What’s the Story?

On January 21, 2021, the Coresight Research team attended American Eagle Outfitters’ annual Investor Day, which was held virtually this year. In this report, we present insights from the event, covering the company’s “Real Power. Real Growth” plan and its multi-year financial targets.

American Eagle Outfitters Investor Day 2021: Key Insights

“Real Power. Real Growth” Plan: Double Aerie’s Revenues and Reignite the AE Banner

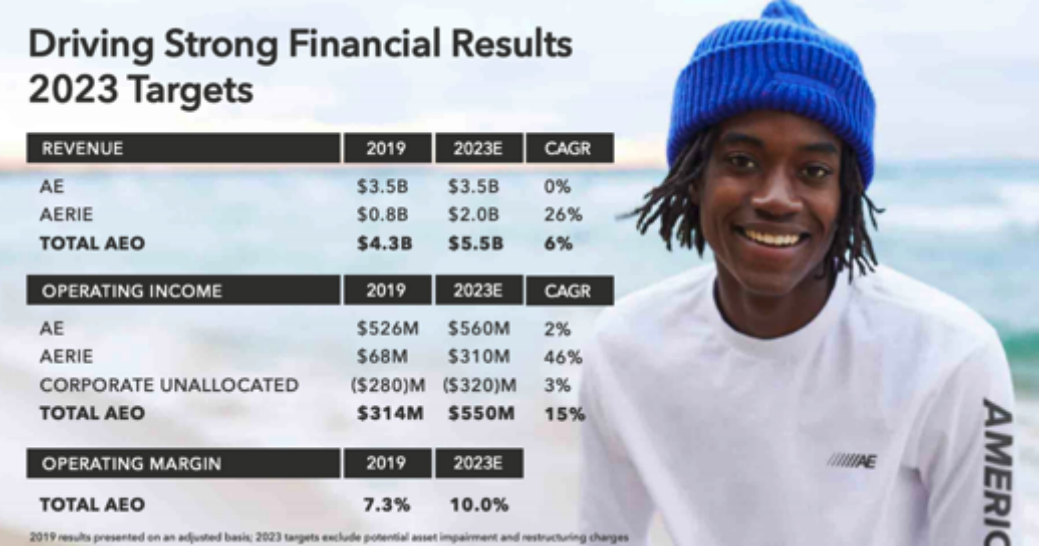

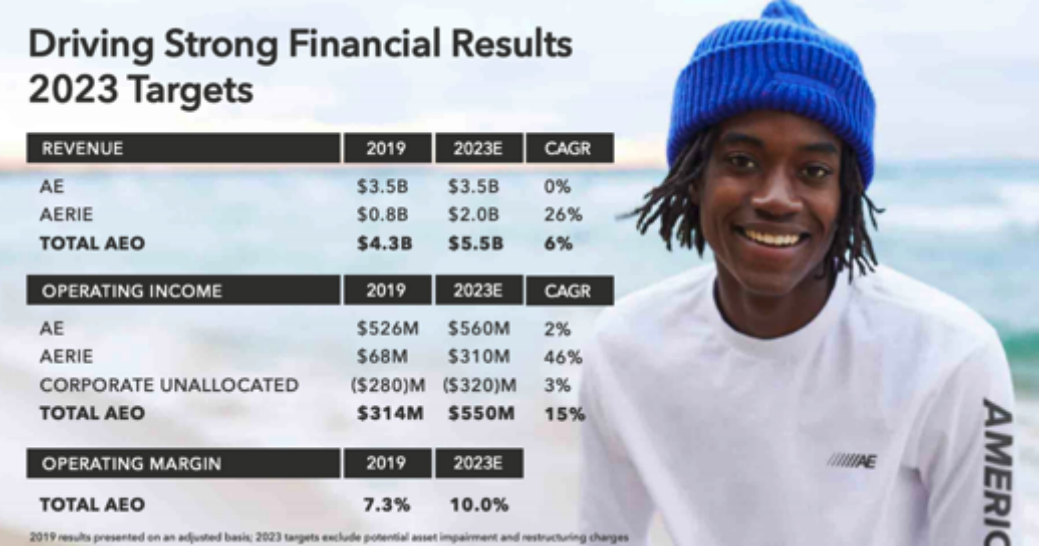

Jay Schottenstein, CEO at American Eagle Outfitters presented the company’s “Real Power. Real Growth” strategic plan, which has two main objectives:

- Double Aerie banner revenues to $2 billion: The company aims to double Aerie brand revenues to $2 billion by 2023, at a CAGR of 26% from 2019 to 2023. The company expects the banner’s operating income to grow from $68 million in 2019 to $310 million by 2023.

