Nitheesh NH

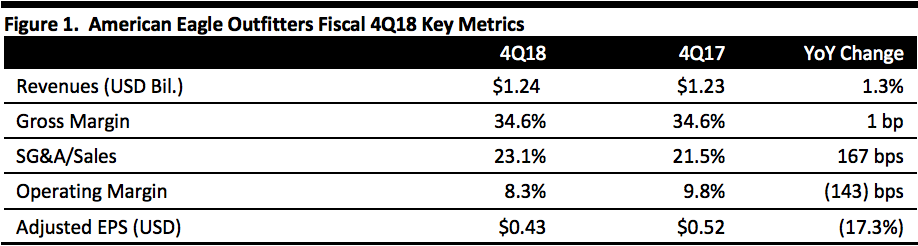

[caption id="attachment_79616" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

American Eagle Outfitters reported fiscal 4Q18 revenues of $1.24 billion, lower than the consensus estimate of $1.26 billion, and up 1.3% year over year. The company reported 4Q18 EPS of $0.43, higher than the consensus estimate of $0.42, and 17.3% lower than the year ago period, but exceeding the company’s guidance of $0.40-0.42.

American Eagle's fourth quarter comp sales rose 3%, marking the seventh consecutive quarter of comp increases. For the fiscal year, AEO comparable sales were 8%. By brand, American Eagle comps were up 3%, compared to a 5% increase last year. Aerie comps increased 23%, following a 34% increase in the prior year. This is Aerie’s 17th consecutive quarter of double-digit comp growth.

For the 2018 fiscal year, AEO reached a milestone of $4 billion in sales, up 6.3% from $3.79 billion in the year ago period.

The company reported its digital channel posted a positive high single-digit increase in the quarter, its highest volume quarter ever. Digital penetration rose to 31% of revenue in the fourth quarter and 28% for the full year.

American Eagle Outfitters surpassed $1 billion in jeans sales in 2018. Management stated the American Eagle Outfitters’ brand is the number one women’s jeans brand across all age demographics, and the number two jeans brand for men and women. The company reported it continues to see growth in its jeans and bottoms categories as well as complementary businesses including graphics, shoes and accessories.

The company stated it is testing new concepts with customers. For example, the company opened a sneaker shop within its New York City, SoHo Store in partnership with Urban Necessities, a retailer of premium sneakers. Urban Necessities is a resale sneaker store that sells special-edition sneakers including brands Supreme, Adidas and Nike. Prices range from $150.00 to $50,000. American Eagle Outfitters also launched “American Eagle Style Drop,” a monthly rental service that lets consumers select three pieces for $49.99 a month.

The company commented that it sees its Aerie brand as a growth opportunity for the company and the team is focusing on “gaining market share by offering compelling, quality products that make customers feel good.” Management stated that Aerie’s differentiator is its ability to focus on new trends, engage with styles missing from the market, and deliver these new styles to the customer. The company reported it is focusing on entering new markets and growing its customer base by prioritizing global expansion in 2019.

In 2018, the company opened 12 Aerie stand-alone stores, 29 Aerie side-by-side locations, and closed six old format stores. Management said it plans to open 60-75 Aerie locations in 2019.

For the AE Brand, the company opened 16 total locations and closed 15 stores in 2018 In 2019, the company plans to reposition and remodel AE stores and to continue expanding globally through its franchise partnerships.

Outlook

For In the 1Q19, the company projects earnings per share of $0.19 to $0.21, lower than the consensus estimate of $0.24. AEO expects comparable sales to be in the positive low single digits.

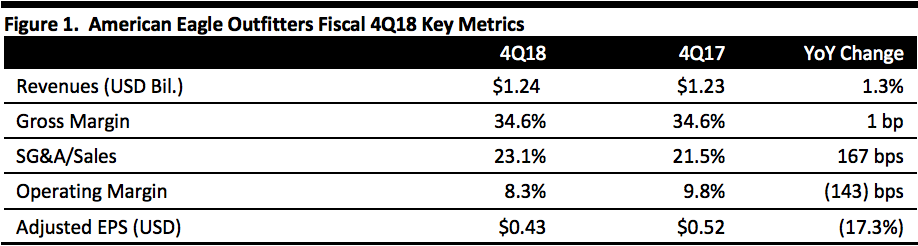

Source: Company reports/Coresight Research[/caption]

4Q18 Results

American Eagle Outfitters reported fiscal 4Q18 revenues of $1.24 billion, lower than the consensus estimate of $1.26 billion, and up 1.3% year over year. The company reported 4Q18 EPS of $0.43, higher than the consensus estimate of $0.42, and 17.3% lower than the year ago period, but exceeding the company’s guidance of $0.40-0.42.

