albert Chan

Introduction

Even before the coronavirus outbreak dealt a severe blow to discretionary physical retailers in the US, many malls were experiencing significant business headwinds—particularly Class B and C malls—due to reduced shopper traffic and heavy store closures in the core apparel sector. With discretionary spending incrementally shifting from products to services and sales migrating online, the physical retail landscape was witnessing ongoing store-rationalization trends as struggling retailers tried to optimize their brick-and-mortar fleets.

However, the rationalization of mall space typically lagged store closures. The coronavirus-induced lockdowns and resulting economic fallout could prove to be a turning point for American shopping centers, accelerating the pace of mall-space consolidation through 2020.

Short- to Medium-Term Impact

Customer Visits Stayed Low at Reopened Malls, but Are Gaining Momentum

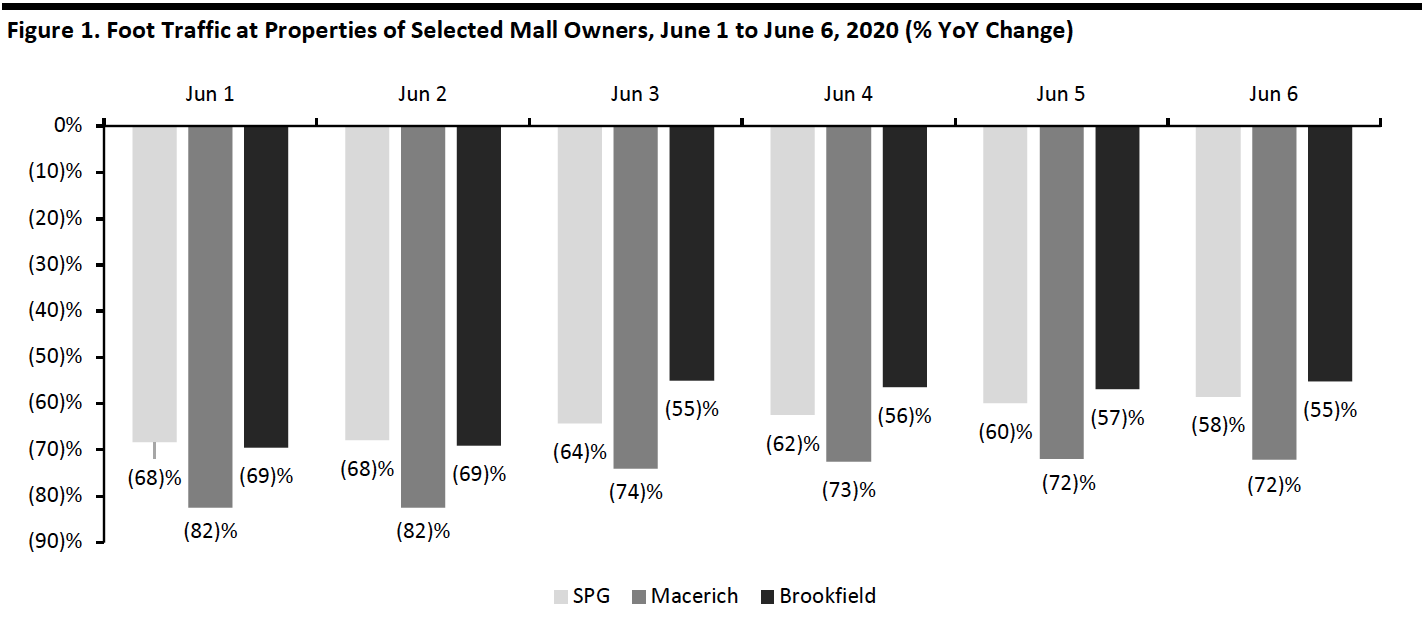

In May, property owners including Brookfield, Macerich and Simon Property Group (SPG) reopened several of their properties across the US in phases, with a slew of initiatives to help customers, tenants and employees feel safe. However, daily visits at several of those properties were initially low compared to last year, according to location-data analytics company Placer.ai. This suggests that consumers remained concerned about the risk of infection in enclosed public spaces as lockdowns were lifted, and many had cut their discretionary spending.

Most of the malls that reopened did so with shorter operating hours, and many businesses inside malls—such as restaurants, retail stores and movie theaters—remained closed by choice or reopened with social distancing restrictions and capacity limits, subject to state-by-state regulations.

