DIpil Das

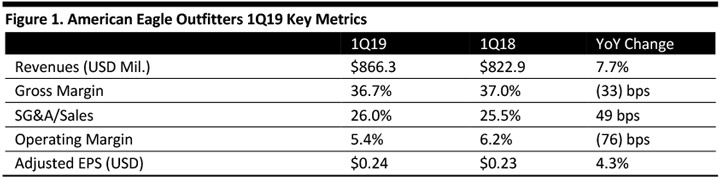

[caption id="attachment_89954" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

American Eagle Outfitters reported fiscal 1Q19 revenues of $866.3 million, higher than the consensus estimate of $855.5 million, and up 7.7% year over year. The company reported adjusted 1Q19 EPS excluding restructuring charges of $0.24, higher than the consensus estimate of $0.21 and higher than the year-ago period.

American Eagle's first quarter comp sales rose 4% compared to the consensus estimate of 1.7%, while Aerie’s comparable sales increased 14%, higher than the consensus estimate of 13.3%. This was the 17th consecutive quarter of positive comparable sales for the company.

The company reported its online business was fueled by a significant increase in mobile, which is now over 50% of its digital business.

The American Eagle brand was driven by its jeans business: Jeans showed positive comps with the 23rd straight quarter of record jeans sales. The company claims American Eagle is now the number one selling women's jeans brand in the US. The company is focusing on expanding its presence in women's denim and increasing its share in the men's business, a segment in which the company also claims AE jeans are number one among 15-25 year olds.

For back to school, American Eagle is launching an inclusive jeans collection: For women, the company will launch a curvy jeans collection and is expanding its size ranges to include 00 to size 24 in every jeans style in every store. For men, the company will launch fabric innovation and fits, broaden the size range up to a 48-inch waist with more offerings in length across all sizes.

The company highlighted it is focusing on product innovation through new fabrics and manufacturing techniques. Its factories have invested in laser processing and updated techniques to reduce water usage and minimize environmental impact. The company is increasing its use of sustainable fabrics, and each pair of jeans is made with recycled polyester. The company has a “jeans recycling program” that gives customers $10 off a new pair of jeans for returning a used pair. Management commented that due to the overwhelming response of this program, American Eagle will offer this service year-round and will begin to upcycle some of these used jeans into apparel in future seasons.

Aerie revenues rose 20% in the quarter. By category, management commented that Aerie posted record sales volume in the following categories: bras, underwear, apparel and swim. The company attributed the performance to newness and Aerie’s emphasis on cozy, casual, comfortable and active. Two additional strategic growth areas for Aerie have been swim and “bralettes” (which Aerie launched a few years ago, and contineus to be a growth area for the company). Aerie attributed its positive swim sales during the quarter to its in-store and fitting room experience.

Aerie management reported that brand building with its customers is a top priority. It is growing followers on Instagram through its “Love the Swim You're In” campaign, and the brand continues to report success from its #AerieREAL campaign. The brand held Aerie pop-up tours across eight college campuses which helped to grow its new customer base.

The company commented it expects the impact of tariffs announced to date will be immaterial. If, however, tariffs are expanded to apparel, there would be an adverse effect to American Eagle’s financial results. The company is collaborating with sourcing partners and estimates it can significantly mitigate any potential impact from additional tariffs by diversifying production across geographies.

During the quarter, the company opened 7 American Eagle stores and closed 5 stores, ending with 936 stores. The company has 151 Aerie side by side locations and 119 standalone stores. The company ended the quarter with 235 licensed stores.

The company plans to open 60-75 new Aerie locations this fiscal year.

Outlook

For 2Q19, the company projects EPS of $0.30-0.32, lower than the consensus estimate of $0.35, and lower than last year’s second quarter EPS of $0.34. Management expects comparable sales to increase in the low single digits compared to the consensus estimate of 2.7%.

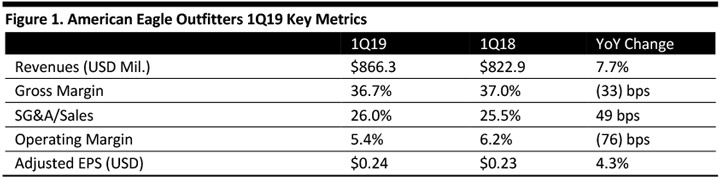

Source: Company reports/Coresight Research[/caption]

1Q19 Results

American Eagle Outfitters reported fiscal 1Q19 revenues of $866.3 million, higher than the consensus estimate of $855.5 million, and up 7.7% year over year. The company reported adjusted 1Q19 EPS excluding restructuring charges of $0.24, higher than the consensus estimate of $0.21 and higher than the year-ago period.