- Reignite the AE banner for profit growth: The company plans to revitalize its AE banner for profit growth through promotions, strong inventory management and rightsizing stores. The company expects 2023 revenues for AE to remain almost flat to fiscal 2019 revenues, at around $3.5 billion. The company expects AE’s operating income to grow at a CAGR of 2% between 2019 and 2023.

[caption id="attachment_124650" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters[/caption]

The Roadmap to “Real Power. Real Growth”: Four Initiatives To Double Aerie Revenues

To accomplish its target of achieving $2 billion in sales at its Aerie brand by 2023, the company outlined four initiatives, which we discuss below.

1. Winning in Intimates and Loungewear

The first initiative is to gain market share in intimates, soft apparel (apparel made from soft fabrics, such as the Aerie Real Soft® Ribbed nightie and tank tops) and swimwear, by launching new products and marketing campaigns. The company’s Chief Creative Officer, Jennifer Foyle, said that Aerie’s core product lines, intimate, soft apparel and swimwear, currently present a $44 billion market opportunity. The company is looking to capitalize on the remaining market share in its $65 billion addressable US market.

[caption id="attachment_124654" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters[/caption]

2. Activewear Product Extension

The company’s second strategy is to expand its presence in the activewear category. In 2021, the company plans to open 30 OFFLINE stores—its new activewear brand that launched in July 2020. The company sees a strong opportunity in the $21 billion US activewear market, where Aerie currently commands just a 2% market share.

[caption id="attachment_124655" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters [/caption]

3. New Market Expansion

The third initiative is to grow the Aerie banner in its underpenetrated US markets, such as Houston and Los Angeles. The company aims to open 60 to 75 new stores every year in its new consumer markets in the US. The company expects news market expansion to support brand growth and help it to deliver strong financial returns.

4. New Customer Acquisition

American Eagle Outfitter’s fourth strategy is to acquire new customers that are solely dedicated to its Aerie brand within its portfolio. Since 2014, Aerie has more than doubled its customer count to 8.5 million, with a 60% increase in average annual spending.

We believe that one of Aerie’s competitive advantages lies in its “inclusive” value proposition. Its marketing campaigns focus on body positivity by using unretouched images of women with different body types, racial backgrounds and medical needs. Aerie’s marketing message and branding strategy will likely continue to broaden the company’s customer base to include more young consumers.

Furthermore, the company expects its stores to fuel customer acquisition, engagement and retention. The company aims to have between 500 and 600 Aerie stores by 2023, from about 350 currently.

[caption id="attachment_124656" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters[/caption]

The Roadmap to Revitalizing AE for Profit Growth

The company has outlined four initiatives in order to reinvigorate its AE banner, which we discuss below.

