albert Chan

American Eagle Outfitters

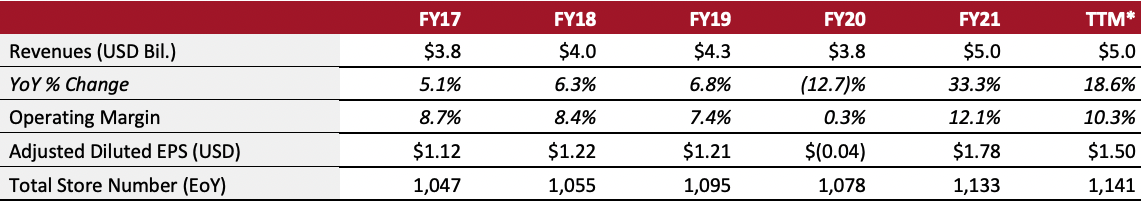

Sector: Apparel specialty retail Countries of operation: Stores in Canada, China, Hong Kong, Mexico and the US, with shipping available to 81 countries via the retailer’s website Key product categories: Accessories, clothing, footwear and personal care products Annual Metrics [caption id="attachment_150431" align="aligncenter" width="700"] Fiscal year ends on January 30 of the following calendar year

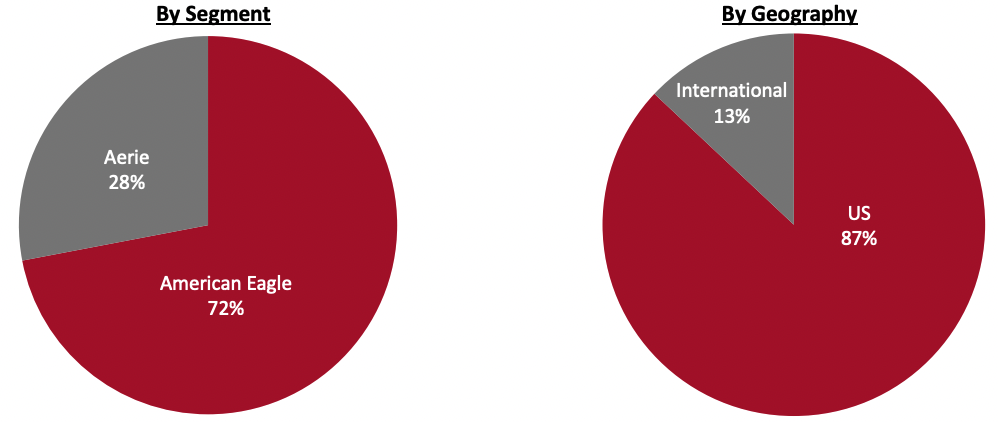

Fiscal year ends on January 30 of the following calendar year*Trailing 12 months ended April 30, 2022[/caption] Summary Founded in 1977 and headquartered in Pennsylvania, American Eagle Outfitters offers a range of products, including accessories, clothing and personal care products under its American Eagle (AE) and Aerie banners. AE offers men’s and women’s apparel and footwear with a focus on denim and casualwear, while Aerie focuses on women’s underwear and loungewear. The company also operates Todd Snyder, a high-end menswear brand, and Unsubscribed, a new brand with an emphasis on consciously manufactured “slow fashion.” The company operates stores in Canada, China, Hong Kong, Mexico and the US and ships to 81 countries worldwide through its websites. Its AE and Aerie merchandise is also available at more than 200 international locations operated by licensees across 25 countries. Company Analysis Coresight Research insight: American Eagle Outfitters reported consistent and stable sales growth over the five years before the coronavirus crisis. The company reacted quickly to the pandemic—it enhanced its e-commerce capabilities, which helped offset lost sales from brick-and-mortar store closures, and reduced its in-store inventory. In 2021, American Eagle Outfitters witnessed strong recovery from the crisis, with sales growth of over 33%. The Aerie brand, focused on intimate apparel, loungewear and underwear, remains the company’s key growth engine, posting 28 consecutive quarters of double-digit sales growth since the third quarter of fiscal 2018. In the company’s latest reported quarter (ended April 30, 2022), the Aerie banner’s sales growth decelerated to still strong 8% while the American Eagle (AE) banner saw sales decline of 6% year over year. Aerie remains on track to reach the milestone of $2.2 billion in sales by 2023. Aerie’s competitive advantage lies in its “inclusive” value proposition—for instance, its marketing campaigns focus on body positivity with unretouched images of women with disabilities and different body types, medical needs and racial backgrounds. Aerie’s marketing message and branding strategy will likely continue to broaden its customer base, to include more young consumers and social media influencers. Furthermore, Aerie’s activewear line OFFLINE, launched in late 2020, will support the brand’s revenues—in fiscal 2022, the company plans to open 20 OFFLINE by Aerie stores.

| Tailwinds | Headwinds |

|

|

- Increase the Aerie banner revenues to $2.2 billion by fiscal 2023, from $1.4 billion in fiscal 2021