However, according to Placer.ai data, foot traffic at reopened malls has been gaining momentum and is showing signs of recovery. Although the number of visits is still lower than last year’s figures, foot traffic at US shopping centers owned by Brookfield, Macerich and SPG increased from June 1 to June 6, 2020.

[caption id="attachment_112202" align="aligncenter" width="700"] Source: Placer.ai[/caption]

Source: Placer.ai[/caption]

Mall Owners Collect Low Percentages of Rent in April; Rental Rates Likely To Fall Further

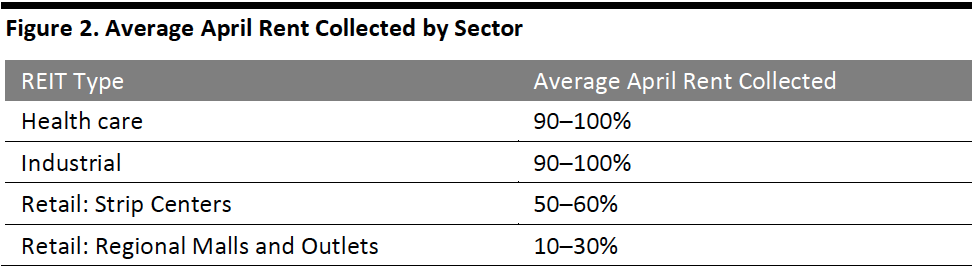

As retail business came to a standstill in the March and April, mall owners’ rent collections hit rock bottom, with most retail tenants negotiating rent agreements with landlords or not being able to pay rents altogether. According to S&P Financial Services, malls and outlet centers collected only 10–30% of April rent, and this is a trend that was forecast to remain challenging for May and June.

- Washington Prime Group announced on May 8 that it collected only 30% of its base rent from tenants for April, with just 25% collection rate from its 43 indoor malls and 50% from its 56 open-air properties. The company expects to collect about 45% of rent for the second quarter of 2020, while deferring 45% and abating the remaining 10% of rent payments.

- Macerich announced in its first-quarter conference call that it collected only 26% of its rents from tenants at its 47 shopping centers in the US for April and 18% of May rents as of May 8.

- In its first-quarter 2020 results, Brookfield reported that it collected only 20% of its April rent from its retail portfolio.

- CBL Properties reported in its first-quarter earnings release that it collected 27% of its rent for April, and estimated May rent collection to be in the range of 25–30%.

Source: S&P[/caption]

Source: S&P[/caption]

With a large share of mall tenants already failing to pay their full rents and negotiations with landlords still ongoing, many mall operators must also brace for a downward resetting of rental rates this year. According to real-estate information firm CoStar Group, retail rents in the US have increased by 2.6% year over year in the past three years and currently average $21.80 per square foot. However, the firm projects that retail rents could fall by 8–13% in 2020 due to the pandemic.

