. For health-care systems, which are increasingly focusing on lower-cost preventative outpatient care, retail centers offer locations that are more accessible to a larger population.

Several property owners are signing leases with health-care providers or redesigning vacant spaces to attract health-care tenants across their portfolio.

Source: ICSC/CoStar Realty[/caption]

The share of shopping-center space taken by health-care tenants is likely to continue growing in the future. Health-care tenants provide benefits for property owners as they have higher credit ratings than the average retail renter and tend to favor longer-term contracts compared to retail brands. For health-care systems, which are increasingly focusing on lower-cost preventative outpatient care, retail centers offer locations that are more accessible to a larger population.

Several property owners are signing leases with health-care providers or redesigning vacant spaces to attract health-care tenants across their portfolio.

- On July 22, Brookfield Properties, in collaboration with real estate services firm Colliers International, announced that it has launched redevelopment plans to convert a vacant Sears space at the Neshaminy Mall, Pennsylvania into a health-care office space—including establishing proprietary parking for patients, a covered patient drop-off pavilion and a dedicated entrance and lobby.

- On June 22, Washington Prime Group announced plans to redevelop a former Sears store into a logistics, distribution and fulfillment center for the West Virginia University Medicine network.

- Macerich announced leasing a 56,000-square-foot former Sears department store space at Wilton Mall to Saratoga Hospital on October 19, 2019. Construction is currently under way, and the hospital is set to complete the shift of outpatient and other health-care services to the mall by 2021.

- Time Equities noted that a vacating JCPenney store at Foothills Mall, an enclosed mall in Maryville, Tennessee, is attracting much attention from nonretail businesses, including a tenant in the health-care space.

- Dana Farber Cancer Institute will open a 34,000-square-foot oncology and hematology outpatient hospital satellite facility at Patriot Place mall, Massachusetts in 2022.

Source: Company reports[/caption]

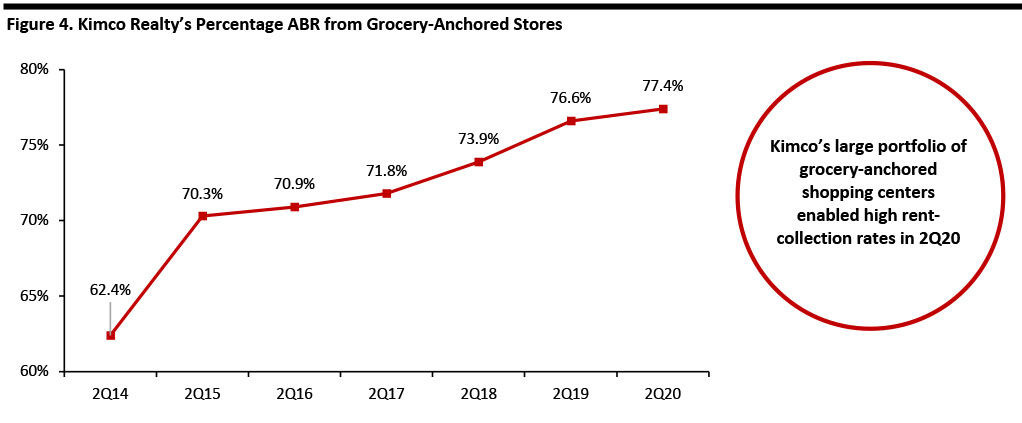

As grocery tenants tend to do well during a sluggish economy and provide consistent traffic that benefits inline tenants, they remain highly sought-after investments by property owners.

Source: Company reports[/caption]

As grocery tenants tend to do well during a sluggish economy and provide consistent traffic that benefits inline tenants, they remain highly sought-after investments by property owners.

- Gallatin Mall Group announced on October 15 that Whole Foods Market will open a new grocery store at the space formerly occupied by restaurant chain Fuddruckers at its Gallatin Valley Mall. Whole Foods will join Barnes & Noble, JoAnn Fabrics, Macy’s and Regal Cinemas in anchoring the 365,000-square-foot center.