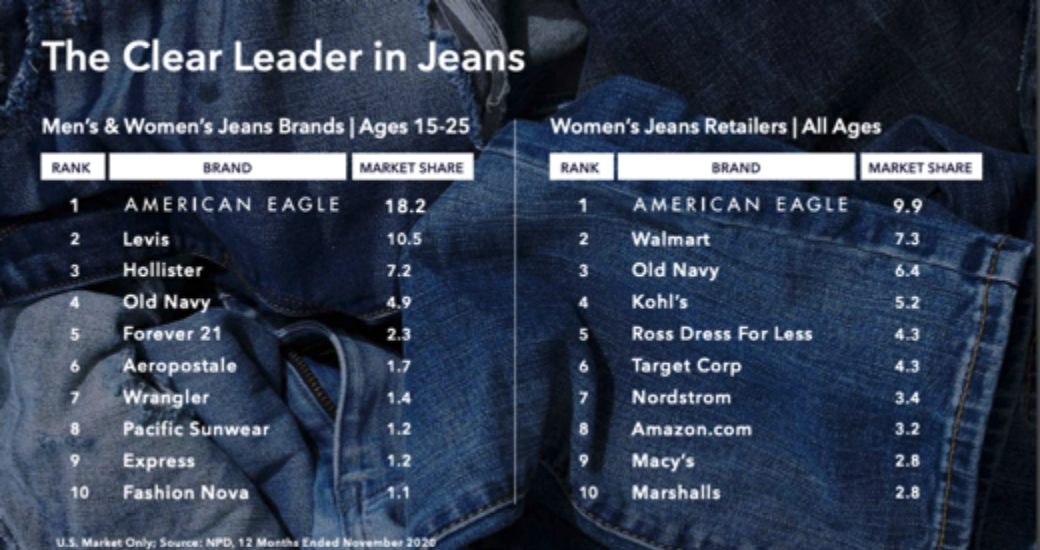

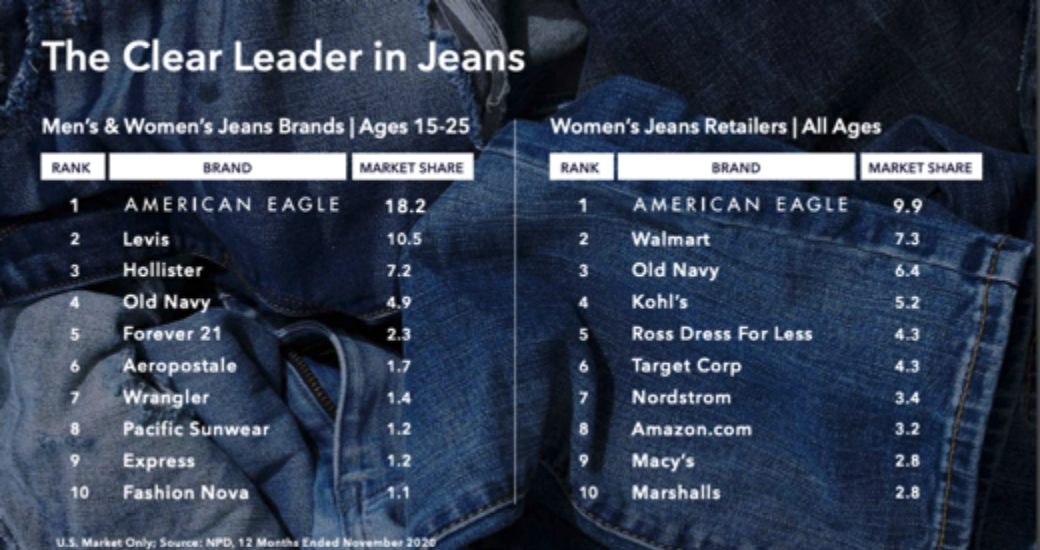

1. Refresh the Brand DNA

The company aims to grow AE by updating its platform and finding new ways to engage with its customers, such as strengthening its storytelling and product message through new campaigns and marketing collaborations. The company sees the jeans category as central to its customer connection and retention—almost 50% of its new customers choose jeans as the main item in their first basket. The company will continue to invest and innovate in the jeans category, where it sees significant growth opportunities in the near future.

[caption id="attachment_124657" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters[/caption]

2. Complete the Outfit

To refresh the AE brand, the company plans to offer a wider range of complementary clothing and footwear categories, such as tops, to pair with jeans—its highest growth category. By offering more valuable complementary categories, the company aims to be a platform for consumers to purchase a complete outfit.

[caption id="attachment_124658" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters[/caption]

3. Inventory Optimization

The company aims to optimize inventory at AE by focusing on inventory efficiency, managing expenses and enhancing merchandise margins. The company’s CFO Michael Mathias stated that about 95% of AE’s revenues are generated from the most productive 40% of items, including jeans and bottoms. The company will focus on these most productive items for inventory buying. Furthermore, the company aims to transform AE’s supply chain by improving inventory turns, ensuring faster store replenishment and better in-stocks to reduce trapped inventory.