Experiential Retail Will Not Save the Day in the Near Term

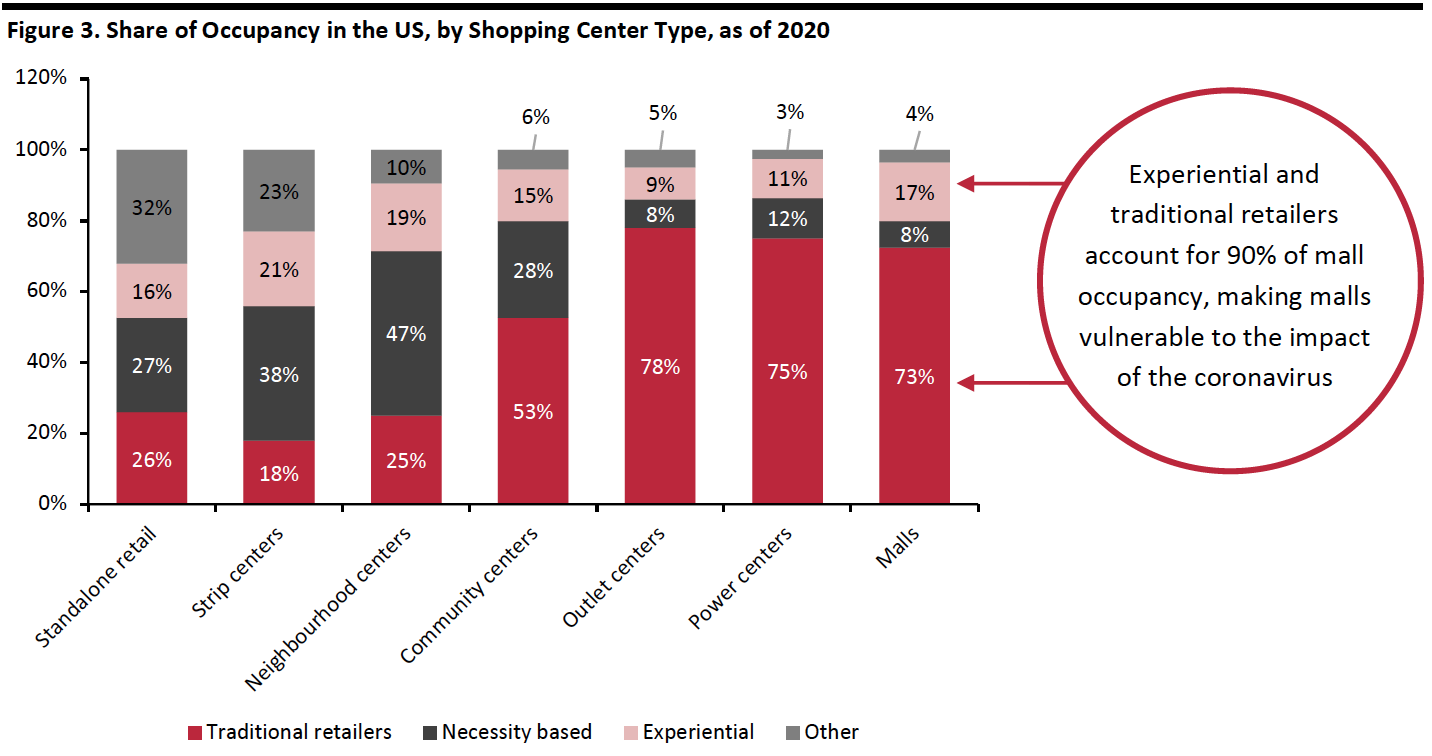

With consumers reprioritizing their spending more on discretionary services than discretionary goods, alongside the migration of apparel sales online, many mall owners were expanding their experience-led offerings prior to the pandemic—by adding food services, fitness centers, children’s entertainment and movie theaters to their tenant mix. However, this strategy is unlikely to help malls to recover quickly post lockdown: Shopping centers were the first casualties of social distancing public health protocols and will probably be the last coming out of them as well.

As of 2020, traditional and experiential retailers account for around 90% of mall occupancy—the highest proportion compared to other types of shopping centers (see Figure 3), which means that malls are highly vulnerable to the adverse effects and downturn caused by the coronavirus crisis.

[caption id="attachment_112204" align="aligncenter" width="700"] Source: Statista/CoStar Group[/caption]

Source: Statista/CoStar Group[/caption]

Medium- to Long-Term Impact

As of June 5, 2020, US retailers had announced 4,005 permanent store closures this year, most of which were made public before the crisis. With several retailers facing losses due to temporarily shutting down shop, the pandemic will likely spur record store closures this year, leaving a glut of empty space at shopping malls nationwide. This scenario would add severe occupancy- and rental-rate pressure on mall owners, perhaps even pushing them to take the drastic step of permanently closing down several malls.

Flurry of Department-Store Closures Will Lead to Occupancy Issues and Reduced Property Cash Flows

Department stores, which have traditionally served as mall anchors, were struggling well before the coronavirus halted nonessential shopping. Department-store chains were suffering from bloated debt levels and dwindling cash flows. It is not surprising then that the coronavirus crisis has only accelerated these companies’ downward spiral, seeing them edge toward bankruptcy.

- Luxury department-store chain Neiman Marcus and fashion retailer J.Crew Group each filed for bankruptcy protection in the first week of May because of heavy debts combined with slumping sales due to the coronavirus-induced temporary store closures.

- Nordstrom announced that it would permanently close 16 of its full-line department stores after assessing the market and impact from pandemic.