- Achieve a sales CAGR of mid-20% between 2021 and 2023

- Reach 500–600 Aerie stores by 2023, from 427 as of January 2022

- Expand intimate and loungewear product categories and extend active assortment

- Incur capital expenditure of $315–335 million in fiscal 2022, compared to $234 million in fiscal 2021, toward investments in expanding e-commerce capabilities, enhancing supply chain and information technology upgrades

- Capitalize scale and innovation to manage fulfillment costs and improve delivery services

- Strengthen its return on investment (ROI) discipline

- Revitalize growth of the AE banner through reduced promotions, strong inventory management and favorable rent costs or relocations. The company expects 2023 revenue for AE to be $3.6 billion, marginally higher than fiscal 2019 revenues at about $3.5 billion.

- Close 200–225 AE low-productivity stores in North America between 2020 and 2023—management believes a larger portion of sales under this banner can be shifted online.

Company Developments

Company Developments

| Date | Development |

| May 31, 2022 | American Eagle Outfitters announces that its subsidiary Quiet Platforms has partnered with global shipping and mailing company Pitney Bowes, wherein, the latter will provide carrier services to Quiet Platforms’ shared supply chain network. |

| May 23, 2022 | American Eagle Outfitters announces plans to expand in India, with the opening of 50 new AE stores in next three years. |

| May 5, 2022 | American Eagle Outfitters opens first retail store of its consciously-manufactured “slow fashion” women’s brand Unsubscribed in New York City. |

| April 11, 2022 | American Eagle Outfitters plans to monetize its recently acquired supply chain platforms Quiet Logistics and AirTerra by growing its third-party customer base. |

| March 11, 2022 | American Eagle Outfitters debuts in the metaverse through a collaboration with online gaming platform Roblox. |

| March 2, 2022 | American Eagle Outfitters launches its Spring 2022 Members Always campaign, built on the brand’s leadership in social commerce. The campaign has extensions across social media channels, such as Snapchat and TikTok, to drive customer experience and engagement. |

| December 29, 2021 | American Eagle Outfitters acquires its supply chain partner Quiet Logistics for $360 million in cash–marking the next step in the retailer’s ongoing supply chain transformation. |

| September 22, 2021 | American Eagle Outfitters launches AE77, a new sustainably crafted premium denim brand for men and women. |

| August 17, 2021 | American Eagle Outfitters launches Aerie’s #AerieREAL Voices campaign with actress Antonia Gentry, singer-songwriter Kelsea Ballerini and TikTok creators NaeNae Twins, among others. |

| July 28, 2021 | American Eagle Outfitters launches AE’s back-to-school “Future Together. Jeans Forever” campaign. |

| June 3, 2021 | American Eagle Outfitters approves a 31% increase in its quarterly cash dividend. The company’s management states the material increase in its dividend policy reflects strength in the company’s financial health, business and conviction in delivering steady long-term growth. |

| May 13, 2021 | American Eagle Outfitters announces the development of a limited AE jeans collection, made of 100% organic cotton, and reiterates its commitment to sustainability. It aims to use more sustainable manufacturing techniques and raw materials, and to reduce water usage. |

| February 25, 2021 | American Eagle Outfitters announces the launch of its AE brand’s Spring 2021 “Jeans Are Forever” campaign. AE will debut its AE x Snapchat AR Jeans Guide, which allows shoppers to view its jeans offerings in augmented reality (AR). |

| January 21, 2021 | American Eagle Outfitters hosts a virtual investor meeting to present its “Real Power. Real Growth” strategy, focusing on achieving revenues of $5.5 billion and an operating margin of 10% by 2023. |

| December 3, 2020 | American Eagle Outfitters announces that it is restoring its stock dividend, which the company deferred in April 2020, as its business recovers from the pandemic. |

| September 30, 2020 | American Eagle Outfitters appoints Steven Davis, former chairman and CEO of Bob Evans Farms, to its Board of Directors, expanding the company’s Board to nine Directors. |

| September 9, 2020 | American Eagle Outfitters announces that Jennifer Foyle has been promoted to Chief Creative Officer while retaining her existing responsibilities as Aerie’s Global Brand President. |

| July 27, 2020 | American Eagle Outfitters announces the launch of OFFLINE by Aerie, a new sub-brand offering a collection of activewear and accessories. |

| April 20, 2020 | American Eagle Outfitters announces the promotion of Michael Mathias to Executive Vice President and CFO, replacing Bob Madore. Mathias most recently served as American Eagle Outfitters’ Senior Vice President and Head of Financial Planning and Analysis. |

| February 07, 2020 | American Eagle Outfitters reaffirms the company’s goal of being carbon neutral by 2030. |

- Jay Schottenstein—Executive Chairman and CEO

- Michael Mathias—Executive VP and CFO

- Michael Rempell—Executive VP and COO

- Jennifer Foyle—President and Executive Creative Director

- Andrew McLean—Executive VP and Chief Commercial Officer

Source: Company reports/S&P Capital IQ