[caption id="attachment_124659" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters[/caption]

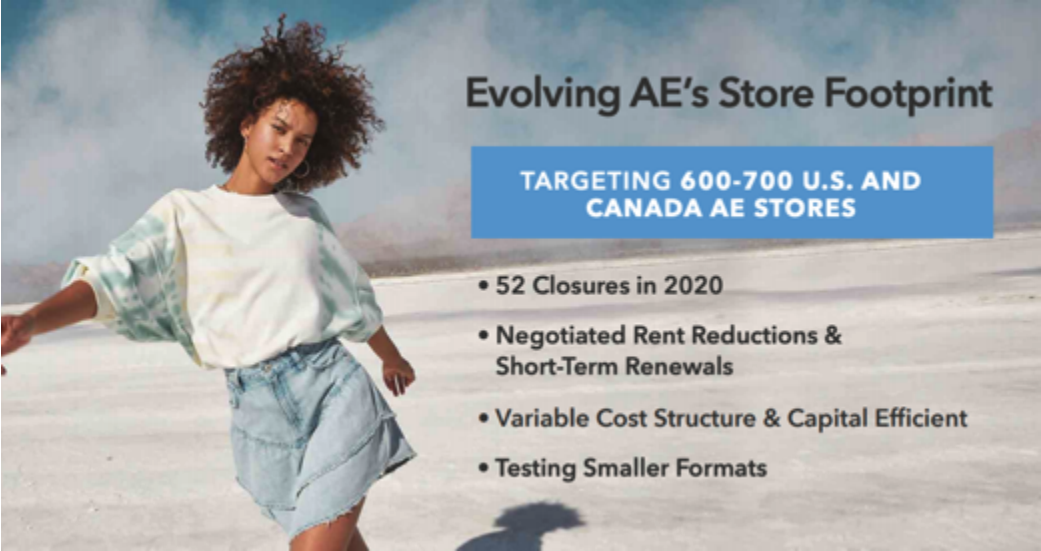

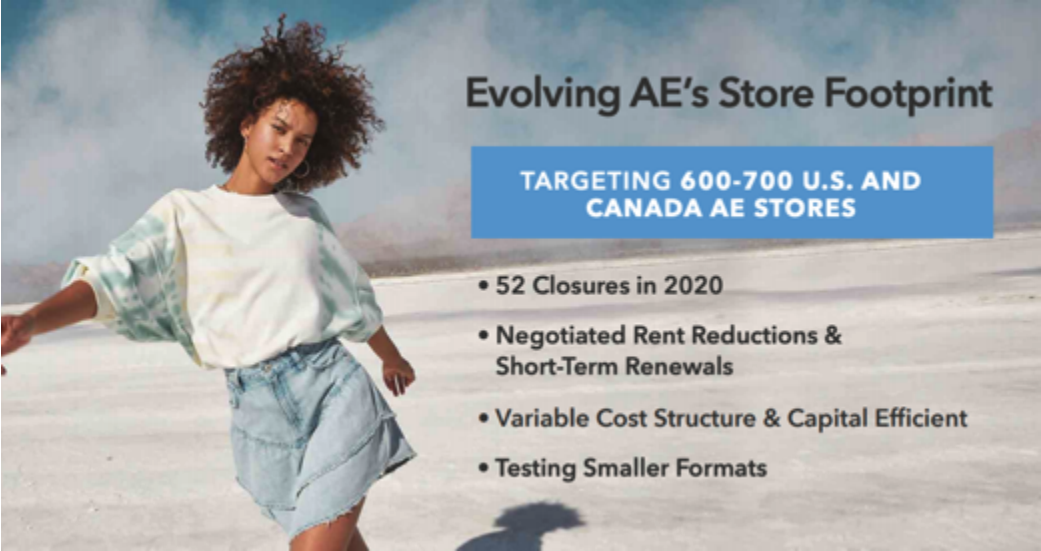

4. Rightsizing the Store Footprint

Mathias also discussed the company’s plans to

close 200–225 AE stores in North America that are on the lower end of productivity by 2023. The struggling stores identified generated revenues of $250–300 million in 2019, with per store revenue from these stores being lower than the company’s average. Mathias stated that the company expects a large portion of sales from these stores to be shifted online following brick-and-mortar closures. The company noted that the right number of AE stores in the US and Canada is 600–700 by 2023, from around 880 currently.