- Stage Stores, which operates department stores including Bealls, Goody’s and Gordmans, filed for bankruptcy on May 11 and plans to liquidate its store portfolio if a suitable buyer is not found. The company stated that the “increasingly challenging market exacerbated by the Covid-19 epidemic” made it impossible to secure financing to continue operations.

- JCPenney, which was facing declining sales and losses heading into the crisis, filed for bankruptcy protection on May 15 and said that its plan to restructure would include closing 242 stores, or nearly 30% of its store estate. The department-store chain said that it plans to close 192 stores by February 2021, followed by another 50 in 2022, leaving the company with just over 600 stores.

According to the CoStar Group, 14 of the 20 largest mall tenants are either apparel tenants or department-store chains; Macy’s takes the largest share of US mall space with 6.2%, while JCPenney occupies the second largest mall space at 6%. CoStar Group noted that four of the companies that have filed for bankruptcy protection (JCPenney, J.Crew, Neiman Marcus and Stage Stores) together occupy almost 117 million square feet of retail space, 65.4% of which (75.2 million square feet) is in malls.

With a flurry of department store closures, many malls are expected to struggle to find new tenants, as businesses pull back sharply on spending and expansion amid the pandemic. The threat of a second wave of infection later this year is also preventing many retailers from making investments into future expansion. Even Class A malls may find themselves in a tough position to find replacement tenants for empty anchors.

This means that many malls will be faced with multiple anchor vacancies for an extended period, adding revenue pressure on mall operators—reducing their ability to pay mortgages to lenders as well as expenses associated with property maintenance. CBL Properties, which has a high concentration of Class B regional malls in its portfolio, has already announced its intent to cooperate with lenders in foreclosure proceedings on several malls in its portfolio. The property owner is facing pressure from the store-closure plans of its top revenue producer, L Brands, which accounts for 4.3% of CBL’s annual revenues. The company also counts JCPenney as among its top tenants, as the retailer occupies 5.69 million square feet, accounting for about 1% of CBL’s total revenue.

In-Line Tenants Can Terminate Their Leases When Anchors Depart

Anchor department stores have traditionally helped to drive traffic to shopping centers, making mall space attractive to smaller in-line stores. Losing anchors could prove disastrous for mall owners as many in-line tenants would likely attempt to exercise their co-tenancy rights.

Co-tenancy clauses permit rent reductions or the ability to terminate a lease early if other specified tenants stop operating/leave and/or the overall occupancy of the mall falls below a pre-determined level. If the vacant space is not backfilled within the grace period, the co-tenancy provision can trigger a domino effect, allowing even more tenants to leave as occupancy falls further. This scenario could further hollow out the mall, ultimately pushing it entirely out of business.

Curbside Pickup Is Here To Stay

Many US shopping center operators are making curbside pickup a permanent fixture at their properties, enabling their tenants to sell while maintaining social distancing guidelines. The curbside-pickup trend gained traction during coronavirus lockdowns. According to Adobe Analytics, the number of customer orders placed online and picked up at stores soared 208% in the first 20 days of April versus the same period last year.

Kimco Realty noted that some of its national tenants reported a 200% increase in curbside pickup during the lockdown. In light of this, the real-estate owner announced on April 30 that it would roll out a permanent curbside-pickup feature at its Texas shopping centers, with plans to extend the program nationwide. The company has designated curbside-pickup zones at its centers for use by all tenants and their customers.

[caption id="attachment_112205" align="aligncenter" width="550"] Source: Kimco Realty[/caption]

Source: Kimco Realty[/caption]

New Tenants for Empty Anchors

In the wake of the coronavirus crisis, we believe that mall operators will be inclined to backfill the vacant space left by anchor tenants such as department-store chains by onboarding logistics tenants and “essential services” providers to their tenant mix. These companies are well positioned to offer low risk of rental-rate volatility, steady cash flow and stable occupancy levels during the uncertain market environment. However, it will likely remain a potential long-term challenge for many mall operators to lease out vacant spaces; demand for such large spaces is expected to decline further.

Dark stores: Heightened demand for e-commerce brings a greater need for fulfillment, and we could see some mall space repurposed as local distribution centers, including dark stores—i.e., “stores” that purely fulfill online orders. Particularly as mall owners seek to repurpose the substantial space vacated as department stores close, nontraditional tenants such as fulfillment centers could prove appealing. The concept of dark stores is most associated with online grocery, but we could see the emergence of local in-mall distribution centers for nonfood categories. A trend of retail-to-logistics conversions would align with REITs’ emphasis on repurposing space for other nonretail uses, from housing to coworking spaces, in recent years.

