Source: Company reports/Coresight Research

4Q17 Results

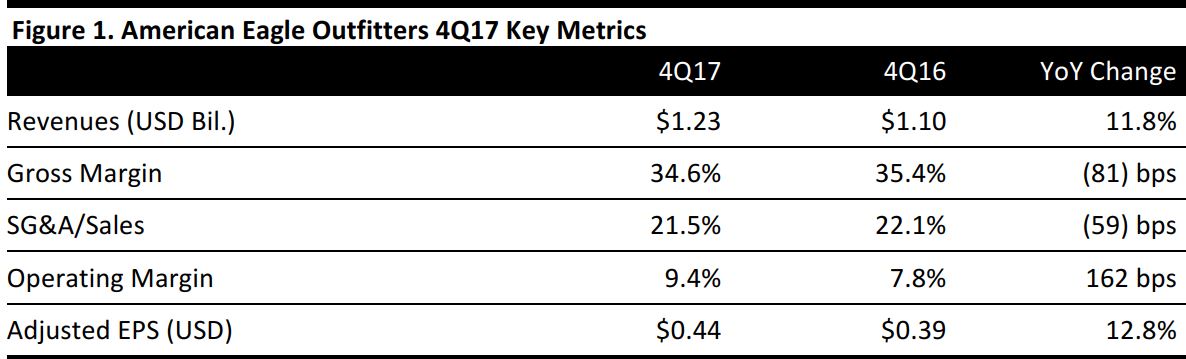

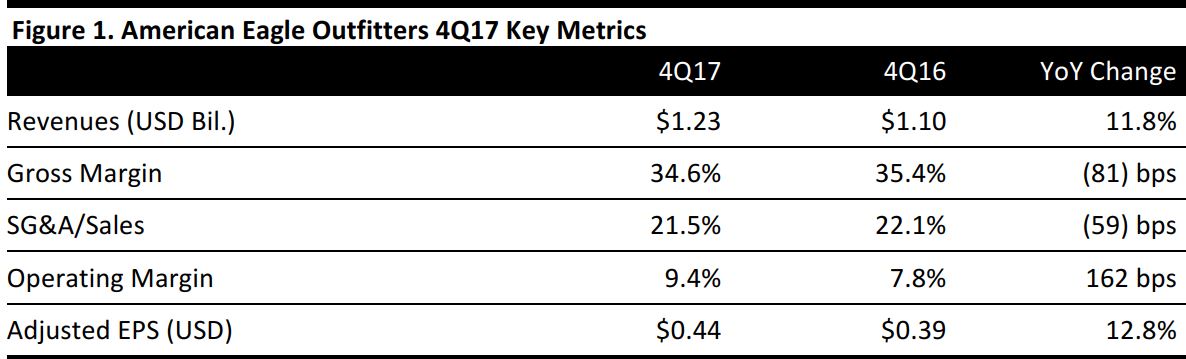

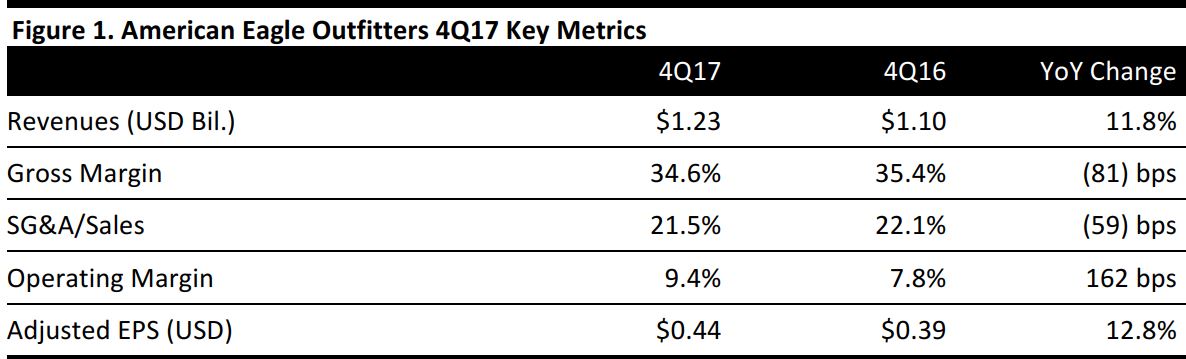

American Eagle Outfitters reported 4Q17 revenues of $1.23 billion, up 11.8% year over year and beating the $1.21 billion consensus estimate. Adjusted EPS was $0.44, in line with the consensus estimate and up 12.8% from the year-ago quarter.

Comparable sales were up 8.0% year over year, beating the consensus estimate of 7.2% and representing the company’s strongest comp sales performance since 3Q15. American Eagle and Aerie both posted positive brick-and-mortar comps, capitalizing on “improved mall trends.”By brand, American Eagle reported 5% comps, compared with the 4.6% consensus estimate, and Aerie posted 34% comps, compared with the 26.5% consensus estimate. Digital sales grew by more than 20% in the quarter.

American Eagle Outfitters reported that its bottoms categories are driving sales, with record category sales for the 18th consecutive quarter in both the male and female categories. The company views bottoms as a growth initiative and acquisition tool. Half of its customers buy its jeans, presenting opportunities regarding awareness and innovation in its jeans collection.

Store closures: American Eagle Outfitters ended the year with a total of 1,047 stores. During the year, the company opened 15 American Eagle stores and closed 25, ending the year with 933 American Eagle stores, including 116 Aerie side-by-side locations. The company opened 15 Aerie stand-alone stores and closed eight during the year, ending the year with 109 Aerie stand-alone stores.

Outlook

For 1Q18, the company anticipates a comparable sales increase in the mid-single digits and adjusted EPS of $0.20–$0.22, compared with consensus of $0.19.