[caption id="attachment_124660" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters[/caption]

Long-Term Opportunities in the International Market

American Eagle Outfitters see a sizable opportunity in the international market. The company focus will be capital-light and digitally led. Initially, American Eagle Outfitters plans to invest substantially in Mexico and Hong Kong, where it already has successful direct-to-consumer (DTC) businesses. In other international markets, the company will pursue commercial models that require limited upfront capital, including franchise partnerships and strategic wholesale arrangements.

[caption id="attachment_124661" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters[/caption]

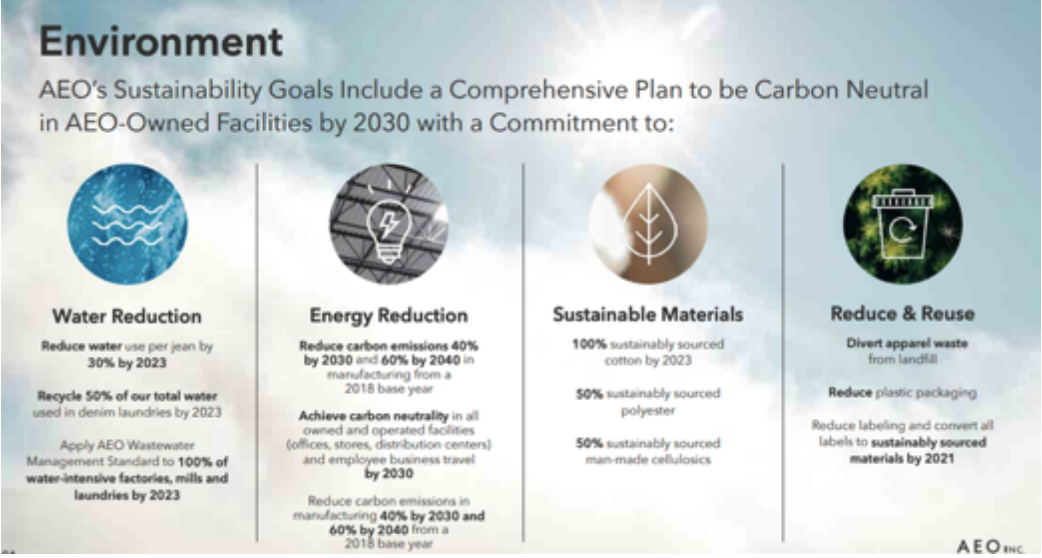

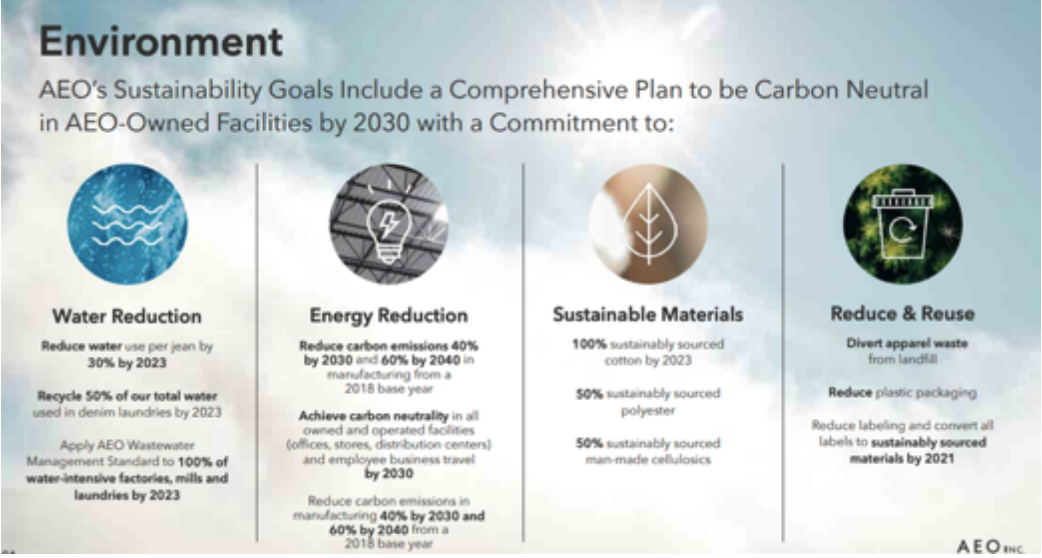

Sustainability Remains a Priority

American Eagle Outfitters laid out sustainability goals as part of its Investor Day. The company aims to be carbon neutral in its company-owned facilities by 2030, with a commitment to also reduce water usage and ensure sustainable material sourcing. By 2023, American Eagle Outfitters plans to reduce the water used to produce each pair of its jeans by 30% and achieve 100% sustainable cotton sourcing. Moreover, the company stated that it aims to reduce labeling on its produces and convert labels to sustainably sourced materials where possible.

[caption id="attachment_124662" align="aligncenter" width="720"]

Source: American Eagle Outfitters

Source: American Eagle Outfitters[/caption]

Source: American Eagle Outfitters[/caption]

The Roadmap to “Real Power. Real Growth”: Four Initiatives To Double Aerie Revenues

To accomplish its target of achieving $2 billion in sales at its Aerie brand by 2023, the company outlined four initiatives, which we discuss below.

1. Winning in Intimates and Loungewear

The first initiative is to gain market share in intimates, soft apparel (apparel made from soft fabrics, such as the Aerie Real Soft® Ribbed nightie and tank tops) and swimwear, by launching new products and marketing campaigns. The company’s Chief Creative Officer, Jennifer Foyle, said that Aerie’s core product lines, intimate, soft apparel and swimwear, currently present a $44 billion market opportunity. The company is looking to capitalize on the remaining market share in its $65 billion addressable US market.

[caption id="attachment_124654" align="aligncenter" width="720"]

Source: American Eagle Outfitters[/caption]

