Nitheesh NH

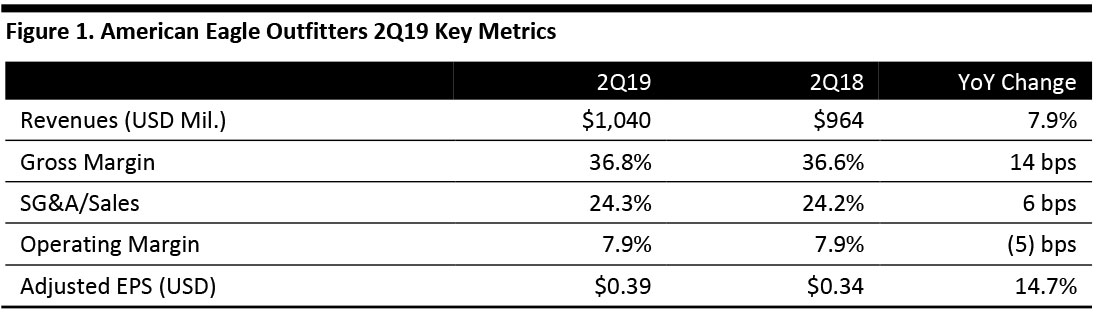

[caption id="attachment_95835" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

American Eagle Outfitters reported fiscal 2Q19 revenues of $1.04 billion, higher than the consensus estimate of $1.00 billion, and up 7.9% year over year. The company reported adjusted 2Q19 earnings per share (EPS) ex-items of $0.39, higher than the consensus estimate of $0.32 and higher than the year-ago period.

American Eagle Outfitter's second quarter comp sales rose 2% compared to a 9% increase in the year-ago period and lower than the consensus estimate of 2.9%. Aerie comps increased 16% compared to 27% in the year-ago period and lower than the consensus estimate of 16.8%. American Eagle brand comparable sales declined 1%, following a 7% increase in the year-ago period and lower than the consensus estimate of 1%.

Management said weather impacted American Eagle Brand comp sales; specifically, cooler temperatures in May hurt demand for shorts and warmer weather apparel. Additionally, in women’s tops, the trend skewed to the lower average unit rate (AUR) style which also put pressure on comps. The company reported it is seeing an improvement in August and early September with strength in jeans and fall apparel.

The company reported that its American Eagle jeans continue to post record sales, marking six consecutive years of all-time highs in each quarter. The company claims to be “the #1 women's jeans brand in America, #1 men's jeans brand in our core 15-to 25-year-old age group and the #2 jeans brand overall.”

Management said it is pleased with the initial response to its extended size ranges it launched last quarter. For women, its curvy collection includes sizes 00 to 24 and for men up to a 48-inch waist with more offerings in length across all sizes.

At Aerie, comparable sales increased 16%, compared to a 27% comp increase last year. All categories posted sales growth with bras one of the strongest areas, supported by demand for Aerie’s core bras and bralettes. Management said customers responded positively to its new apparel collections. The company projects Aerie revenues will exceed $1 billion in the short term.

Management commented that most of its already-engaged customers are participating in the AE Style Drop program, which lets customers can rent styles for flat monthly fee. The company said it is testing the subscription model to see if subscription customers end up spending more in total.

The company hinted it will get into the beauty business in time for the holiday season, with an announcement to come this fall.

The company commented on tariffs and said it is actively collaborating with sourcing partners to reduce exposure through a combination of partnering with vendors and diversifying production capabilities.

The company opened 20 stores in the quarter, including openings in Texas and California. Management reported that as the company enters new markets, it sees an uplift in digital business in those markets. The company ended the quarter with 1,075 total stores in its portfolio (939 American Eagle brand stores, 131 Aerie stores, four Tailgate stores and one Todd Snyder store). Based on openings to date and plans for the balance of the year, the company expects Aerie store openings this year to come in at the lower end of its 60-75 target.

Management reiterated its 2019 priorities are to accelerate the growth of Aerie, to reposition and remodel American Eagle stores and to continue expanding its global footprint. The company plans to end the fiscal year with a total of 1,080 to 1,100 stores in its portfolio.

Outlook

For 3Q19, the company projects EPS to be $0.47 to $0.49, lower than the consensus estimate of $0.52. The company expects 3Q19 comparable sales growth in the low- to mid-single digits.