American Eagle's first quarter comp sales rose 4% compared to the consensus estimate of 1.7%, while Aerie’s comparable sales increased 14%, higher than the consensus estimate of 13.3%. This was the 17th consecutive quarter of positive comparable sales for the company.

The company reported its online business was fueled by a significant increase in mobile, which is now over 50% of its digital business.

The American Eagle brand was driven by its jeans business: Jeans showed positive comps with the 23rd straight quarter of record jeans sales. The company claims American Eagle is now the number one selling women's jeans brand in the US. The company is focusing on expanding its presence in women's denim and increasing its share in the men's business, a segment in which the company also claims AE jeans are number one among 15-25 year olds.

For back to school, American Eagle is launching an inclusive jeans collection: For women, the company will launch a curvy jeans collection and is expanding its size ranges to include 00 to size 24 in every jeans style in every store. For men, the company will launch fabric innovation and fits, broaden the size range up to a 48-inch waist with more offerings in length across all sizes.

The company highlighted it is focusing on product innovation through new fabrics and manufacturing techniques. Its factories have invested in laser processing and updated techniques to reduce water usage and minimize environmental impact. The company is increasing its use of sustainable fabrics, and each pair of jeans is made with recycled polyester. The company has a “jeans recycling program” that gives customers $10 off a new pair of jeans for returning a used pair. Management commented that due to the overwhelming response of this program, American Eagle will offer this service year-round and will begin to upcycle some of these used jeans into apparel in future seasons.

Aerie revenues rose 20% in the quarter. By category, management commented that Aerie posted record sales volume in the following categories: bras, underwear, apparel and swim. The company attributed the performance to newness and Aerie’s emphasis on cozy, casual, comfortable and active. Two additional strategic growth areas for Aerie have been swim and “bralettes” (which Aerie launched a few years ago, and contineus to be a growth area for the company). Aerie attributed its positive swim sales during the quarter to its in-store and fitting room experience.

Aerie management reported that brand building with its customers is a top priority. It is growing followers on Instagram through its “Love the Swim You're In” campaign, and the brand continues to report success from its #AerieREAL campaign. The brand held Aerie pop-up tours across eight college campuses which helped to grow its new customer base.

The company commented it expects the impact of tariffs announced to date will be immaterial. If, however, tariffs are expanded to apparel, there would be an adverse effect to American Eagle’s financial results. The company is collaborating with sourcing partners and estimates it can significantly mitigate any potential impact from additional tariffs by diversifying production across geographies.

During the quarter, the company opened 7 American Eagle stores and closed 5 stores, ending with 936 stores. The company has 151 Aerie side by side locations and 119 standalone stores. The company ended the quarter with 235 licensed stores.

The company plans to open 60-75 new Aerie locations this fiscal year.

Outlook

For 2Q19, the company projects EPS of $0.30-0.32, lower than the consensus estimate of $0.35, and lower than last year’s second quarter EPS of $0.34. Management expects comparable sales to increase in the low single digits compared to the consensus estimate of 2.7%.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

American Eagle Outfitters reported fiscal 1Q19 revenues of $866.3 million, higher than the consensus estimate of $855.5 million, and up 7.7% year over year. The company reported adjusted 1Q19 EPS excluding restructuring charges of $0.24, higher than the consensus estimate of $0.21 and higher than the year-ago period.

American Eagle's first quarter comp sales rose 4% compared to the consensus estimate of 1.7%, while Aerie’s comparable sales increased 14%, higher than the consensus estimate of 13.3%. This was the 17th consecutive quarter of positive comparable sales for the company.

The company reported its online business was fueled by a significant increase in mobile, which is now over 50% of its digital business.

The American Eagle brand was driven by its jeans business: Jeans showed positive comps with the 23rd straight quarter of record jeans sales. The company claims American Eagle is now the number one selling women's jeans brand in the US. The company is focusing on expanding its presence in women's denim and increasing its share in the men's business, a segment in which the company also claims AE jeans are number one among 15-25 year olds.

For back to school, American Eagle is launching an inclusive jeans collection: For women, the company will launch a curvy jeans collection and is expanding its size ranges to include 00 to size 24 in every jeans style in every store. For men, the company will launch fabric innovation and fits, broaden the size range up to a 48-inch waist with more offerings in length across all sizes.

The company highlighted it is focusing on product innovation through new fabrics and manufacturing techniques. Its factories have invested in laser processing and updated techniques to reduce water usage and minimize environmental impact. The company is increasing its use of sustainable fabrics, and each pair of jeans is made with recycled polyester. The company has a “jeans recycling program” that gives customers $10 off a new pair of jeans for returning a used pair. Management commented that due to the overwhelming response of this program, American Eagle will offer this service year-round and will begin to upcycle some of these used jeans into apparel in future seasons.