The Roadmap to “Real Power. Real Growth”: Four Initiatives To Double Aerie Revenues

To accomplish its target of achieving $2 billion in sales at its Aerie brand by 2023, the company outlined four initiatives, which we discuss below.

1. Winning in Intimates and Loungewear

The first initiative is to gain market share in intimates, soft apparel (apparel made from soft fabrics, such as the Aerie Real Soft® Ribbed nightie and tank tops) and swimwear, by launching new products and marketing campaigns. The company’s Chief Creative Officer, Jennifer Foyle, said that Aerie’s core product lines, intimate, soft apparel and swimwear, currently present a $44 billion market opportunity. The company is looking to capitalize on the remaining market share in its $65 billion addressable US market.

[caption id="attachment_124654" align="aligncenter" width="720"] Source: American Eagle Outfitters[/caption]

2. Activewear Product Extension

The company’s second strategy is to expand its presence in the activewear category. In 2021, the company plans to open 30 OFFLINE stores—its new activewear brand that launched in July 2020. The company sees a strong opportunity in the $21 billion US activewear market, where Aerie currently commands just a 2% market share.

[caption id="attachment_124655" align="aligncenter" width="720"]

Source: American Eagle Outfitters[/caption]

2. Activewear Product Extension

The company’s second strategy is to expand its presence in the activewear category. In 2021, the company plans to open 30 OFFLINE stores—its new activewear brand that launched in July 2020. The company sees a strong opportunity in the $21 billion US activewear market, where Aerie currently commands just a 2% market share.

[caption id="attachment_124655" align="aligncenter" width="720"] Source: American Eagle Outfitters [/caption]

3. New Market Expansion

The third initiative is to grow the Aerie banner in its underpenetrated US markets, such as Houston and Los Angeles. The company aims to open 60 to 75 new stores every year in its new consumer markets in the US. The company expects news market expansion to support brand growth and help it to deliver strong financial returns.

4. New Customer Acquisition

American Eagle Outfitter’s fourth strategy is to acquire new customers that are solely dedicated to its Aerie brand within its portfolio. Since 2014, Aerie has more than doubled its customer count to 8.5 million, with a 60% increase in average annual spending.