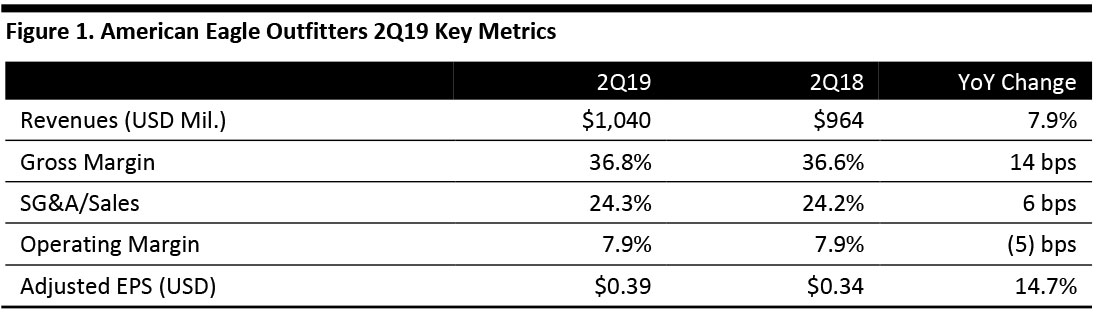

Source: Company reports/Coresight Research[/caption]

2Q19 Results

American Eagle Outfitters reported fiscal 2Q19 revenues of $1.04 billion, higher than the consensus estimate of $1.00 billion, and up 7.9% year over year. The company reported adjusted 2Q19 earnings per share (EPS) ex-items of $0.39, higher than the consensus estimate of $0.32 and higher than the year-ago period.

American Eagle Outfitter's second quarter comp sales rose 2% compared to a 9% increase in the year-ago period and lower than the consensus estimate of 2.9%. Aerie comps increased 16% compared to 27% in the year-ago period and lower than the consensus estimate of 16.8%. American Eagle brand comparable sales declined 1%, following a 7% increase in the year-ago period and lower than the consensus estimate of 1%.

Management said weather impacted American Eagle Brand comp sales; specifically, cooler temperatures in May hurt demand for shorts and warmer weather apparel. Additionally, in women’s tops, the trend skewed to the lower average unit rate (AUR) style which also put pressure on comps. The company reported it is seeing an improvement in August and early September with strength in jeans and fall apparel.

The company reported that its American Eagle jeans continue to post record sales, marking six consecutive years of all-time highs in each quarter. The company claims to be “the #1 women's jeans brand in America, #1 men's jeans brand in our core 15-to 25-year-old age group and the #2 jeans brand overall.”

Management said it is pleased with the initial response to its extended size ranges it launched last quarter. For women, its curvy collection includes sizes 00 to 24 and for men up to a 48-inch waist with more offerings in length across all sizes.

At Aerie, comparable sales increased 16%, compared to a 27% comp increase last year. All categories posted sales growth with bras one of the strongest areas, supported by demand for Aerie’s core bras and bralettes. Management said customers responded positively to its new apparel collections. The company projects Aerie revenues will exceed $1 billion in the short term.

Management commented that most of its already-engaged customers are participating in the AE Style Drop program, which lets customers can rent styles for flat monthly fee. The company said it is testing the subscription model to see if subscription customers end up spending more in total.

The company hinted it will get into the beauty business in time for the holiday season, with an announcement to come this fall.

The company commented on tariffs and said it is actively collaborating with sourcing partners to reduce exposure through a combination of partnering with vendors and diversifying production capabilities.

The company opened 20 stores in the quarter, including openings in Texas and California. Management reported that as the company enters new markets, it sees an uplift in digital business in those markets. The company ended the quarter with 1,075 total stores in its portfolio (939 American Eagle brand stores, 131 Aerie stores, four Tailgate stores and one Todd Snyder store). Based on openings to date and plans for the balance of the year, the company expects Aerie store openings this year to come in at the lower end of its 60-75 target.

Management reiterated its 2019 priorities are to accelerate the growth of Aerie, to reposition and remodel American Eagle stores and to continue expanding its global footprint. The company plans to end the fiscal year with a total of 1,080 to 1,100 stores in its portfolio.

Outlook

For 3Q19, the company projects EPS to be $0.47 to $0.49, lower than the consensus estimate of $0.52. The company expects 3Q19 comparable sales growth in the low- to mid-single digits.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

American Eagle Outfitters reported fiscal 2Q19 revenues of $1.04 billion, higher than the consensus estimate of $1.00 billion, and up 7.9% year over year. The company reported adjusted 2Q19 earnings per share (EPS) ex-items of $0.39, higher than the consensus estimate of $0.32 and higher than the year-ago period.

American Eagle Outfitter's second quarter comp sales rose 2% compared to a 9% increase in the year-ago period and lower than the consensus estimate of 2.9%. Aerie comps increased 16% compared to 27% in the year-ago period and lower than the consensus estimate of 16.8%. American Eagle brand comparable sales declined 1%, following a 7% increase in the year-ago period and lower than the consensus estimate of 1%.

Management said weather impacted American Eagle Brand comp sales; specifically, cooler temperatures in May hurt demand for shorts and warmer weather apparel. Additionally, in women’s tops, the trend skewed to the lower average unit rate (AUR) style which also put pressure on comps. The company reported it is seeing an improvement in August and early September with strength in jeans and fall apparel.

The company reported that its American Eagle jeans continue to post record sales, marking six consecutive years of all-time highs in each quarter. The company claims to be “the #1 women's jeans brand in America, #1 men's jeans brand in our core 15-to 25-year-old age group and the #2 jeans brand overall.”