- Brixmor Property noted in its second-quarter 2020 earnings call that it has two gross leases with grocery tenants and three more in the legal pipeline. It is expecting more to come through in the near future.

- In its earnings call for the second quarter, ended June 30, Simon Property Group hinted at the idea of increasing grocery exposure in its malls.

- Brookfield Properties, in partnership with residential developer AvalonBay Communities, is transforming a wide portion of the Alderwood Mall in Lynwood, Seattle, into Avalon Alderwood Place, a 300-unit apartment complex with underground parking, which is expected to open by 2022. Brookfield will not completely erase the shopping side of the development, with commercial businesses still expected to take up 90,000 square feet of retail space.

- In November 2018, Brookfield Properties announced that it plans to redevelop at least 100 of the 125 malls in the GGP portfolio (acquired by Brookfield in August 2018) in the next few years to repurpose or add residential/office space and turn them into mixed-use “mini cities.” In its Analyst Day presentation on September 24, 2020, the mall operator said that it will expedite the “mini cities” plan to meet changing consumer demand and benefit the surrounding retail sectors.

- Simon Property Group, in partnership with developer Cornerstone Tracy, is planning to build two apartment buildings at the Oxford Valley Mall, Pennsylvania, on the site of a vacant Boscov’s department store. The project, which was greenlit by township supervisors on August 5, will feature a parking garage and several amenities, including fitness centers, green spaces and pools.

- In its first quarter, ending March 30, Acadia Realty signed a lease with digitally native apparel brand Veronica Beard, which will open two locations in late 2020, at its shopping centers in Chicago and Connecticut.

- In March, the Westfield Valley Fair shopping mall in California, owned by Unibail-Rodamco-Westfield, opened a new “Digital District,” a section on its property specifically designed for born-on-the-web brands. Online firms that have joined the Digital District following lockdowns include Brik + Clik, Felix Gray, Goodies and We The People.

- Online footwear company Allbirds opened a new location at the Westfield UTC mall in San Diego, California in June.

- Amazon has been doubling down on its brick-and-mortar expansion by opening Amazon 4-star locations in selected malls this year: Willowbrook Mall, New Jersey (in October); The Mall at Millenia, Florida (in September); The Gardens Mall, Florida (in September); Westfield Topanga & The Village, California (in March); and The SoNo Collection, Connecticut (in February). The company plans to open two new 4-star stores at the American Dream mall, New Jersey and Lincoln Road Mall, Florida by the end of 2020.