We believe that one of Aerie’s competitive advantages lies in its “inclusive” value proposition. Its marketing campaigns focus on body positivity by using unretouched images of women with different body types, racial backgrounds and medical needs. Aerie’s marketing message and branding strategy will likely continue to broaden the company’s customer base to include more young consumers.

Furthermore, the company expects its stores to fuel customer acquisition, engagement and retention. The company aims to have between 500 and 600 Aerie stores by 2023, from about 350 currently.

[caption id="attachment_124656" align="aligncenter" width="720"]

Source: American Eagle Outfitters [/caption]

3. New Market Expansion

The third initiative is to grow the Aerie banner in its underpenetrated US markets, such as Houston and Los Angeles. The company aims to open 60 to 75 new stores every year in its new consumer markets in the US. The company expects news market expansion to support brand growth and help it to deliver strong financial returns.

4. New Customer Acquisition

American Eagle Outfitter’s fourth strategy is to acquire new customers that are solely dedicated to its Aerie brand within its portfolio. Since 2014, Aerie has more than doubled its customer count to 8.5 million, with a 60% increase in average annual spending.

We believe that one of Aerie’s competitive advantages lies in its “inclusive” value proposition. Its marketing campaigns focus on body positivity by using unretouched images of women with different body types, racial backgrounds and medical needs. Aerie’s marketing message and branding strategy will likely continue to broaden the company’s customer base to include more young consumers.

Furthermore, the company expects its stores to fuel customer acquisition, engagement and retention. The company aims to have between 500 and 600 Aerie stores by 2023, from about 350 currently.

[caption id="attachment_124656" align="aligncenter" width="720"] Source: American Eagle Outfitters[/caption]

The Roadmap to Revitalizing AE for Profit Growth

The company has outlined four initiatives in order to reinvigorate its AE banner, which we discuss below.

1. Refresh the Brand DNA

The company aims to grow AE by updating its platform and finding new ways to engage with its customers, such as strengthening its storytelling and product message through new campaigns and marketing collaborations. The company sees the jeans category as central to its customer connection and retention—almost 50% of its new customers choose jeans as the main item in their first basket. The company will continue to invest and innovate in the jeans category, where it sees significant growth opportunities in the near future.

[caption id="attachment_124657" align="aligncenter" width="720"]

Source: American Eagle Outfitters[/caption]

The Roadmap to Revitalizing AE for Profit Growth

The company has outlined four initiatives in order to reinvigorate its AE banner, which we discuss below.

1. Refresh the Brand DNA

The company aims to grow AE by updating its platform and finding new ways to engage with its customers, such as strengthening its storytelling and product message through new campaigns and marketing collaborations. The company sees the jeans category as central to its customer connection and retention—almost 50% of its new customers choose jeans as the main item in their first basket. The company will continue to invest and innovate in the jeans category, where it sees significant growth opportunities in the near future.

[caption id="attachment_124657" align="aligncenter" width="720"] Source: American Eagle Outfitters[/caption]

2. Complete the Outfit

To refresh the AE brand, the company plans to offer a wider range of complementary clothing and footwear categories, such as tops, to pair with jeans—its highest growth category. By offering more valuable complementary categories, the company aims to be a platform for consumers to purchase a complete outfit.

[caption id="attachment_124658" align="aligncenter" width="720"]

Source: American Eagle Outfitters[/caption]

2. Complete the Outfit

To refresh the AE brand, the company plans to offer a wider range of complementary clothing and footwear categories, such as tops, to pair with jeans—its highest growth category. By offering more valuable complementary categories, the company aims to be a platform for consumers to purchase a complete outfit.

[caption id="attachment_124658" align="aligncenter" width="720"] Source: American Eagle Outfitters[/caption]

3. Inventory Optimization

The company aims to optimize inventory at AE by focusing on inventory efficiency, managing expenses and enhancing merchandise margins. The company’s CFO Michael Mathias stated that about 95% of AE’s revenues are generated from the most productive 40% of items, including jeans and bottoms. The company will focus on these most productive items for inventory buying. Furthermore, the company aims to transform AE’s supply chain by improving inventory turns, ensuring faster store replenishment and better in-stocks to reduce trapped inventory.