American Eagle's fourth quarter comp sales rose 3%, marking the seventh consecutive quarter of comp increases. For the fiscal year, AEO comparable sales were 8%. By brand, American Eagle comps were up 3%, compared to a 5% increase last year. Aerie comps increased 23%, following a 34% increase in the prior year. This is Aerie’s 17th consecutive quarter of double-digit comp growth.

For the 2018 fiscal year, AEO reached a milestone of $4 billion in sales, up 6.3% from $3.79 billion in the year ago period.

The company reported its digital channel posted a positive high single-digit increase in the quarter, its highest volume quarter ever. Digital penetration rose to 31% of revenue in the fourth quarter and 28% for the full year.

American Eagle Outfitters surpassed $1 billion in jeans sales in 2018. Management stated the American Eagle Outfitters’ brand is the number one women’s jeans brand across all age demographics, and the number two jeans brand for men and women. The company reported it continues to see growth in its jeans and bottoms categories as well as complementary businesses including graphics, shoes and accessories.

The company stated it is testing new concepts with customers. For example, the company opened a sneaker shop within its New York City, SoHo Store in partnership with Urban Necessities, a retailer of premium sneakers. Urban Necessities is a resale sneaker store that sells special-edition sneakers including brands Supreme, Adidas and Nike. Prices range from $150.00 to $50,000. American Eagle Outfitters also launched “American Eagle Style Drop,” a monthly rental service that lets consumers select three pieces for $49.99 a month.

The company commented that it sees its Aerie brand as a growth opportunity for the company and the team is focusing on “gaining market share by offering compelling, quality products that make customers feel good.” Management stated that Aerie’s differentiator is its ability to focus on new trends, engage with styles missing from the market, and deliver these new styles to the customer. The company reported it is focusing on entering new markets and growing its customer base by prioritizing global expansion in 2019.

In 2018, the company opened 12 Aerie stand-alone stores, 29 Aerie side-by-side locations, and closed six old format stores. Management said it plans to open 60-75 Aerie locations in 2019.

For the AE Brand, the company opened 16 total locations and closed 15 stores in 2018 In 2019, the company plans to reposition and remodel AE stores and to continue expanding globally through its franchise partnerships.

Outlook

For In the 1Q19, the company projects earnings per share of $0.19 to $0.21, lower than the consensus estimate of $0.24. AEO expects comparable sales to be in the positive low single digits.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

American Eagle Outfitters reported fiscal 4Q18 revenues of $1.24 billion, lower than the consensus estimate of $1.26 billion, and up 1.3% year over year. The company reported 4Q18 EPS of $0.43, higher than the consensus estimate of $0.42, and 17.3% lower than the year ago period, but exceeding the company’s guidance of $0.40-0.42.

American Eagle's fourth quarter comp sales rose 3%, marking the seventh consecutive quarter of comp increases. For the fiscal year, AEO comparable sales were 8%. By brand, American Eagle comps were up 3%, compared to a 5% increase last year. Aerie comps increased 23%, following a 34% increase in the prior year. This is Aerie’s 17th consecutive quarter of double-digit comp growth.

For the 2018 fiscal year, AEO reached a milestone of $4 billion in sales, up 6.3% from $3.79 billion in the year ago period.

The company reported its digital channel posted a positive high single-digit increase in the quarter, its highest volume quarter ever. Digital penetration rose to 31% of revenue in the fourth quarter and 28% for the full year.

American Eagle Outfitters surpassed $1 billion in jeans sales in 2018. Management stated the American Eagle Outfitters’ brand is the number one women’s jeans brand across all age demographics, and the number two jeans brand for men and women. The company reported it continues to see growth in its jeans and bottoms categories as well as complementary businesses including graphics, shoes and accessories.