Amazon 4-star, The Mall at Millenia

Amazon 4-star, The Mall at Millenia Source: The Mall at Millenia [/caption] CBD Specialty Stores CBD (cannabidiol) products have surged in popularity since the passage of the 2018 Farm Bill, which effectively made hemp and CBD legal in all US states and allowed its transport across state lines. Many brands and companies jumped on the opportunity by launching new product lines with CBD as an ingredient—such as in lotions and topicals—or purified and made into capsules, oils, tinctures and edible products. Many CBD specialty stores have cropped up in malls owned by some of the country’s largest landlords, such as Simon Property Group. We expect that CBD will continue to be one of the biggest growth categories in the retail industry, relying on physical stores for expansion. According to cannabis market research firm Brighton Field Group, the US CBD market is projected to reach $4.7 billion in sales in 2020, up 14% year over year, and is estimated to grow to $16.8 billion in 2025. Coresight Research estimates that the US market for CBD health and wellness products—including skin care, sleep care and cosmetics—will grow from $350 million in 2020 to $1.0 billion in 2025, at a CAGR of 24.0%, propelled by consumer interest in CBD’s functional properties. In addition, several states and local governments deemed CBD businesses as “essential,” allowing these stores to continue to operate during lockdown restrictions. Against this backdrop, we believe that many mall operators will continue to capitalize on the growing CBD industry by onboarding more CBD specialty retail tenants at their shopping centers. Implications Grocery emerged as one of the strongest retail sectors during the pandemic. The majority of shopping centers that have turned a profit amid the Covid-19 crisis are anchored by grocery stores. Landlords and developers are recognizing the need for filling vacant space with retailers that will generate steady foot traffic, and grocery stores are quickly becoming top candidates. At the same time, grocery is a highly mature sector that, pandemic aside, was growing modestly—and the sector is now seeing rapid online growth. These factors imply relatively limited total opportunities for net new space in the sector, although pockets of opportunity will remain, with expanding chains and retailers seeking to relocate stores. In light of the current health crisis, the symbiotic relationship between health care and retail real estate will likely intensify. As the health-care system’s capacity to deal with possible future pandemics is reviewed, interest in shopping centers for use as emergency facilities will likely grow, supported by consumers’ increasing preference for proximity, convenience and lower-cost services from their medical providers. With US health-care expenditure projected to reach $6.19 trillion by 2028, the health-care industry is only getting bigger. Given that health-care providers occupied only 2% of retail space in shopping centers in 2019, we believe there is a lot of potential for medical providers to expand into shopping centers and backfill the vacant spaces left by department stores. Repurposing part of the mall real estate to create residential and mixed-use spaces can be a potential game-changer for shopping malls as housing units are always in high demand. However, we believe that mall operators will be unlikely to go full steam on this trend as residential conversions require a significant amount of time and money, expensive constructions, renegotiations with lenders and investors and the rezoning of spaces, which can be a long and tedious process. Digitally native firms typically require less physical space than traditional retailers, because many of them do not carry much inventory. These brands usually open smaller stores that complement their online businesses and occupy small-box locations in the mall. In addition, they open new stores at a lower frequency than their offline retail peers. Considering these factors, we believe that the transition of digitally native brands into malls may not help mall operators to compensate for the falling occupancy rates caused by retail and department store closures. 2. Opening Open-Air Pop-Ups Many consumers are still worried about returning to indoor malls as the pandemic drags on, so mall operators are creating safe and innovative ways to serve retailers and customers, including by extending retailers’ offerings outdoors through open-air pop-ups. The Unibail-Rodamco-Westfield Westfield Valley Fair mall in Santa Clara and Westfield Oakridge mall in San Jose, California, both launched Open Air Markets in July 2020. The event is held weekly from Fridays to Sundays and allows retailers to sell mall products in an outdoor space. The malls launched the concept with only a few retailers but has been adding market stalls over time as more retailers become ready to operate in an outdoor format. Participating chains include Ann Taylor, Athleta, David Yurman, Haagen-Dazs, Hugo Boss, Pottery Barn and Quay Australia. Similarly, South Coast Plaza in Costa Mesa, California has refurbished its parking structure to hold 14 open-air rooms called “The Pavillion,” equipped with mobile fitting rooms, floral arrangements and Wi-Fi. Shoppers can set up appointments and shop at the participating tenant boutiques, including Omega, Prada and Versace. Simon Property-owned malls including The Shops at Mission Viejo, Ontario Mills and Del Amo Fashion Center (all in California) are holding open-air pop-ups hosted by various retailers and eateries on weekends, Friday through Sunday, in their parking lots. Participating retailers include Kate Spade New York, TravisMathew and Nature Republic. [caption id="attachment_120014" align="aligncenter" width="700"]