[caption id="attachment_124659" align="aligncenter" width="720"]

Source: American Eagle Outfitters[/caption]

3. Inventory Optimization

The company aims to optimize inventory at AE by focusing on inventory efficiency, managing expenses and enhancing merchandise margins. The company’s CFO Michael Mathias stated that about 95% of AE’s revenues are generated from the most productive 40% of items, including jeans and bottoms. The company will focus on these most productive items for inventory buying. Furthermore, the company aims to transform AE’s supply chain by improving inventory turns, ensuring faster store replenishment and better in-stocks to reduce trapped inventory.

[caption id="attachment_124659" align="aligncenter" width="720"] Source: American Eagle Outfitters[/caption]

4. Rightsizing the Store Footprint

Mathias also discussed the company’s plans to close 200–225 AE stores in North America that are on the lower end of productivity by 2023. The struggling stores identified generated revenues of $250–300 million in 2019, with per store revenue from these stores being lower than the company’s average. Mathias stated that the company expects a large portion of sales from these stores to be shifted online following brick-and-mortar closures. The company noted that the right number of AE stores in the US and Canada is 600–700 by 2023, from around 880 currently.

[caption id="attachment_124660" align="aligncenter" width="720"]

Source: American Eagle Outfitters[/caption]

4. Rightsizing the Store Footprint

Mathias also discussed the company’s plans to close 200–225 AE stores in North America that are on the lower end of productivity by 2023. The struggling stores identified generated revenues of $250–300 million in 2019, with per store revenue from these stores being lower than the company’s average. Mathias stated that the company expects a large portion of sales from these stores to be shifted online following brick-and-mortar closures. The company noted that the right number of AE stores in the US and Canada is 600–700 by 2023, from around 880 currently.

[caption id="attachment_124660" align="aligncenter" width="720"] Source: American Eagle Outfitters[/caption]

Long-Term Opportunities in the International Market

American Eagle Outfitters see a sizable opportunity in the international market. The company focus will be capital-light and digitally led. Initially, American Eagle Outfitters plans to invest substantially in Mexico and Hong Kong, where it already has successful direct-to-consumer (DTC) businesses. In other international markets, the company will pursue commercial models that require limited upfront capital, including franchise partnerships and strategic wholesale arrangements.

[caption id="attachment_124661" align="aligncenter" width="720"]

Source: American Eagle Outfitters[/caption]

Long-Term Opportunities in the International Market

American Eagle Outfitters see a sizable opportunity in the international market. The company focus will be capital-light and digitally led. Initially, American Eagle Outfitters plans to invest substantially in Mexico and Hong Kong, where it already has successful direct-to-consumer (DTC) businesses. In other international markets, the company will pursue commercial models that require limited upfront capital, including franchise partnerships and strategic wholesale arrangements.

[caption id="attachment_124661" align="aligncenter" width="720"] Source: American Eagle Outfitters[/caption]

Sustainability Remains a Priority

American Eagle Outfitters laid out sustainability goals as part of its Investor Day. The company aims to be carbon neutral in its company-owned facilities by 2030, with a commitment to also reduce water usage and ensure sustainable material sourcing. By 2023, American Eagle Outfitters plans to reduce the water used to produce each pair of its jeans by 30% and achieve 100% sustainable cotton sourcing. Moreover, the company stated that it aims to reduce labeling on its produces and convert labels to sustainably sourced materials where possible.

[caption id="attachment_124662" align="aligncenter" width="720"]

Source: American Eagle Outfitters[/caption]

Sustainability Remains a Priority

American Eagle Outfitters laid out sustainability goals as part of its Investor Day. The company aims to be carbon neutral in its company-owned facilities by 2030, with a commitment to also reduce water usage and ensure sustainable material sourcing. By 2023, American Eagle Outfitters plans to reduce the water used to produce each pair of its jeans by 30% and achieve 100% sustainable cotton sourcing. Moreover, the company stated that it aims to reduce labeling on its produces and convert labels to sustainably sourced materials where possible.

[caption id="attachment_124662" align="aligncenter" width="720"] Source: American Eagle Outfitters[/caption]

Source: American Eagle Outfitters[/caption]