The company stated it is testing new concepts with customers. For example, the company opened a sneaker shop within its New York City, SoHo Store in partnership with Urban Necessities, a retailer of premium sneakers. Urban Necessities is a resale sneaker store that sells special-edition sneakers including brands Supreme, Adidas and Nike. Prices range from $150.00 to $50,000. American Eagle Outfitters also launched “American Eagle Style Drop,” a monthly rental service that lets consumers select three pieces for $49.99 a month.

The company commented that it sees its Aerie brand as a growth opportunity for the company and the team is focusing on “gaining market share by offering compelling, quality products that make customers feel good.” Management stated that Aerie’s differentiator is its ability to focus on new trends, engage with styles missing from the market, and deliver these new styles to the customer. The company reported it is focusing on entering new markets and growing its customer base by prioritizing global expansion in 2019.

In 2018, the company opened 12 Aerie stand-alone stores, 29 Aerie side-by-side locations, and closed six old format stores. Management said it plans to open 60-75 Aerie locations in 2019.

For the AE Brand, the company opened 16 total locations and closed 15 stores in 2018 In 2019, the company plans to reposition and remodel AE stores and to continue expanding globally through its franchise partnerships.

Outlook

For In the 1Q19, the company projects earnings per share of $0.19 to $0.21, lower than the consensus estimate of $0.24. AEO expects comparable sales to be in the positive low single digits.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

American Eagle Outfitters reported fiscal 4Q18 revenues of $1.24 billion, lower than the consensus estimate of $1.26 billion, and up 1.3% year over year. The company reported 4Q18 EPS of $0.43, higher than the consensus estimate of $0.42, and 17.3% lower than the year ago period, but exceeding the company’s guidance of $0.40-0.42.

American Eagle's fourth quarter comp sales rose 3%, marking the seventh consecutive quarter of comp increases. For the fiscal year, AEO comparable sales were 8%. By brand, American Eagle comps were up 3%, compared to a 5% increase last year. Aerie comps increased 23%, following a 34% increase in the prior year. This is Aerie’s 17th consecutive quarter of double-digit comp growth.

For the 2018 fiscal year, AEO reached a milestone of $4 billion in sales, up 6.3% from $3.79 billion in the year ago period.

The company reported its digital channel posted a positive high single-digit increase in the quarter, its highest volume quarter ever. Digital penetration rose to 31% of revenue in the fourth quarter and 28% for the full year.

American Eagle Outfitters surpassed $1 billion in jeans sales in 2018. Management stated the American Eagle Outfitters’ brand is the number one women’s jeans brand across all age demographics, and the number two jeans brand for men and women. The company reported it continues to see growth in its jeans and bottoms categories as well as complementary businesses including graphics, shoes and accessories.

The company stated it is testing new concepts with customers. For example, the company opened a sneaker shop within its New York City, SoHo Store in partnership with Urban Necessities, a retailer of premium sneakers. Urban Necessities is a resale sneaker store that sells special-edition sneakers including brands Supreme, Adidas and Nike. Prices range from $150.00 to $50,000. American Eagle Outfitters also launched “American Eagle Style Drop,” a monthly rental service that lets consumers select three pieces for $49.99 a month.

The company commented that it sees its Aerie brand as a growth opportunity for the company and the team is focusing on “gaining market share by offering compelling, quality products that make customers feel good.” Management stated that Aerie’s differentiator is its ability to focus on new trends, engage with styles missing from the market, and deliver these new styles to the customer. The company reported it is focusing on entering new markets and growing its customer base by prioritizing global expansion in 2019.

In 2018, the company opened 12 Aerie stand-alone stores, 29 Aerie side-by-side locations, and closed six old format stores. Management said it plans to open 60-75 Aerie locations in 2019.

For the AE Brand, the company opened 16 total locations and closed 15 stores in 2018 In 2019, the company plans to reposition and remodel AE stores and to continue expanding globally through its franchise partnerships.

Outlook

For In the 1Q19, the company projects earnings per share of $0.19 to $0.21, lower than the consensus estimate of $0.24. AEO expects comparable sales to be in the positive low single digits.