Aerie revenues rose 20% in the quarter. By category, management commented that Aerie posted record sales volume in the following categories: bras, underwear, apparel and swim. The company attributed the performance to newness and Aerie’s emphasis on cozy, casual, comfortable and active. Two additional strategic growth areas for Aerie have been swim and “bralettes” (which Aerie launched a few years ago, and contineus to be a growth area for the company). Aerie attributed its positive swim sales during the quarter to its in-store and fitting room experience.

Aerie management reported that brand building with its customers is a top priority. It is growing followers on Instagram through its “Love the Swim You're In” campaign, and the brand continues to report success from its #AerieREAL campaign. The brand held Aerie pop-up tours across eight college campuses which helped to grow its new customer base.

The company commented it expects the impact of tariffs announced to date will be immaterial. If, however, tariffs are expanded to apparel, there would be an adverse effect to American Eagle’s financial results. The company is collaborating with sourcing partners and estimates it can significantly mitigate any potential impact from additional tariffs by diversifying production across geographies.

During the quarter, the company opened 7 American Eagle stores and closed 5 stores, ending with 936 stores. The company has 151 Aerie side by side locations and 119 standalone stores. The company ended the quarter with 235 licensed stores.

The company plans to open 60-75 new Aerie locations this fiscal year.

Outlook

For 2Q19, the company projects EPS of $0.30-0.32, lower than the consensus estimate of $0.35, and lower than last year’s second quarter EPS of $0.34. Management expects comparable sales to increase in the low single digits compared to the consensus estimate of 2.7%.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

American Eagle Outfitters reported fiscal 1Q19 revenues of $866.3 million, higher than the consensus estimate of $855.5 million, and up 7.7% year over year. The company reported adjusted 1Q19 EPS excluding restructuring charges of $0.24, higher than the consensus estimate of $0.21 and higher than the year-ago period.

American Eagle's first quarter comp sales rose 4% compared to the consensus estimate of 1.7%, while Aerie’s comparable sales increased 14%, higher than the consensus estimate of 13.3%. This was the 17th consecutive quarter of positive comparable sales for the company.

The company reported its online business was fueled by a significant increase in mobile, which is now over 50% of its digital business.

The American Eagle brand was driven by its jeans business: Jeans showed positive comps with the 23rd straight quarter of record jeans sales. The company claims American Eagle is now the number one selling women's jeans brand in the US. The company is focusing on expanding its presence in women's denim and increasing its share in the men's business, a segment in which the company also claims AE jeans are number one among 15-25 year olds.

For back to school, American Eagle is launching an inclusive jeans collection: For women, the company will launch a curvy jeans collection and is expanding its size ranges to include 00 to size 24 in every jeans style in every store. For men, the company will launch fabric innovation and fits, broaden the size range up to a 48-inch waist with more offerings in length across all sizes.

The company highlighted it is focusing on product innovation through new fabrics and manufacturing techniques. Its factories have invested in laser processing and updated techniques to reduce water usage and minimize environmental impact. The company is increasing its use of sustainable fabrics, and each pair of jeans is made with recycled polyester. The company has a “jeans recycling program” that gives customers $10 off a new pair of jeans for returning a used pair. Management commented that due to the overwhelming response of this program, American Eagle will offer this service year-round and will begin to upcycle some of these used jeans into apparel in future seasons.

Aerie revenues rose 20% in the quarter. By category, management commented that Aerie posted record sales volume in the following categories: bras, underwear, apparel and swim. The company attributed the performance to newness and Aerie’s emphasis on cozy, casual, comfortable and active. Two additional strategic growth areas for Aerie have been swim and “bralettes” (which Aerie launched a few years ago, and contineus to be a growth area for the company). Aerie attributed its positive swim sales during the quarter to its in-store and fitting room experience.

Aerie management reported that brand building with its customers is a top priority. It is growing followers on Instagram through its “Love the Swim You're In” campaign, and the brand continues to report success from its #AerieREAL campaign. The brand held Aerie pop-up tours across eight college campuses which helped to grow its new customer base.

The company commented it expects the impact of tariffs announced to date will be immaterial. If, however, tariffs are expanded to apparel, there would be an adverse effect to American Eagle’s financial results. The company is collaborating with sourcing partners and estimates it can significantly mitigate any potential impact from additional tariffs by diversifying production across geographies.

During the quarter, the company opened 7 American Eagle stores and closed 5 stores, ending with 936 stores. The company has 151 Aerie side by side locations and 119 standalone stores. The company ended the quarter with 235 licensed stores.

The company plans to open 60-75 new Aerie locations this fiscal year.

Outlook

For 2Q19, the company projects EPS of $0.30-0.32, lower than the consensus estimate of $0.35, and lower than last year’s second quarter EPS of $0.34. Management expects comparable sales to increase in the low single digits compared to the consensus estimate of 2.7%.