Retailers have already been ramping up ship-from-store capabilities with temporarily closed stores serving as de facto dark stores. For instance, in its most recently quarterly update, Kohl’s reported that 40% of digital orders were shipped from stores, while Gap Inc. management has pointed to an expected increase in fulfillment of online orders in stores. Amid ongoing risks related to localized coronavirus resurgences, we may see some retailers temporarily re-close stores and focus those spaces on fulfilling online orders, whether for delivery or curbside pickup—and in some cases, retailers may opt to make those changes permanent.

Grocers: Grocery stores are unique in their ability to attract shoppers often two or three times per week—regardless of the economic circumstances. This provides a grocery-anchored mall with consistent traffic that benefits in-line tenants. This is particularly appealing in the context of a coronavirus-induced recession looming.

According to Coresight Research, grocers represented almost 7% of the total announced US store openings in 2019, and instances of them filling up spaces vacated by department stores are not new. Supermarket chain Stew Leonard, for example, moved into an 80,000-square-foot location at New Jersey’s Paramus Park Mall formerly occupied by Sears in September 2019. Lidl announced plans to open a 26,170-square-foot full-service store at the former Sears space at the Mall in Columbia in Maryland.

Health-care centers: Property owners could tap health-care providers to help them reinvigorate their malls in this global uncertainty. Health-care clinics have high credit ratings and sign longer leases—10–12 years as compared to the typical five-year lease for traditional retailers—providing continuity of stable rental income for an extended period. In addition, health-care centers can bring more daytime traffic to malls, as opposed to other tenants, such as restaurants, which bring in evening custom. The number of retail health-care clinics in the US increased by 47% during 2016–2019, but despite this potential, only 10% of US shopping centers had a health-care-related tenant, according to a JLL research report published in 2019.

Currently, health-care services in retail locations typically provide low-acuity patient care and routine health-care services. However, retail centers are also growing in the type of services that health facilities offer. More intensive treatment such as chronic disease management, oncology and specialty care are being considered for retail locations as well.

How Malls Plan To Reopen

As states across the US relaxed stay-at-home guidelines, several mall owners introduced a slew of measures to persuade wary shoppers that reopened malls are safe zones. Some of the key initiatives include:

- Introducing technologies to monitor traffic in the mall, including geofencing and traffic-counting solutions, especially in common areas such as food courts.

- Installing multiple sanitation stations, particularly at mall entrances, equipped with hand sanitizer, masks, gloves and other personal protective equipment.

- Mall staff frequently steaming garments and disinfecting surfaces such as escalators, changing rooms and shopping bags.

- Plexiglass barriers, also known as sneeze guards, being installed at point-of-sale locations.

- Requiring shoppers to form lines outside stores to avoid overcrowding inside, with floor markers to indicate how close consumers can stand to each other.

- Implementing mandated temperature checks to help identify shoppers who may be symptomatic with the coronavirus or other illnesses.

- Putting up physical and digital signages to encourage social distancing and other safety protocols.

- Adjusting food-court and movie-theater layouts. Movie-theater operators may have to stagger interval times between movies to avoid crowding the food-service section and washrooms.

- Setting up multi-retailer product pickup and return stations, positioned outdoors or in a separate building, for shoppers who wish to return online purchases from mall tenants but are not ready to enter public spaces.

The Way Ahead

With department stores undergoing rapid consolidation due to the coronavirus crisis, we believe that mall operators will be more inclined to replace them with essential service providers such as grocers and health-care centers, as they can offer steady cash flow and stable occupancy levels. However, it will likely remain a potential long-term challenge for many mall operators to lease out vacant space, as demand for such large spaces is expected to decline further.

With state and local governments relaxing stay-at-home restrictions, mall owners and experiential retail tenants will likely work out a framework for relaunching leisure offerings while maintaining social distancing guidelines. Providing safe and reassuring retail experiences will involve sustained work on operational details and may require a permanent or semi-permanent reduction in service offerings.

Mall operators will potentially work closely with tenants to establish centralized locations for order pickup and returns. Prior to the crisis, shoppers were receptive to click-and-collect shopping, and this trend could accelerate as the economy reopens.