Open-air pop-ups, The Shops at Mission Viejo

Open-air pop-ups, The Shops at Mission Viejo Source: Simon Property Group [/caption] 3. Rolling Out Digital Programs Under pressure due to rising e-commerce and a large number of consumers staying away from malls for an extended period, mall operators are launching their own digital programs, underpinning collaboration with retail tenants to extend their customer reach. In September, Centennial Realty announced that it will launch an omnichannel Shop Now! service in October, a cross-portfolio e-commerce marketplace that allows consumers to shop products listed at each of its seven regional and super-regional malls. For Phase 1 of the service, the mall operator hired Adeptmind, an AI-powered e-commerce company, to aggregate the inventories of all tenants of each mall and install them in the shoppable format on the mall’s website. Customers are offered home delivery, curbside delivery or pickup-in-mall fulfillment options for their online orders. In Phase 2 of the program, which will launch in 2021, inventory from different stores across malls will be consolidated, enabling consumers to make several cross-mall purchases and pay in one transaction. Tanger Outlets introduced a virtual shopping concierge app in June that connects consumers with a personal Tanger associate who recommends a selection of offerings in each store, including the hottest and best deals as well as new product launches. Once the associate gathers the merchandise, shoppers can either opt for curbside pickup or have it delivered to their homes. In June, Brookfield Properties teamed up with FIT:MATCH to roll out 3D AI (artificial intelligence)-powered body-scan technology at three of its US shopping malls. Shoppers can use the FIT:MATCH kiosk in the mall, which takes 3D measurements of their body within two minutes. They can then start shopping a personalized assortment of apparel from participating retailers. This saves consumers the hassle of trying on clothes and, for retailers, increases conversion rates and limits returns. The contactless fitting experience was introduced in Oakbrook Center, Chicago in August, followed by Glendale Galleria, Los Angeles and Stonebriar Center, Dallas in September. In August, PREIT forayed into online shopping for the first time by launching a curated back-to-school shopping program, sMALL Surprises, which includes merchandise from multiple PREIT mall tenants. Each sMALL Surprises pack contains a selection of products including toys/games, on-trend accessories, activity cards, stickers and other school supplies. Shoppers can visit the dedicated website to fill out a survey, the results of which are used by the professional stylists to create a personalized surprise pack, which is home-delivered to the consumer anywhere in the country. In addition to various digital programs, malls quickly pivoted amid the Covid-19 pandemic by launching curbside-delivery programs to make it safer for customers to shop and help tenants to lift sales.

- Unibail-Rodamco-Westfield has launched a curbside-pickup program at 70 of its mall properties since the onset of the pandemic in the US, and its concierge teams have been utilized to help understaffed tenants execute curbside delivery.

- Brookfield Properties has launched curbside pickup at its malls in 38 states during the pandemic.

- Federal Realty launched curbside pickup across its shopping centers nationwide in May.

- Kimco Realty has introduced a curbside-pickup program at more than 300 centers since the crisis began and has decided to designate space for curbside pickup at some locations on a permanent basis.

What We Think

Based on year-to-date company announcements as of November 18, Coresight Research has recorded 1,340 department store closures in the US for the full-year 2020. In light of this, mall operators will have to step up their transformation through a sustained pivot away from less relevant apparel-dominated offerings toward a more diverse and resilient tenant mix to ensure their long-term financial stability. Mall operators must capitalize on the e-commerce boom but also justify their physical location, taking into account consumer concern around social distancing: They could reconfigure parking lots to include a drive-thru lane for online-order pickup as well as converting some vacant store space to serve as common delivery points for e-commerce orders via “buy online, pick up in mall” services.Looking Ahead

Malls are facing significant headwinds as a retail format, given that many are anchored by big department stores and the pandemic accelerated their downward spiral, pushing them towards bankruptcy. In the light of an accelerated retail shakeup, malls are seeking to adapt to, and capitalize on, changing consumer trends and sustain their revenue productivity. We expect to see the following changes in the mall landscape in five years’ time:- A higher proportion of non-apparel tenants such as grocery and health care will backfill the vacant space created by department stores and online brands occupying small-box stores at malls.

- Experience-based retail is on pause and is not a primary driver for mall real-estate demand for now. However, we expect that consumers’ prioritization of quality experiences over products will resume once the pandemic subsides, restarting the shift in spending from discretionary goods to discretionary services. In this context, experiential retail could still be a key component of malls’ future in the long term, supporting changes in the tenant mix away from traditional retailers.

- The pandemic has sparked a rise in curbside delivery options, which bridge the gap between e-commerce and physical retail, offering consumers the convenience of contactless order fulfillment alongside the relative ease of ordering online. Consumers are more likely to stick to this channel even when the pandemic subsides, and it will just become part of a suite of options that shoppers will expect from retailers in the future. In this context, malls will have permanently designated parking areas or pickup stations for multiple retail brands to facilitate curbside delivery.