Management said it is pleased with the initial response to its extended size ranges it launched last quarter. For women, its curvy collection includes sizes 00 to 24 and for men up to a 48-inch waist with more offerings in length across all sizes.

At Aerie, comparable sales increased 16%, compared to a 27% comp increase last year. All categories posted sales growth with bras one of the strongest areas, supported by demand for Aerie’s core bras and bralettes. Management said customers responded positively to its new apparel collections. The company projects Aerie revenues will exceed $1 billion in the short term.

Management commented that most of its already-engaged customers are participating in the AE Style Drop program, which lets customers can rent styles for flat monthly fee. The company said it is testing the subscription model to see if subscription customers end up spending more in total.

The company hinted it will get into the beauty business in time for the holiday season, with an announcement to come this fall.

The company commented on tariffs and said it is actively collaborating with sourcing partners to reduce exposure through a combination of partnering with vendors and diversifying production capabilities.

The company opened 20 stores in the quarter, including openings in Texas and California. Management reported that as the company enters new markets, it sees an uplift in digital business in those markets. The company ended the quarter with 1,075 total stores in its portfolio (939 American Eagle brand stores, 131 Aerie stores, four Tailgate stores and one Todd Snyder store). Based on openings to date and plans for the balance of the year, the company expects Aerie store openings this year to come in at the lower end of its 60-75 target.

Management reiterated its 2019 priorities are to accelerate the growth of Aerie, to reposition and remodel American Eagle stores and to continue expanding its global footprint. The company plans to end the fiscal year with a total of 1,080 to 1,100 stores in its portfolio.

Outlook

For 3Q19, the company projects EPS to be $0.47 to $0.49, lower than the consensus estimate of $0.52. The company expects 3Q19 comparable sales growth in the low- to mid-single digits.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

American Eagle Outfitters reported fiscal 2Q19 revenues of $1.04 billion, higher than the consensus estimate of $1.00 billion, and up 7.9% year over year. The company reported adjusted 2Q19 earnings per share (EPS) ex-items of $0.39, higher than the consensus estimate of $0.32 and higher than the year-ago period.

American Eagle Outfitter's second quarter comp sales rose 2% compared to a 9% increase in the year-ago period and lower than the consensus estimate of 2.9%. Aerie comps increased 16% compared to 27% in the year-ago period and lower than the consensus estimate of 16.8%. American Eagle brand comparable sales declined 1%, following a 7% increase in the year-ago period and lower than the consensus estimate of 1%.

Management said weather impacted American Eagle Brand comp sales; specifically, cooler temperatures in May hurt demand for shorts and warmer weather apparel. Additionally, in women’s tops, the trend skewed to the lower average unit rate (AUR) style which also put pressure on comps. The company reported it is seeing an improvement in August and early September with strength in jeans and fall apparel.

The company reported that its American Eagle jeans continue to post record sales, marking six consecutive years of all-time highs in each quarter. The company claims to be “the #1 women's jeans brand in America, #1 men's jeans brand in our core 15-to 25-year-old age group and the #2 jeans brand overall.”

Management said it is pleased with the initial response to its extended size ranges it launched last quarter. For women, its curvy collection includes sizes 00 to 24 and for men up to a 48-inch waist with more offerings in length across all sizes.

At Aerie, comparable sales increased 16%, compared to a 27% comp increase last year. All categories posted sales growth with bras one of the strongest areas, supported by demand for Aerie’s core bras and bralettes. Management said customers responded positively to its new apparel collections. The company projects Aerie revenues will exceed $1 billion in the short term.

Management commented that most of its already-engaged customers are participating in the AE Style Drop program, which lets customers can rent styles for flat monthly fee. The company said it is testing the subscription model to see if subscription customers end up spending more in total.

The company hinted it will get into the beauty business in time for the holiday season, with an announcement to come this fall.

The company commented on tariffs and said it is actively collaborating with sourcing partners to reduce exposure through a combination of partnering with vendors and diversifying production capabilities.

The company opened 20 stores in the quarter, including openings in Texas and California. Management reported that as the company enters new markets, it sees an uplift in digital business in those markets. The company ended the quarter with 1,075 total stores in its portfolio (939 American Eagle brand stores, 131 Aerie stores, four Tailgate stores and one Todd Snyder store). Based on openings to date and plans for the balance of the year, the company expects Aerie store openings this year to come in at the lower end of its 60-75 target.

Management reiterated its 2019 priorities are to accelerate the growth of Aerie, to reposition and remodel American Eagle stores and to continue expanding its global footprint. The company plans to end the fiscal year with a total of 1,080 to 1,100 stores in its portfolio.

Outlook

For 3Q19, the company projects EPS to be $0.47 to $0.49, lower than the consensus estimate of $0.52. The company expects 3Q19 comparable sales growth in the low- to mid-single digits.